As DeFi matures in 2025, undercollateralized loans emerge as a transformative force, challenging the overcollateralized status quo that has long defined decentralized lending. Platforms now leverage on-chain risk scores to gauge borrower reliability through transparent blockchain data, echoing yet improving upon Traditional Finance’s Collateralized Loan Obligations (CLOs). Yet, history warns us: without rigorous risk frameworks, innovation can unravel. This article draws lessons from TradFi CLO pitfalls to fortify undercollateralized DeFi loans.

DeFi’s Shift to Risk-Managed Undercollateralized Lending

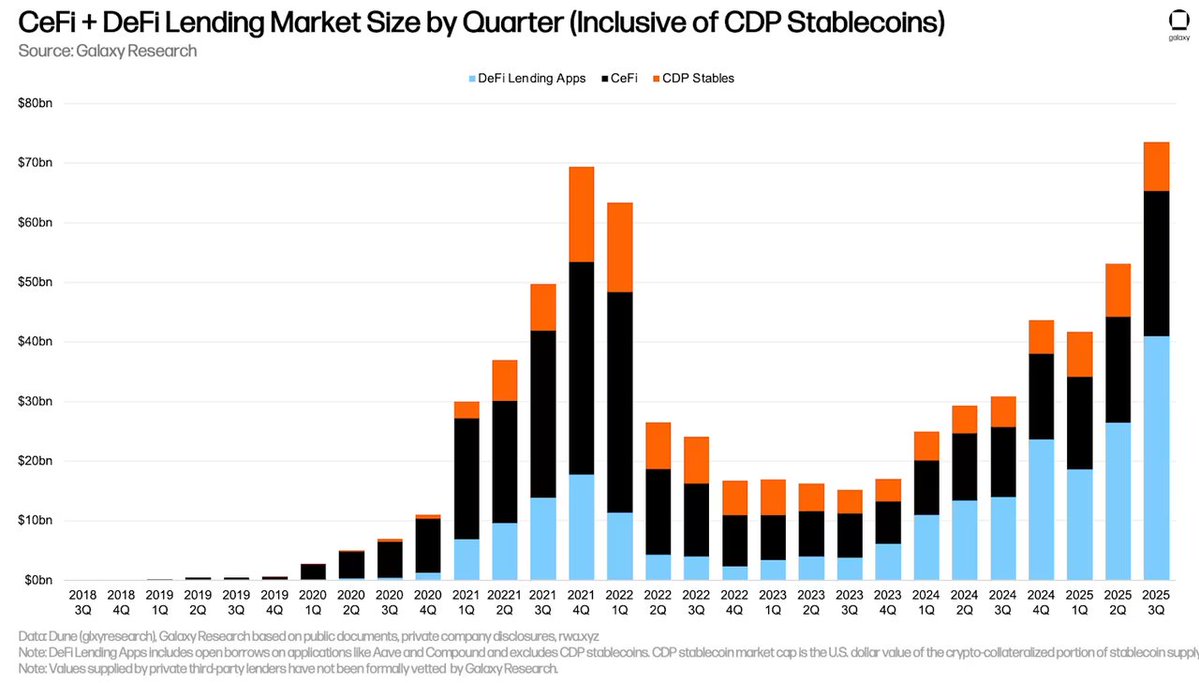

In April 2025, on-chain money markets hit approximately $20 billion in active loans, eclipsing CeFi for the first time, per Reflexivity Research. This surge reflects growing confidence in crypto credit scoring mechanisms that analyze wallet histories rather than demanding excess collateral. Protocols like those highlighted in Galaxy’s report on Sky Protocol’s Grove $1 Billion CLO revolution demonstrate how low rates and record TVLs fuel this trend. Unlike early DeFi, where loans required 150-200% collateral to buffer volatility, today’s systems use onchain repayment history and predictive models to offer loan-to-value ratios closer to 80% for proven borrowers.

Undercollateralized DeFi loans unlock capital efficiency, but they amplify DeFi lending risks like defaults in trustless settings. On-chain scores mitigate this by quantifying default probability via transaction patterns, borrowing frequency, and repayment timeliness. Mitosis University’s guide underscores how these scores pave the way for permissionless credit, blending DeFi’s ethos with TradFi prudence.

TradFi CLOs: A Cautionary Tale for DeFi Innovators

The 2008 crisis exposed CLO vulnerabilities when opaque risk assessments masked subprime exposures, triggering cascading defaults and bailouts. CLOs pooled leveraged loans, tranching them by risk, but flawed models underestimated correlations during stress. Analytics Insight notes DeFi must heed this by prioritizing transparent, data-driven evaluations over blind trust in smart contracts.

In DeFi, undercollateralized positions mirror CLO leverage without centralized recourse, heightening protocol insolvency risks amid exploits or market downturns. Token Metrics highlights persistent threats like smart contract bugs, yet on-chain analytics offer real-time visibility absent in TradFi’s black boxes. By studying CLO tranching failures, DeFi can design dynamic risk tiers, adjusting rates and limits based on live on-chain risk scores.

Risk Comparison: TradFi CLOs (2008) vs. DeFi Undercollateralized Loans

| Risk Factor | TradFi CLOs (2008) | DeFi Undercollateralized Loans | Mitigations: TradFi vs. DeFi |

|---|---|---|---|

| Opacity | Hidden risks in bundled subprime loans and complex tranching led to mispriced assets | Off-chain borrower behavior and potential exploits obscure true risk | Off-chain ratings models (failed due to conflicts) ❌ | On-chain transparency via blockchain data ✅ |

| Correlation Underestimation | Defaults highly correlated in recession, not independent as modeled | Crypto asset correlations amplify losses in market downturns | Static risk models → Systemic crisis | Dynamic on-chain scoring for real-time correlation assessment |

| Default Risk | Inadequate underwriting caused widespread CLO defaults | No direct collateral recourse in trustless environment | Tranching and liquidity support (post-crisis) | On-chain credit risk scores (e.g., OCCR Score) assessing historical activity |

| Exploits / Systemic Vulnerabilities | Liquidity crunch and opacity fueled bank runs | Smart contract hacks and protocol exploits | Enhanced regulation and stress testing | Audits, insurance, and adjustable lending parameters via scores |

Building Robust On-Chain Risk Scores

The On-Chain Credit Risk Score (OCCR Score), as detailed in arXiv research, probabilistically measures DeFi credit risk using blockchain-native signals: wallet age, asset diversity, interaction velocity, and historical solvency. Tied to addresses for privacy, per Onchain insights, these scores enable trillions in inflows by signaling repayment likelihood without KYC.

Integrating Decentralized Identity (DID) enhances this, allowing DID credit assessment that verifies reputations across chains. CryptoCreditScores. org reports how 2025’s scores redefine trust, powering higher LTVs for low-risk wallets. Yet, challenges persist: weekend price dislocations, noted by Yahoo Finance, could skew scores if not volatility-adjusted. Protocols counter this with oracles and ensemble models, learning from CLOs’ static pitfalls. For deeper mechanics, explore how on-chain risk scores enable under-collateralized lending in DeFi.

Digital Finance News emphasizes default risks in uncollateralized DeFi, but dynamic scoring adjusts parameters in real-time, fostering institutional adoption as per Superex. This fusion of lessons positions on-chain risk scores as DeFi’s safeguard against TradFi echoes.

DeFi protocols that embed these safeguards stand to attract institutional capital, mirroring how post-2008 CLO reforms restored market confidence through enhanced disclosures and stress testing. Yet, success hinges on proactive governance, where DAOs vote on score thresholds and oracle integrations, preventing the agency problems that plagued TradFi managers.

Stress Testing On-Chain Scores Against CLO-Style Scenarios

Imagine a 2025 bear market echo of 2008: correlated asset crashes trigger mass defaults in undercollateralized DeFi loans. CLOs failed here because models ignored tail risks and liquidity crunches. DeFi counters with simulation engines that replay historical on-chain data, adjusting for onchain repayment history under stress. Protocols like those pioneering OCCR Scores run Monte Carlo analyses on wallet clusters, flagging high-correlation exposures before they cascade.

This forward-looking approach, informed by arXiv’s probabilistic frameworks, outperforms static CLO ratings. For instance, volatility-adjusted scores penalize weekend mispricings, ensuring crypto credit scoring remains resilient. Token Metrics warns of exploit risks, but audited models with circuit breakers, pausing high-risk loans, offer layered defense, turning potential pitfalls into competitive edges.

Risk Mitigation Strategies: TradFi CLO Lessons vs. DeFi Innovations

| Mitigation Category | TradFi CLO Lessons | DeFi Approaches |

|---|---|---|

| Transparency & Disclosure | Enhanced disclosures | Dynamic on-chain credit risk scores (e.g., OCCR Score assessing historical blockchain activity) |

| Risk Assessment & Testing | Stress tests | Oracle ensembles for real-time data validation and predictive modeling |

| Risk Allocation & Governance | Tranching reforms | DAO governance for protocol solvency monitoring and parameter adjustments |

Practical Implementation: From Scores to Secure Lending

Builders integrate on-chain risk scores via APIs that feed into lending dashboards, dynamically setting LTVs: 90% for top-tier wallets with flawless repayment records, dropping to 50% for novices. DID credit assessment layers cross-chain verifiability, as cryptocreditscores. org details, fostering seamless interoperability. Polygon’s crypto loan economy analysis critiques off-chain scores for centralization risks; on-chain alternatives preserve pseudonymity while delivering precision.

Consider Sky Protocol’s Grove: its $1 billion CLO structures undercollateralized pools with score-gated tranches, yielding low rates amid record TVLs. Lenders gain yield without TradFi opacity, borrowers access capital sans overkill collateral. Challenges like oracle delays persist, but ensemble feeds and timelocks mitigate them, drawing directly from CLO post-mortem reforms.

Reflexivity Research notes $20 billion in active on-chain loans by April 2025, a milestone underscoring scalability. Yet, true maturity demands adversarial testing: red-team audits simulating collusion or flash loan attacks, ensuring scores evolve faster than threats.

Navigating Risks with Proven Tools

CoinGecko questions if undercollateralized loans define DeFi’s future, given overcollateralization’s dominance. The answer lies in hybrid models: scores as the core, collateral as backstop for edge cases. This balances efficiency and safety, unlocking trillions as Onchain predicts, without repeating CLO overleverage.

Governance evolves too. DAOs with quadratic voting prioritize long-term stability, vetoing risky parameter tweaks. Transparency dashboards publish score methodologies, inviting community scrutiny, a stark contrast to CLO black boxes. For protocols eyeing institutional inflows, Superex’s adoption insights stress real-time adjustments via DID credit assessment, blending DeFi speed with TradFi rigor.

Undercollateralized DeFi loans, fortified by these lessons, propel a more inclusive financial layer. Lenders deploy capital confidently, borrowers build reputations portably, and the ecosystem absorbs shocks with grace. As 2025 progresses, platforms mastering this alchemy will lead, proving blockchain’s edge over legacy flaws. Explore further in our guide on how onchain risk scores reduce liquidation risks.