For years, DeFi lending protocols have been locked behind a wall of over-collateralization. If you wanted to borrow $1,000, you often needed to lock up $1,250 or more in crypto – not exactly capital efficient or accessible for most users. But that’s changing fast. Onchain wallet scores are shaking up the rules of under-collateralized DeFi lending by giving protocols a transparent, data-driven way to assess borrower risk. The result? A new era of crypto credit that’s more open, efficient, and dynamic than anything we’ve seen before.

The Over-Collateralization Dilemma

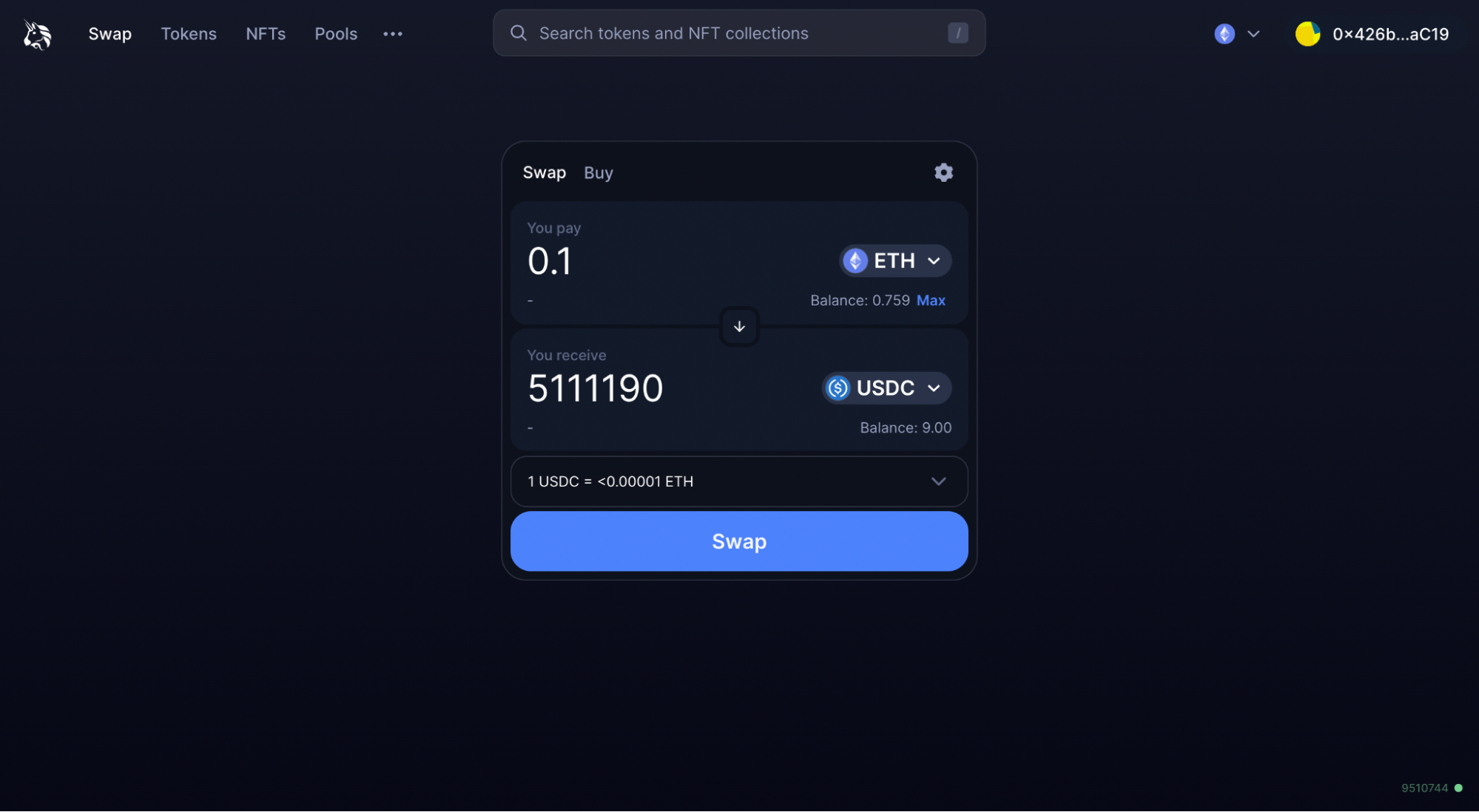

Let’s start with the problem: traditional DeFi lending platforms like Aave and Compound have always played it safe. They require borrowers to put up collateral worth 125% to 150% of their loan amount. This system protects lenders from volatility and default risk, but it also creates a huge barrier to entry. If you don’t already have substantial crypto holdings, you’re out of luck. This model limits participation and locks up billions in idle capital that could be put to work elsewhere.

Recent research and market data confirm what many in the industry have long suspected: over-collateralization is a bottleneck for mainstream DeFi adoption. According to sources like digitalfinancenews. com and arXiv, the inability to borrow without massive collateral requirements is one of the biggest hurdles for both retail and institutional users.

How Onchain Wallet Scores Work

So what’s the breakthrough? Enter the onchain wallet score. Instead of treating every borrower as a blank slate, protocols now analyze a user’s entire onchain footprint: repayment history, asset diversity, interactions with DeFi protocols, and more. This isn’t just a theoretical idea – it’s already live in the wild.

Leading DeFi Protocols Using Onchain Wallet Scores

-

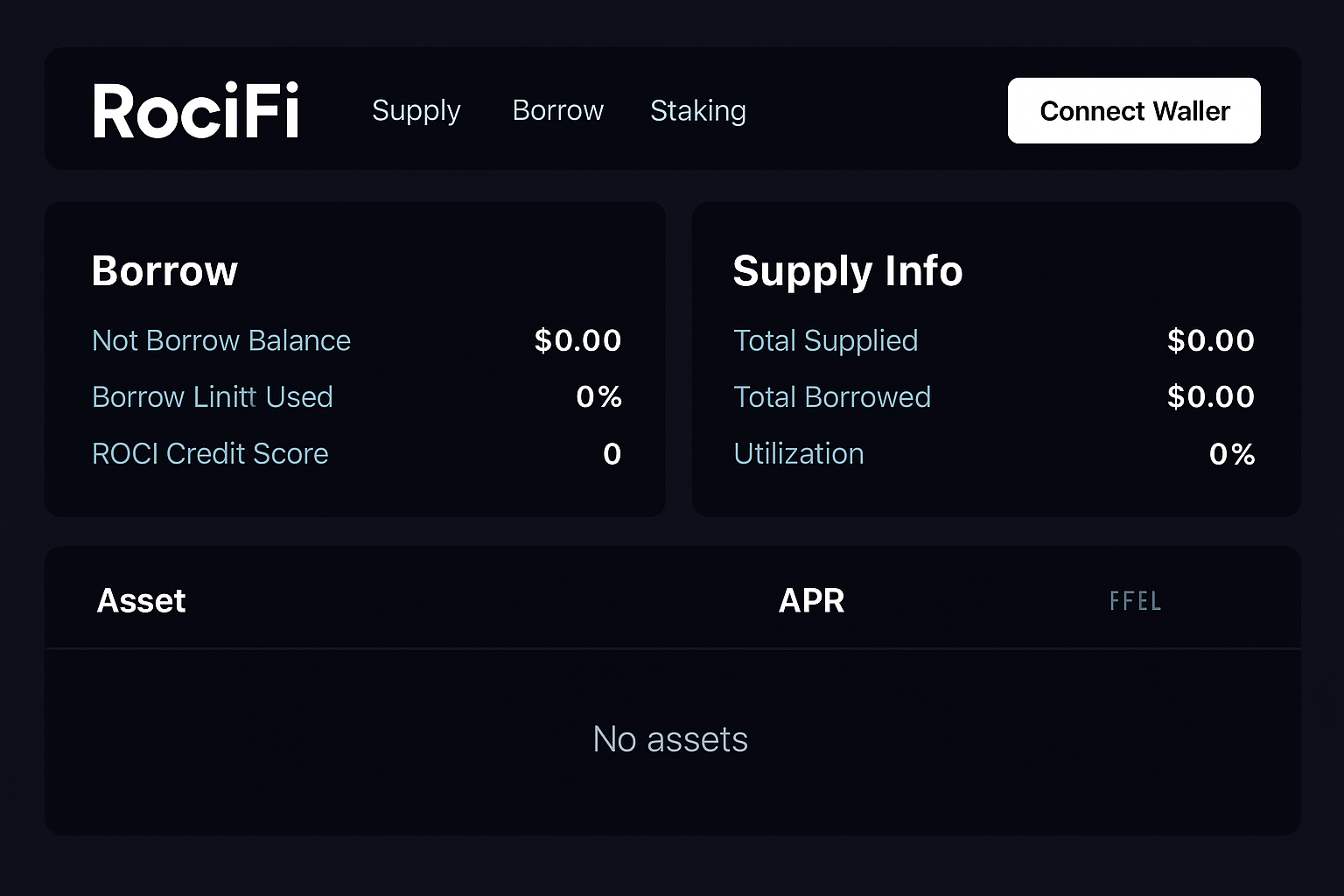

RociFi is pioneering under-collateralized lending by assigning Non-Fungible Credit Scores (NFCS) to users based on their onchain activity. Borrowers with higher scores can access fixed-rate USDC loans with reduced collateral requirements.

-

Spectral introduces the Multi-Asset Credit Risk Oracle (MACRO) score, an onchain credit score ranging from 300 to 850. This score is encapsulated in Non-Fungible Credits (NFCs), allowing users to prove their creditworthiness and access under-collateralized loans.

-

Credora (formerly Credmark) leverages onchain wallet analytics and credit scoring to provide institutional-grade under-collateralized loans. Their platform assesses borrower risk using real-time blockchain data.

-

Goldfinch enables under-collateralized crypto loans by evaluating borrower creditworthiness through a combination of onchain and offchain data, including wallet history and business metrics.

-

TrueFi offers unsecured lending to vetted borrowers by utilizing a mix of onchain reputation, wallet analytics, and community governance for credit assessment, helping expand access to capital.

Take RociFi, for example. Built on Polygon, RociFi assigns each user a Non-Fungible Credit Score (NFCS) ranging from 1 (prime) to 10 (risky). Your score determines how much collateral you need to post for a loan. High scorers can access fixed-rate 30-day USDC loans with minimal collateral, while riskier borrowers face stricter terms. Similarly, Spectral uses the Multi-Asset Credit Risk Oracle (MACRO) score – an onchain equivalent to the FICO score – to unlock flexible lending terms based on wallet reputation.

Academic work backs this up. The On Chain Credit Risk Score (OCCR) quantifies the probability that a wallet will be liquidated, giving protocols a scientific basis for setting LTV ratios and liquidation thresholds. It’s all about turning blockchain data into actionable insights for smarter lending.

Unlocking Capital Efficiency and Inclusion

The impact of onchain risk scoring is already visible:

- Enhanced Accessibility: With reduced collateral requirements, users who were previously shut out of DeFi lending can now participate.

- Improved Capital Efficiency: Borrowers can put more of their assets to work instead of locking them up as deadweight collateral.

- Dynamic Risk Management: Lenders get a granular view of borrower risk and can adjust terms accordingly, balancing yield with safety.

But it’s not just about numbers and algorithms. This shift is fundamentally about trust. By building transparent credit profiles onchain, users can prove their reliability without ever revealing their real-world identity. It’s a radical upgrade for privacy and financial sovereignty.

Notable Protocols Leading the Charge

Let’s highlight a few of the most exciting projects in this space:

- RociFi: Pioneering under-collateralized loans with NFCS on Polygon.

- Spectral: Bringing FICO-style credit scoring to Web3 with the MACRO score and Non-Fungible Credits (NFCs).

- Credora: Combining payment history and liquidation data for smarter DeFi risk scoring.

These platforms are proving that under-collateralized DeFi lending isn’t just possible – it’s here, and it’s gaining momentum. As adoption grows, the days of one-size-fits-all collateral rules are numbered.

What’s especially exciting is how onchain wallet scores are creating a feedback loop of innovation. As more lending protocols integrate these risk metrics, users are incentivized to maintain healthy borrowing behaviors and build up their wallet reputation. This opens the door for new entrants, encourages responsible participation, and gradually reduces the stigma around under-collateralized lending in crypto.

Real-World Impact: From Niche to Mainstream

While under-collateralized lending is still a small slice of the DeFi pie, it’s rapidly evolving from a moonshot experiment to a credible asset class with real product-market fit. According to Reflexivity Research, the volume of under-collateralized loans is compounding as protocols like RociFi, Spectral, and Credora prove out their models. The key driver? Dynamic onchain credit risk scores that empower both lenders and borrowers with actionable data.

Let’s be clear: this isn’t just about making loans easier to get. It’s about unleashing trillions in untapped capital by lowering the systemic barriers that have long kept DeFi out of reach for most people. With transparent, algorithmic credit scoring, protocols can finally offer competitive yields and flexible terms, without taking on reckless risk.

Ethereum Technical Analysis Chart

Analysis by Jared Hollister | Symbol: BINANCE:ETHUSDT | Interval: 4h | Drawings: 7

Technical Analysis Summary

ETHUSDT just printed a classic volatility squeeze and is sitting at a major inflection zone around $4,012.58 after a sharp retrace from the $4,800 peak earlier in October 2025. Price action shows a strong V-shaped recovery off the $3,500s, but the bounce stalled at $4,200 and has faded, forming a lower-high structure. Immediate price action is consolidating with a slight bullish bias, but overall momentum is neutral-to-weak. Aggressive traders can look for a high-risk, short-term swing long scalp if $4,000 holds, but should be quick to exit if $3,900 breaks. For bears, a failure at $4,100-$4,200 is an ideal re-entry for targeting the $3,700-$3,600 liquidity pocket. Key is to watch for a breakout from this $4,200 resistance or breakdown below $3,900. Use tight stops. Volume and confirmation from MACD crossovers will be crucial for conviction.

Risk Assessment: high

Analysis: Extreme volatility and rapid trend reversals. Price is in a squeeze zone with uncertain direction and high potential for stop runs.

Jared Hollister’s Recommendation: Trade aggressively but with tight stops. Look for volume confirmation on any breakout/breakdown. Both sides can be played here, but keep risk management strict and act fast on failed moves.

Key Support & Resistance Levels

📈 Support Levels:

-

$3,900 – Recent local support, tested multiple times post-drop.

moderate -

$3,600 – Major wick low, V-shape recovery origin.

strong

📉 Resistance Levels:

-

$4,200 – Lower high, rejection zone after bounce.

moderate -

$4,800 – Major swing high and psychological resistance.

strong

Trading Zones (high risk tolerance)

🎯 Entry Zones:

-

$4,010 – Aggressive long scalp if $4,000 holds, targeting $4,200.

high risk -

$4,190 – Aggressive short entry on rejection at $4,200 resistance.

high risk

🚪 Exit Zones:

-

$3,900 – Stop-loss for long scalp; break below invalidates bullish setup.

🛡️ stop loss -

$4,200 – Profit target for quick long scalp.

💰 profit target -

$3,700 – Profit target for short from $4,200.

💰 profit target

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Volume spike on the dump to $3,500s, followed by declining participation in bounce.

Look for new volume inflow on any breakout or breakdown to confirm the move.

📈 MACD Analysis:

Signal: MACD likely neutral to slightly bearish, watch for bullish crossover if price holds $4,000.

MACD crossing up from oversold zones could trigger a momentum play.

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Jared Hollister is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (high).

For developers and institutions, this shift means new opportunities to create products that blend traditional financial logic with the composability of blockchain. Imagine a world where your crypto credit score follows you across protocols, unlocking better rates, higher leverage, or even cross-chain financial products, all without ever filling out a form or sacrificing privacy.

What’s Next? Challenges and Opportunities

Of course, this revolution isn’t without its challenges. Onchain risk scoring is only as good as the data it ingests. Protocols must remain vigilant against sybil attacks, wash trading, or attempts to game the system. There’s also the ongoing debate about how much weight to give each onchain metric, should repayment history trump asset diversity? Should protocol interactions be scored differently than simple token transfers?

Despite these hurdles, the direction of travel is clear: DeFi lending is moving toward a future where wallet reputation and onchain trust scores are as important as collateral itself. Lenders can now tailor risk exposure with surgical precision, while borrowers finally get rewarded for responsible behavior.

If you’re curious about how these systems work under the hood, or want to see real examples of protocols using onchain risk scoring, check out our deep dive here: How Onchain Risk Scores Enable Under-Collateralized Lending in DeFi.

Getting Started: Building Your Wallet Reputation

If you’re ready to participate in this next wave of DeFi, start by:

Steps to Boost Your Onchain Wallet Score

-

4. Avoid Liquidations and Over-Leveraging: Monitor your collateral ratios and avoid positions that risk liquidation. Tools like DeFi Saver can help automate risk management and protect your score.

-

6. Build Long-Term Wallet Reputation: Use the same wallet for major DeFi activities over time. A long, positive transaction history boosts your credibility with both protocols and scoring systems.

Remember: every interaction counts. Repaying loans on time, diversifying assets, and engaging with reputable protocols all help grow your reputation, and unlock more capital with less collateral locked away.

The bottom line? Onchain wallet scores aren’t just a technical upgrade, they’re a paradigm shift for crypto finance. By turning blockchain data into trust signals, they make DeFi fairer, smarter, and radically more accessible. The future of under-collateralized lending isn’t just possible, it’s already unfolding before our eyes.