Decentralized finance (DeFi) has revolutionized access to financial services, but traditional over-collateralized lending models have created capital inefficiencies and limited participation for users lacking significant crypto assets. The emergence of on-chain risk scores is transforming this landscape, offering a data-driven approach to under-collateralized lending that leverages blockchain transparency, behavioral analytics, and decentralized identity.

The Mechanics of On-Chain Risk Scores

On-chain risk scores are quantitative measures derived from a user’s historical blockchain activity. These scores evaluate factors such as transaction frequency, protocol interactions, asset holdings, borrowing and repayment histories, and even liquidation events. By aggregating this real-time data, protocols can create a dynamic credit profile for each borrower.

This data-centric approach allows smart contracts to automatically adjust loan parameters, like loan-to-value (LTV) ratios, interest rates, and liquidation thresholds, based on the borrower’s assessed risk. For example, a user with a robust repayment history and diversified asset base might be offered an 80% LTV ratio, while a newer or higher-risk user receives only 60%. This level of granularity was previously unattainable in anonymous DeFi ecosystems.

Unlocking Capital Efficiency in DeFi Lending Markets

The integration of on-chain risk scores directly addresses one of DeFi’s core challenges: capital lock-up due to excessive collateral requirements. By providing lenders with transparent and actionable insights into borrower behavior, these systems empower protocols to extend loans with lower collateralization, without sacrificing risk management.

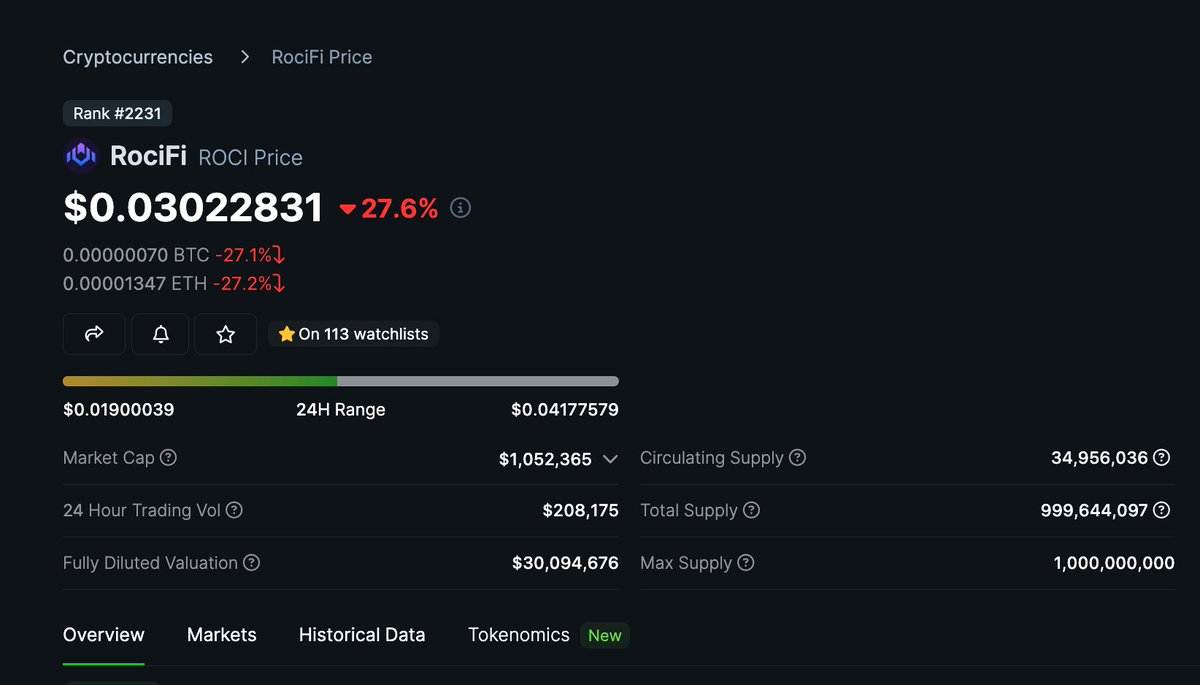

This innovation is already being realized by projects like Cred Protocol, which quantifies on-chain lending risk to expand access for underserved communities. Similarly, platforms like RociFi utilize multi-factor scoring, including fraud detection and reputation, to tailor loan offers dynamically. Spectral’s MACRO score introduces an on-chain equivalent to traditional FICO scores by analyzing wallet-level transaction data.

The result? Improved capital efficiency for lenders and broader access to credit for borrowers, two essential ingredients for scaling the DeFi ecosystem beyond its current boundaries. As highlighted in recent research (see more here), these advances could unlock trillions of dollars in untapped liquidity.

Navigating the Challenges: Identity, Privacy and Smart Contract Risks

Despite their promise, on-chain credit scoring systems face notable hurdles:

- Sybil Attacks: Without robust identity verification, malicious actors can create multiple wallets to game the system. While Know Your Customer (KYC) checks can mitigate this risk, they introduce friction that may clash with DeFi’s ethos of permissionless access.

- Data Privacy: Storing sensitive personal or behavioral information on public blockchains raises privacy concerns. Protocols must balance transparency with secure handling of user data, potentially using zero-knowledge proofs or off-chain storage solutions.

- Smart Contract Vulnerabilities: As more complex logic is embedded into lending protocols via smart contracts that reference dynamic credit scores, the attack surface grows. Rigorous audits and ongoing monitoring are essential to safeguard funds.

The interplay between transparency and privacy remains an active area of innovation within the sector. For an in-depth look at how these risks are being addressed through technology and governance frameworks, explore our dedicated resource: How On-Chain Risk Scores Reduce Liquidation Risks in Under-Collateralized DeFi Lending.

As on-chain risk scoring evolves, the DeFi ecosystem is witnessing a wave of experimentation and best-practice sharing. Protocols are increasingly collaborating with data analytics providers and decentralized identity (DID) projects to create interoperable credit profiles that travel with users across platforms. This portability not only incentivizes responsible on-chain behavior but also fosters competition among protocols, driving down borrowing costs for high-quality borrowers.

Moreover, the adoption of privacy-preserving technologies, such as zero-knowledge proofs, is enabling protocols to verify user attributes or repayment histories without exposing sensitive information. This innovation addresses regulatory concerns and aligns with the crypto community’s emphasis on sovereignty and confidentiality. As highlighted in recent studies, third-party risk assessment remains a vital component, offering external validation of creditworthiness while allowing protocols to remain agile in their lending policies.

Emerging Use Cases and Real-World Impact

Beyond individual lending markets, under-collateralized credit powered by on-chain risk scores is unlocking new financial products and services. For instance, DAOs (Decentralized Autonomous Organizations) can issue revolving credit lines to contributors based on their historical participation and governance activity. Similarly, institutional players are exploring blockchain-based private credit funds that leverage real-time risk analytics to optimize capital allocation.

This paradigm shift is also lowering barriers for unbanked populations globally. By using blockchain repayment history instead of traditional credit reports, individuals in emerging markets can access capital without intermediaries or legacy infrastructure, a step toward true financial inclusion.

Top DeFi Protocols Using On-Chain Risk Scores

-

Cred Protocol: Cred Protocol develops decentralized credit scores by analyzing users’ on-chain transaction history, enabling under-collateralized lending and expanding access to DeFi for underserved communities. The protocol integrates these scores directly into lending smart contracts to dynamically adjust loan terms.

-

RociFi: RociFi leverages a multi-factor on-chain credit scoring system, assessing fraud risk, reputation, and historical borrowing behavior to offer under-collateralized loans. Its protocol operates on Polygon and supports dynamic risk-based lending rates.

-

Spectral: Spectral introduces the Multi-Asset Credit Risk Oracle (MACRO) score, which quantifies borrower risk using on-chain activity. This score allows lending protocols to tailor loan-to-value ratios and rates, making under-collateralized lending more viable.

-

Goldfinch: Goldfinch is a leading under-collateralized DeFi lending platform that uses off-chain and on-chain data—including on-chain risk scores—to assess borrower creditworthiness, enabling real-world businesses to access crypto loans with reduced collateral requirements.

-

Maple Finance: Maple Finance provides under-collateralized loans to institutional borrowers by combining on-chain analytics with off-chain risk assessments. The protocol’s credit experts evaluate borrower profiles, while loan terms are enforced via smart contracts.

The market opportunity is substantial: as more assets migrate onto blockchains and as standards for decentralized identity mature, the addressable pool for under-collateralized lending expands rapidly. According to industry forecasts, integrating transparent crypto credit risk assessment could bring trillions in liquidity into DeFi over the coming years, reshaping both retail and institutional finance.

Key Takeaways for Lenders and Borrowers

- Lenders: Gain access to advanced analytics for pricing loans according to borrower-specific risks rather than relying solely on collateral value.

- Borrrowers: Build a portable reputation through consistent repayment behavior across multiple protocols, unlocking progressively better terms over time.

- Developers: Leverage composable APIs and open-source frameworks to integrate dynamic risk scoring into new financial products.

The next phase of DeFi growth will be defined by platforms that combine robust on-chain risk scores, privacy preservation, and seamless user experiences. Those able to navigate this intersection will set new standards for trustless yet efficient lending, pushing decentralized finance toward mainstream adoption.