Under-collateralized lending is rewriting the rulebook for DeFi, unlocking new capital flows and empowering borrowers who were once sidelined by over-collateralization. The magic ingredient? On-chain risk scores. By leveraging transparent blockchain data, these platforms are making trustless, under-collateralized loans a working reality, no more relying solely on off-chain credit bureaus or opaque decision-making. Let’s dive into three standout case studies: Goldfinch, Credora, and Spectra, each blazing a trail with unique approaches to on-chain credit assessment.

Goldfinch: Expanding Real-World Credit Access with On-Chain Transparency

Goldfinch is a pioneer in connecting crypto liquidity to real-world borrowers, think small businesses in emerging markets who need growth capital but lack massive amounts of crypto collateral. Goldfinch’s approach blends off-chain credit assessments (via trusted auditors) with on-chain automation and transparency. Here’s how it works:

- Borrowers apply for loans, providing business details and repayment history.

- Auditors vet these applications off-chain, then their findings get locked into smart contracts.

- Lenders supply capital into pools, earning yield as repayments stream in.

- The community participates via the GFI governance token, helping underwrite loan risks and keep incentives aligned.

This hybrid model brings the best of both worlds, human expertise for nuanced risk assessment plus on-chain enforcement for transparency and automation. The result? More efficient use of capital and broader access to credit globally.

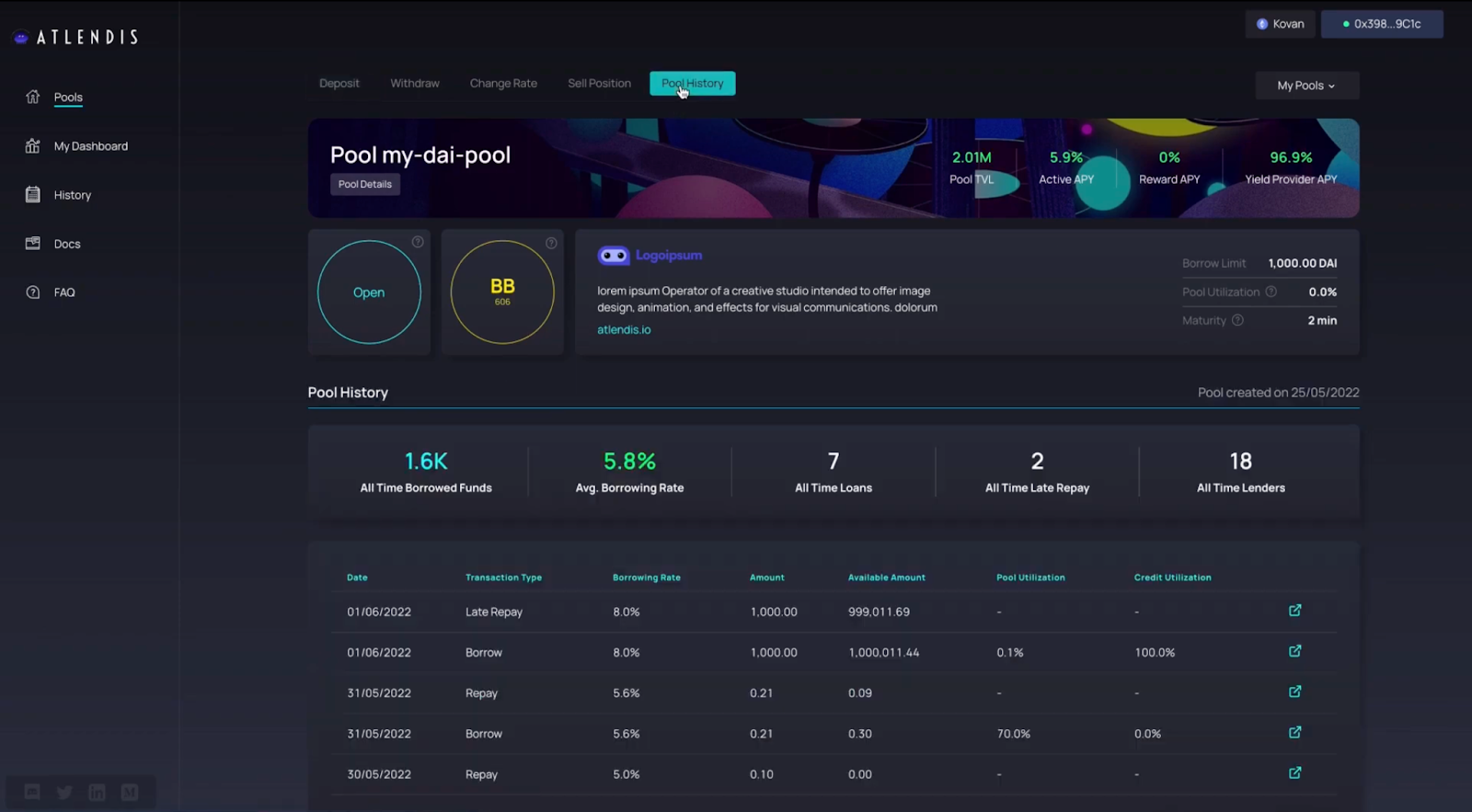

Credora: Privacy-Preserving Risk Analysis Meets Institutional DeFi

Credora is focused on bridging institutional-grade risk assessment with decentralized finance. Their platform uses advanced cryptography (think zero-knowledge proofs) to analyze borrower data without exposing sensitive details publicly, a huge win for privacy-conscious institutions!

- Borrowers submit off-chain financials and on-chain activity; Credora’s system calculates a credit score using both data streams.

- Lenders get granular risk insights before allocating capital, all while preserving borrower privacy.

- The protocol supports both institutional players and sophisticated DeFi users seeking higher yields without excessive collateral demands.

This privacy-first approach opens the door to traditional finance participants who want exposure to DeFi yields but need robust risk controls. It’s also a leap forward for compliance in the ever-evolving regulatory landscape.

Spectral: Multi-Asset Credit Risk Scores as On-Chain Reputation Layers

Spectra (often referenced as Spectral) is pushing the envelope with its MACRO score, a blockchain-native answer to FICO. Instead of relying solely on traditional payment history, Spectra analyzes:

- User’s transaction history across multiple assets

- Past liquidation events (if any)

- Diversity of borrowing/lending activity within DeFi protocols

The cherry on top? Users can mint their own Non-Fungible Credits (NFCs): ERC-721 NFTs that serve as portable credit reports across compatible DeFi platforms! This means your good behavior isn’t siloed; it becomes part of your digital reputation wherever you go in Web3 lending markets.

Top Features of Leading Under-Collateralized DeFi Platforms

-

Goldfinch: Goldfinch connects crypto liquidity providers with off-chain borrowers, especially in emerging markets, using trusted partner assessments and on-chain smart contracts for transparency and automated repayments. The dual-token system (GFI and Staked GFI) incentivizes community participation in risk underwriting and governance.

-

Credora: Credora leverages real-time on-chain risk scoring and decentralized identity to assess borrower creditworthiness. By analyzing payment history and liquidation risks, Credora enables capital-efficient under-collateralized loans while maintaining robust risk controls.

-

Spectra: Spectra introduces the Multi-Asset Credit Risk Oracle (MACRO) score, an on-chain equivalent to a traditional credit score. Users can mint Non-Fungible Credits (NFCs) as ERC-721 NFTs, representing their credit profiles, which can be used across DeFi platforms to access under-collateralized loans.

The Bigger Picture: Why On-Chain Risk Scores Matter Now More Than Ever

The current wave of innovation isn’t just about better yields or new products, it’s about building trust through transparency, data-driven insights, and decentralized governance. Platforms like Goldfinch, Credora, and Spectra are proving that you can assess risk accurately using blockchain data while keeping user privacy intact where needed. As these protocols mature, expect even more sophisticated tools for lenders, and greater access for borrowers around the globe.

What’s really exciting is how these platforms are transforming the DeFi landscape by making under-collateralized lending not only possible, but sustainable and scalable. Let’s break down what sets each apart, and why their models are gaining traction among both retail and institutional players.

Goldfinch: Empowering Real-World Impact

Goldfinch’s unique blend of off-chain due diligence and on-chain execution means borrowers in emerging markets can access much-needed capital, while lenders enjoy transparency into how funds are deployed and repaid. The platform’s use of community governance (via GFI tokens) ensures that incentives stay aligned, and risk is collectively managed. This structure also helps Goldfinch scale globally, since trusted auditors can operate in different regions, adapting credit assessments to local realities without sacrificing on-chain accountability.

Credora: Institutional-Grade Risk in a Decentralized World

Credora stands out for its privacy-preserving analytics. By using zero-knowledge proofs, Credora lets institutions participate in DeFi lending without exposing their sensitive financial data to the public blockchain. This is a game changer for compliance-focused entities who want DeFi yields but need to meet regulatory requirements around confidentiality and risk management. For sophisticated DeFi users, Credora offers a new level of insight into borrower quality, helping them deploy capital more confidently into under-collateralized loan pools.

Spectra: Portable Credit Reputation for Web3

Spectra’s MACRO score isn’t just another credit metric, it’s a powerful tool for building your reputation across the decentralized web. By analyzing multi-asset behavior and letting users mint Non-Fungible Credits (NFCs), Spectra enables borrowers to “carry” their good track record from one protocol to another. This portability unlocks more borrowing opportunities with less friction, since lenders can instantly verify a user’s creditworthiness based on real on-chain activity, not just promises or paperwork.

Top Platforms Powering Under-Collateralized Lending with On-Chain Risk Scores

-

Goldfinch connects crypto liquidity providers with real-world borrowers, especially small businesses in emerging markets. Its hybrid risk assessment model combines off-chain credit evaluations by trusted partners with on-chain smart contracts for transparency and automated repayments. The platform’s dual-token system (GFI and Staked GFI) incentivizes community participation in risk underwriting and governance.

-

Credora specializes in privacy-preserving on-chain credit scoring for both institutional and individual borrowers. By leveraging zero-knowledge proofs and analyzing borrowers’ on-chain repayment history, Credora enables under-collateralized loans while maintaining privacy and trust. Its risk engine integrates seamlessly with DeFi protocols, expanding access to capital without sacrificing security.

-

Spectra (formerly Spectral) introduces the Multi-Asset Credit Risk Oracle (MACRO) score, an on-chain equivalent to traditional credit scores. The MACRO score evaluates wallet activity, liquidation events, and credit mix, allowing users to mint Non-Fungible Credits (NFCs) as ERC-721 NFTs. These credit NFTs can be used across DeFi platforms to unlock under-collateralized lending opportunities based on provable on-chain behavior.

The bottom line? These case studies show that with the right mix of technology, data science, and community governance, under-collateralized lending can be both secure and inclusive. As protocols continue to refine their risk models, integrating even more data sources like decentralized identity (DID) or cross-chain activity, the barriers to entry will keep falling.

If you’re a lender seeking higher yields or a borrower looking for capital without massive collateral requirements, it’s never been easier to get started in this new era of decentralized credit. And if you’re building DeFi apps? Integrating with platforms like Goldfinch, Credora, or Spectra could give your users instant access to advanced risk scoring tools, and help push the whole ecosystem forward.

Ready to Explore Further?

The evolution of on-chain risk scores is just beginning! Keep an eye on these projects as they iterate, and check out our resources at cryptocreditscore. org for guides, real-time market insights, and actionable strategies tailored for this fast-moving space.