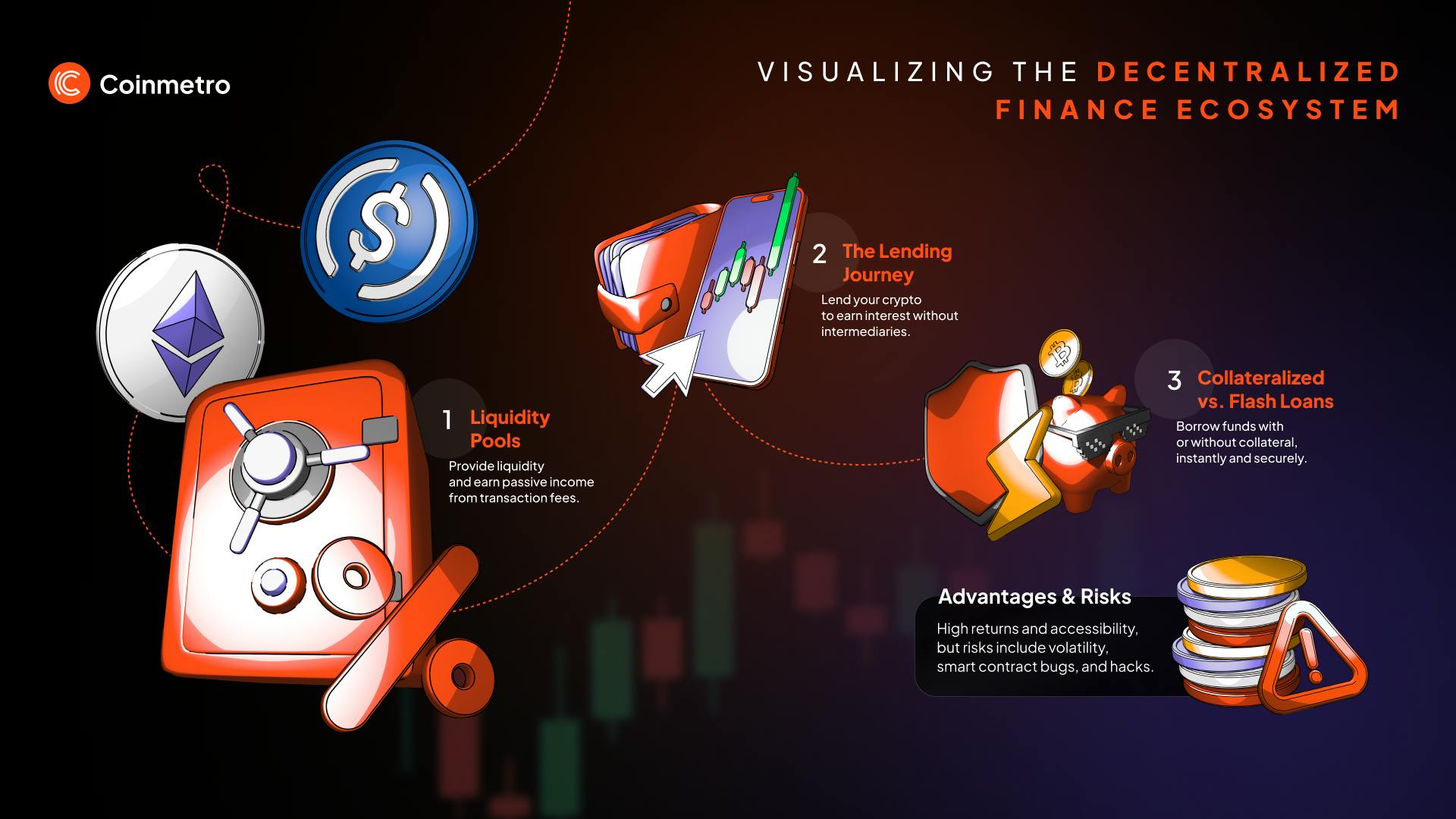

Decentralized Finance (DeFi) has redefined access to credit by removing traditional gatekeepers, but the sector’s early growth has been limited by a reliance on overcollateralized lending. In this model, borrowers must pledge assets worth more than the loan itself, creating high barriers for individuals and institutions without substantial crypto holdings. The emergence of onchain credit scores is now shifting this paradigm, enabling undercollateralized lending where trust is built on transparent, data-driven risk assessment.

Why Overcollateralization Limits DeFi’s Potential

Traditional finance utilizes credit scores to assess borrower risk, allowing banks to offer loans with minimal or no collateral. DeFi, in contrast, has historically required borrowers to lock up assets exceeding their loan value. This approach is rooted in the pseudonymous nature of blockchain addresses, which makes it difficult to evaluate creditworthiness or enforce recourse in the event of default.

While overcollateralization protects lenders, it severely limits capital efficiency and excludes vast segments of the global population. Billions remain unbanked or underbanked, unable to access affordable credit due to a lack of traditional credit history or sufficient crypto collateral. Onchain risk assessment and portable reputation in DeFi are now seen as critical innovations for unlocking the next wave of growth.

How Onchain Credit Scores Work

Onchain credit scores analyze a user’s blockchain activity to quantify risk. Instead of relying on opaque, off-chain data, these scores are built from:

- Transaction and repayment history across DeFi protocols

- Interactions with liquidity pools, lending platforms, and stablecoin issuers

- Wallet age, diversity of counterparties, and frequency of onchain activity

- Repayment punctuality and historical loan performance

Protocols like Credora and Cred Protocol aggregate these metrics to generate a real-time risk profile for each user. This profile can be used to set borrowing limits, interest rates, and collateral requirements dynamically. As highlighted in recent industry reports, onchain credit scores have enabled platforms to offer borrowing limits up to 200% of posted collateral, a major leap from the traditional 150% or higher overcollateralization seen in legacy DeFi lending.

Decentralized Identity and Privacy-Preserving Risk Assessment

Key to the adoption of onchain credit scoring is the integration of decentralized identity (DID) frameworks. DID enables users to link verifiable credentials, such as proof of KYC, employment, or off-chain credit history, to their wallet addresses without compromising privacy. Innovations like zero-knowledge proofs further allow platforms to verify and utilize sensitive borrower data without exposing it publicly, addressing long-standing concerns about transparency and confidentiality in crypto lending.

Key Benefits of Onchain Risk Scores in DeFi

-

Enables Undercollateralized Lending: Onchain credit scores allow DeFi platforms like Credora and MORE Markets to offer undercollateralized loans, expanding beyond traditional overcollateralized models and increasing capital efficiency.

-

Improves Risk Assessment for Lenders: Lenders can evaluate borrower creditworthiness using transparent, blockchain-based data—such as transaction history and repayment behavior—reducing default risk and informing dynamic interest rates.

-

Expands Access to Borrowers: Onchain credit scoring opens DeFi lending to a broader range of users, including those without traditional credit histories, by leveraging blockchain activity as a reputation metric.

-

Enhances Protocol Capital Efficiency: By quantifying and pricing risk more accurately, protocols can optimize collateral requirements, freeing up liquidity and enabling higher loan-to-value ratios.

-

Supports Privacy-Preserving Credit Evaluation: Innovations like zero-knowledge proofs enable secure, privacy-respecting onchain credit scores, allowing users to prove creditworthiness without exposing sensitive data.

This evolution not only improves risk management but also opens the door for more inclusive lending models. For a deeper dive into how these mechanisms work, explore this resource on enabling undercollateralized lending with onchain credit scores.

With decentralized identity and privacy solutions in place, onchain credit scores are rapidly gaining traction as the backbone of undercollateralized lending in DeFi. By leveraging transparent, immutable blockchain data, protocols can offer borrowers more favorable terms while mitigating counterparty risk. This shift is especially relevant for emerging markets and digitally native users who lack access to traditional credit infrastructure but have established onchain reputations.

Capital Efficiency and Market Expansion

Undercollateralized lending powered by onchain risk assessment stands to unlock tremendous capital efficiency. Instead of requiring borrowers to lock up $1.50 or more for every $1 borrowed, platforms can now tailor collateral requirements based on granular risk profiles. For example, a user with a strong repayment history and diverse DeFi activity may qualify for a loan with only 50% collateral, or even less. This dynamic approach reallocates idle capital, increasing lending volume and attracting new participants to the DeFi ecosystem.

Market data underscores the scale of this opportunity. According to recent research, trillions of dollars in untapped liquidity could flow into DeFi as undercollateralized lending becomes mainstream. Protocols like Clearpool and More Markets are already piloting these models, with onchain credit scores determining borrowing limits and interest rates in real time. As adoption accelerates, the line between traditional and decentralized finance will continue to blur.

Addressing Challenges: Risk, Privacy, and Adoption

Despite its promise, undercollateralized lending in DeFi is not without challenges. Risk management remains paramount; protocols must constantly refine their scoring algorithms to adapt to evolving attack vectors and market volatility. The integration of zero-knowledge proofs and secure enclaves is a critical development, enabling verification of creditworthiness without exposing sensitive user data. This not only protects borrower privacy but also enhances trust in the system.

Adoption will hinge on continued education and robust governance. Lenders need confidence that onchain risk scores are accurate and tamper-proof, while borrowers must understand how their onchain actions impact their reputation and borrowing power. Interoperability between protocols and the portability of credit scores across platforms will be key drivers of network effects and user growth.

The Road Ahead: Towards Inclusive and Transparent Credit

The convergence of decentralized identity crypto, onchain analytics, and privacy-preserving technology is catalyzing a new era of capital formation. By making onchain credit scores the standard for risk assessment, DeFi protocols can serve a broader user base while maintaining the security and transparency that define blockchain finance.

Ultimately, the ability to build, own, and port a digital reputation across the decentralized web will empower millions to access credit on their own terms. As onchain credit scoring matures, expect to see a proliferation of innovative lending products, reduced reliance on collateral, and a more inclusive financial system that bridges the gap between Web2 and Web3.