Decentralized Finance (DeFi) has experienced exponential growth, yet its lending markets remain largely constrained by the need for over-collateralization. This mechanism requires borrowers to lock up crypto assets worth more than their loan, which is effective for risk mitigation but stifles capital efficiency and excludes participants without substantial holdings. As DeFi matures, the integration of decentralized identity for DeFi lending and onchain risk scores is rapidly emerging as the catalyst for unlocking under-collateralized crypto loans at scale.

The Over-Collateralization Bottleneck in DeFi Lending

Traditionally, DeFi protocols have protected lenders by requiring collateralization ratios exceeding 100%. While this guards against default risk, it also results in locked capital that could otherwise be deployed productively. According to coinbackyard.com, this paradigm not only limits yield opportunities for lenders but also restricts access for users lacking large crypto portfolios. The result: a system that’s secure but inefficient and exclusionary.

DID: The Foundation of Trust Without Centralization

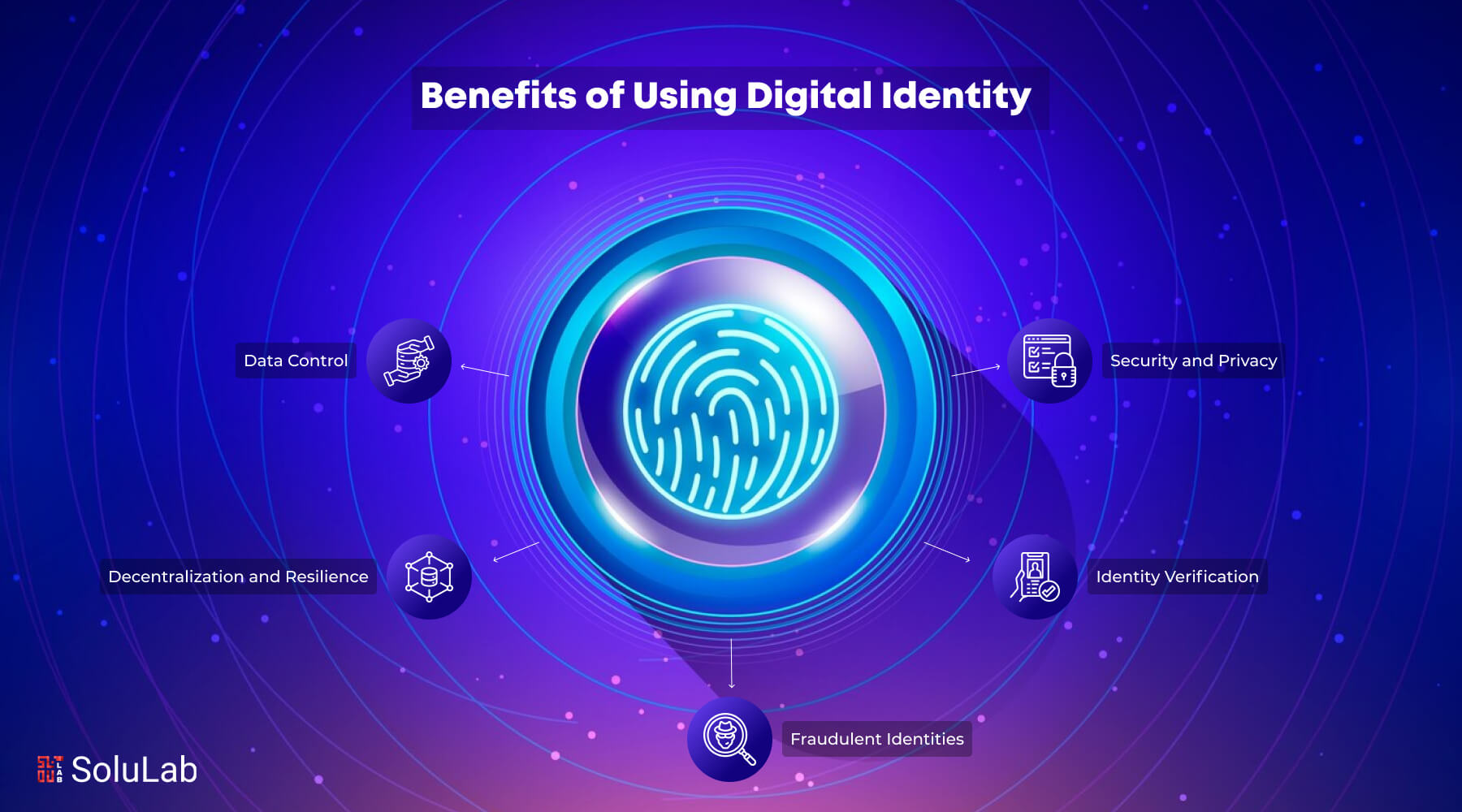

Decentralized Identity (DID) systems are redefining how individuals prove who they are in digital ecosystems. Unlike traditional KYC processes that rely on centralized authorities, DID allows users to generate self-sovereign identities, collections of verifiable credentials under their sole control. In the context of DeFi:

- User Privacy: Borrowers selectively disclose only necessary information, preserving privacy while enabling trust.

- Verifiable Credentials: Lenders can access cryptographically proven attributes (like repayment history or wallet age) without exposing sensitive personal data.

- Portability: Identities are not tied to a single platform; they travel with the user across DeFi protocols, creating a persistent reputation layer.

This approach dramatically increases both accountability and accessibility, two pillars previously difficult to balance in permissionless finance. For an in-depth discussion on DID’s impact on financial sovereignty in DeFi, see bestdapps.com.

The Mechanics of Onchain Risk Scores

The second pillar enabling under-collateralized lending is the rise of onchain credit reputation systems. These platforms analyze blockchain transaction histories, such as loan repayments, liquidation events, protocol interactions, and wallet longevity, to generate dynamic risk scores. Protocols like RociFi employ Non-Fungible Credit Scores (NFCS), assigning each wallet a unique score based on its behavior rather than off-chain attributes.

Leading DeFi Credit Scoring Platforms Compared

-

RociFi: Utilizes a Non-Fungible Credit Score (NFCS) system, analyzing a user’s on-chain transaction history and wallet behavior to assign credit scores. This enables under-collateralized lending by rewarding trustworthy borrowers with lower collateral requirements. RociFi integrates decentralized identity (DID) credentials for enhanced risk assessment and privacy.

-

Credora: Offers real-time credit analytics by aggregating both on-chain and off-chain data. Credora enables institutional and retail lenders to assess borrower risk using a combination of payment history, liquidation records, and DID frameworks. Its platform is widely used for facilitating under-collateralized loans across multiple DeFi protocols.

-

Spectra: Focuses on on-chain credit scoring by evaluating wallet activity, repayment behavior, and protocol interactions. Spectra’s system supports DID integration, allowing users to build portable, verifiable credit profiles. This approach improves capital efficiency and broadens access to DeFi lending.

This innovation empowers lenders to:

- Dynamically Adjust Collateral Requirements: Borrowers with strong repayment records or robust DID credentials can access lower collateral ratios.

- Create Tiered Lending Markets: Risk-adjusted interest rates and loan terms become possible without introducing centralized gatekeepers.

- Pave the Way for zk Attestations in DeFi: Zero-knowledge proofs allow users to prove specific facts about their creditworthiness without revealing underlying data, a critical step toward privacy-preserving compliance.

This model moves beyond binary eligibility checks; instead it enables nuanced assessments rooted in transparent data flows native to blockchain infrastructure. More details can be found at mirror.xyz.

The Synergy: Enabling Under-Collateralized Crypto Loans at Scale

The convergence of DID and onchain risk scores marks a paradigm shift for decentralized finance. By layering verifiable identity with transparent behavioral analytics, protocols can offer under-collateralized loans while managing risk more intelligently than ever before. This unlocks several key advantages:

- Enhanced Risk Assessment: Lenders replace blunt collateral requirements with granular evaluations based on real-time data and decentralized credentials.

- Financial Inclusion: Users previously excluded due to insufficient collateral now gain access based on meritocratic reputation systems rather than wealth alone.

- Capital Efficiency: Lowering overcollateralization unlocks trillions in dormant assets for productive use across the ecosystem (source).

The next section will examine live case studies from leading platforms and discuss current challenges such as privacy preservation and score manipulation resistance as these innovations move from concept to mainstream adoption.

Live Protocols and Real-World Impact

Several DeFi protocols have already begun integrating DID in decentralized finance and advanced onchain risk scores to facilitate under-collateralized lending. Platforms like Credora, Spectra, and RociFi each implement distinctive methodologies, combining repayment histories, wallet analytics, and decentralized attestations, to generate actionable credit scores. These systems are not theoretical; they underpin live markets where users can access loans with collateral ratios far below the traditional 150%-200% range.

The practical result is a more inclusive and efficient credit market. Borrowers with established onchain reputations can now unlock better rates and terms, while lenders gain new tools for risk management without sacrificing transparency. As these platforms mature, their data-driven approach is expected to attract institutional liquidity, fueling growth across the ecosystem.

Navigating Risks: Privacy, Security, and Score Integrity

Despite its promise, this new paradigm introduces fresh challenges that must be addressed for sustainable adoption:

- Privacy Concerns: Even with zero-knowledge proofs and selective disclosure, maintaining user privacy while providing verifiable data remains a delicate balance.

- Score Manipulation: Protocols must defend against sybil attacks or artificial score inflation by ensuring robust verification of both identity and behavioral data.

- Standardization: The lack of unified frameworks for DID issuance or risk scoring can create fragmentation, making it harder for users to port their reputation across protocols.

Protocols at the forefront are investing heavily in cryptographic research (such as zk attestations) and multi-protocol interoperability to address these risks. Ongoing audits, open-source standards, and community governance will be critical as adoption accelerates.

The Road Ahead: From Niche to Norm

The integration of decentralized identity systems with transparent onchain credit scoring is poised to transform DeFi from a capital-constrained niche into a truly global financial infrastructure. As these tools become standardized, and as user education improves, the barriers that once restricted access to DeFi lending will erode.

Key Benefits of Under-Collateralized DeFi Loans with DID & Onchain Risk Scores

-

Greater Financial Inclusion: DID and on-chain risk scores enable users without large crypto holdings to access DeFi loans, expanding opportunities for individuals traditionally excluded from over-collateralized lending models.

-

Improved Capital Efficiency: By reducing collateral requirements, borrowers can utilize more of their assets elsewhere, leading to more efficient capital allocation across DeFi platforms.

-

Personalized, Risk-Based Borrowing Terms: On-chain risk scores allow platforms like RociFi and Credora to tailor loan terms to individual credit profiles, offering better rates and terms to trustworthy borrowers.

-

Enhanced Privacy and Security: Decentralized identity (DID) frameworks let users prove their credentials and reputation without exposing sensitive personal data, reducing risks of data breaches.

-

Transparent and Tamper-Resistant Credit Assessment: On-chain risk scoring protocols, such as RociFi and Spectra, provide auditable and transparent credit evaluations, increasing trust in the lending process.

The shift toward reputation-based lending is more than just a technical upgrade; it’s a philosophical realignment toward meritocratic access. By rewarding responsible behavior rather than merely wealth or tenure in crypto markets, DeFi can begin to rival traditional finance not only in yield but also in fairness and accessibility.

Lenders seeking sustainable yields should closely monitor developments in onchain credit reputation systems. Borrowers should explore how building an onchain identity today could unlock new opportunities tomorrow. As these innovations converge, expect under-collateralized crypto loans, and the protocols powering them, to move rapidly from experimental to essential within the next market cycle.