In the volatile world of DeFi, where asset prices swing wildly, lenders have long demanded hefty collateral buffers-typically 150% to 300% of the loan value-to shield against defaults. But as 2025 unfolds, on-chain risk scores are reshaping this landscape, paving the way for under-collateralized DeFi loans that slash requirements toward 50%. This isn’t hype; protocols are already dipping below 100%, unlocking trillions in trapped capital while smartly managing risk through transparent blockchain data.

Why Over-Collateralization Is a Relic of Early DeFi

Early DeFi lending platforms like Aave and Compound built empires on over-collateralization, a pragmatic fix for crypto’s price chaos. Borrowers locked up far more value than they borrowed, ensuring lenders could liquidate positions if markets tanked. It worked, fueling growth from a bear-market low of $1.8 billion in open borrows to explosive expansion. Yet this model ties up capital inefficiently; a $100,000 loan might require $200,000 in collateral, sidelining assets that could earn elsewhere.

Enter crypto credit scoring: by mining on-chain histories for repayment patterns, transaction volumes, and even decentralized identity signals, protocols now gauge true borrower reliability. No more blunt-force collateral; risk is quantified per user. Sources like Galaxy Research highlight this shift, with on-chain lending apps surging post-bear market, driven by nuanced assessments.

Decoding On-Chain Risk Scores: Data-Driven Trust

On-chain risk scores pull from a borrower’s full blockchain footprint. Repayment history tops the list-whether they’ve nailed deadlines across protocols. Collateral management follows: past loan-to-value ratios reveal if they’ve danced close to liquidation edges or stayed conservative. Transaction velocity, wallet age, and even cross-chain behavior feed into models, creating a holistic onchain repayment history profile.

ArXiv papers detail this as systematic creditworthiness analysis, while platforms like Gauntlet and Chaos Labs pioneer the tech. Huma Finance frames it as fully decentralized lending, blending on-chain purity with off-chain proofs via Chainlink’s DECO for identity and balances. The result? Scores that dynamically adjust loan terms, fostering DeFi lending collateral reduction without reckless exposure.

This transparency builds trust absent in black-box TradFi scores. Lenders see verifiable data; borrowers build reputations that compound over time. Mitosis University notes hybrid on/off-chain data turbocharges this, enabling under-collateralized issuance at scale.

Pioneers Pushing Collateral to New Lows in 2025

RociFi leads with credit markets tiered by scores. Their Pool 1 delivers 30-day USDC loans at just 71% collateral for institutions and DAOs with solid reps-a far cry from 150% norms. This targets lower-score entities while high-flyers borrow near barebones. Blockchain App Factory reports DeFi lending up 72% by September 2025, fueled by such innovations and real-world assets (RWAs) as stabler collateral.

RWAs tokenize stables like treasuries, damping volatility and justifying lighter buffers. Institutional inflows amplify this; Cointelegraph ties the surge to RWA adoption. Yet challenges linger: immature scoring risks bad debt spikes. Still, maturation promises 50% collateral, supercharging capital efficiency.

“On-chain credit scoring bridges traditional lending with DeFi, creating a single, transparent financial ecosystem. ” – Duredev on Medium

Block3 Finance emphasizes how decentralized identity lending via on-chain identity impacts borrowing power directly. Consistent repayers unlock better rates, lower collateral. As systems refine, expect widespread adoption, drawing trillions per Onchain. org projections. For now, these pioneers prove the model viable.

Protocols blending on-chain risk scores with safeguards like dynamic liquidation thresholds and insurance pools are minimizing defaults. Chaos Labs’ models, for instance, simulate stress scenarios using historical data, flagging high-risk borrowers before they access under-collateralized terms. This layered defense lets lenders confidently dip below 100% collateral, as seen in RociFi’s tiered pools.

Reducing Liquidation Risks in Volatile Markets

Volatility remains DeFi’s Achilles heel, but crypto credit scoring tames it through predictive analytics. Scores incorporate volatility-adjusted LTVs, ensuring collateral buffers scale with market swings. A borrower with pristine onchain repayment history might secure a 60% ratio during calm periods, tightening to 80% in turbulence. Gauntlet’s tools exemplify this, backtesting scores against past crashes to validate resilience.

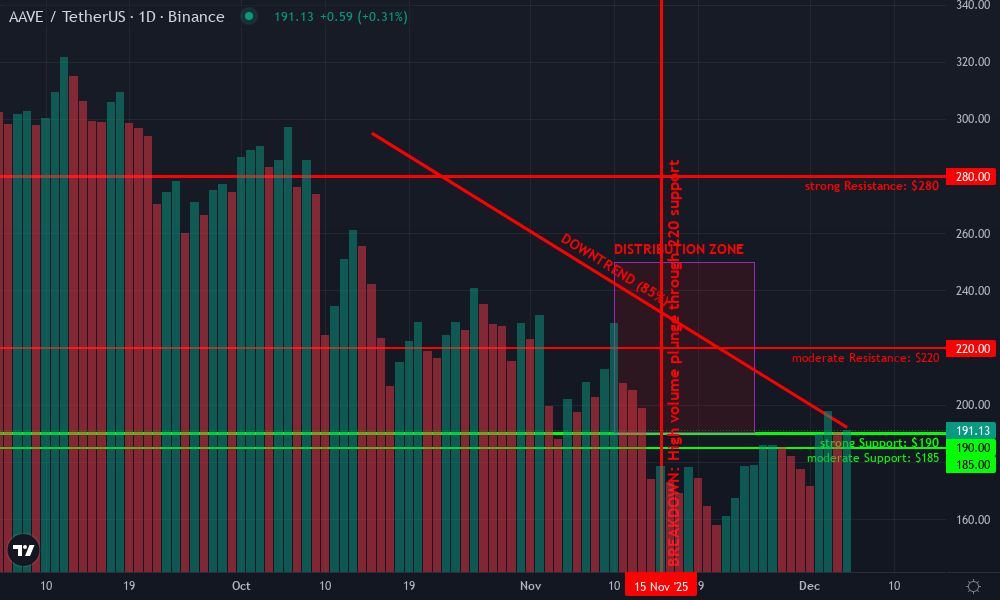

Aave Technical Analysis Chart

Analysis by Devon Carlisle | Symbol: BINANCE:AAVEUSDT | Interval: 1D | Drawings: 7

Technical Analysis Summary

As Devon Carlisle, start by drawing a prominent downtrend line connecting the October 2025 high near 295 to the late November low around 192, using the ‘trend_line’ tool with red color for bearish bias. Add horizontal lines at key support 190 (strong) and resistance 220/280. Overlay a rectangle for the recent consolidation zone from Nov 20 to Dec 5 between 185-205. Place fib retracement from Oct high to Nov low, highlighting 38.2% at 225. Mark volume climax with callout on Nov drop. Add up arrow at current 192 for potential reversal. Text box for MACD bearish divergence note. Vertical line at Nov 15 breakdown.

Risk Assessment: medium

Analysis: Choppy downtrend with exhaustion signals but macro DeFi tailwinds; volatility from lending innovations adds uncertainty

Devon Carlisle’s Recommendation: Scale in longs on dips to 190-192, target 250 with tight stops; hybrid play favors bulls long-term

Key Support & Resistance Levels

📈 Support Levels:

-

$190 – Recent lows and volume shelf, strong psychological floor

strong -

$185 – Extension of Nov breakdown low

moderate

📉 Resistance Levels:

-

$220 – 50% fib retrace and prior swing high

moderate -

$280 – Prior consolidation ceiling

strong

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$192 – Bounce off support with volume dry-up, aligned with DeFi credit score catalysts

medium risk

🚪 Exit Zones:

-

$250 – 38.2% fib target, prior resistance confluence

💰 profit target -

$182 – Below key support invalidation

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: climax then dry-up

High volume on Nov drop indicates distribution exhaustion, low volume now suggests accumulation basing

📈 MACD Analysis:

Signal: bearish but histogram contracting

MACD line below signal but momentum divergence hints at reversal as price stabilizes

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Devon Carlisle is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

Yellow. com breakdowns show how these ratings evolve: machine learning refines scores over time, learning from collective DeFi behavior. Lenders gain granular control, setting custom risk appetites per pool. Borrowers, meanwhile, incentivize good habits-repay early, diversify collateral, boost scores organically. The payoff? Fewer liquidations, steadier yields.

Path to 50% Collateral: What Lenders Need

Hitting 50% collateral hinges on maturing data oracles and hybrid signals. Chainlink’s DECO integrates off-chain proofs-like bank balances or TradFi scores-while keeping everything verifiable on-chain. Huma Finance pushes this envelope, defining on-chain credit as blockchain-native yet enriched. As decentralized identity (DID) standards solidify, wallets become passports to prime rates.

Galaxy Research charts on-chain lending’s rebound to billions in borrows, underscoring demand. For lenders, this means deploying capital at 2x efficiency; $1 million idle in over-collateral now funds two $500k loans at 50%. Borrowers access liquidity without selling assets, preserving upside in bull runs. Block3 Finance nails it: on-chain identity directly amplifies borrowing power for reliable actors.

Yet balance tempers optimism. Early under-collateralized experiments faced hiccups-bad actors gaming scores via sybil attacks or flash loans. Solutions emerge swiftly: zero-knowledge proofs for private histories, multi-sig DAOs for institutional checks. By late 2025, RWA collateral stabilizes further, with tokenized treasuries yielding 4-5% while backing loans. DeFi’s 72% lending surge reflects this momentum, per Cointelegraph.

Institutions eye entry, drawn by transparency TradFi can’t match. DAOs like those on Polygon via RociFi borrow for ops at fractions of old costs, fueling ecosystem growth. Developers integrate scores via APIs, embedding them in custom dApps. Hedera’s DeFi primers highlight user choice in yields, now paired with risk-tiered access.

Onchain projections of trillions unlocked aren’t pie-in-sky; they’re math. With $1.8 billion as bear-bottom baseline, scaled assessments multiply throughput. Mitosis University dives into issuance mechanics, blending on/off-chain for robust under-collateralized loans. As scores proliferate, expect protocol forks prioritizing DeFi lending collateral reduction.

Dive into liquidation safeguards

Smart participants build scores today: consistent small loans, diverse activity, RWA pairings. Lenders curate pools, harvest premiums from risk-adjusted rates. This symbiosis propels DeFi toward TradFi parity-smarter, fairer credit on public ledgers.