Decentralized finance (DeFi) has always promised open access to capital, but for years, this access came with a significant caveat: over-collateralization. Borrowers often needed to lock up more value than they wished to borrow, limiting the utility and inclusivity of DeFi lending. In 2025, this paradigm is changing rapidly as onchain reputation scores unlock the era of under-collateralized crypto lending, transforming who can participate and how capital flows through blockchain ecosystems.

From Overcollateralization to Onchain Credit: The 2025 Shift

Historically, DeFi lending protocols like Compound and Aave required users to deposit collateral exceeding their loan amounts. This model protected lenders but restricted borrowers without substantial crypto holdings from accessing liquidity. According to recent data, the total stablecoin lending volume since January 2020 now exceeds $670 billion, yet a large portion of potential borrowers remained sidelined due to high collateral requirements.

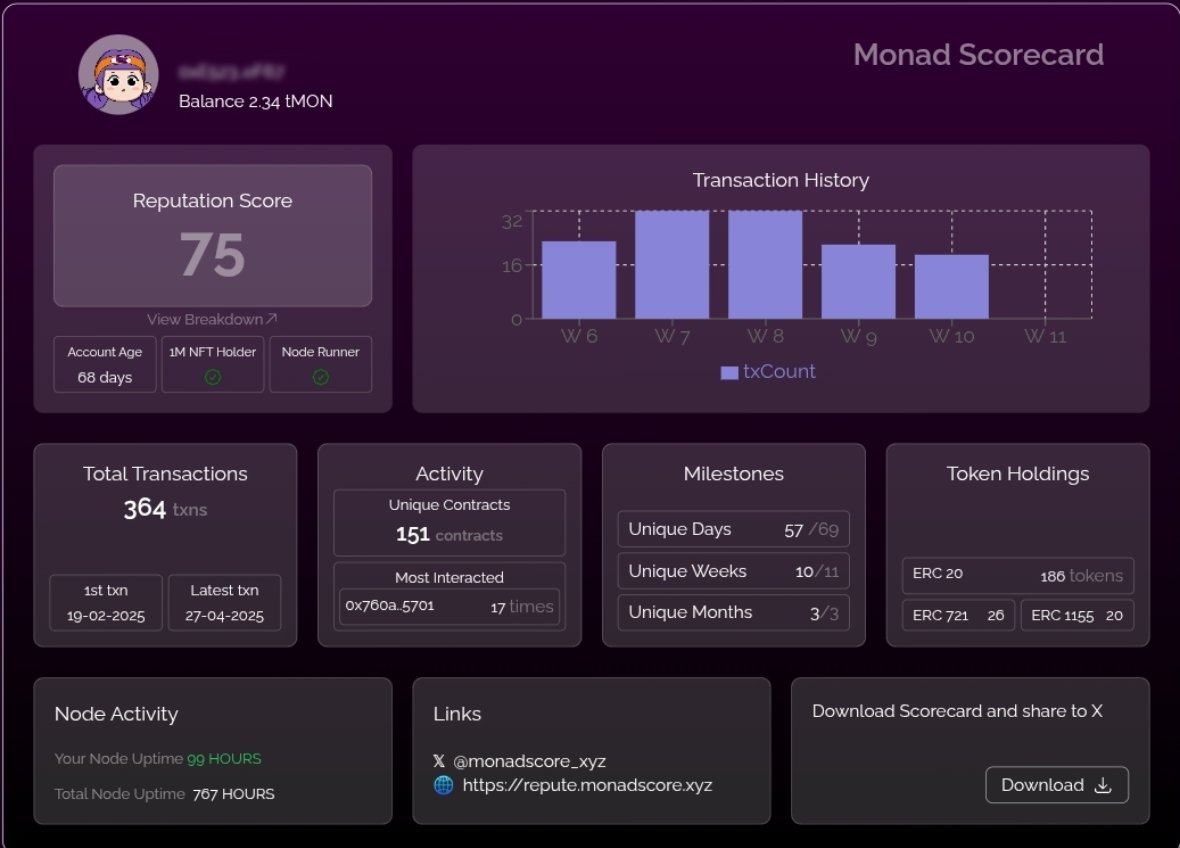

The breakthrough comes from onchain reputation systems. These frameworks analyze a user’s historical wallet activities – including transaction patterns, protocol interactions, and repayment histories – to generate a dynamic risk profile. With these insights, lenders can confidently extend loans with less or even no collateral for users demonstrating strong onchain behavior.

The Mechanics of Onchain Reputation Scores

Modern onchain credit scoring leverages advanced AI models and decentralized identity (DID) standards. The zScore framework is one leading example: it aggregates wallet data across multiple DeFi platforms, evaluating factors such as asset quality, liquidity management, time-weighted activity, and even compliance signals.

This approach is fundamentally different from traditional credit checks or opaque off-chain ratings. Instead, every action on the blockchain – staking in liquidity pools, timely loan repayments, responsible asset management – contributes transparently to a borrower’s reputation score. Lenders can then calibrate loan terms based on real-time risk assessments rather than static or exclusionary rules.

Recent studies show that users with high onchain reputation scores have seen their collateral requirements reduced by up to 40%. This not only increases capital efficiency but also attracts new participants who previously found DeFi inaccessible due to prohibitive entry barriers.

Real-World Asset Integration Meets Onchain Risk Assessment

The convergence of tokenized real-world assets (RWAs) with under-collateralized DeFi lending marks another major milestone in 2025. Platforms such as Maple Finance are now allowing borrowers with proven onchain reputations to access loans backed by tangible assets like invoices or real estate tokens. By combining transparent wallet behavior with verifiable RWA collateralization, these protocols are unlocking unprecedented scale for decentralized credit markets.

This evolution is not just theoretical: as of July 2025, there are over $35 billion in active on-chain loans powered by these mechanisms. The majority of new DeFi credit products now incorporate some form of wallet behavior risk assessment or decentralized identity verification at their core.

For lenders, this shift translates to a more nuanced and data-driven approach to credit risk. Instead of relying solely on collateral as the primary defense against default, platforms can now evaluate a borrower’s onchain reputation score, a composite metric reflecting months or years of wallet activity, repayment discipline, and protocol engagement. This not only diversifies risk but also fosters a more inclusive financial ecosystem.

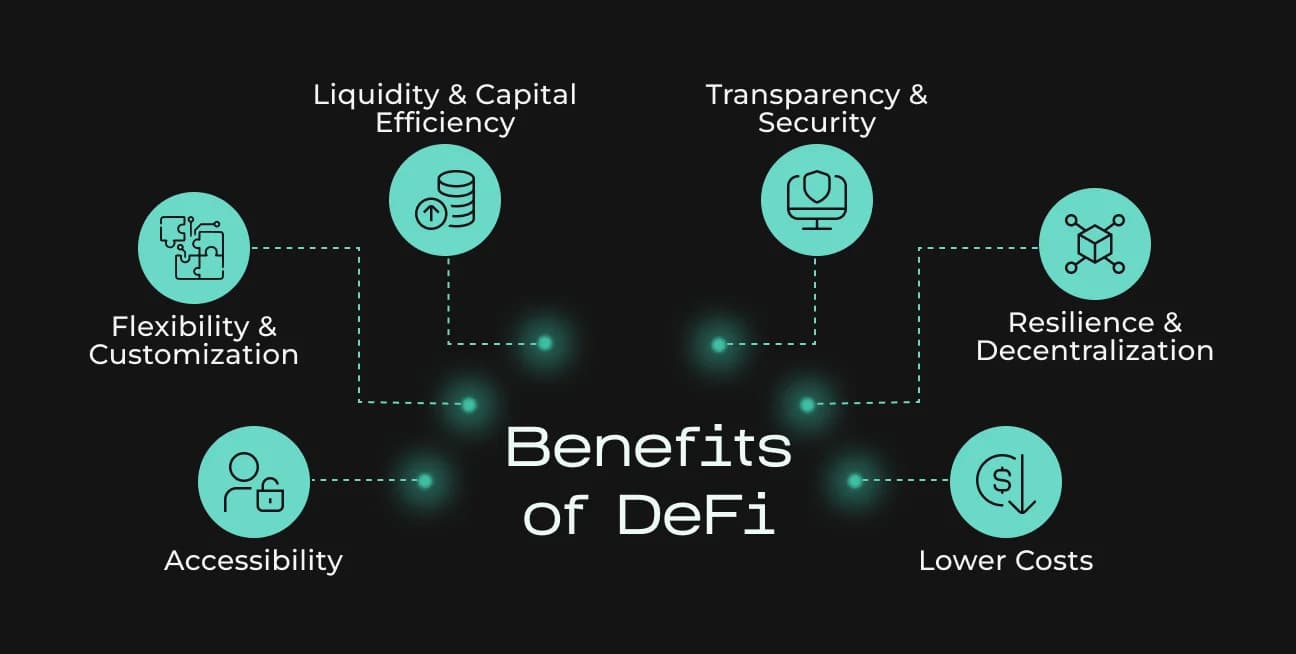

Key Benefits of Under-Collateralized Crypto Lending in 2025

-

Increased Capital Efficiency: Onchain reputation scores enable borrowers to access loans with significantly less collateral, freeing up more capital for productive use and boosting overall liquidity in DeFi markets.

-

Broader Access to Credit: Platforms like Credible Finance leverage onchain credit scoring to offer under-collateralized loans, making borrowing accessible to users who lack large crypto reserves.

-

Real-Time Transparency and Trust: Onchain reputation systems provide transparent, tamper-proof credit histories, building trust between lenders and borrowers and reducing the risk of default.

-

Integration with Real-World Assets (RWAs): Protocols such as Maple Finance use onchain reputation to facilitate under-collateralized loans backed by tokenized real-world assets, expanding lending opportunities beyond digital-only collateral.

-

AI-Driven Credit Assessment: Frameworks like zScore utilize advanced AI to analyze wallet activity and assign reliable credit scores, helping lenders identify responsible borrowers and price risk more accurately.

-

Reduced Collateral Requirements: Studies show users with high onchain reputation scores can experience up to a 40% reduction in collateral needed for loans, making DeFi lending more inclusive and efficient.

Borrowers benefit from this new paradigm by gaining access to capital with less friction. Those who may lack significant crypto holdings but have demonstrated responsible DeFi behavior can secure loans for entrepreneurial ventures, liquidity needs, or personal investments. As protocols like Credible Finance and Maple Finance continue to refine their AI-driven scoring models, expect even greater granularity in how risk is priced, rewarding transparency and positive behavior with better terms and lower collateral ratios.

The Future of Wallet Behavior Risk Assessment

The rapid adoption of wallet behavior risk assessment tools is already reshaping the competitive landscape of DeFi lending. Advanced frameworks like zScore are being integrated as core infrastructure across multiple blockchains and protocols, setting new standards for what constitutes a trustworthy borrower. These systems analyze not just basic transaction history but also patterns such as participation in governance, frequency of protocol upgrades, and even interactions with bridges or cross-chain assets.

Importantly, decentralized identity (DID) solutions are enhancing privacy while preserving accountability. Borrowers can prove their credibility without exposing sensitive personal data, ushering in an era where trust is algorithmically earned rather than institutionally bestowed.

Challenges and Opportunities Ahead

Despite remarkable progress, under-collateralized crypto lending is not without its challenges. Reputation-based systems must guard against Sybil attacks (where users create multiple wallets to game scores), ensure fairness across diverse user profiles, and continuously update models to reflect evolving market dynamics. Regulatory clarity around decentralized credit scoring remains a work in progress as well.

Yet the opportunities far outweigh the hurdles. The integration of real-world assets with onchain reputation frameworks could unlock entirely new classes of borrowers, including small businesses and emerging market entrepreneurs, while providing institutional lenders with transparent audit trails for compliance. As stablecoin borrowing volumes surpassed $51.7 billion in August 2025 alone, it’s clear that appetite for efficient DeFi credit solutions is soaring.

What Comes Next for DeFi Credit Scoring?

The next phase will likely see increased interoperability between scoring systems, broader integration with off-chain data sources (such as payroll or supply chain records), and ongoing refinement through AI-driven analytics. For developers and institutions looking to build on this momentum, the focus should be on transparency, user empowerment, and robust security practices.

If you’re interested in diving deeper into how these innovations are transforming lending markets right now, and what it means for your portfolio or project, explore our detailed analysis at How On-Chain Reputation Scores Are Powering Undercollateralized DeFi Loans in 2025.

The era of over-collateralization is fading fast as onchain reputation scores become the backbone of under-collateralized crypto lending. With transparent credit histories replacing blunt capital requirements, DeFi is finally living up to its promise: open access to financial opportunity for all, with security and accountability built in at every layer.