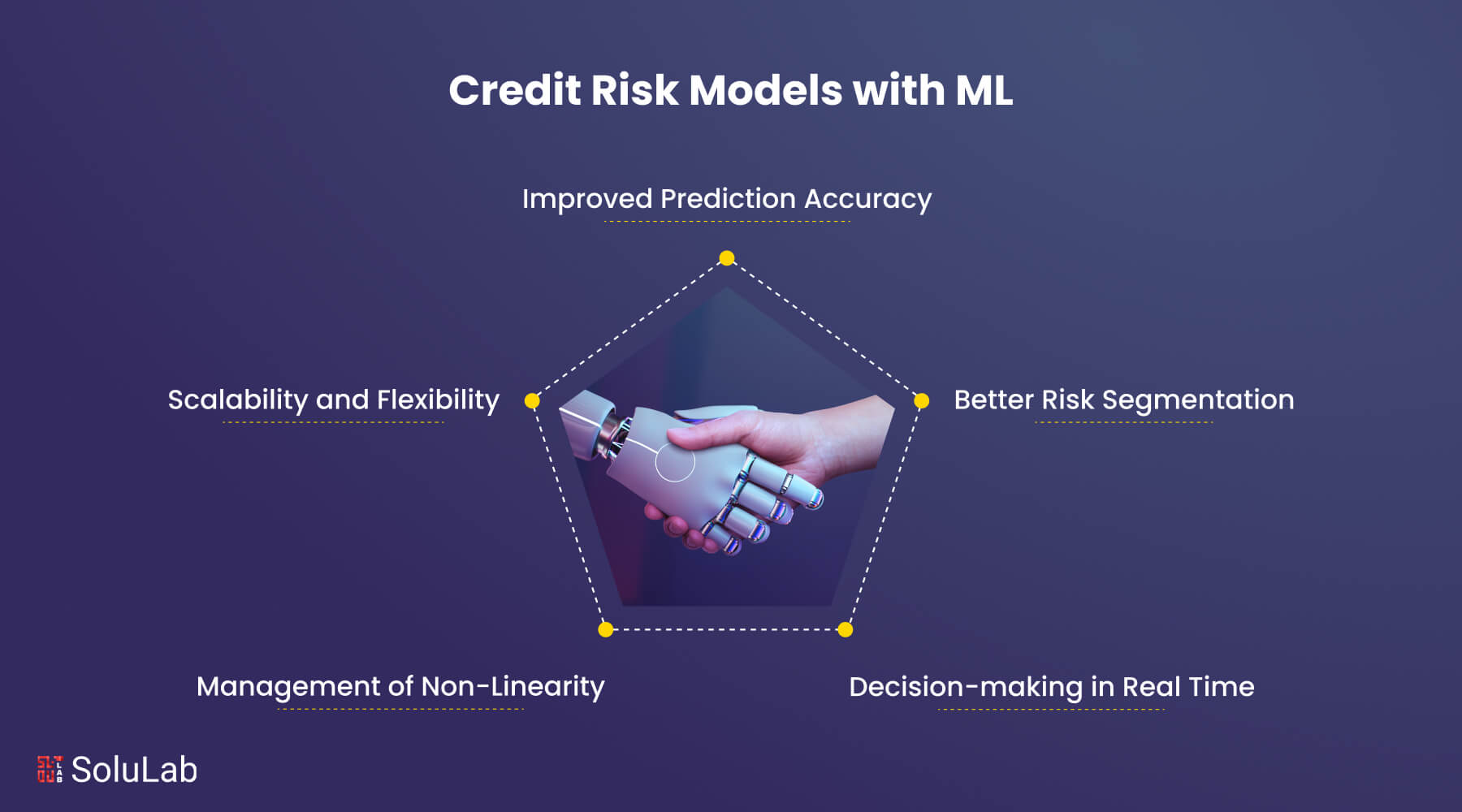

On-chain credit scoring is rapidly transforming the landscape of decentralized finance (DeFi), unlocking new models for under-collateralized lending and capital efficiency. For developers, integrating these systems into DeFi protocols presents a significant opportunity: by leveraging transparent, data-driven risk assessments, protocols can expand access to credit while maintaining robust risk management.

Why On-Chain Credit Scoring Matters for DeFi Protocols

Traditional DeFi lending relies heavily on overcollateralization, often requiring users to lock up assets far exceeding their loan amounts. While this approach minimizes protocol risk, it creates barriers for users and limits capital efficiency. On-chain credit scoring addresses these challenges by evaluating user behavior, transaction history, and digital identity directly on the blockchain. This enables more flexible lending terms and opens the door to scalable under-collateralized loans.

The market is taking notice: platforms like Creditlink, RociFi, and Credora are demonstrating how composable credit modules and on-chain activity-based scores can optimize lending operations across ecosystems.

Core Approaches to Integration: From Plug-and-Play APIs to Custom Solutions

Developers have several pathways to bring on-chain credit scoring into their protocols:

Top On-Chain Credit Scoring Solutions for DeFi Developers

-

Creditlink: Offers AI-driven, composable on-chain credit scoring modules. Creditlink enables DeFi protocols to integrate application and behavior-based scores for more precise risk assessment. Learn more

-

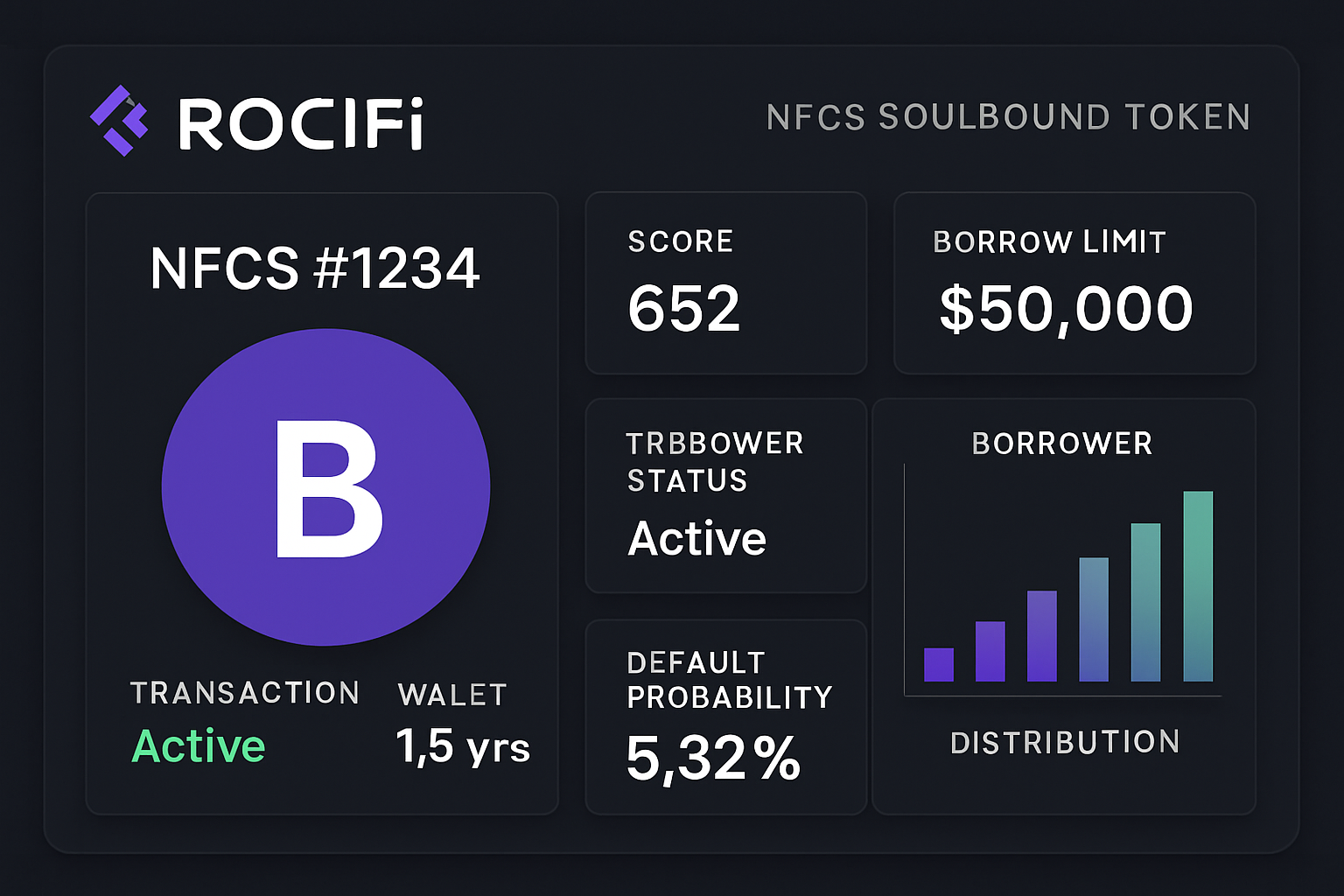

RociFi: Provides Non-Fungible Credit Scores (NFCS) as soulbound tokens, representing a user’s on-chain creditworthiness using transaction history and balances. Scores range from 1 to 10 for granular risk evaluation. Explore RociFi

-

Credora: Delivers on-chain credit assessments benchmarked against traditional credit ratings, enhancing transparency and trust in DeFi lending markets. Discover Credora

-

Lendvest: Utilizes Chainlink’s Cross-Chain Interoperability Protocol (CCIP) to transmit credit score data across multiple blockchains, enabling cross-chain DeFi lending and risk management. See Lendvest in action

-

zkMe’s zkCreditScore: Integrates privacy-preserving zero-knowledge proofs to bridge traditional FICO scores on-chain, allowing anonymous yet credible digital identity verification for DeFi users. Read about zkMe

-

Crediflex: An undercollateralized lending protocol that leverages on-chain activity-based credit scoring, enabling users to borrow more than their posted collateral based on behavioral data. View Crediflex on GitHub

1. Use Existing Credit Scoring Services: Solutions like Creditlink offer API-driven modules that can be seamlessly integrated into smart contracts. RociFi’s Non-Fungible Credit Scores (NFCS) use soulbound tokens as user reputation badges, while Credora benchmarks crypto-native scores against traditional ratings for cross-market transparency.

2. Enable Cross-Chain Functionality: Lendvest leverages Chainlink’s Cross-Chain Interoperability Protocol (CCIP) to transmit credit score data between blockchains, enabling multi-chain lending markets with unified risk profiles. This approach is critical as liquidity fragments across chains.

3. Prioritize User Privacy: zkMe’s zkCreditScore uses zero-knowledge proofs to bridge off-chain FICO scores onto public ledgers without exposing sensitive data, enhancing both compliance and user trust.

4. Build Custom Scoring Models: Protocols like Crediflex show how analyzing wallet activity and repayment patterns can support dynamic borrowing limits, enabling more granular control over under-collateralized exposure based on real user behavior.

The Developer Workflow: Key Steps for Seamless Integration

The integration process follows a clear technical sequence:

- Assess Protocol Needs: Define your target audience (retail vs institutional), desired loan-to-value ratios, and acceptable risk parameters.

- Select a Solution: Choose between existing APIs or custom systems based on protocol requirements and developer resources.

- Coding and Smart Contract Integration: Embed the chosen scoring mechanism within your protocol’s smart contracts, ensuring secure data flow between score providers and lending logic.

- Audit and Testing: Conduct rigorous security audits and scenario testing before deploying live integrations.

- Continuous Monitoring: Set up analytics dashboards to track usage patterns, default rates, and score efficacy; update algorithms as needed based on market feedback.

This workflow allows protocols to move beyond static collateral models toward adaptive risk management frameworks, maximizing capital efficiency without sacrificing security or transparency.

As adoption accelerates, the composability of on-chain credit scoring modules is becoming a competitive differentiator. Developers can now leverage modular APIs and cross-chain data feeds to build lending products that dynamically adjust risk parameters in real time. This flexibility is crucial as DeFi protocols seek to attract a broader user base while maintaining prudent risk controls.

Implementation in Practice: Real-World Examples

Protocols like Creditlink and RociFi have demonstrated how on-chain credit scoring can be implemented with minimal friction. By integrating these services, developers enable features such as:

- Dynamic Loan-to-Value (LTV) Ratios: Adjust borrowing power based on evolving user credit scores.

- Automated Risk-Based Pricing: Offer differentiated interest rates, rewarding reliable borrowers with lower costs.

- Soulbound Reputation Badges: Use non-transferable tokens to represent verified creditworthiness across DeFi ecosystems.

- Cross-Chain Credit Portability: Allow users to carry their credit history between blockchains, reducing onboarding friction for new protocols.

This granular approach gives protocols the tools to tailor lending experiences while maintaining transparency and auditability. The result: increased protocol stickiness, improved capital utilization, and a more inclusive financial system for users who lack traditional collateral.

Key Considerations for Secure Integration

Security and privacy are paramount. Integrating external credit scoring services requires careful vetting of data sources, oracle reliability, and smart contract code. Privacy-preserving solutions like zkMe’s zkCreditScore are gaining traction for protocols handling sensitive off-chain data. Additionally, continuous monitoring is essential, credit models must adapt to evolving user behavior and market volatility.

Regular audits from reputable firms remain a best practice before mainnet deployment. Developers should also consider fallback mechanisms if external APIs become unavailable or compromised. Building robust error-handling logic ensures protocol resilience under all conditions.

The Future: Composable Credit Markets at Scale

The integration of on-chain risk scores paves the way for programmatic, scalable under-collateralized lending markets across DeFi. As more protocols adopt these tools, expect increased competition around data quality, privacy guarantees, and cross-protocol interoperability. The winners will be those who deliver seamless user experiences while maintaining rigorous risk controls, unlocking new liquidity sources and driving further adoption of decentralized finance.

The evolution from static collateral requirements toward adaptive, data-driven lending is underway, and developers are at the forefront of this transformation.

Key Benefits of On-Chain Credit Scoring in DeFi

-

Increased Capital Efficiency: On-chain credit scoring enables undercollateralized lending, allowing users to borrow more relative to their collateral and unlocking idle liquidity across DeFi protocols.

-

Broader User Access: By assessing on-chain behavior, protocols like Creditlink and RociFi expand lending opportunities to users without traditional credit histories, fostering greater financial inclusion.

-

Dynamic Risk Management: Integrating solutions such as Credora allows real-time credit assessment, helping protocols adjust loan terms and interest rates based on up-to-date on-chain data.

-

Cross-Chain Interoperability: Platforms like Lendvest leverage cross-chain protocols to make credit scores portable, enabling seamless lending and borrowing across multiple blockchain networks.

-

Enhanced User Privacy: Privacy-preserving solutions such as zkMe’s zkCreditScore use zero-knowledge proofs to verify creditworthiness without exposing sensitive personal data.

-

Transparent and Tamper-Resistant Assessments: On-chain credit scores are verifiable and immutable, increasing trust and transparency for both lenders and borrowers in decentralized lending markets.