Undercollateralized lending has long been the holy grail for decentralized finance (DeFi), promising to unlock capital efficiency and financial inclusion on a scale rarely seen in traditional banking. Yet, for years, DeFi protocols have relied almost exclusively on over-collateralization. Why? Because the pseudonymous nature of blockchain made it nearly impossible to assess borrower risk without demanding excessive collateral. This is changing fast. The emergence of onchain credit scores: transparent, data-driven profiles built from users’ blockchain activity, signals a paradigm shift in how trust and risk are managed in crypto lending markets.

Why Over-Collateralization Dominated Early DeFi

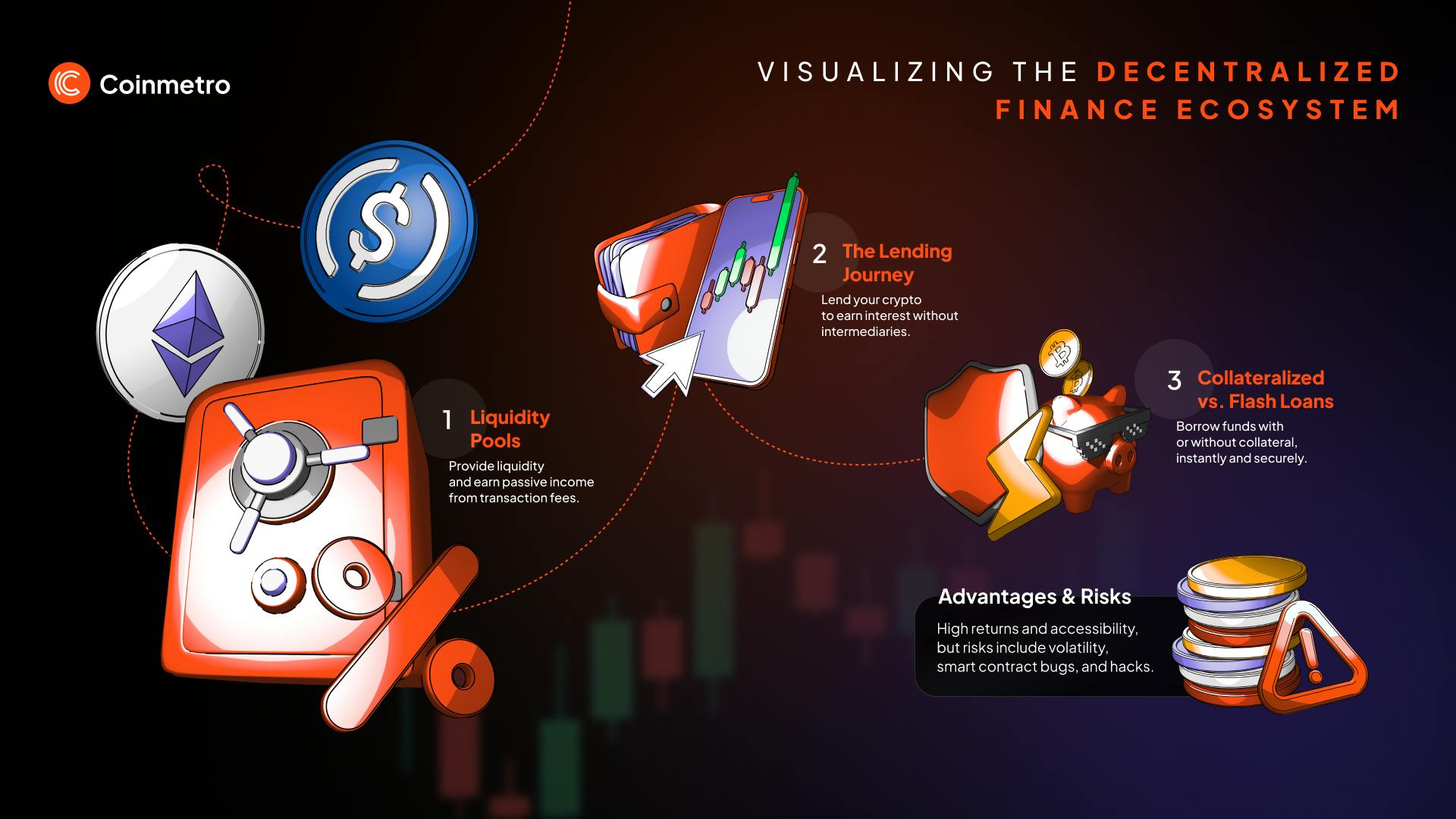

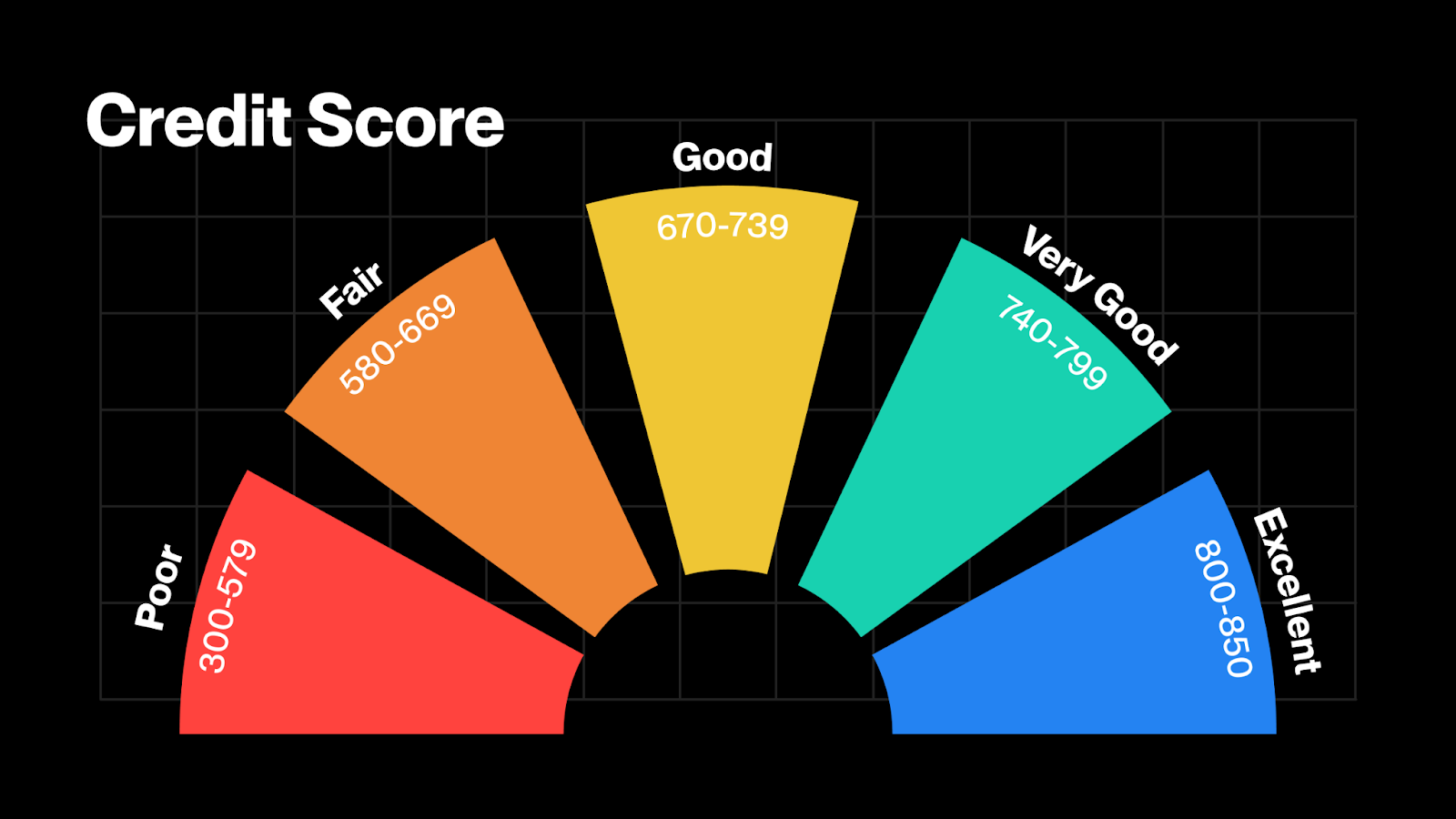

In legacy finance, lenders rely on established credit bureaus to gauge a borrower’s trustworthiness. These scores open doors to unsecured loans, mortgages, and flexible credit lines. DeFi’s early years lacked this infrastructure. Instead, protocols like Aave and Compound required borrowers to lock up assets worth far more than their loans, sometimes 150% or more.

This approach made sense as a stopgap: when identities are hidden and histories opaque, collateral is the only safeguard against default. However, this model is inherently inefficient. It locks away capital that could otherwise be deployed productively and excludes millions who lack large crypto holdings but have strong repayment potential.

The Rise of Onchain Credit Scores: Turning Data Into Trust

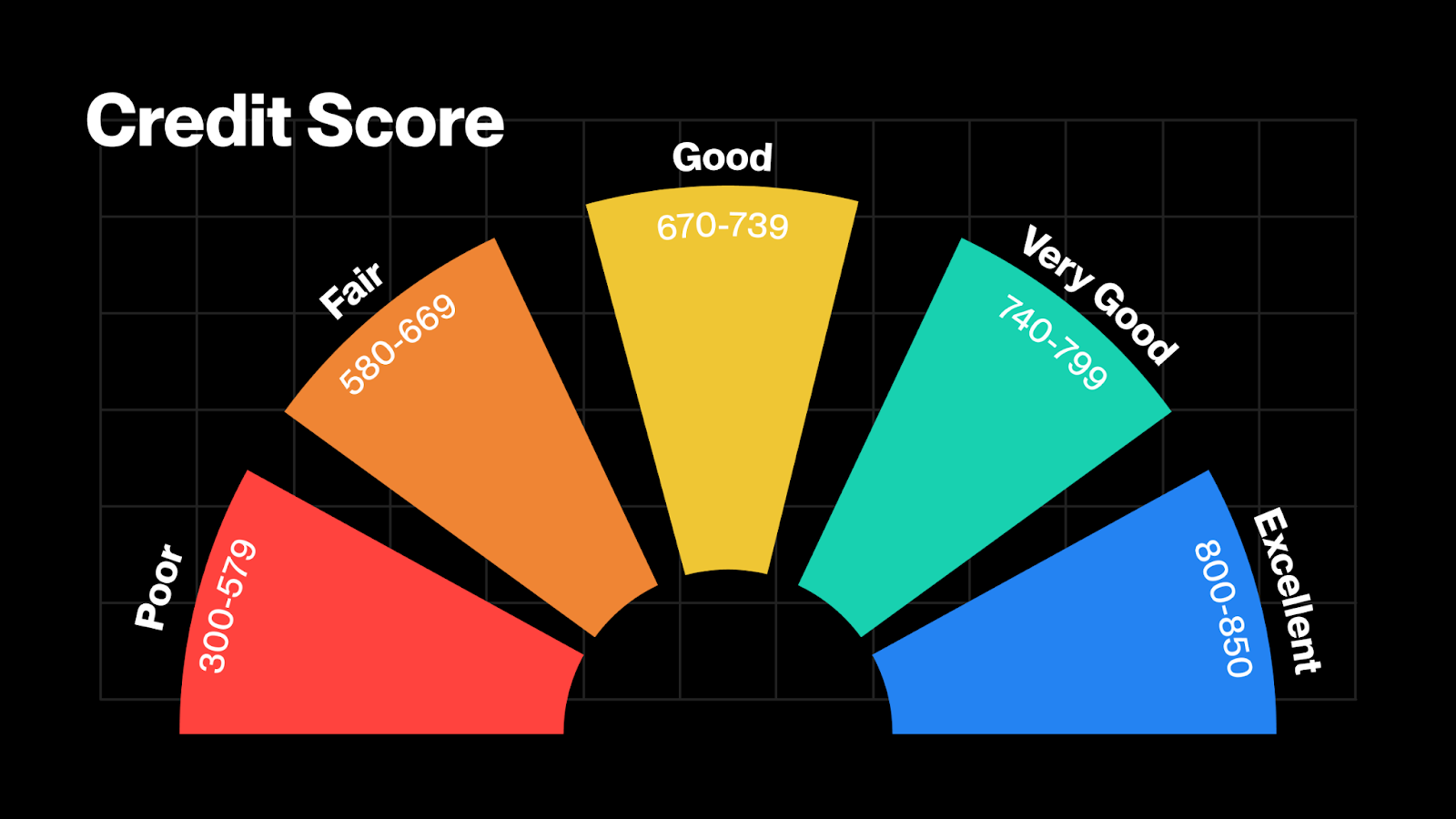

Onchain credit scoring transforms every wallet interaction, lending, borrowing, repaying, staking, into a verifiable track record accessible to anyone on the blockchain. By analyzing transaction histories and smart contract engagements, these systems quantify risk with unprecedented transparency.

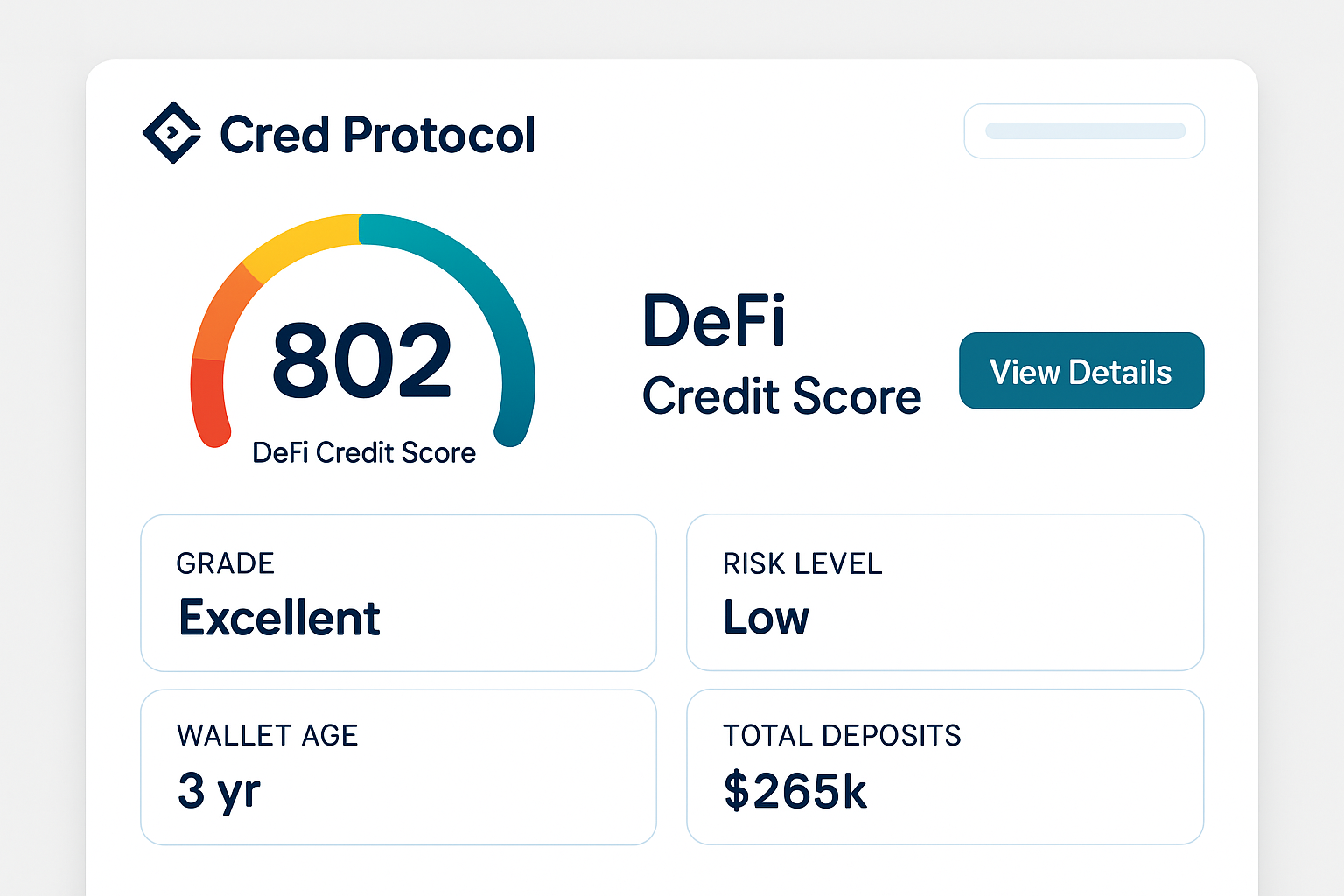

This innovation isn’t just theoretical. Projects like Cred Protocol (see details here) are already issuing decentralized credit scores based on users’ on-chain behavior. RociFi takes it further by minting Non-Fungible Credit Scores (NFCS), blending decentralized identity with real-time reputation analytics. CreDA analyzes cross-protocol financial behavior to enable non-collateralized loans for users with robust crypto histories.

How Onchain Risk Assessment Enables Undercollateralized Lending

The mechanics are elegantly simple yet technologically sophisticated: instead of demanding $1,500 in ETH for a $1,000 loan, lenders use onchain risk scores to determine appropriate collateral levels, or even offer fully unsecured loans for high-reputation borrowers.

Leading DeFi Projects Using Onchain Reputation for Lending

-

Cred Protocol builds decentralized credit scores by analyzing users’ on-chain activity, enabling under-collateralized lending and expanding access to DeFi loans. Its transparent scoring system helps lenders assess risk more accurately.

-

RociFi leverages decentralized identity and on-chain reputation to offer zero and under-collateralized loans. The platform issues Non-Fungible Credit Scores (NFCS) that reflect a borrower’s blockchain behavior, supporting more inclusive lending.

-

CreDA (Credit DeFi Alliance) introduces credit scoring to DeFi by evaluating users’ financial standing and behavior within the crypto ecosystem. This enables non-collateralized loans, increasing capital efficiency and financial inclusion.

This process leverages several core components:

- Decentralized Identity (DID): Linking wallet addresses with persistent reputations while preserving privacy

- Transparent Repayment Histories: Immutable records of timely or late payments across multiple protocols

- Cross-Platform Analytics: Aggregating data from liquidity pools, lending platforms, and DEXs to build holistic borrower profiles

The result? More nuanced DeFi risk assessment that empowers protocols to price loans dynamically based on actual behavior, not just static collateral ratios.

Pioneering Protocols Shaping the Future of Crypto Credit Scoring

The competitive landscape is evolving rapidly as new entrants experiment with different models for under-collateralized lending via onchain reputation systems. Some focus heavily on transparent payment histories; others blend off-chain data via secure oracles for even richer profiles.

But what does this mean for lenders and borrowers on the ground? For lenders, onchain credit scores unlock a larger, more diverse pool of potential clients. With granular risk segmentation, they can confidently offer better rates or lower collateral requirements to proven borrowers, without sacrificing protocol safety. For borrowers, especially those with limited upfront capital but strong onchain reputations, the barriers to entry are finally coming down. This is the real promise of DeFi trust systems: financial access based on merit and transparency, not just wallet size.

Risks and Challenges: Not All Scores Are Created Equal

Yet, as with any major innovation in finance, there are new risks to navigate. The quality and accuracy of crypto credit scoring models depend entirely on the data inputs and the algorithms that interpret them. If protocols rely solely on limited or manipulated data, such as wash trading or Sybil attacks, risk assessments can be skewed, leading to unexpected defaults. This is why robust decentralized identity frameworks and cross-protocol analytics are essential for maintaining integrity.

Another challenge lies in privacy: while transparency is a strength, users may be wary of linking too much personal behavior to a single wallet or DID. Emerging solutions like zero-knowledge proofs and selective disclosure are beginning to address these concerns, allowing users to prove creditworthiness without exposing every detail of their financial history.

The Road Ahead: From Niche Experiments to Trillions in Onchain Lending

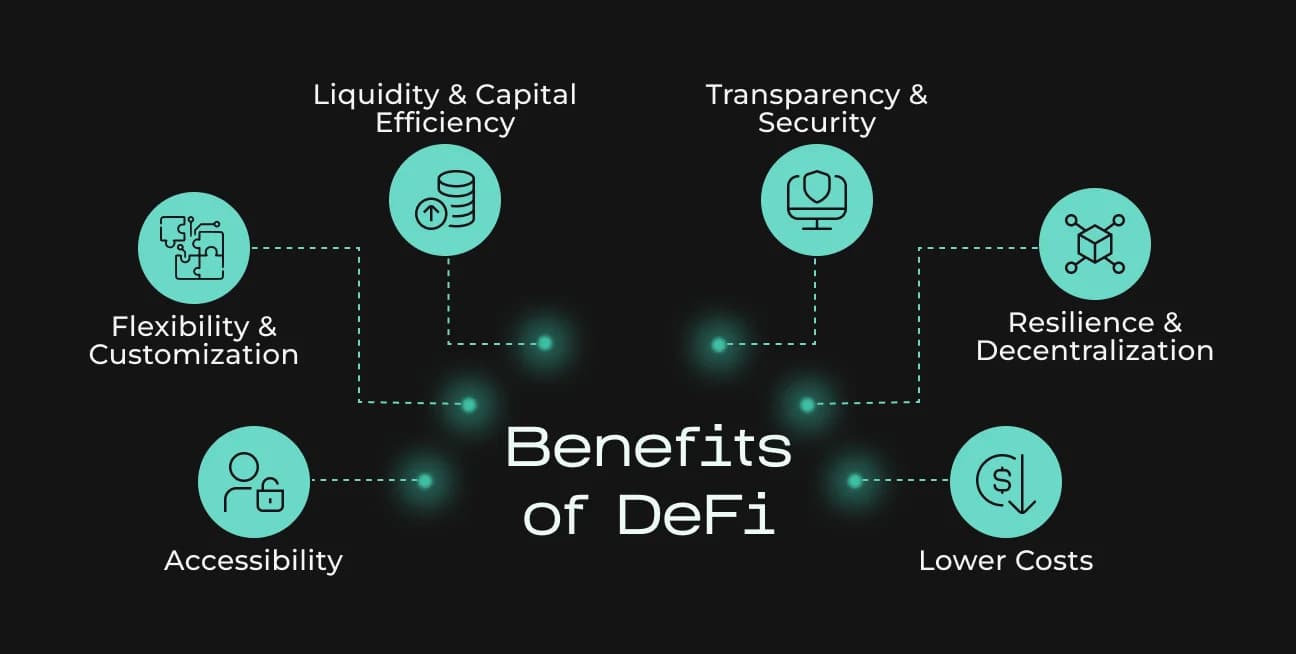

The impact of onchain reputation extends far beyond individual loans. As more protocols adopt standardized risk scores and interoperable decentralized identity systems, we’re likely to see:

Key Benefits of Under-Collateralized DeFi Lending

-

Enhanced Capital Efficiency: Onchain credit scores enable platforms like Cred Protocol to assess risk more accurately, allowing borrowers to access funds with less collateral. This increases the overall liquidity and utilization of assets within the DeFi ecosystem.

-

Greater Financial Inclusion: By leveraging blockchain data rather than traditional credit checks, protocols such as RociFi open up lending opportunities to users worldwide, including those without access to conventional banking or credit infrastructure.

-

Transparent and Immutable Credit Assessment: Onchain credit scores provide a public, tamper-proof record of a borrower’s financial behavior, as seen with CreDA. This transparency fosters trust between lenders and borrowers in DeFi.

-

Broader Range of Financial Products: With reliable onchain credit scoring, DeFi platforms can introduce more sophisticated offerings, such as unsecured loans and dynamic interest rates, bringing DeFi closer to the flexibility of traditional finance.

-

Lower Borrowing Costs for Trusted Users: Users with strong onchain credit histories can access loans at better terms, reducing the need for excessive collateral and potentially lowering interest rates compared to over-collateralized models.

This shift could bring trillions of dollars in previously untapped capital into DeFi markets, a prediction echoed by industry leaders and highlighted in recent research (see analysis here). With improved DeFi risk assessment, lenders can price loans more competitively while managing default risks transparently through immutable smart contracts.

The next wave will also see greater integration with traditional finance (TradFi), as banks and fintechs begin leveraging open-source onchain credit data for cross-border lending and emerging market inclusion. Expect hybrid models where off-chain data augments blockchain-native profiles, providing an even fuller picture of borrower reliability.

What’s Next for Developers?

If you’re building in this space, now is the time to explore composable credit modules, experiment with new reputation primitives, or integrate existing DID standards into your dApps. Community-driven scoring algorithms will become increasingly important as users demand both fairness and privacy from their financial tools.

The era of over-collateralization dominating DeFi is drawing to a close. By harnessing transparent blockchain histories, advanced analytics, and decentralized identity protocols, under-collateralized lending is no longer a distant goal, it’s an emerging reality. The winners will be those who master both technical rigor and ethical stewardship as crypto credit scoring matures. For deeper insights into how these systems work, and how you can participate, explore our resources at Crypto Credit Scores.