Decentralized identity (DID) is shaking up the world of crypto credit scoring, giving users more control, privacy, and access than ever before. Forget the old days of relying on opaque credit bureaus or handing over piles of personal data to centralized lenders. With DID, your reputation and financial trustworthiness can travel with you across DeFi apps, protocols, and even chains – all while keeping sensitive details secure.

Why Decentralized Identity Matters for Crypto Credit Scoring

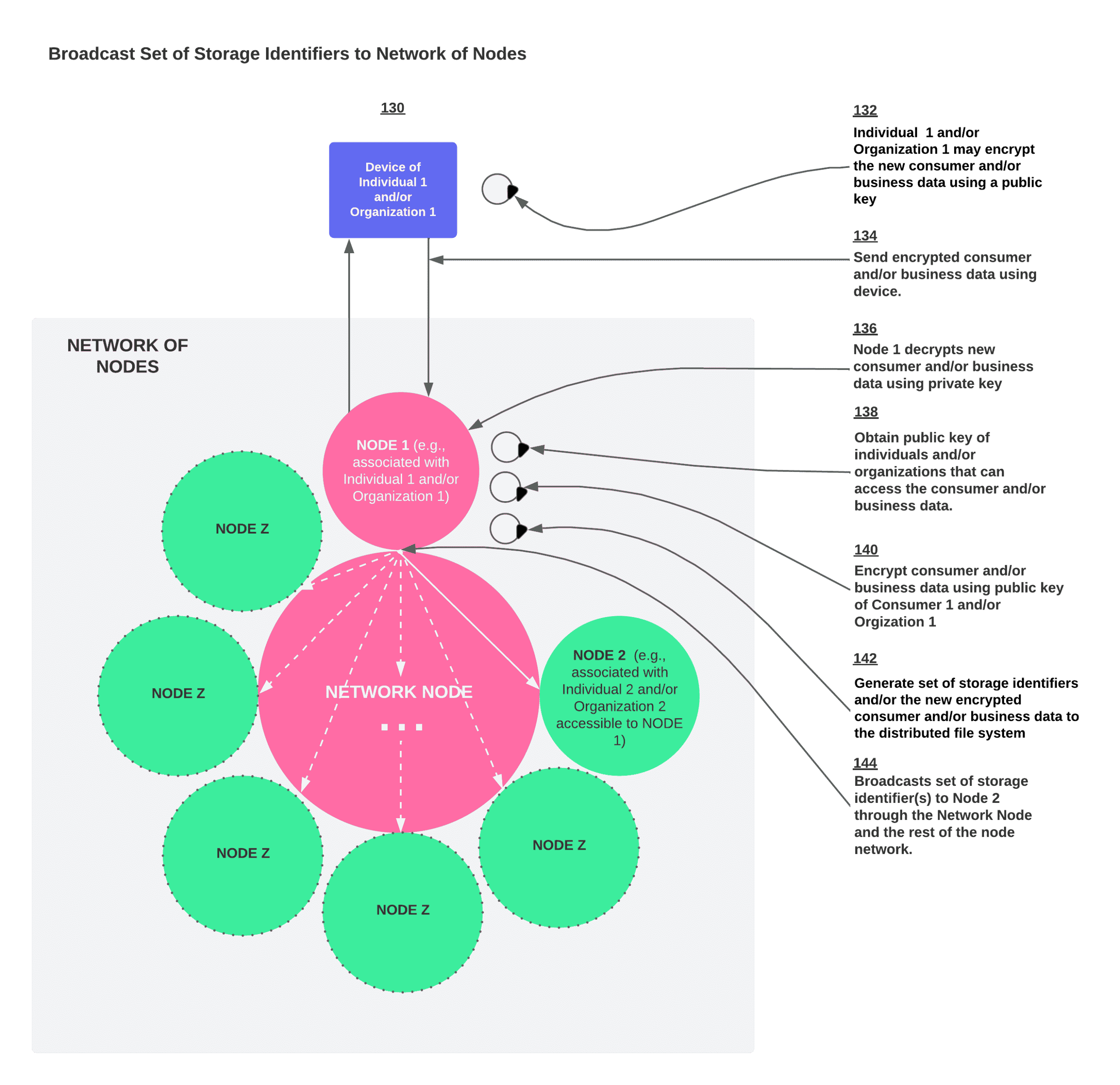

Traditional financial systems gatekeep lending opportunities based on legacy credit scores – if you don’t have a robust banking history or live in an underbanked region, you’re often left out in the cold. Enter DID in DeFi: a user-centric approach where individuals manage their own digital identifiers and verifiable credentials. These DIDs act as secure passports for your online reputation, enabling on-chain identity verification without needing to expose your private info to every new protocol or lender.

Platforms like CreDA are already proving how powerful this can be. By linking users’ on-chain activity across multiple blockchains, CreDA generates comprehensive profiles that fuel reliable Crypto Credit Scores. These scores are minted as cNFTs (Credit NFTs) that you can use throughout Web3 – from borrowing on DeFi lending apps to accessing exclusive services. It’s interoperability and self-sovereignty rolled into one!

How DID-Based Credit Scoring Works: Real-World Examples

Top DID-Powered Crypto Credit Scoring Platforms

-

CreDA: Leverages Decentralized Identity (DID) to analyze users’ on-chain activities across multiple blockchains, minting Credit NFTs (cNFTs) as verifiable crypto credit scores. These cNFTs boost interoperability and trust throughout the DeFi ecosystem.

-

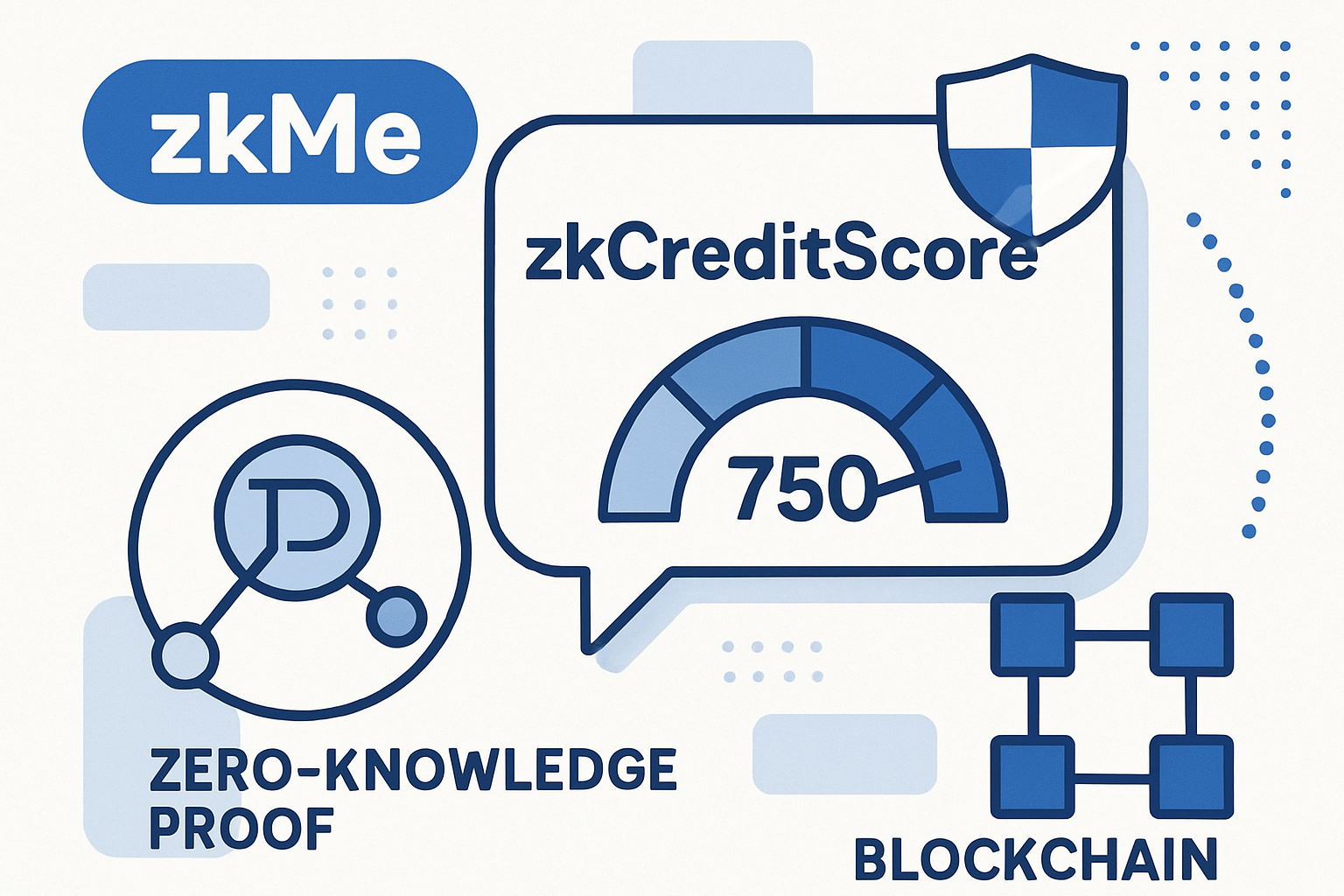

zkMe’s zkCreditScore: Uses zero-knowledge proofs to anonymously bridge traditional FICO credit scores onto the blockchain. This enables users to prove their creditworthiness for DeFi lending without exposing sensitive personal data.

-

TransUnion’s Blockchain Credit Data Service: In partnership with Spring Labs and Quadrata, TransUnion delivers identity-protected credit scoring to public blockchain networks. Their digital passport network lets users share credit data with DApps securely and privately.

-

RociFi: Connects DIDs with social and on-chain reputation signals to generate non-fungible credit scores (NFCS). This enables zero and under-collateralized lending, expanding credit access in DeFi.

The nuts and bolts of DID-based scoring are fascinating. Instead of scraping your off-chain history or demanding personal docs, these systems tap into alternative data sources:

- On-chain transaction histories: Your wallet’s behavior speaks volumes about your reliability as a borrower.

- DAO participation and social signals: Engaged community members can earn extra trust points.

- Cross-chain activity: Proving good behavior across networks builds a holistic reputation.

- Zero-knowledge proofs: Like zkMe’s zkCreditScore tool that lets you prove your TradFi FICO score on-chain, without revealing any specifics (read more here)!

This shift isn’t just about privacy – it’s about inclusion. By leveraging alternative data and DIDs instead of requiring collateral or legacy scores, platforms like RociFi unlock zero and under-collateralized lending for users who would otherwise be excluded from the financial system (see their approach).

The Benefits: Privacy, Accessibility and Efficiency at Scale

The advantages of integrating decentralized identity into crypto credit scoring are impossible to ignore:

- Enhanced privacy: Prove your trustworthiness without oversharing personal info.

- Bigger reach: Open up fair lending to unbanked or underbanked individuals worldwide.

- No more data silos: Your reputation is portable, use it anywhere in Web3!

- Smoother onboarding: Automated risk assessments speed up approvals for borrowers and reduce friction for lenders.

The momentum is real! Even legacy players like TransUnion are jumping in by offering identity-protected credit scoring directly to public blockchains through partnerships with Spring Labs and Quadrata (details here). Expect this trend to accelerate as new tools make it easier for everyone, from DAOs to individuals, to tap into transparent blockchain lending markets with less collateral required than ever before.

But what does this mean for your day-to-day DeFi experience? For starters, it’s a game-changer for borrowers and lenders alike. If you’re a borrower, you can finally access capital without over-collateralizing or jumping through endless KYC hoops. If you’re a lender, DID-backed credit scores offer deeper insights into user risk profiles, without exposing you (or them) to unnecessary privacy risks.

Take RociFi’s approach: their non-fungible credit scores (NFCS) combine on-chain data with decentralized identity credentials to create a transparent, tamper-resistant record of user reputation. This allows protocols to confidently offer zero or under-collateralized loans, something that was nearly unthinkable in DeFi just a few years ago. Similarly, zkMe’s zkCreditScore lets users bring traditional creditworthiness into the crypto world, all while safeguarding sensitive details via zero-knowledge proofs.

Challenges and What’s Next for DID in DeFi Lending

No revolution comes without hurdles. While DID-based crypto credit scoring is surging ahead, there are still some big questions on the table:

- Standardization: With so many protocols and networks, will DIDs and verifiable credentials work seamlessly across the entire ecosystem?

- User onboarding: How can platforms make it super simple for newcomers to set up their DIDs and build reputations from scratch?

- Sybil resistance: Stopping bad actors from gaming the system by creating fake identities remains an ongoing challenge.

The good news? The community is moving fast. Initiatives like the Metaverse Standards Forum are already exploring cross-platform standards for decentralized credit scoring using user-controlled data sources. Meanwhile, projects like CreDA and TransUnion are showing that partnerships between Web3 innovators and TradFi giants can drive real-world adoption at scale.

Top Advantages of DID-Based Crypto Credit Scoring

-

Enhanced Privacy & User Control: DID systems like CreDA let users prove creditworthiness without exposing personal details, giving them full control over their digital identities.

-

Anonymous Bridging of Traditional Credit Scores: zkMe’s zkCreditScore allows users to prove their FICO scores on-chain using zero-knowledge proofs, enhancing trust without sacrificing privacy.

-

Seamless Integration of Off-Chain Credit Data: TransUnion and DeCredit are bridging traditional credit data with blockchain, letting users access better loan terms while keeping their identities protected.

The Road Ahead: Building Trust and Opportunity in DeFi

This isn’t just about technology, it’s about financial empowerment. As more users take control of their digital identities and as protocols harness richer on-chain data, we’ll see an explosion of lending products tailored to individual needs, risk appetites, and reputations. Imagine being able to walk into any DeFi protocol with your DID wallet and instantly qualify for fair terms based on your actual behavior, not your zip code or legacy bank records!

The momentum is impossible to ignore:

- Lenders get better tools for assessing risk while protecting privacy.

- Borrowers unlock new opportunities, even if they’re outside the reach of traditional finance.

- The entire ecosystem grows safer, more efficient, and more inclusive as trustless reputation becomes portable across chains.

If you’re ready to level up your own DeFi journey, or just want to see where this tech is heading next, keep an eye on emerging DID standards and watch how on-chain identity verification continues to reshape blockchain lending markets. The future of decentralized finance is open, transparent, and built around YOU!

Would you use a DID-powered crypto credit score for borrowing or lending in DeFi?

Decentralized Identity (DID) enables privacy-preserving and accessible credit scoring for DeFi users, letting you prove your creditworthiness without revealing personal data. With growing adoption by projects like CreDA, zkMe, and RociFi, would you trust and use DID-based credit scores for your next crypto loan or lending decision?