Picture this: a world where you can borrow against your crypto without locking up 150% of your assets. That’s not just a DeFi dream – it’s rapidly becoming reality, thanks to the rise of on-chain reputation scores. These scores are flipping the script on what’s possible for under-collateralized lending in decentralized finance, opening the door to trillions in untapped capital and a whole new era of financial inclusion.

What Is an On-Chain Reputation Score?

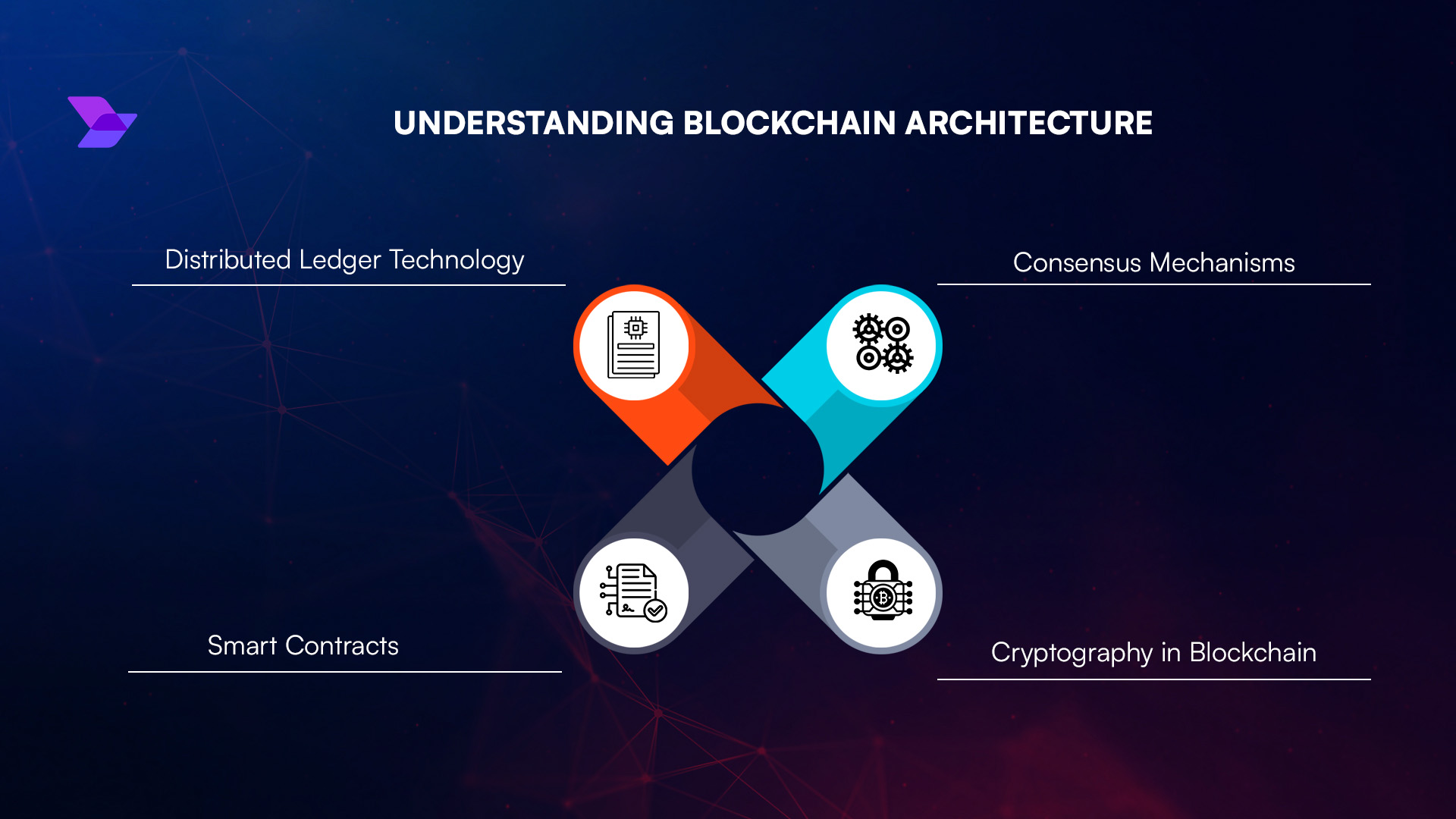

At its core, an on-chain reputation score is like a crypto-native credit score. Instead of relying on off-chain data or traditional credit bureaus, these scores analyze your wallet’s actual blockchain activity: transaction history, lending and borrowing patterns, liquidity provision, and even your participation in DAOs or governance votes. The goal? To quantify your financial reliability and trustworthiness directly from on-chain behavior – no paperwork or middlemen required.

This shift is massive for DeFi. Historically, protocols like Aave and Compound have demanded hefty collateral (often 120%-150%) because they couldn’t gauge if an anonymous wallet would repay its debts. But with granular onchain risk assessment tools, lenders can now differentiate between high- and low-risk borrowers based on real blockchain evidence.

The Mechanics: How Reputation Powers Under-Collateralized Lending

Let’s get practical. Imagine you’ve used DeFi for years – always repaid loans on time, never got liquidated, provided stablecoin liquidity during market chaos. With a strong wallet reputation score, you could now access loans with only 20% collateral (or less), instead of the usual 120%. This isn’t just theory; platforms like RociFi and Spectral are already putting it into practice:

- RociFi: Issues soulbound Non-Fungible Credit Scores (NFCS) that rate wallets from 1 (best) to 10 (worst) based on balances, transactions, protocol usage, and more. High scorers can unlock under-collateralized loans.

- Spectral: Analyzes Ethereum wallets’ histories to generate transparent scores that lenders use to offer variable interest rates and lower collateral requirements.

- Cred Protocol: Focuses on expanding access for underserved users by building decentralized credit scores from their DeFi interactions.

The results? According to recent studies (LFG: Decentralized Lending with On-Chain Social Profiles), users with high reputation saw collateral requirements slashed by up to 40%. That’s not just incremental change – it’s a revolution in capital efficiency.

Bigger Than Just Loans: Why Reputation Multiplier Matters

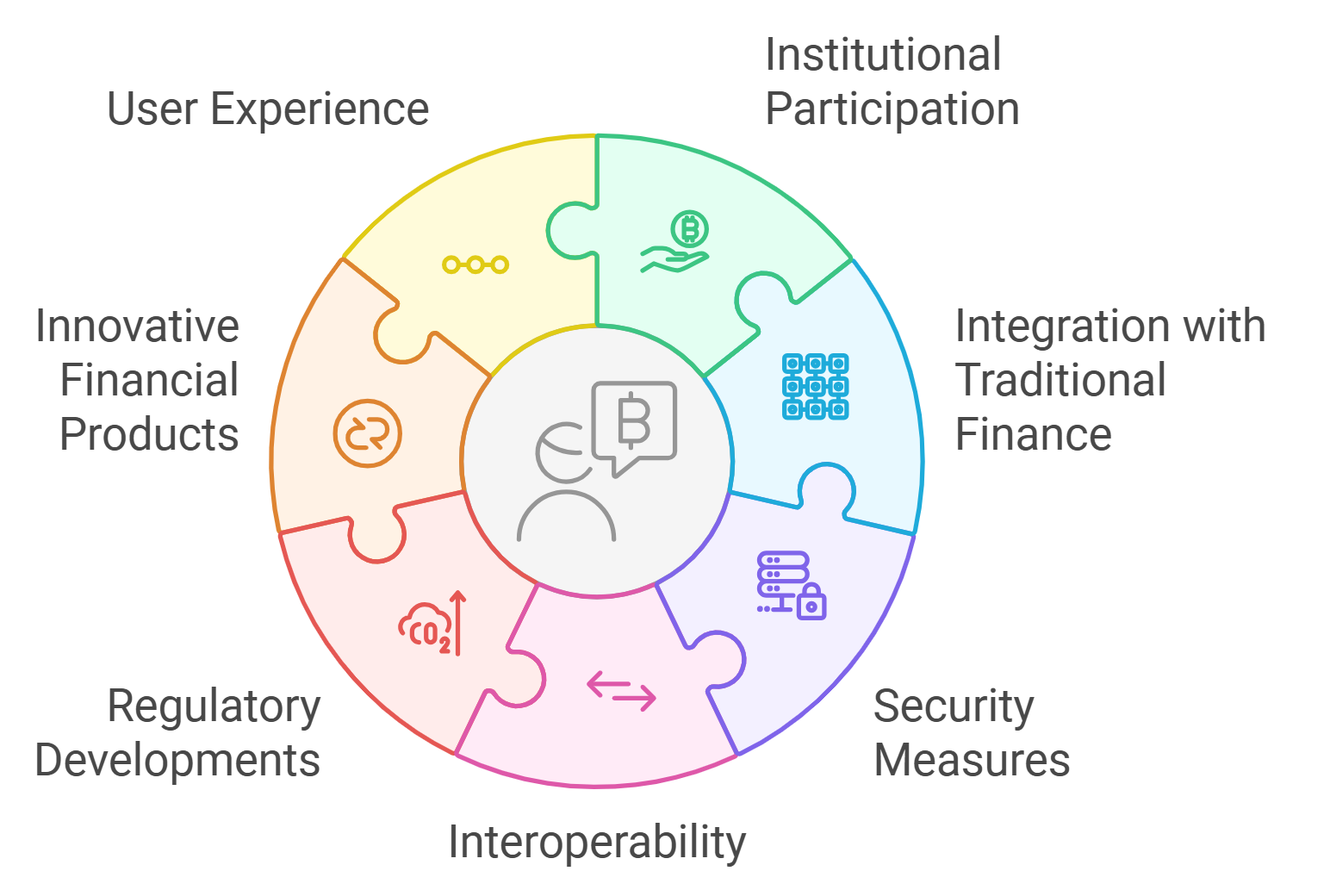

The impact goes far beyond borrowing. As more protocols integrate decentralized credit scoring, we’re seeing the emergence of the “Reputation Multiplier” effect: trustworthy users get better rates across lending pools, higher limits in flash loan markets, and even priority access to new protocol launches or DAO roles. It’s creating a positive feedback loop where good actors are rewarded throughout the ecosystem – all verifiable by anyone who checks their chain record.

This is especially game-changing for users who lack traditional banking access or large crypto holdings. If you’re active in DeFi but don’t have six figures to lock up as collateral, your proven behavior can finally open doors that were previously closed.

The Challenges Ahead: Privacy and Regulation

No innovation comes without hurdles. Aggregating detailed wallet histories raises real privacy questions – after all, do we want every lender peeking into our full financial lives? Privacy-preserving tech like zero-knowledge proofs may help here but aren’t widespread yet. Meanwhile, regulatory uncertainty around KYC/AML compliance remains an ongoing challenge as jurisdictions race to keep up with Web3 advances.

Despite these obstacles, the momentum behind decentralized credit scoring is undeniable. As protocols refine their algorithms and more users build up positive on-chain reputations, the DeFi lending landscape is set to become more accessible, nuanced, and secure. For lenders, this means smarter risk management and the ability to serve a much broader audience. For borrowers, it’s a shot at fairer terms and real financial empowerment, no matter where you live or what your TradFi history looks like.

Top Benefits of On-Chain Reputation Scores in DeFi

-

Unlocks Under-Collateralized Loans: On-chain reputation scores let trustworthy users access loans with less collateral, making DeFi lending more capital-efficient and flexible.

-

Boosts Financial Inclusion: Users with strong on-chain reputations—but limited assets—can access credit, opening DeFi to a broader, global audience.

-

Enables Personalized Loan Terms: Platforms like Spectral use on-chain scores to offer borrowers variable interest rates and terms tailored to their risk profile.

-

Reduces Risk for Lenders: By analyzing borrowers’ transaction history and protocol interactions, on-chain reputation scores help lenders make more informed decisions and minimize defaults.

-

Increases Capital Efficiency: Lower collateral requirements free up more crypto for productive use, allowing users to deploy their assets elsewhere in the DeFi ecosystem.

-

Promotes Transparency and Trust: Reputation scores are built from verifiable blockchain data, making the lending process more transparent and boosting trust between borrowers and lenders.

Let’s not forget the ripple effects across the ecosystem. As under-collateralized DeFi lending scales up, capital trapped in over-collateralized vaults can finally flow into productive uses, supporting innovation, entrepreneurship, and global liquidity. Imagine a world where your positive wallet reputation gets you access to everything from microloans to high-yield farming strategies, all without unnecessary capital lock-up.

What’s Next for Crypto Credit Risk? The Road to Mainstream Adoption

Looking ahead, expect fierce competition among protocols racing to build the most accurate and privacy-conscious reputation systems. We’ll see more composable onchain risk assessment tools that plug into any dApp or wallet interface, think real-time credit checks for every DeFi interaction. New entrants will experiment with combining off-chain data (like social profiles or employment history) with pure blockchain analytics to further refine crypto credit risk models.

The big question: Who will set the standards? Open-source frameworks and transparent scoring methodologies will likely win out over black-box algorithms. Community governance will play a huge role in defining what counts as “good” on-chain behavior, and how much weight different activities should have in your score.

For developers and protocol builders, now’s the time to integrate decentralized credit scoring into your products. For users? Start building that wallet reputation today: repay loans on time, participate in DAOs, provide liquidity during volatile markets, and keep your activity transparent but secure.

Ready to Dive In? Explore More About On-Chain Reputation Scores

If you’re curious about how these new systems work under the hood, or want actionable tips for improving your own wallet reputation score: check out our deep dives:

- How Onchain Credit Scores Enable Under-Collateralized Lending in DeFi

- How On-Chain Reputation Scores Unlock Uncollateralized Loans in DeFi

- How Decentralized On-Chain Credit Scores Enable Undercollateralized Lending in DeFi

The future of decentralized finance is being built right now by those who understand, and leverage, the power of on-chain reputation. Whether you’re a lender seeking smarter returns or a borrower aiming for better rates with less collateral, it pays (literally) to care about your blockchain behavior.