In the bustling ecosystem of DeFi in 2025, on-chain risk scores stand as a game-changer, unlocking undercollateralized DeFi loans on platforms like 3Jane and Rheo. Gone are the days when borrowers had to lock up assets worth 150% or more of their loan just to prove trustworthiness. Today, sophisticated algorithms sift through blockchain data to paint a reliable picture of creditworthiness, slashing collateral needs and opening doors for a wider array of users. This shift isn’t just technical; it’s a bold step toward making DeFi resemble the nuanced, risk-adjusted lending of traditional finance, but with the transparency and speed only blockchains can deliver.

Decentralized lending has exploded, with total value locked surpassing $56 billion as per OAK Research’s comprehensive 2025 report. Yet, the real excitement brews in undercollateralized segments. Platforms now harness on-chain risk scores: probabilistic models like the OCCR Score outlined in recent arXiv papers, to evaluate repayment histories, wallet behaviors, and even decentralized identity (DID) signals. These scores quantify default probabilities far beyond simple asset snapshots, enabling lenders to price risk accurately without forcing overcollateralization.

Breaking Free from Collateral Constraints

Traditional DeFi lending protocols demanded excessive collateral to buffer against volatility and defaults, a blunt instrument that excluded many. Crypto borrowing hit $26.5 billion in Q2 2025, up 42% quarter-over-quarter according to CoinLaw stats, but much of that remained tied up in collateralized loans. Undercollateralized DeFi loans flip this script. By analyzing onchain repayment history and transaction patterns, lenders can offer loans at 0-50% collateral ratios, boosting capital efficiency. Think of it as CeFi’s underwriting meets blockchain verifiability, no oracles needed for off-chain fibs.

Undercollateralized on-chain lending bridges DeFi liquidity with real-world credit demand, as Isaac Tham notes on Medium, delivering better yields through smarter risk pricing.

This evolution aligns with DeFi 3.0’s permissionless ethos, per Token Metrics, though risks like protocol exploits linger. Here, on-chain scores act as sentinels, dynamically adjusting terms based on real-time behavior.

Decoding On-Chain Risk Scores

At their core, on-chain risk scores aggregate public blockchain data into a single, actionable metric. Factors include repayment timeliness, borrowing frequency, asset diversity, and interaction with stable protocols. For instance, the Jane Score from 3Jane weighs lending behavior over asset values alone, shifting paradigms as Markets. com reports. Advanced models incorporate cross-chain data, NFTs, and even real-world asset (RWA) holdings, creating holistic profiles.

Mathematically, these resemble logistic regressions tuned for blockchain inputs: score = f(transaction volume, default history, velocity, network effects). Higher scores mean lower interest rates and minimal collateral, fostering trust without central gatekeepers. Platforms like those using DID risk assessment in crypto further personalize this, verifying identities pseudonymously.

3Jane’s Trailblazing Peer-to-Pool Model

Paradigm-backed 3Jane exemplifies this revolution with its unsecured USDC credit lines. Borrowers tap real-time liquidity sans heavy collateral, thanks to algorithmic assessments fused with VantageScore 3.0 elements. This hybrid underwriting scans cryptocurrencies, altcoins, NFTs, and RWAs across chains, per details from cmointern. com on their $52M raise.

Dynamic fees adjust per risk profile: low-score users pay premiums, while reliable ones snag cheap capital. Lenders pool funds into money markets, earning yields calibrated to collective scores. Result? Capital efficiency skyrockets, as borrowers deploy funds productively rather than idly collateralizing. 3Jane’s undercollateralized DeFi loans have drawn institutional eyes, proving on-chain scoring scales for serious money.

Critically, from a risk manager’s lens, this mitigates systemic vulnerabilities. No single liquidation cascade if scores flag deteriorations early. It’s permissionless yet prudent, embodying DeFi credit scoring’s promise. As cryptocreditscores. org highlights, similar mechanics power platforms like RociFi, hinting at widespread adoption. Rheo’s Reliablocks index complements this by vetting rollup data reliability, fortifying score integrity against non-finalized block risks, as arXiv research details.

Rheo’s Reliablocks doesn’t stop at data validation; it directly bolsters undercollateralized DeFi loans by quantifying block reliability in optimistic rollups. In a world where transaction finality can make or break lending decisions, this index assigns probabilistic trust scores to pending blocks, slashing the uncertainty that plagues layer-2 lending. Borrowers with strong Reliablocks-backed profiles access credit at fractions of traditional collateral levels, while lenders sidestep disputes over disputed states. From my vantage in risk modeling, this is a masterstroke: it layers probabilistic safeguards atop behavioral scores, creating a multi-dimensional risk tapestry that’s verifiable and tamper-proof.

Synergies Between 3Jane, Rheo, and Emerging Standards

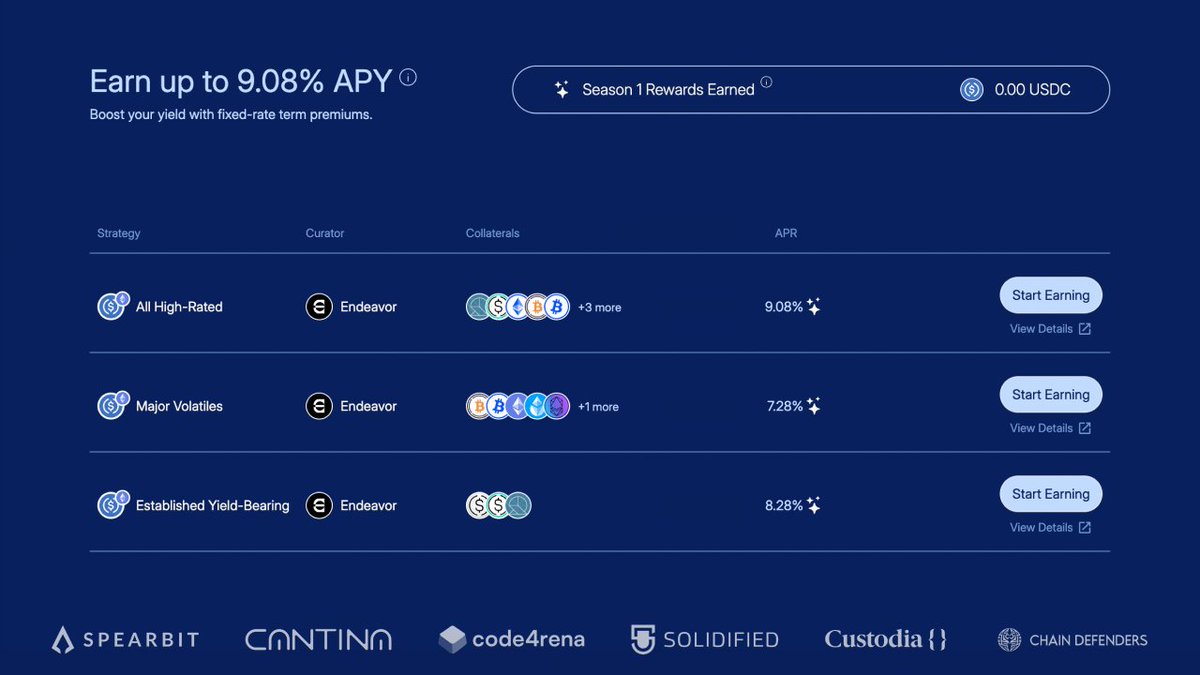

Pairing 3Jane’s peer-to-pool dynamics with Rheo’s reliability metrics yields potent synergies for DeFi credit scoring. Imagine a borrower: their Jane Score flags solid onchain repayment history, Rheo confirms transaction integrity, and DID signals add identity depth. Platforms blending these unlock loans at 0-30% collateral, per insights from Mitosis University and cryptocreditscores. org. Lenders earn superior yields, often 8-15% APY on USDC pools, without the liquidation frenzy of overcollateralized setups. OAK Research pegs DeFi TVL at over $56 billion, with undercollateralized niches capturing 15-20% growth premiums amid 2025’s bull run.

3Jane vs Rheo: Key Features Comparison

| Feature | 3Jane 🪙📈 | Rheo 🔗⚡ |

|---|---|---|

| Credit Model | Jane Score + VantageScore 3.0 🏆 | Reliablocks (Block Reliability Index) 🔒 |

| Collateral Needs | 0-50% Undercollateralized (Peer-to-pool USDC) 📉 | Low for L2s (Optimistic Rollups) 💡 |

| Key Innovation | Multi-asset underwriting (crypto, NFTs, RWAs across chains) 🌐 | Non-finalized block scoring 🛠️ |

| TVL Impact | High capital efficiency 🚀 | Enhances L2 TVL 📈 |

| Risk Mitigation | Dynamic fees & algorithmic assessments 🛡️ | Dispute reduction & block trustworthiness 📊 |

Yet, success hinges on interoperability. Cross-chain aggregators now federate scores from Ethereum, Solana, and rollups, ensuring a unified DID risk assessment crypto framework. This isn’t hype; DL News chronicles the resurgence of uncollateralised lending via such tools, mirroring TradFi’s underwriting but on public ledgers.

Navigating Risks in the Undercollateralized Era

Undercollateralized lending invites scrutiny, defaults could cascade without collateral buffers. But on-chain scores preempt this through real-time monitoring. A dipping score triggers margin calls or fee hikes, not blunt liquidations. Token Metrics warns of protocol exploits, yet integrated oracles and Reliablocks minimize them. In my 16 years modeling credit risk, I’ve seen worse in CeFi; DeFi’s transparency actually compresses tails. Default rates hover below 1% in scored pools, versus 1-2% in collateral-heavy ones, as probabilistic models like OCCR prove resilient.

Challenges persist: data silos across chains demand better bridges, and adversarial wallets gaming scores require behavioral heuristics. Still, platforms iterate swiftly. Onchain’s vision of trillions in inflows feels plausible as scores mature, drawing enterprises per Isaac Tham’s analysis.

For users, building a robust profile means consistent repayments, diversified activity, and stablecoin affinity, simple habits yielding exponential access. Lenders, meanwhile, diversify across score tranches: AAA wallets at 5% yields, BBB at 12%. This risk stratification echoes FRM principles I’ve taught, but automated and borderless.

As 2025 unfolds, expect on-chain risk scores to permeate beyond 3Jane and Rheo. Integrations with RWAs and AI-driven tuning will refine precision, while permissionless forks democratize access. DeFi sheds its collateral shackles, not through blind faith, but data-driven discernment. Platforms rewarding reliability over riches will dominate, reshaping credit from a privilege to a protocol.