In the volatile world of decentralized finance, where crypto lending just hit a staggering $73.59 billion record high by Q3 2025, on-chain repayment histories stand out as the linchpin for unlocking true capital efficiency. Platforms now parse immutable blockchain data to score borrower reliability, slashing the need for excessive collateral in undercollateralized DeFi loans. Ethereum trades at $3,003.06, down 1.65% amid broader market dips, while Bitcoin holds at $90,578.00, off 1.05%. These conditions underscore why DeFi credit scoring rooted in repayment patterns matters: it mitigates risk without tying up billions in idle assets.

On-Chain Repayment Histories: The Backbone of Risk Assessment

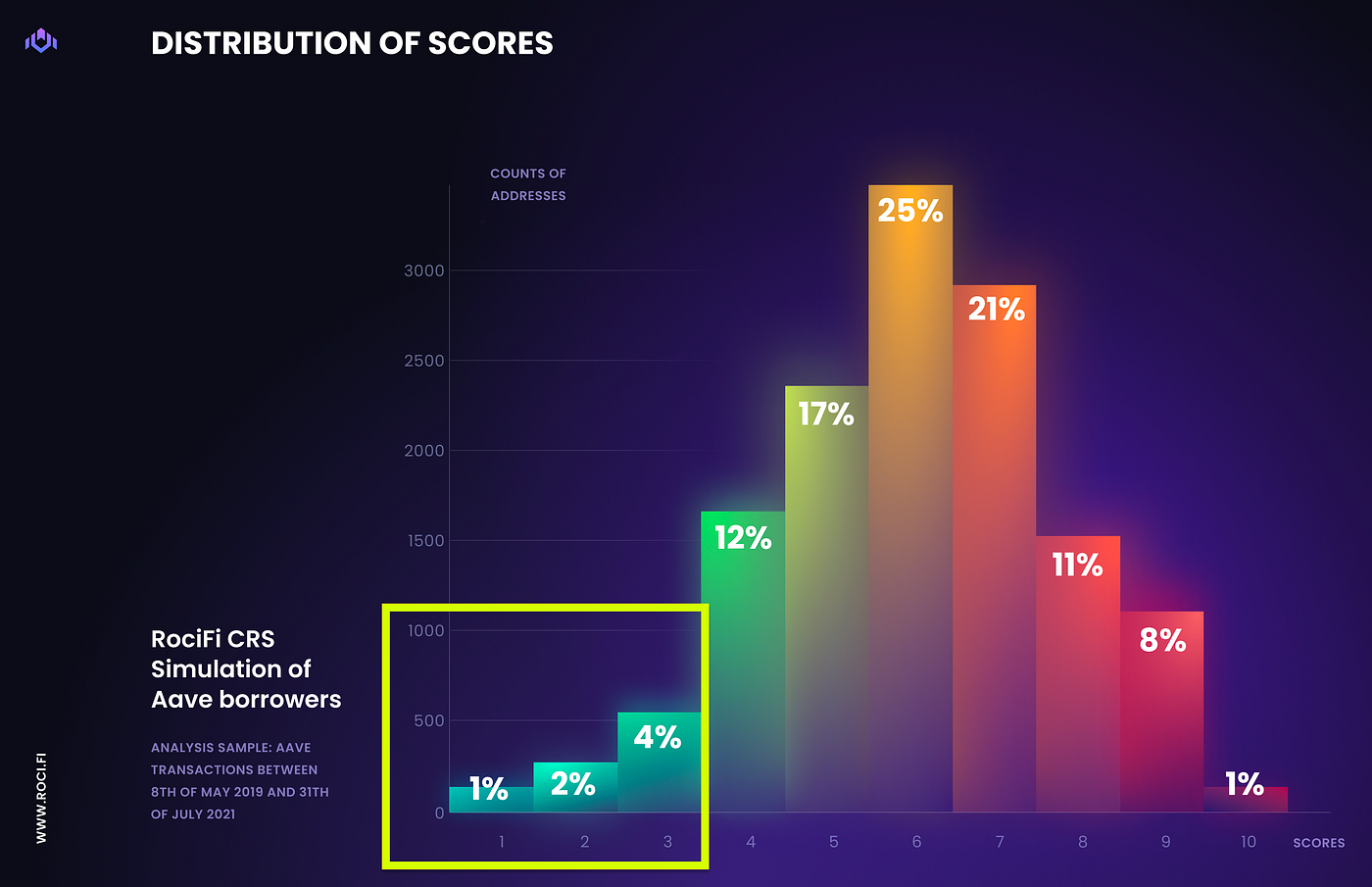

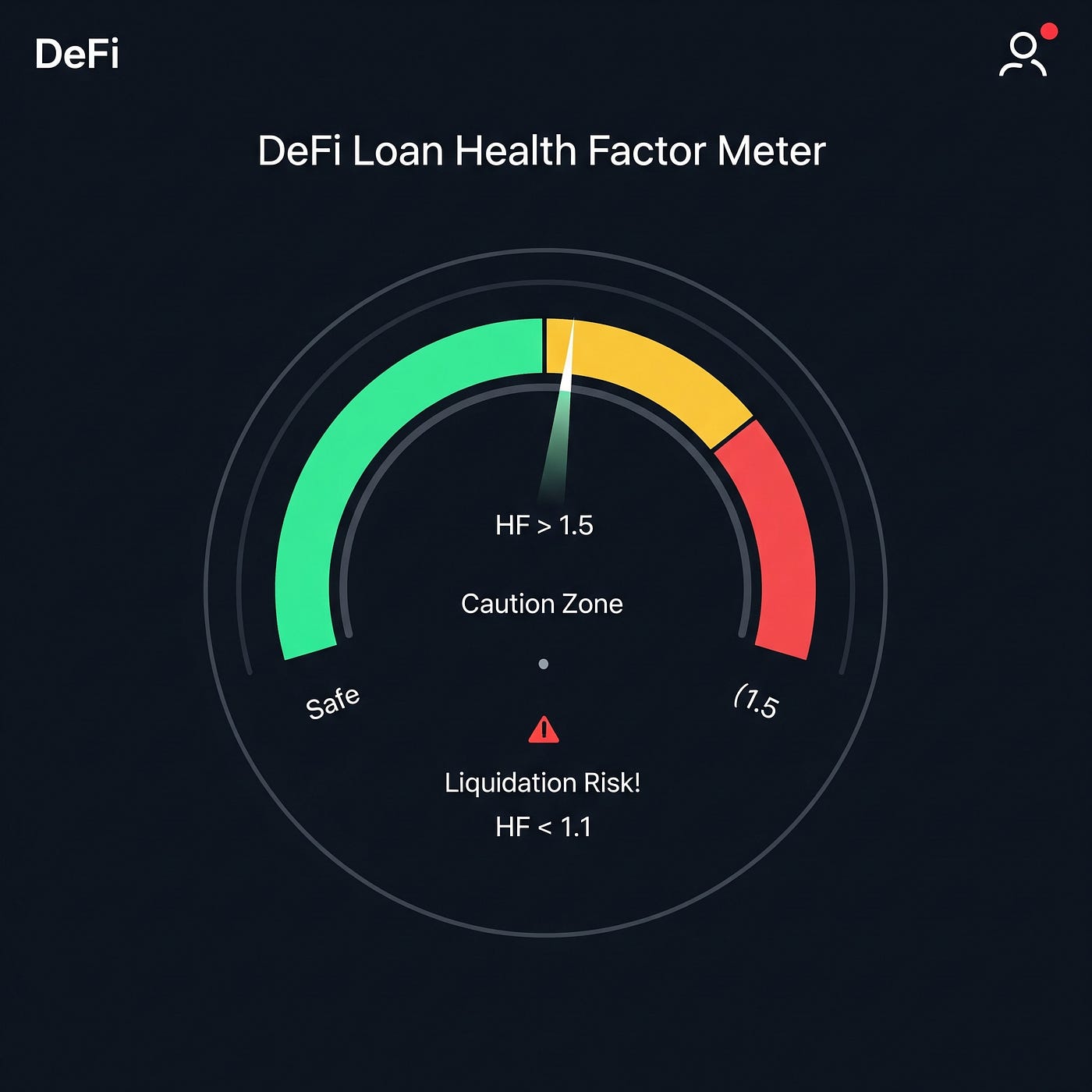

At its core, an on-chain repayment history is a tamper-proof ledger of a user’s borrowing behavior. Protocols analyze metrics like timely repayments, loan-to-value ratios, and default rates across chains. Block3 Finance highlights repayment consistency as the top factor, with collateral management close behind. This data-driven approach replaces blind overcollateralization- often 150-200% ratios- with precise crypto risk scores. I argue this shift isn’t just evolutionary; it’s revolutionary, as it mirrors TradFi underwriting but on public blockchains.

Comparison of Overcollateralized vs Undercollateralized DeFi Loans

| Loan Type | Collateral Ratio | Risk Assessment | Capital Efficiency | Examples |

|---|---|---|---|---|

| Overcollateralized | >150% 💰 | Automated via LTV ratios ⚙️ | Low (excess collateral locked) ❌ | Aave 🏦 |

| Undercollateralized | <100% or none 📉 | On-chain credit scores & repayment history 📊 | High (optimal capital use) ✅ | TrueFi 🌟 |

TrueFi exemplifies this by tracking on-chain ratings to issue loans at 0-20% collateral. Huma Finance defines on-chain credit as fully decentralized lending, where histories build reputation scores. Yet, Gauntlet and Chaos Labs are pushing boundaries with predictive models, forecasting defaults from transaction patterns. As Galaxy Research notes, this fuels DeFi’s growth, capturing market share from CeFi.

Key DeFi Credit Scoring Factors

-

Repayment History: Tracks consistent on-time loan repayments across protocols like TrueFi, reducing default risk.

-

LTV Ratios: Monitors historical loan-to-value ratios to assess collateral management and borrowing discipline.

-

Wallet Age/Activity: Evaluates wallet maturity and transaction frequency for reliability signals.

-

Cross-Protocol Usage: Analyzes interactions across DeFi platforms for diversified, reputable behavior.

-

Off-Chain Integrations via DECO: Incorporates privacy-preserved traditional credit data using Chainlink’s DECO with Teller.

Market Momentum and Protocol Innovations

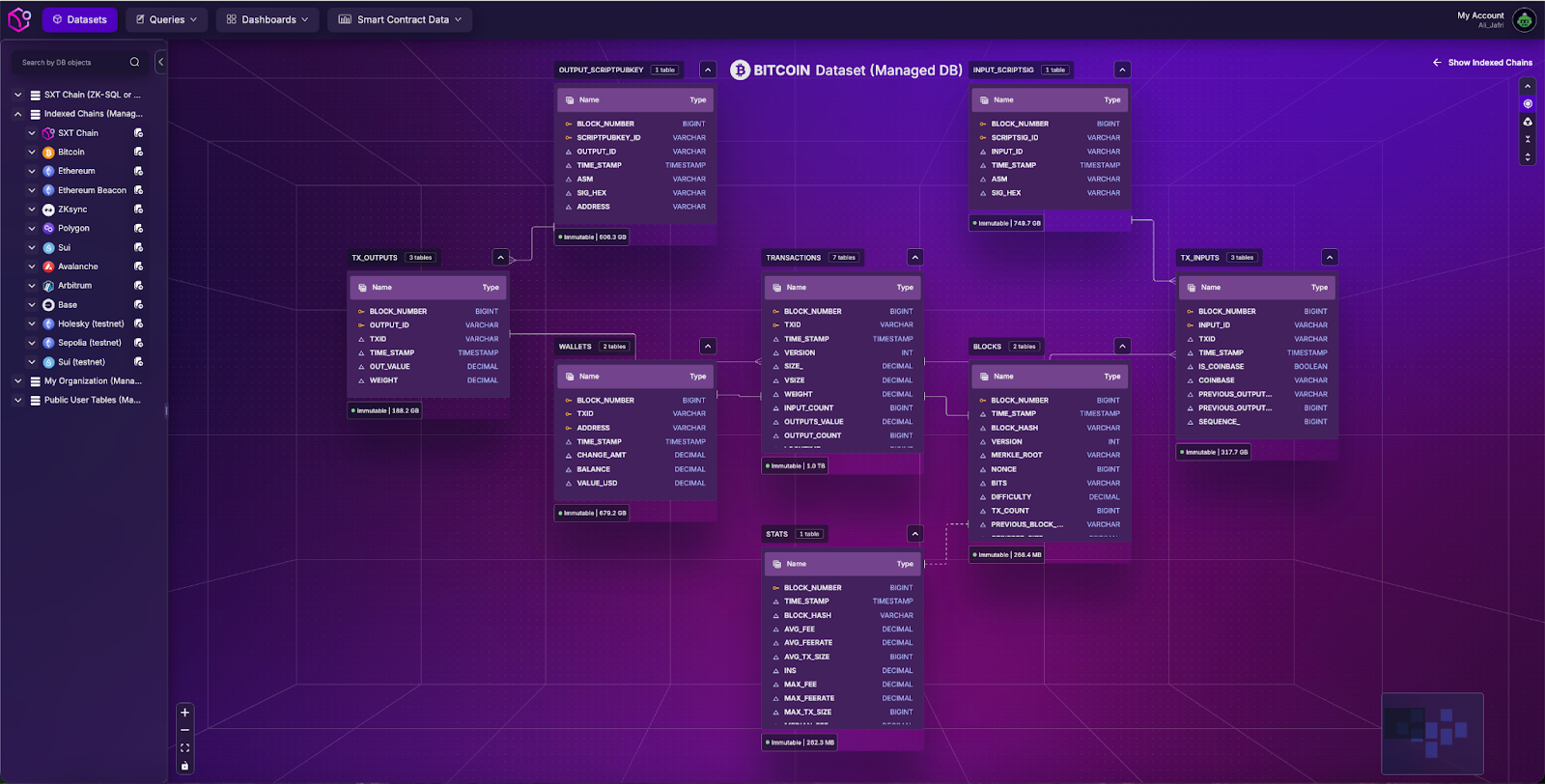

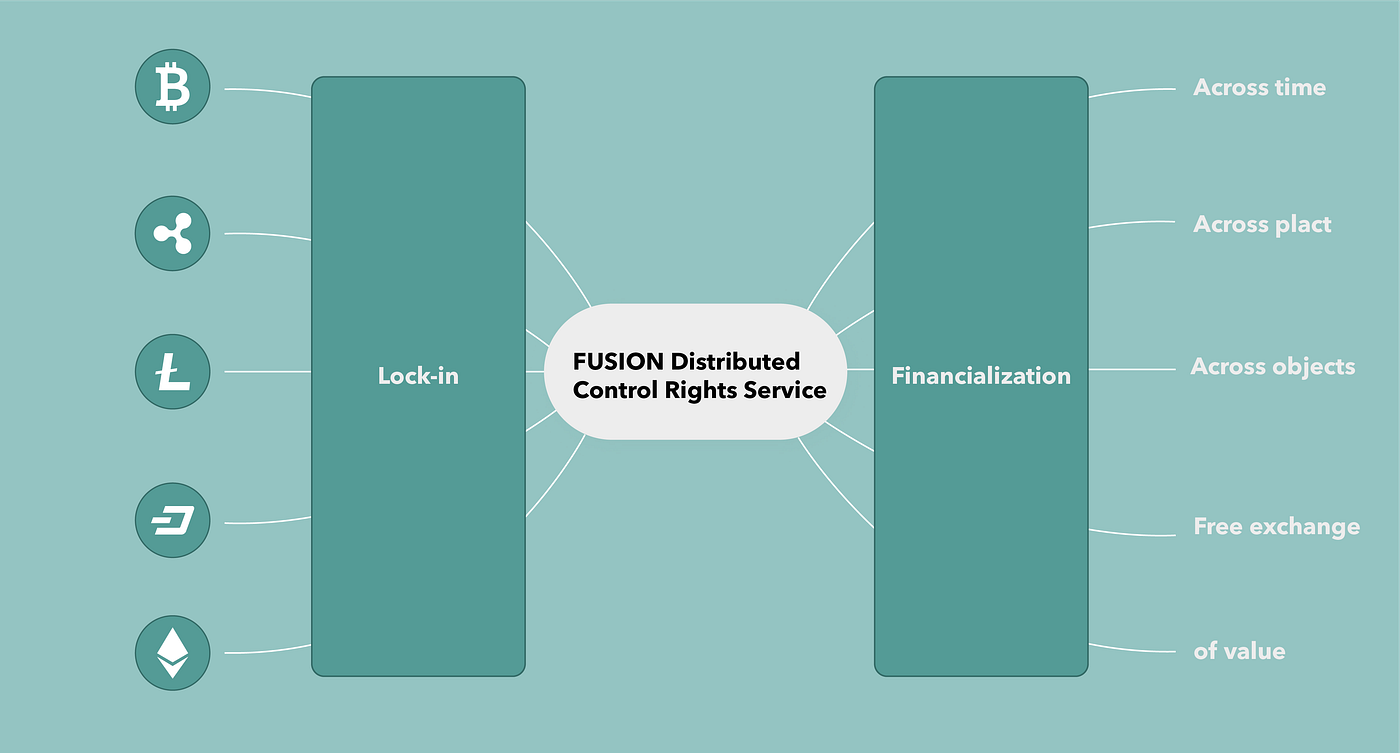

DeFi 3.0 emphasizes permissionless lending, with Token Metrics spotlighting capital efficiency gains. Onchain predicts trillions inflows via decentralized lending protocols that reward proven repayers. Chainlink’s DECO integrates off-chain data privately, as Teller’s POC demonstrates, verifying bank balances without exposure. This hybrid model addresses pure on-chain limitations, like sybil attacks, boosting lender confidence.

Consider Mitosis University: protocols blend on- and off-chain signals for nuanced scores. CoinGecko questions if undercollateralized loans are DeFi’s future, citing third-party checks. My view? Absolutely, but only with robust oracles and insurance. TechUnity on LinkedIn forecasts fraud-resistant systems via reputation scores, aligning with 2025’s on-chain identity boom.

Quantifying the Edge: Data-Driven Advantages

Lenders gain from transparent audits; no more opaque black boxes. Borrowers with clean histories access funds at lower costs- think 5-10% APR versus 20% and in collateral-heavy setups. Protechbro warns of default risks and smart contract bugs, valid concerns given exploits’ $1B and toll historically. Still, immutable histories cut fraud by 70%, per industry estimates.

Yellow. com unpacks ratings from Gauntlet: scores from 0-100 dictate terms. A 850 and wallet might borrow at 10% collateral, versus 200% for newbies. This granularity drives inclusion, especially for emerging markets where TradFi excludes millions. As BTC steadies at $90,578.00 and ETH at $3,003.06, volatility tests these systems, yet resilience shines through lower liquidation cascades.

Lower liquidation cascades mean fewer forced sales during dips like today’s 1.65% drop in ETH to $3,003.06, preserving protocol stability. This edge positions decentralized lending protocols to capture more of the $73.59 billion crypto lending market, outpacing collateral-locked rivals.

Leading Protocols: TrueFi, Huma, and Beyond

TrueFi leads with its on-chain credit ratings, where borrowers with scores above 80 access loans at under 20% collateral. Data shows their default rates hovering at 1.2%, far below industry averages for overcollateralized setups. Huma Finance pushes pure on-chain credit, scoring users on repayment velocity- how quickly they cycle loans- alongside wallet diversity. Their model, per recent audits, flags risky patterns with 92% accuracy.

Top Undercollateralized DeFi Protocols (2025)

| Protocol | TVL ($B) | Avg Collateral (%) | Default Rate (%) | Key Metric |

|---|---|---|---|---|

| TrueFi 🟢 | 0.5 | 15 | 1.2 | Repayment Score >80% |

| Huma 🟢 | 1.2 | 12 | 0.8 | On-Chain Credit Score 85+ |

| Teller 🟡 | 0.4 | 18 | 1.5 | DECO Off-Chain Verification |

| Goldfinch 🟢 | 2.1 | 10 | 0.9 | Backed Loans >90% |

Goldfinch adds senior/junior tranche structures, using on-chain histories to allocate risk. Lenders in junior pools earn yields up to 15% annualized, backed by backers’ due diligence. Teller’s Chainlink DECO integration verifies off-chain income streams, like payroll, enabling hybrid scores that blend blockchain purity with real-world proof. These innovations, as Protechbro analyzes, tilt toward opportunity over raw risk.

Risks Demystified: Defaults and Defenses

Skeptics fixate on defaults, yet data tempers fears. Mitosis University reports undercollateralized pools average 2-3% losses, mitigated by dynamic interest rates that rise with score drops. Smart contract vulnerabilities persist- think Ronin or Wormhole echoes- but formal verification and bug bounties have slashed exploits by 40% since 2023. Sybil resistance via DID and social graphs further fortifies, with platforms like DECO anonymizing inputs to thwart gaming.

Insurance protocols like Nexus Mutual cover lender principal, pricing premiums off crypto risk scores. In my analysis, this creates a flywheel: strong histories lower premiums, attracting capital, which funds more loans, refining scores further. Current BTC at $90,578.00 weathers outflows better than 2022 crashes, as reputation layers dampen panic liquidations.

DeFi Lending Ecosystem: 6-Month Price Performance Comparison

Ethereum and key DeFi tokens amid on-chain repayment histories enabling undercollateralized loans (as of 2025-11-29)

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Ethereum | $3,002.26 | $2,609.74 | +15.1% |

| Bitcoin | $90,569.00 | $60,000.00 | +51.0% |

| Uniswap | $6.12 | $5.50 | +11.3% |

| Aave | $183.35 | $150.00 | +22.2% |

| Maker | $1,234.59 | $1,100.00 | +12.2% |

| Compound | $31.97 | $28.00 | +14.2% |

| Lido DAO | $0.6536 | $0.6000 | +8.9% |

Analysis Summary

Over the past six months, Bitcoin has led with a +51.0% surge, significantly outpacing Ethereum’s +15.1% gain. DeFi tokens show varied performance, with Aave at +22.2% and Lido DAO lagging at +8.9%, reflecting strong market growth supporting innovations in undercollateralized DeFi lending.

Key Insights

- Bitcoin’s +51.0% growth highlights its dominance amid DeFi expansion.

- Aave (+22.2%) outperforms most DeFi peers, tied to lending protocol strength.

- Ethereum’s +15.1% rise underpins on-chain credit scoring advancements.

- DeFi tokens average ~14% gains, signaling capital efficiency in 2025 DeFi TVL boom.

Prices sourced from real-time data via Coinmasterstats.com and Investing.com historical data (e.g., ETH: 2025-06-03). Changes calculated as percentage from 6 months ago to current, last updated 2025-11-29.

Data Sources:

- Main Asset: https://coinmasterstats.com/coin/ethereum

- Bitcoin: https://www.investing.com/crypto/bitcoin/historical-data

- Uniswap: https://www.investing.com/crypto/uniswap/historical-data

- Aave: https://www.investing.com/crypto/aave/historical-data

- Maker: https://www.investing.com/crypto/maker/historical-data

- Compound: https://www.investing.com/crypto/compound/historical-data

- Lido DAO: https://www.investing.com/crypto/lido-dao/historical-data

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

Undercollateralized lending demands vigilance, but on-chain transparency outshines TradFi’s hidden fees and biases. Lenders audit histories permissionlessly, borrowers bootstrap reputations from zero.

2025 Horizon: Trillions in Sight

Galaxy Research’s $73.59 billion milestone signals acceleration. Onchain forecasts trillions as scores mature, with DeFi 3.0 permissionless pools drawing institutions. Token Metrics highlights liquidity solutions like concentrated pools, amplifying efficiency. AI-driven aggregators, per TechUnity, will parse cross-chain histories, unlocking undercollateralized yield farming.

Picture this: a wallet with 24 months of flawless repayments borrows $100K at 8% collateral, yield 12% for lenders. Scale to millions, and TradFi quakes. Challenges like oracle centralization linger, but zero-knowledge proofs evolve fast. With ETH steady at $3,003.06 and BTC at $90,578.00, protocols prove antifragile, converting volatility to opportunity via precise DeFi credit scoring.

On-chain repayment histories don’t just enable undercollateralized DeFi loans; they redefine trust as code. Lenders deploy capital boldly, borrowers thrive on merit, and the ecosystem scales. As scores proliferate, expect narrower spreads, deeper liquidity, and a credit revolution etched in blocks.