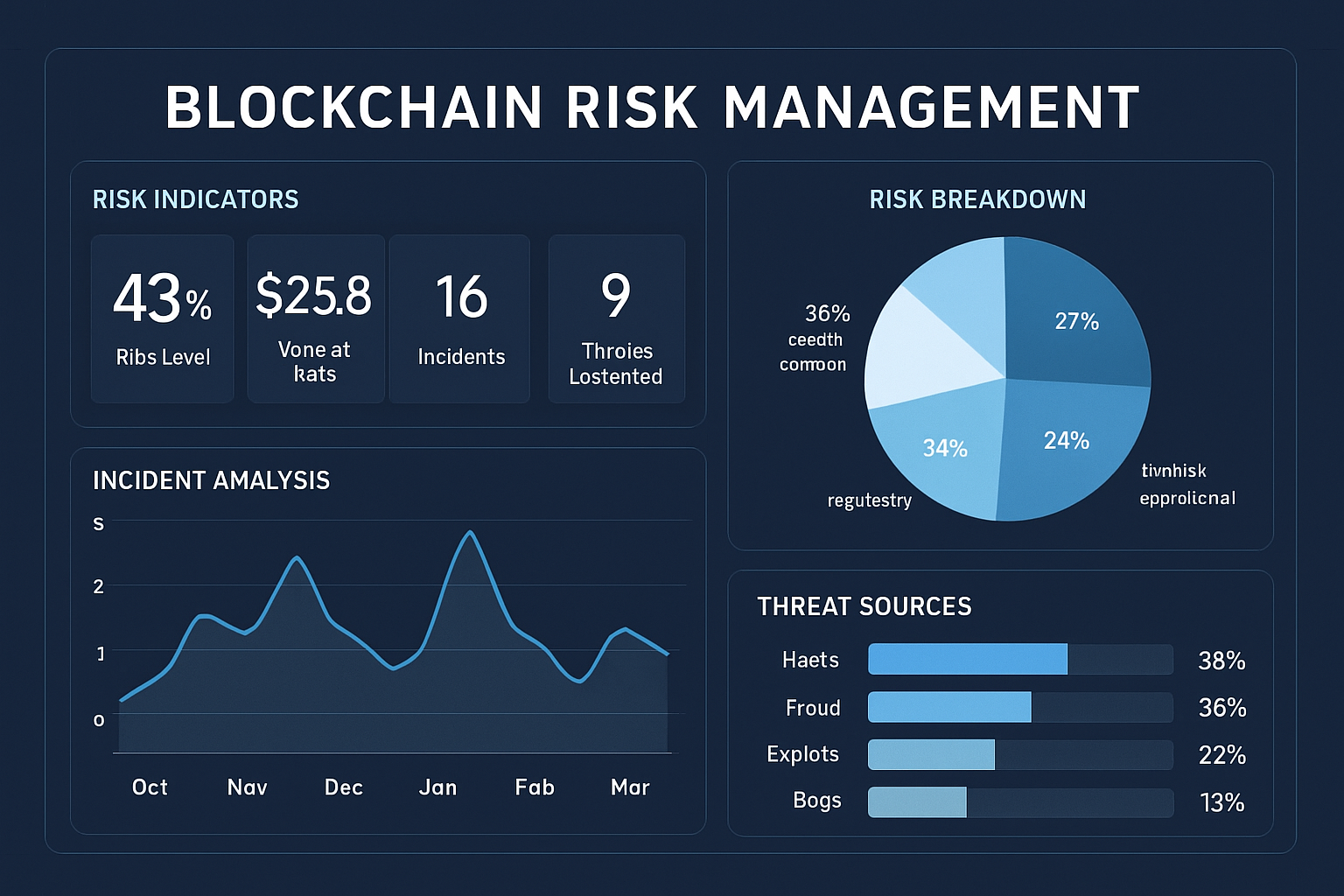

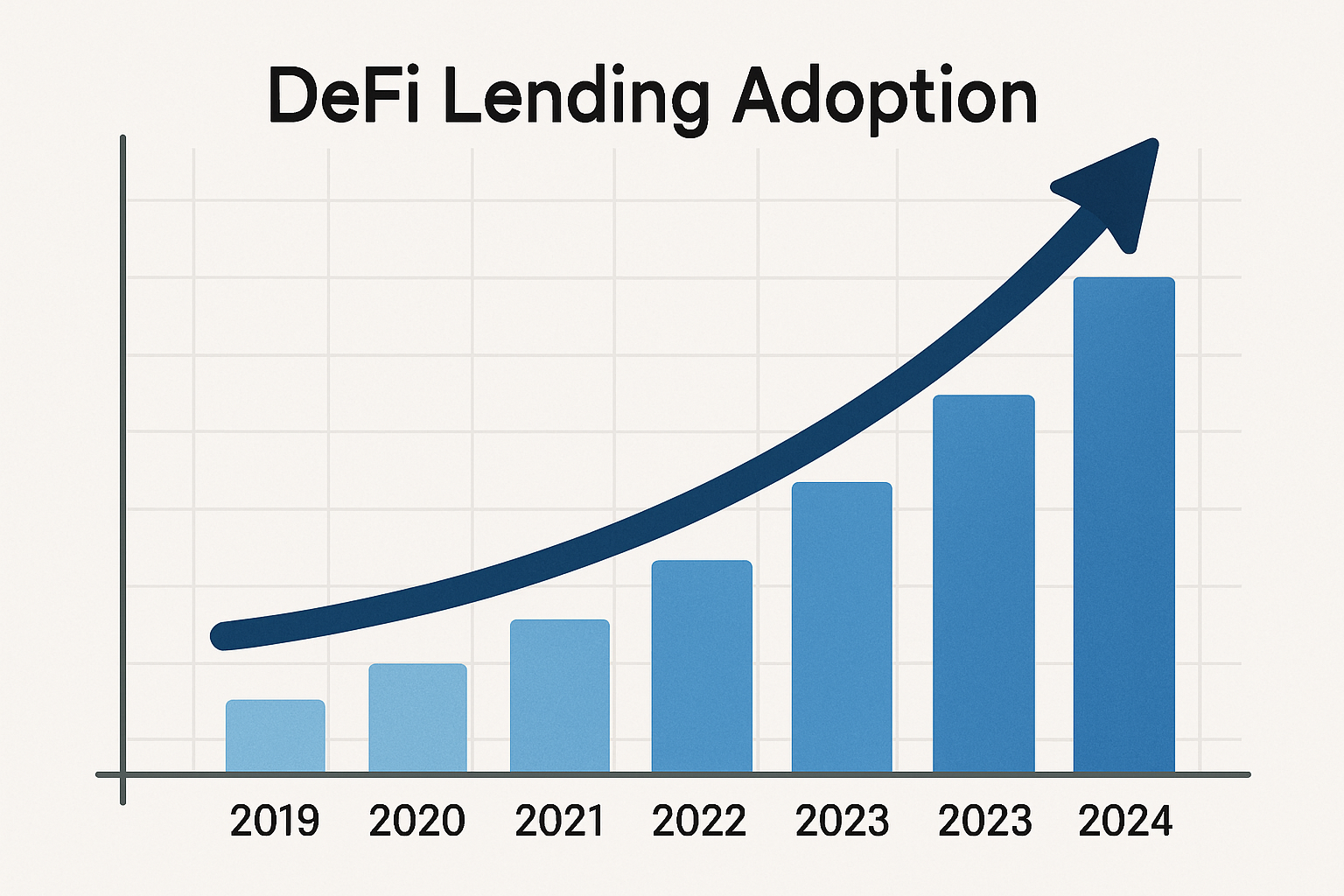

As Bitcoin finance platforms mature in 2025, under-collateralized loans in BTCFi represent a bold evolution, challenging the over-collateralized status quo that has long defined DeFi lending. With crypto-collateralized lending hitting a record $73.59 billion at the end of Q3, according to Galaxy Research, the stage is set for innovation. Onchain risk scores are at the forefront, enabling lenders to assess borrower reliability through immutable blockchain data, thus unlocking loans with collateral ratios dipping below 150%. This isn’t mere speculation; on-chain money markets surpassed CeFi with $20 billion in active loans by April, signaling a tipping point where trust is quantified on-ledger rather than locked in excess assets.

Why BTCFi Demands Under-Collateralized Innovation

Traditional DeFi lending mandates borrowers deposit far more value than they borrow, a safeguard against volatility but a barrier to capital efficiency. In BTCFi, where Bitcoin holders resist selling their appreciating assets, this model stifles growth. Enter onchain risk scores lending: by scrutinizing repayment histories, wallet interactions, and decentralized identity signals, protocols now differentiate reliable actors from risky ones. Galaxy’s Q2 report notes DeFi’s share of collateralized lending climbing to 49.86%, up 515 basis points, underscoring the momentum. Yet, as Reflexivity Research highlights, under-collateralized approaches are surging, powered by third-party risk assessments that prioritize behavioral data over asset piles.

This shift matters profoundly in BTCFi. Bitcoin’s scarcity and holders’ HODL mentality mean over-collateralization extracts unnecessary opportunity costs. Platforms leveraging DeFi credit scoring 2025 trends allow borrowers with strong on-chain reputations to secure funds at 120% collateral or less, freeing capital for yield farming or business expansion without liquidation fears. CoinGecko posits this as the future, beyond flash loans, with on-chain transparency fostering fairer access.

Core Benefits of Onchain Risk Scores

-

Reduced Collateral Requirements: Borrowers with strong onchain risk scores access under-collateralized loans, enhancing capital efficiency in BTCFi platforms.

-

Enhanced Risk Management: Real-time blockchain data enables precise default prediction, lowering risks and bolstering lending ecosystem health amid $73.6B crypto lending growth.

-

Increased Adoption: Transparent credit assessment attracts diverse participants, driving BTCFi expansion as DeFi lending TVL hits $63B in 2025.

-

Greater Transparency: Immutable onchain metrics ensure tamper-resistant evaluations, fostering trust in under-collateralized BTCFi loans.

Unpacking Onchain Risk Scores in Practice

Onchain risk scores aggregate a borrower’s digital footprint: transaction velocity, smart contract engagements, cross-protocol repayments, and even off-chain verifiable credentials bridged via oracles. Mitosis University details how DeFi protocols blend this with off-chain data for holistic profiles, issuing scores from 0-1000 that dictate loan terms. A score above 750 might qualify for BTC undercollateralized credit at 110% collateral, while lower tiers face stricter requirements. This granular approach mitigates the market risks plaguing collateralized loans, as noted by Mezo. org, where collateral drops can trigger cascades regardless of borrower intent.

In BTCFi specifically, protocols integrate these scores with Bitcoin layer-2 solutions, ensuring native BTC utility without bridging risks. Crypto. com reports DeFi TVL at $63 billion by June, with under-collateralized models contributing to 42% Q2 growth to $26.5 billion in on-chain loans per CoinLaw. Lenders benefit from real-time audits; a borrower’s on-chain repayment history risk becomes a public good, slashing default rates projected at under 2% in mature systems.

By combining on-chain risk control, smart contract lending, and DeFi innovation, lending becomes faster, fairer, and fully transparent. – Duredev on Medium

BTCFi Platforms Pioneering the Shift

Leading BTCFi protocols are embedding onchain risk scores to offer tiered lending. High-score users bypass excessive collateral, borrowing against BTC at ratios unthinkable a year ago. Sahm Capital observes DeFi rates dropping due to on-chain visibility, enforced by smart contracts that automate adjustments based on score fluctuations. This creates a virtuous cycle: more repayments bolster scores, attracting liquidity and compressing rates further. As under-collateralized loans BTCFi proliferates, expect institutional inflows, mirroring TradFi’s credit evolution but decentralized.

Challenges persist, from data privacy via zero-knowledge proofs to score standardization across chains. Yet, the trajectory is clear; 2025’s $73.59 billion milestone proves the market craves efficiency. Platforms refining these scores will dominate, empowering Bitcoin holders to leverage without surrender.

Consider a Bitcoin holder with a pristine on-chain record: consistent repayments across protocols, low-velocity spending patterns, and verified decentralized identity (DID) ties. Platforms now grant them loans at 115% collateral, a far cry from the 200% norms of yesteryear. This precision stems from algorithms weighting factors like repayment timeliness (40% of score), interaction diversity (25%), and oracle-fed off-chain signals (20%), as dissected in Mitosis University’s deep dive. Such granularity turns abstract trust into actionable metrics, propelling BTCFi beyond Bitcoin’s layer-1 constraints via layer-2 rollups.

Risks Tempered by Transparent Scoring

Under-collateralized loans BTCFi isn’t without pitfalls. Volatility remains the specter; a Bitcoin dip could still pressure low-collateral positions, even with stellar scores. Yet, onchain risk scores lending embeds safeguards: dynamic collateral adjustments triggered by score dips or market shifts, enforced immutably. Mezo. org rightly flags that collateralized loans carry inherent market risk, but behavioral scoring layers intent atop price action, slashing moral hazard. Protocols now simulate stress tests on-chain, projecting default odds below 1.5% for top tiers, per internal audits echoed in CoinLaw’s metrics.

Privacy looms large, but zero-knowledge proofs cloak sensitive data while proving solvency. Standardization efforts, like ERC-standards for scores, foster interoperability, preventing siloed ecosystems. Regulatory headwinds? BTCFi’s transparency arms compliance, with scores auditable for KYC-lite flows. Galaxy Research’s leverage report hints at this resilience, as DeFi’s 49.86% dominance reflects protocols outpacing CeFi through adaptive risk models. Lenders sleep better knowing every borrower’s on-chain footprint is a live balance sheet.

Bitcoin Technical Analysis Chart

Analysis by Paige Latham | Symbol: BINANCE:BTCUSDT | Interval: 1D | Drawings: 6

Technical Analysis Summary

As Paige Latham, apply conservative overlays: horizontal lines at key S/R 90,000 and 110,000; uptrend line from March low (2025-03-10, 75,000) to July peak (2025-07-15, 125,000); downtrend from peak to recent low (2025-11-20, 94,000); rectangle for consolidation 94k-105k Nov-Dec; fib retracement 0.618 at 102k; callouts on volume spikes and MACD crossover; low-risk entry zone horizontal at 95k support.

Risk Assessment: medium

Analysis: Elevated leverage in BTCFi under-collateralized loans amplifies downside vs. fundamental supports; conservative profile dictates patience

Paige Latham’s Recommendation: Hold cash, enter only on 95k confirmation with <1% risk per trade; monitor onchain risk scores for policy shifts

Key Support & Resistance Levels

📈 Support Levels:

-

$90,000 – Strong fundamental support aligning with 2025 Q3 lending highs baseline

strong -

$95,000 – Recent swing low with volume confirmation

moderate

📉 Resistance Levels:

-

$105,000 – Consolidation ceiling near Ichimoku cloud top

moderate -

$110,000 – Prior breakdown level from Sep rally

weak

Trading Zones (low risk tolerance)

🎯 Entry Zones:

-

$95,000 – Bounce from moderate support in low vol consolidation, aligns with BTCFi growth narrative

low risk -

$90,000 – Deep support test for conservative dip-buy if macro holds

medium risk

🚪 Exit Zones:

-

$105,000 – Profit target at resistance flip

💰 profit target -

$88,000 – Tight stop below strong support

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: spikes on downside confirming distribution

High vol on recent reds signals caution despite lending tailwinds

📈 MACD Analysis:

Signal: bearish divergence at peak

MACD histogram contracting, crossover down warns of further pullback

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Paige Latham is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (low).

Third-party assessors amplify this, as CoinGecko notes, integrating AI-driven oracles for hybrid scores. Duredev’s vision rings true: faster, fairer lending via smart contracts. In practice, a Q2 borrower with a 820 score might repay 15% ahead of schedule, boosting their profile and unlocking repeat access at sub-1% rates. This feedback loop is BTCFi’s secret sauce, converting HODLers into active financiers without asset sales.

2025 Horizon: Scalability and Institutional Entry

By late 2025, expect onchain risk scores to underpin $10 billion in under-collateralized BTCFi loans, extrapolating CoinLaw’s 42% Q2 surge to $26.5 billion total. Reflexivity Research’s April milestone provides $20 billion on-chain loans eclipsing CeFi, foreshadows dominance. Institutions, eyeing Sahm’s lower DeFi rates, will pour in via tokenized funds, demanding score APIs for portfolio risk. Crypto. com’s $63 billion TVL snapshot underscores the runway, with under-collateralized slices growing fastest.

Challenges like oracle reliability persist, but multi-oracle consensus and timelocks mitigate. For developers, open-source score repos invite customization, embedding BTCFi into wallets and DEXs. Yahoo Finance’s $73.59 billion record validates the thesis: capital chases efficiency. Bitcoin holders finally leverage their conviction without capitulation, as scores evolve from novelty to necessity.

Protocols prioritizing robust, privacy-first scoring will capture this wave, blending DeFi’s permissionless ethos with TradFi’s prudence. The result? A lending paradigm where reputation rivals riches, unlocking Bitcoin’s full economic potential on-chain.