Decentralized finance (DeFi) has redefined access to capital, but the sector’s reliance on over-collateralized lending has long constrained its global reach. The emergence of on-chain credit scores is rapidly changing this equation, enabling borderless, trustless lending and unlocking undercollateralized loan models that mirror real-world credit markets. By leveraging blockchain transparency and decentralized identity, these risk scores are eliminating barriers for borrowers while giving lenders new tools for precision risk management.

How On-Chain Credit Scores Work: Decentralized Reputation as Collateral

Unlike traditional FICO systems, an on-chain credit score is derived from a user’s historical blockchain activity. Protocols analyze wallet interactions with DeFi applications, repayment histories, liquidity provision, staking participation and even governance voting patterns to build a reputation profile. This profile becomes a persistent financial identity, your wallet as your credit passport, enabling protocols to algorithmically calibrate loan terms and collateral requirements.

Recent innovations have accelerated adoption:

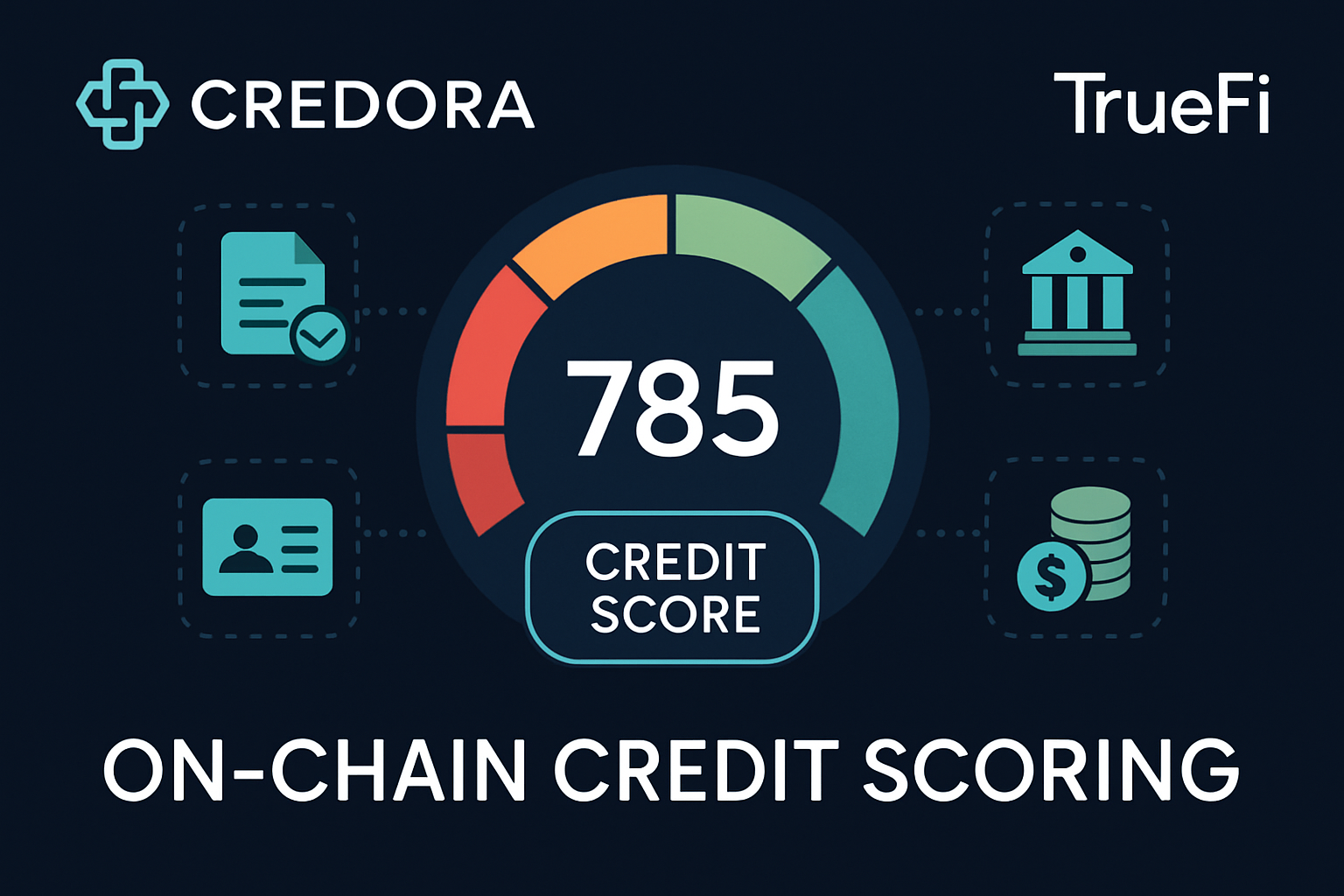

- Credora’s On-Chain Credit Scores (July 2024): These scores are directly integrated into lending protocols, automating exposure management and creating transparent borrower-lender relationships.

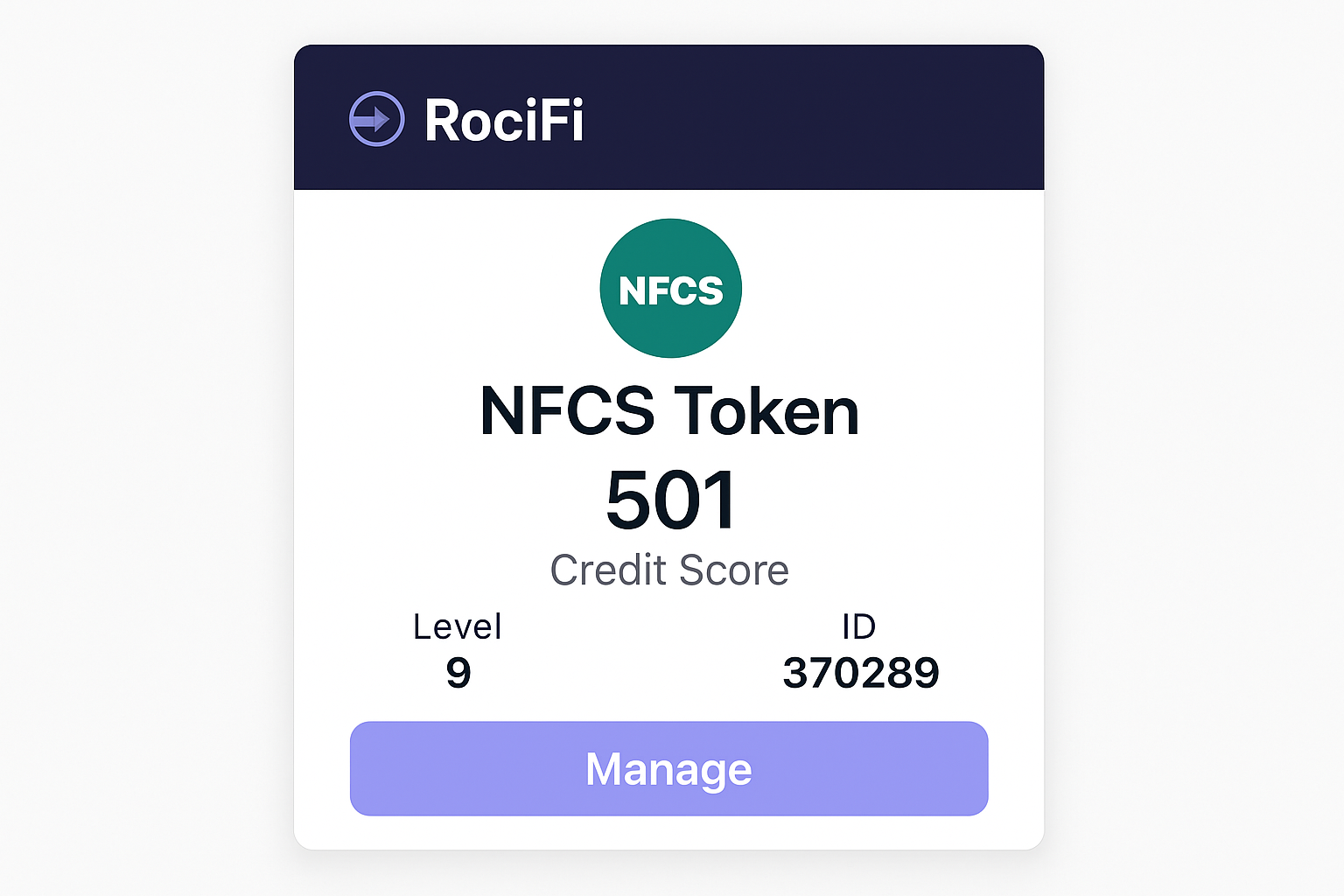

- RociFi’s Non-Fungible Credit Score (NFCS): NFCS tokens serve as non-transferable badges of creditworthiness that unlock undercollateralized loans for users with strong on-chain reputations.

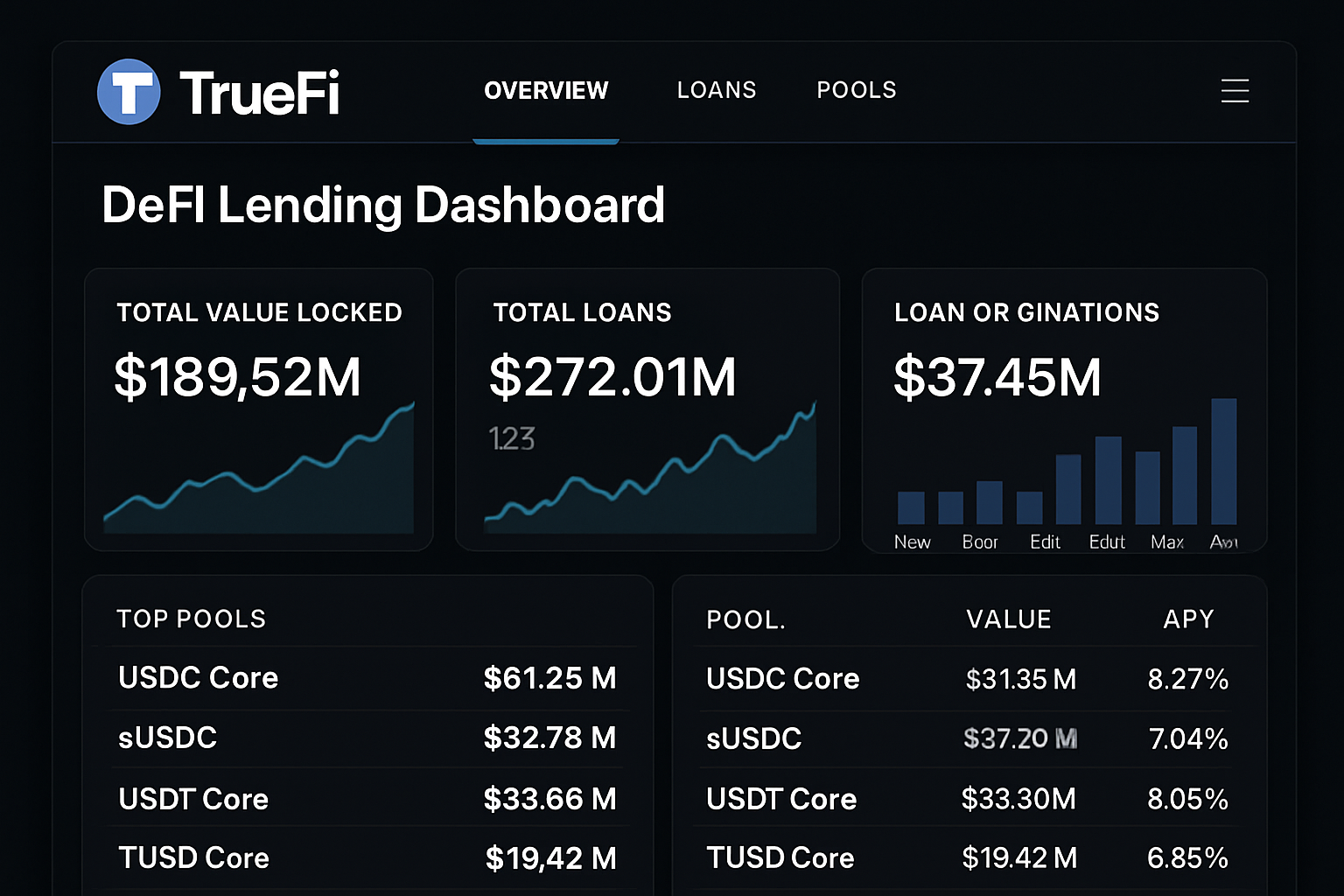

- TrueFi’s Hybrid Model: By combining on-chain analytics with off-chain data, TrueFi has originated over $100 million in unsecured loans without defaults, a milestone for risk-managed DeFi lending.

This paradigm shift is detailed further in our resource on how on-chain credit scoring unlocks borderless trustless lending in DeFi.

Key Benefits: Financial Inclusion, Transparency, Capital Efficiency

The impact of decentralized credit scoring extends far beyond protocol mechanics. Three core benefits are driving exponential growth:

Top Benefits of On-Chain Credit Scoring in DeFi

-

Enhanced Financial Inclusion: On-chain credit scores allow users without traditional credit histories to access DeFi lending, opening financial services to a global, underserved population. Learn more

-

Borderless, Trustless Lending: By leveraging blockchain transparency, on-chain credit scores enable secure, trustless lending across borders without intermediaries, reducing reliance on centralized institutions.

-

Improved Capital Efficiency: Protocols like RociFi use on-chain credit scores to offer under-collateralized loans, letting borrowers access more capital compared to traditional over-collateralized DeFi lending. Explore RociFi NFCS

-

Transparent & Automated Risk Assessment: Platforms such as Credora and TrueFi automate loan terms and risk management by integrating on-chain credit scores, increasing transparency and reducing manual intervention. See Credora’s solution

-

User Data Control & Privacy: Users maintain ownership of their financial data on-chain, with solutions like zkMe enabling anonymous credit scoring and privacy-preserving lending. Discover zkMe zkCreditScore

Financial inclusion: On-chain risk assessment provides unbanked users, those without traditional credit files, access to capital based solely on their blockchain behavior. This levels the playing field for millions globally who have been excluded from legacy finance.

Transparency and user control: The open-source nature of blockchains means users can audit exactly how their actions affect their risk profile. Unlike opaque centralized bureaus, borrowers retain sovereignty over their data while lenders gain confidence in verifiable histories.

Capital efficiency: Instead of blanket over-collateralization, protocols dynamically adjust collateral requirements based on real-time risk analysis. This frees up liquidity across the ecosystem and enables more competitive rates, a win-win for both sides of every loan book.

Pioneering Protocols and New Lending Models in 2024-2025

The last year has seen rapid deployment of these systems by major players:

- Undercollateralized lending platforms, such as those leveraging RociFi’s NFCS or Credora’s scores, now offer dynamic interest rates based on real-time wallet activity, not just static collateral ratios.

- Lending DAOs integrate both quantitative (transaction history) and qualitative (protocol governance participation) metrics into borrower assessments.

- ZK-proof-based solutions like zkCreditScore preserve user privacy while allowing anonymous proof of off-chain reputation bridged onto the blockchain.

This convergence is enabling a new generation of borderless finance where trust is algorithmic and access is universal. For developers seeking implementation guidance or integration strategies, see our guide: How Developers Can Integrate On-Chain Credit Scoring into DeFi Protocols.

As the DeFi landscape matures, data-driven lending models anchored by on-chain credit scores are moving from experimental to mainstream. This evolution is not just technical but structural: protocols can now build lending markets that are truly borderless, with risk assessment and loan origination occurring in real time, without intermediaries or geographic constraints.

Wallet as Credit Identity: Your public blockchain address becomes your persistent financial identity. Lenders analyze wallet history, repayments, protocol participation, and even DAOs voted on, to generate a risk profile. This approach eliminates subjective, off-chain biases and enables anyone with an active DeFi presence to build reputation capital. As a result, the concept of “wallet as credit identity” is rapidly becoming foundational for trustless credit in crypto.

Challenges and Risk Management in Trustless Lending

No system is without risk. While on-chain credit scoring brings transparency and efficiency, it introduces new challenges:

- Sybil attacks: Malicious actors may attempt to game scores using multiple wallets. Advanced analytics and cross-protocol data aggregation are critical countermeasures.

- Anonymity vs. accountability: Protocols must balance privacy (using zero-knowledge proofs or DIDs) with the need for credible borrower histories.

- Market volatility: Even with robust scoring, collateral values can fluctuate sharply in crypto markets, requiring dynamic risk controls and automated liquidation triggers.

Lending protocols are addressing these headwinds by integrating multi-layered risk engines and leveraging both on-chain behavior and select off-chain signals, see more on these strategies at how on-chain credit scores power trust and lower risk in DeFi lending.

The Road Ahead: Scaling Borderless Lending in DeFi

The next phase for decentralized credit scoring involves greater composability across protocols and chains. As standards emerge for interoperable reputation tokens (like RociFi’s NFCS) or privacy-preserving attestations (zkCreditScore), users will be able to port their reputational capital seamlessly between platforms, amplifying financial inclusion at global scale.

Top DeFi Protocols Using On-Chain Credit Scores

-

Credora: Integrated on-chain credit scores in July 2024, enabling transparent, automated risk assessment and seamless loan management for undercollateralized lending.

-

RociFi: Pioneered the Non-Fungible Credit Score (NFCS), an immutable on-chain token representing user creditworthiness, empowering borrowers to access undercollateralized loans based on their blockchain history.

-

TrueFi: Launched a blockchain credit scoring model that combines on-chain and off-chain data, successfully originating over $100 million in unsecured loans with zero defaults, showcasing robust reputation-based lending.

The market potential is staggering: as highlighted by recent research, trillions of dollars could flow into DeFi once trustless, undercollateralized lending is proven at scale. This shift will not only unlock new yield opportunities for lenders but also democratize access to working capital for entrepreneurs worldwide.

For deeper analysis of how these breakthroughs are transforming risk management, and practical steps for both borrowers and developers, explore our detailed guide: how on-chain credit scores are transforming DeFi lending: risks, benefits, and use cases.