Bitcoin’s recent surge to $91,931.00 underscores a persistent truth for holders: capital tied up in BTC often demands tough choices between liquidity needs and long-term conviction. Under-collateralized Bitcoin loans emerge as a disciplined alternative, harnessing on-chain credit scores and decentralized identifiers (DIDs) to unlock borrowing power without forcing sales. This approach aligns with HODL ethos while introducing rigorous, transparent risk evaluation in DeFi.

Why Under-Collateralized Loans Reshape BTC Lending

Traditional DeFi lending mandates over-collateralization, typically 150% or higher, to buffer volatility. Borrowers lock excess BTC, amplifying liquidation risks during downturns like those seen in past cycles. Under-collateralized Bitcoin loans flip this script, demanding ratios as low as 71% via sophisticated on-chain credit scores DeFi systems. Platforms analyze repayment histories, transaction patterns, and protocol engagements to quantify borrower reliability.

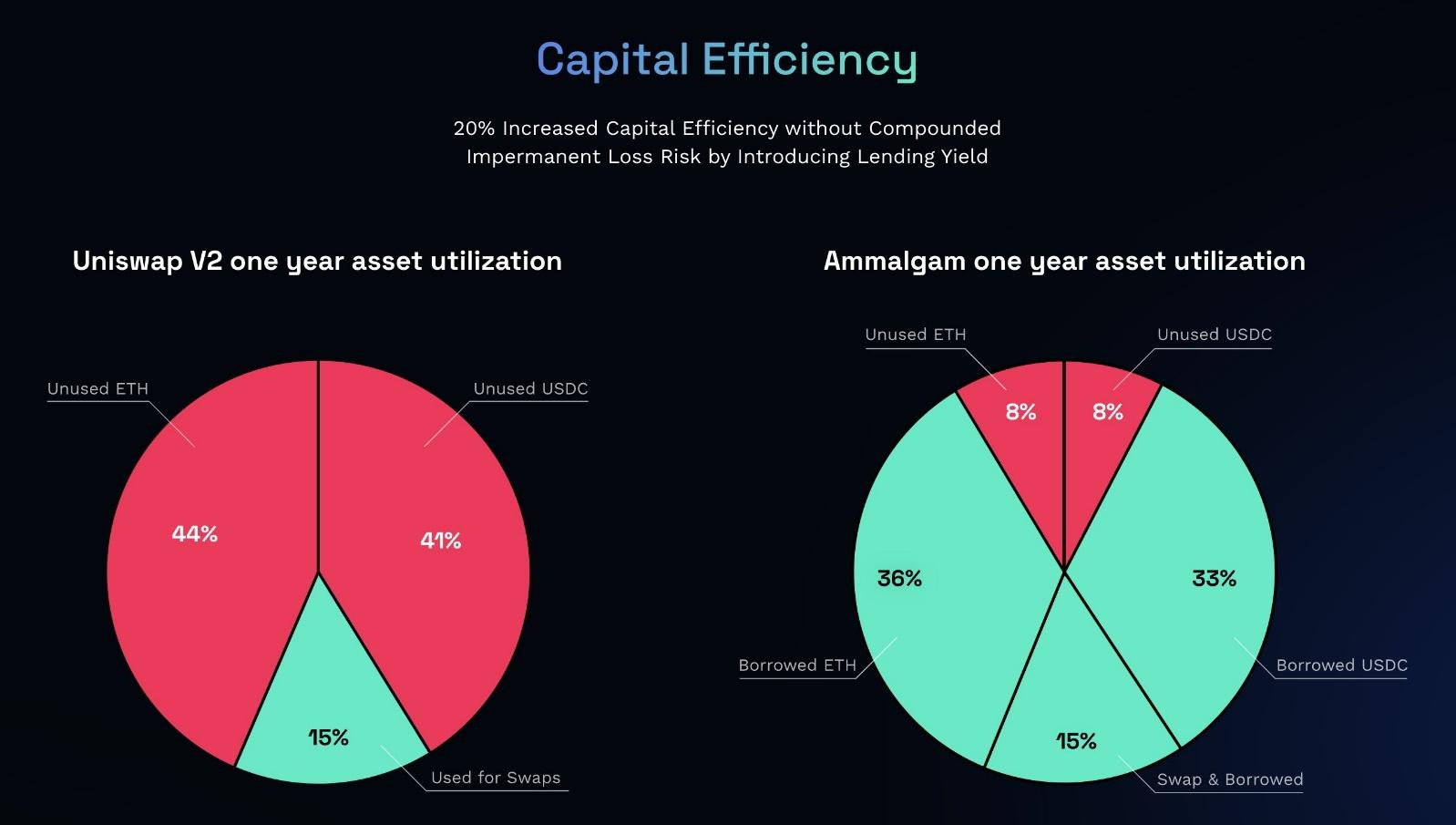

This shift boosts capital efficiency. At Bitcoin’s current $91,931.00 price, a holder with 1 BTC avoids selling for immediate cash, preserving upside exposure. Lenders benefit too, accessing higher yields from risk-adjusted pools. Galaxy’s Q2 2025 report on crypto leverage highlights on-chain lending’s growth, with DeFi capturing 45.31% of collateralized markets by Q1, signaling room for under-collateralized expansion.

Critically, this model demands discipline. Without excessive collateral, defaults hinge on verifiable on-chain behavior, fostering a meritocracy of repayment. It’s not leniency; it’s precision-engineered trust, reducing systemic fragility from over-leveraged positions.

Decoding On-Chain Credit Scores and DID Integration

DID credit scoring crypto anchors this innovation. Decentralized identifiers provide pseudonymous, user-controlled identities, linking to on-chain credit scores without exposing personal data. Scores derive from immutable blockchain metrics: timely repayments, wallet age, interaction diversity, and even social graph signals from protocols.

Consider a borrower with consistent USDC repayments on Aave and Morpho. Their score reflects low fraud risk and high reputation, qualifying for BTC lending without selling at minimal collateral. Research like the arXiv paper “Allowing Blockchain Loans with Low Collateral” validates this, proposing protocols that blend scores with dynamic risk models to sustain low ratios safely.

DIDs ensure portability across chains, vital as Bitcoin operates via wrappers like WBTC on Ethereum or native lending on Layer 2s. Privacy preserves, yet transparency enforces accountability; a default craters the score chain-wide, imposing natural discipline.

Pioneering Protocols for Undercollateralized Lending

RociFi leads on Polygon, deploying holistic scoring for fraud, reputation, and creditworthiness. Borrowers secure loans at 71% collateral, far below Aave’s over-collateralized norms. This enables true undercollateralized lending protocols, where scores supplant excess pledges.

SoLo Protocol innovates further, fusing traditional scoring with on-chain analytics into a proprietary ‘SoLo score. ‘ Non-custodial and decentralized, it targets consumer credit, promising broader adoption. Meanwhile, Coinbase’s Base network collaboration with Morpho offers BTC-backed USDC loans up to $100,000 at 133% ratios, bridging CeFi reliability with DeFi composability.

Cantor Fitzgerald’s $2 billion Bitcoin facility exemplifies institutional entry, using segregated on-chain custody for credit. As DL News notes, reputation and income verification supplant collateral, echoing CeFi’s return but decentralized. These platforms, amid DeFi’s 2025 resurgence, position under-collateralized BTC loans as inevitable evolution.

Bitcoin (BTC) Price Prediction 2026-2031

Forecasts amid the growth of under-collateralized lending using on-chain credit scores and DIDs, enabling BTC holders to access liquidity without selling

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) |

|---|---|---|---|

| 2026 | $95,000 | $145,000 | $210,000 |

| 2027 | $120,000 | $185,000 | $275,000 |

| 2028 | $155,000 | $235,000 | $350,000 |

| 2029 | $200,000 | $300,000 | $450,000 |

| 2030 | $260,000 | $390,000 | $580,000 |

| 2031 | $330,000 | $500,000 | $750,000 |

Price Prediction Summary

Bitcoin’s price is forecasted to experience robust growth from 2026 to 2031, driven by DeFi innovations like under-collateralized loans via on-chain credit scores (e.g., RociFi, Morpho). This reduces sell pressure, enhances utility, and supports HODLing. Average prices rise from $145K in 2026 to $500K by 2031, with min/max reflecting bearish corrections and bullish adoption surges post-halving cycles.

Key Factors Affecting Bitcoin Price

- Expansion of under-collateralized lending protocols (RociFi, Coinbase-Morpho, SoLo) reducing liquidation risks

- On-chain credit scores and DIDs improving creditworthiness assessment and capital efficiency

- Post-2024 halving bull cycle extension into 2026 with DeFi TVL growth

- Institutional adoption via CeFi/DeFi hybrids and treasury integrations (e.g., Cantor Fitzgerald)

- Regulatory clarity on crypto lending boosting confidence

- Macro factors: ETF inflows, global adoption, and BTC as digital gold amid inflation hedges

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

These developments coincide with Bitcoin’s climb to $91,931.00, where holders face amplified incentives to borrow rather than sell. Institutional moves like Cantor Fitzgerald’s $2 billion facility signal maturity, blending on-chain segregation with credit assessment to scale under-collateralized bitcoin loans. Yet success pivots on execution: protocols must calibrate scores rigorously to avert moral hazard.

Risks and Disciplined Mitigation Strategies

Lower collateral invites scrutiny. Volatility at Bitcoin’s $91,931.00 level, swinging from $85,051 to $92,290 in 24 hours, tests even scored borrowers. Defaults could cascade if scores overlook correlated risks, like sector-wide deleveraging seen in prior cycles. Platforms counter with dynamic adjustments: RociFi escalates collateral on score dips, while Morpho’s oracles trigger margin calls preemptively.

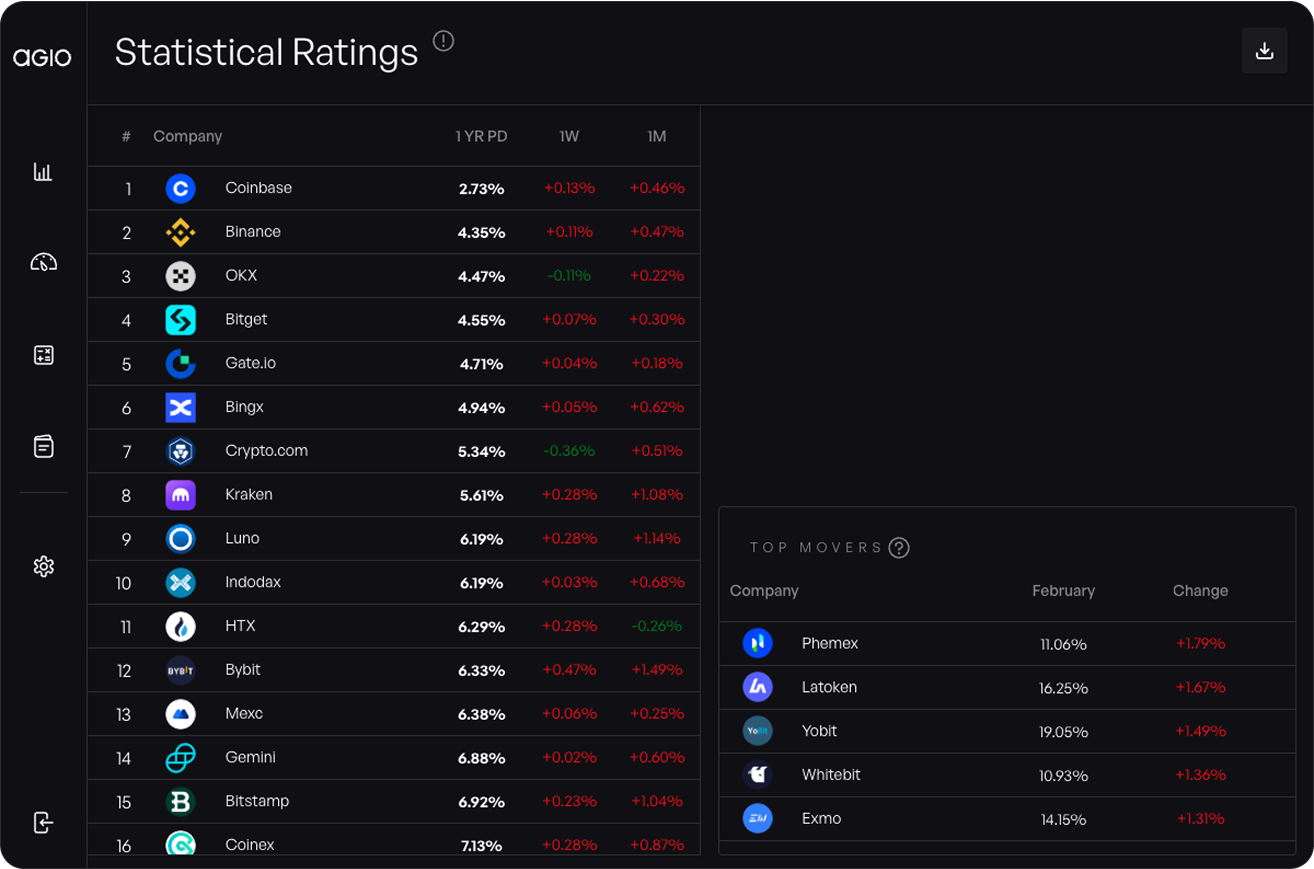

Lenders demand yield premiums, often 2-5% above over-collateralized rates, per CoinLaw’s Q1 2025 stats showing DeFi’s 45.31% market dominance. Borrowers, meanwhile, cultivate scores through small, consistent loans, building reputation as wallet maturity compounds. This merit-based ladder enforces discipline, weeding out speculators for proven performers.

Crypto Collateralized Lending Market Shares and Top Protocols

| Category/Protocol | Value | Notes |

|---|---|---|

| DeFi Lending | 45.31% | Market share end Q1 2025 (CoinLaw) |

| CeFi Platforms | 34.57% | Market share end Q1 2025 (CoinLaw) |

| CDP Stablecoins | 20.12% | Market share balance end Q1 2025 |

| Bitcoin (BTC) Price | $91,931 | As of 2025-12-02 | +8.09% (24h) |

| Aave | Over-collateralized | Top DeFi protocol (Rapid Innovation) |

| RociFi | As low as 71% | Under-collateralized Bitcoin loans on Polygon |

| Morpho | 133% minimum | BTC-backed loans with Coinbase on Base |

In my six years bridging crypto and traditional markets, I’ve seen over-collateralization breed inefficiency, locked capital, forced liquidations. Under-collateralized models, powered by on-chain credit scores DeFi, rectify this with data-driven precision, though they reward only the methodical.

Practical Steps for BTC Holders

To engage BTC lending without selling, start with DID setup on platforms like Polygon or Base. Link your wallet, accrue initial score via low-stake interactions, then apply for loans targeting 80-120% ratios. Monitor via dashboards; repay early to boost scores. At $91,931.00 per BTC, a 1 BTC collateral at 71% unlocks ~$65,000 USDC, retaining full upside without tax events.

Lenders pool via liquidity layers, earning from diversified risk tranches. DebtDAO’s line-of-credit for on-chain revenue DAOs exemplifies yield optimization, funding operations sans dilution. Reflexivity Research notes traditional firms entering cautiously, validating the hybrid path.

Pros & Cons of Undercollateralized BTC Loans

-

Capital Efficiency: Access liquidity with minimal BTC locked (e.g., 71% collateral on RociFi vs. overcollateralized norms), freeing up assets for other uses.

-

HODL Preservation: Borrow against BTC without selling, maintaining long-term holdings amid volatility (BTC at $91,931, +8.09% in 24h).

-

Higher Yields: Lenders earn elevated returns due to risk-adjusted undercollateralization, as seen in emerging protocols like DebtDAO.

-

Score Dependency: Relies heavily on on-chain credit scores and DIDs, limiting access for users with sparse blockchain history.

-

Volatility Risk: BTC price swings (24h range: $85,051–$92,290) can trigger liquidations despite lower collateral ratios.

-

Elevated Rates: Higher interest due to increased lender risk in undercollateralized models vs. traditional overcollateralized DeFi like Aave.

This ecosystem matures amid 2025’s leverage surge, per Galaxy’s Q2 report. CoinGecko queries if undercollateralized loans solve accessibility for collateral-poor users; unequivocally, yes, via reputation ladders. SoLo’s hybrid scoring extends to consumers, potentially onboarding millions.

The Road Ahead for DeFi Credit

Undercollateralized lending protocols evolve cross-chain, with Bitcoin wrappers enabling native BTC pledges. Expect AI-enhanced scores incorporating predictive analytics, further compressing ratios. As DeFi claims larger shares, outrunning CeFi’s 34.57%: Bitcoin at $91,931.00 becomes a leverage cornerstone, not just a store of value.

Holders who master DID credit scoring crypto gain asymmetric edges: liquidity on demand, compounded returns, minimal dilution. Lenders harvest superior risk-adjusted yields in transparent pools. This isn’t speculation; it’s engineered finance, demanding vigilance but delivering efficiency traditional systems envy.

Bitcoin holders, equipped with on-chain tools, now navigate liquidity traps with precision. The $91,931.00 milestone reinforces: conviction pays, but discipline unlocks its full potential in DeFi’s next chapter.