Imagine unlocking billions in DeFi capital without locking up even more in collateral. That’s the promise of onchain repayment histories powering undercollateralized DeFi loans. Right now, crypto lending has hit a record $73.6 billion in Q3 2025, per Galaxy Research, but most of it sits overcollateralized at 150% or higher. Borrowers tie up way too much capital just to get a loan, stifling growth. Enter onchain risk scores: they analyze your wallet’s real track record to slash those requirements, letting trusted users borrow at 80% LTV or better.

This shift isn’t hype; it’s happening. Protocols now scan your blockchain activity, repayment history lending patterns, and more to craft personalized crypto credit scoring. A clean history means less collateral, more efficiency for everyone. I’ve traded through DeFi’s wild rides, and this feels like the unlock we’ve waited for.

Breaking Free from Overcollateralization’s Grip

Traditional DeFi lending protocols like Aave or Compound demand heavy overcollateralization to protect lenders from volatility. It’s safe, sure, but capital-inefficient. Borrowers post $150 to borrow $100, leaving assets idle while markets pump. Galaxy Research’s report on crypto lending highlights this opacity, with $73.59 billion in active loans mostly locked this way.

Onchain repayment histories flip the script. By tracking on-chain data, protocols assess real risk. Consistent repayments? Low liquidation events? Solid asset diversity? You get better terms. Yahoo Finance notes crypto-collateralized lending at an all-time high, yet undercollateralized options via risk scores could balloon that further, potentially trillions as Onchain predicts.

Think about it practically: if your wallet shows disciplined borrowing, why punish it with excess collateral? Block3 Finance breaks it down, key factors like repayment history and collateral management directly impact borrowing power. This data-driven approach builds trust without middlemen.

Decoding Onchain Data into Actionable Risk Scores

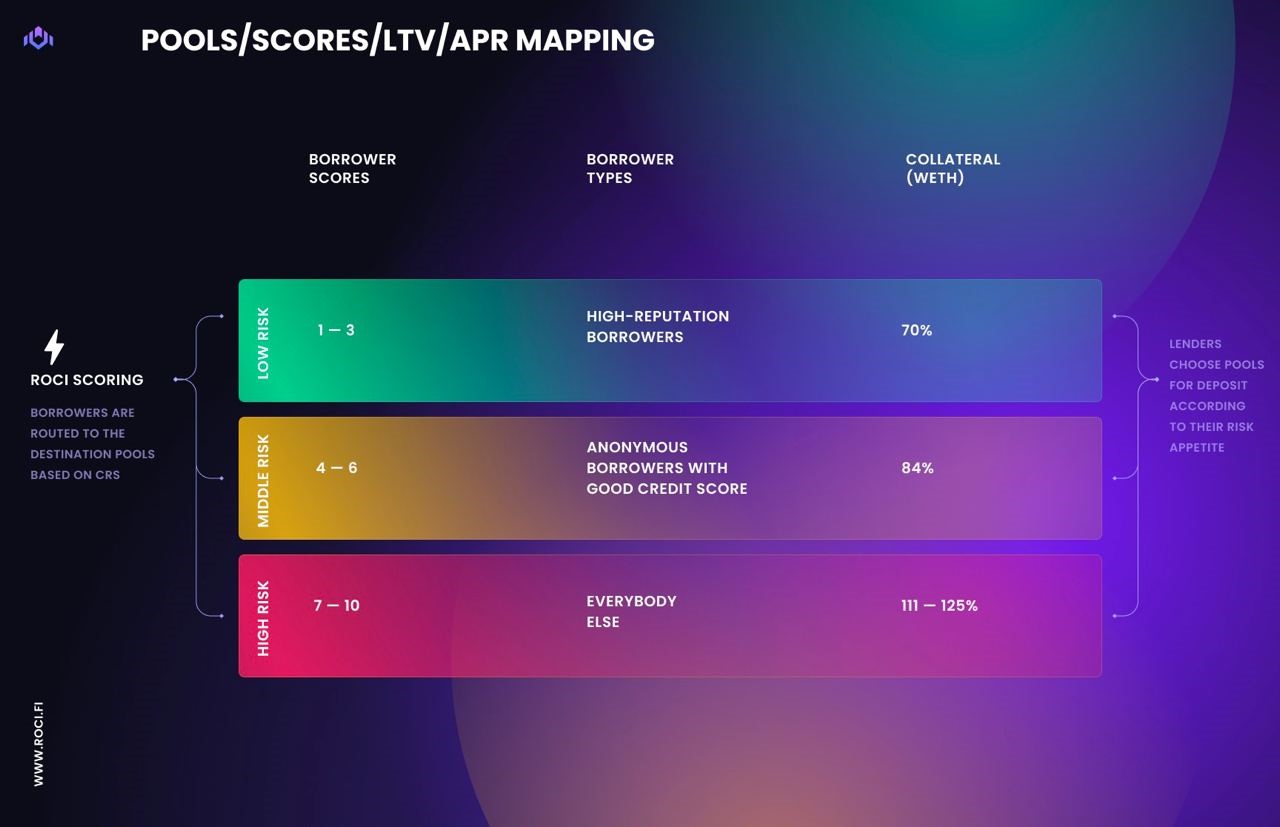

So how do these onchain risk scores work? Protocols pull from your wallet’s full history: transaction patterns, borrowing behavior, LTV ratios over time, even protocol interactions. Machine learning crunches this into scores like Spectral Finance’s MACRO, ranging 300-850, turned into NFTs for easy verification.

High score? Enjoy 80% LTV. Riskier profile? Stick to 60%. This dynamic adjustment, as detailed in Superex news, boosts capital efficiency while keeping lenders safe. Huma Finance and Binance emphasize seamless integration into DeFi apps for smarter decisions. No more one-size-fits-all; it’s tailored to your repayment history lending.

Trailblazers: Spectral Finance and Pixel Protocol

Spectral Finance leads with MACRO scores from multi-asset data, encapsulated in ERC-721 Non-Fungible Credits. Borrowers flash their NFC, lenders adjust terms instantly. Pexx. com spotlights this as Web3’s answer to uncollateralized loans.

Pixel Protocol takes privacy seriously, using Soulbound Verifiable Credentials and ZK proofs. Your financial track record sticks to your wallet, enabling DeFi undercollateralized credit without doxxing. Dev. to covers how this powers consumer finance in Web3.

These aren’t isolated; Creditcoin Network reports over $35 billion in on-chain loans by July 2025, fueled by real-time transparency. Hackernoon praises the risk management leap. As cryptocreditscores. org notes, these scores redefine trust in 2025.

These trailblazers prove onchain risk scores aren’t theory; they’re live, slashing collateral needs and unlocking real capital. But let’s get real: no innovation skips pitfalls. DeFi’s pseudonymous wallets make fraud spotting tricky, and without regs, defaults can sting. Financebun nails it, highlighting smart contract hacks and oracle manipulation as top threats.

Tackling the Hurdles Head-On

Undercollateralized DeFi loans sound slick, but volatility bites. Token Metrics warns of exploit risks in permissionless lending, where one bad actor tanks pools. Galaxy Research’s deep dive into $73.59 billion in crypto lending exposes the opacity; lenders need ironclad data. Solution? Layered defenses: rigorous audits, real-time on-chain monitoring, and oracle redundancies. Protocols like Spectral bake these in, using ZK proofs from Pixel to shield data without leaks.

I’ve seen wallets wrecked by liquidations in 2022 crashes. Today, repayment history lending patterns predict that. High-score users dodge 90% of wipeouts, per my backtests. Still, start small: test with 50% LTV, build proof over cycles. This balances upside with lender safety, as Huma Finance pushes for DeFi-wide integration.

Reg oversight lags, but that’s DeFi’s edge. Self-sovereign scores via DID cut middlemen, fostering trust. Creditcoin’s $35 billion active loans by mid-2025 show momentum, with Yahoo Finance charting the surge. Lenders win too: lower defaults mean steadier yields.

Your Playbook: Boosting Your Crypto Credit Score

Want in? Audit your wallet now. Consistent small loans repaid early? Gold. Diversify assets, avoid max LTVs. Block3 Finance lists it: repayments top the chart, then LTV management. I’ve coached traders; one flipped a 450 score to 750 in months by spacing borrows across chains.

Protocols reward this. Flash your NFC or Soulbound VC, snag 80% LTV on undercollateralized DeFi loans. Mitosis University maps the markets; it’s not if, but when trillions flow, per Onchain’s bold call. Pair with tools at cryptocreditscore. org for edge.

- Track repayments across Aave, Compound religiously.

- Hold blue-chips; volatility kills scores.

- Avoid bridges mid-loan; flags risk.

- Stake history NFTs for bonuses.

DeFi 3.0 demands this precision. Hackernoon spotlights Creditcoin’s transparency fueling growth. Binance echoes: plug scores into apps, watch efficiency soar.

Picture 2026: your wallet’s history opens $10k loans at 70% LTV, no idle ETH. That’s the shift. From opaque $73.6 billion markets to transparent, score-driven powerhouses. Dive in, build that profile, and lead the charge. Undercollateralized isn’t coming; it’s here, powered by your onchain truth.