Traditional DeFi lending has long relied on over-collateralization, requiring borrowers to lock up assets worth more than their loan. While this approach protects lenders, it excludes a vast segment of users who lack sufficient crypto holdings, stifling both capital efficiency and financial inclusion. The emergence of onchain risk scores is rapidly changing this paradigm, paving the way for under-collateralized lending models that rely on data-driven trust rather than sheer asset value.

Why Over-Collateralization Limits DeFi’s Potential

Over-collateralized loans are the backbone of most DeFi protocols today. The mechanism is simple: if you want to borrow $10,000 in stablecoins, you might need to deposit $15,000 or more in ETH or another asset as collateral. This protects lenders from default risk and price volatility but creates a high barrier to entry for anyone without significant crypto wealth.

This system is efficient for those already holding large portfolios but inherently exclusionary. It also traps liquidity in smart contracts rather than enabling it to flow through the ecosystem. As a result, DeFi’s promise of democratized finance remains out of reach for millions who lack deep wallets but could otherwise be creditworthy borrowers.

The Rise of Onchain Risk Scores: Data as Collateral

Onchain risk scores introduce a new trust layer by quantifying borrower reliability through transparent blockchain activity. Instead of relying solely on wallet balances, these protocols analyze:

- Historical loan repayments and defaults

- Transaction patterns across multiple protocols

- The age and activity level of wallets

- Interactions with reputable DeFi platforms

- The use of decentralized identity (DID) frameworks

This shift enables protocols like Cred Protocol, RociFi, and Spectral Finance to assign dynamic credit scores using real-time and historical onchain data. Borrowers can build portable reputations, akin to a blockchain-native FICO score, that unlock access to loans with significantly reduced collateral requirements.

Pioneering Protocols: How Onchain Credit Scoring Works in Practice

The practical application of DeFi credit scoring is already underway:

Leading DeFi Protocols for Under-Collateralized Lending

-

Cred Protocol: Pioneers decentralized credit scoring by analyzing on-chain activity to assess borrower risk, enabling under-collateralized lending and expanding DeFi access. Learn more.

-

RociFi: Utilizes decentralized identity and assigns non-fungible credit scores (NFCS) to borrowers, allowing for under-collateralized loans based on blockchain reputation. Learn more.

-

Spectral Finance: Introduces the Multi-Asset Credit Risk Oracle (MACRO) score to evaluate Ethereum accounts’ creditworthiness using on-chain transaction data, supporting dynamic risk assessment for lending. Learn more.

Cred Protocol quantifies lending risk using decentralized credit scores that are visible and verifiable on-chain. RociFi leverages decentralized identity solutions and assigns non-fungible credit scores (NFCS), allowing users to carry their reputation across dApps. Meanwhile, Spectral Finance’s MACRO score aggregates multi-asset transaction data into a single metric for Ethereum accounts.

This approach not only reduces the collateral burden but also brings privacy-preserving features through zero-knowledge proofs and selective disclosure, critical for institutional adoption and regulatory compliance.

The Mechanics Behind Onchain Reputation Systems

A robust crypto wallet reputation system relies on transparent metrics that cannot be easily manipulated or forged. By combining DID technology with immutable repayment histories, these systems enable permissionless yet reliable assessments of borrower risk profiles. Lenders can dynamically adjust interest rates or loan terms according to each user’s unique score, driving both higher yields for prudent lenders and fairer access for responsible borrowers.

This architecture is fundamentally different from legacy finance where opaque algorithms make decisions behind closed doors. In contrast, DeFi’s open-source ethos ensures that scoring methodologies are auditable by anyone, a key factor in building ecosystem-wide trust.

As these systems mature, onchain credit score protocols are laying the groundwork for a new era of capital efficiency. Lenders are no longer forced to treat every borrower as equally risky. Instead, they can tailor loan-to-value ratios, interest rates, and even loan durations to match real-time risk assessments. This dynamic approach unlocks a spectrum of lending products that were previously impossible in DeFi, from microloans to revolving credit lines.

Borrowers benefit through increased access and more favorable terms. For example, users with strong onchain reputations, built by years of timely repayments and responsible protocol interactions, can now tap liquidity without liquidating their holdings or over-collateralizing. This is especially impactful for small businesses and individuals in emerging markets, where traditional credit infrastructure is lacking but blockchain adoption is high.

Privacy, Security, and the Path Forward

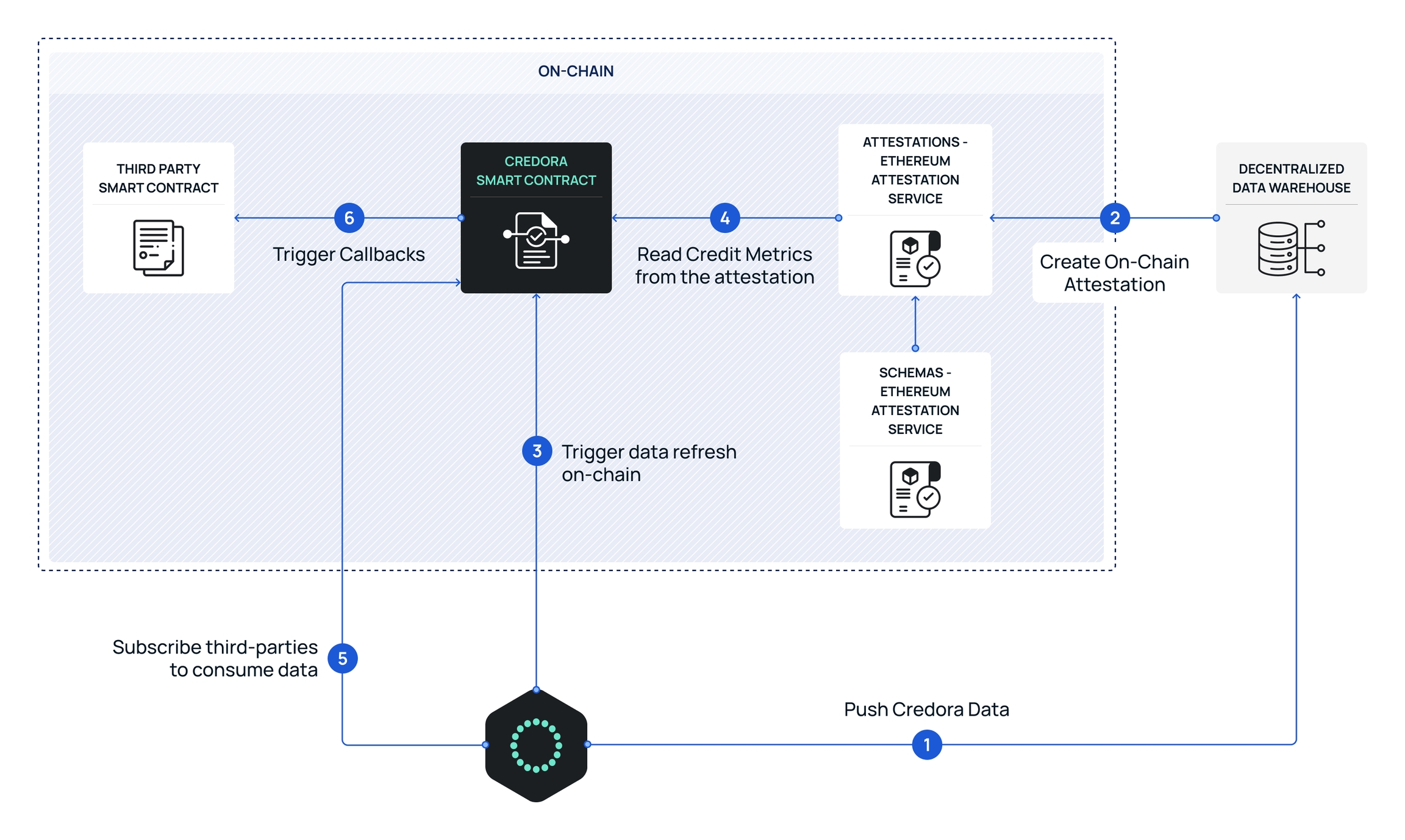

One of the most significant advances in this space is the integration of privacy-preserving technologies such as zero-knowledge proofs. These allow borrowers to prove their creditworthiness without exposing sensitive transaction details or wallet balances. Protocols like Credora and Huma Finance are at the forefront here, enabling selective disclosure that satisfies both regulatory requirements and user confidentiality.

Security remains paramount. Since all risk assessment data is recorded immutably on-chain, attempts at fraud or manipulation are easily detectable by both human auditors and automated systems. Moreover, decentralized identity (DID) frameworks further reduce Sybil attacks by linking reputation to verifiable digital identities rather than disposable wallet addresses.

The Road to Trillions: Scaling DeFi with Trust Layers

The implications stretch far beyond individual lending markets. As onchain risk scores become standardized across protocols, they form a composable trust layer for DeFi as a whole. This interoperability means users can build reputations that travel with them from one application to another, creating network effects that drive adoption among both retail users and institutional capital allocators.

The ultimate vision: unlocking trillions of dollars in capital currently sidelined due to lack of trust or excessive collateral requirements (read more here). By bridging crypto-native reputation with real-world asset (RWA) opportunities, such as tokenized bonds or property, DeFi platforms can compete directly with traditional finance on both yield and accessibility.

Key Benefits of Onchain Risk Scores in DeFi Lending

-

Expanded Access to Credit: Onchain risk scores, like those from Cred Protocol and RociFi, enable under-collateralized lending by evaluating users’ on-chain behavior, allowing borrowers without large crypto holdings to access loans.

-

Improved Capital Efficiency: By reducing or eliminating the need for excessive collateral, DeFi platforms like Spectral Finance allow more capital to circulate, increasing overall lending activity and yield opportunities.

-

Dynamic and Data-Driven Risk Assessment: Onchain credit scores use real-time blockchain data to assess borrower risk, enabling protocols to adjust loan terms and interest rates dynamically, as highlighted in research from arXiv and GARP.

-

Enhanced Privacy and Security: Solutions like Credora utilize zero-knowledge proofs, allowing borrowers to prove creditworthiness without exposing sensitive personal information, preserving privacy while maintaining trust.

-

Broader Inclusion of Real-World Assets: Onchain risk scoring supports the integration of real-world assets (RWA) into DeFi lending, bridging traditional finance and DeFi, and unlocking new sources of liquidity as discussed by Onchain and Huma Finance.

This evolution does not come without challenges. Standardizing scoring methodologies across chains, ensuring privacy compliance globally, and managing black swan risks all require ongoing innovation. But the momentum is clear: DeFi trust layers powered by transparent onchain data are rapidly moving from experiment to essential infrastructure.

The future of decentralized lending will not be built solely on code, it will be built on trust that is quantified, portable, and open for all to verify.