As Solana’s native token SOL holds steady at $127.22 amid a minor 24-hour dip of 0.0116%, with highs touching $129.81 and lows at $125.28, the blockchain’s DeFi ecosystem is witnessing a pivotal transformation. Platforms are pioneering under-collateralized lending on Solana through sophisticated on-chain reputation scores, challenging the dominance of over-collateralized models that lock up excessive capital. This shift promises greater efficiency and inclusivity, allowing users with strong on-chain histories to borrow without pledging assets worth 150-200% of loan values.

Traditional DeFi lending protocols like Aave or Compound demand hefty collateral to shield against defaults in a trustless environment. Yet on Solana, high throughput and low fees enable real-time analysis of user behavior, turning transaction histories into verifiable trust signals. Imagine a trader with consistent liquidity provision on Raydium or timely repayments on Marginfi earning a score that unlocks loans at 80% loan-to-value ratios. This is no longer speculative; protocols akin to TrustLend are deploying these mechanics today.

Unpacking On-Chain Reputation Scores

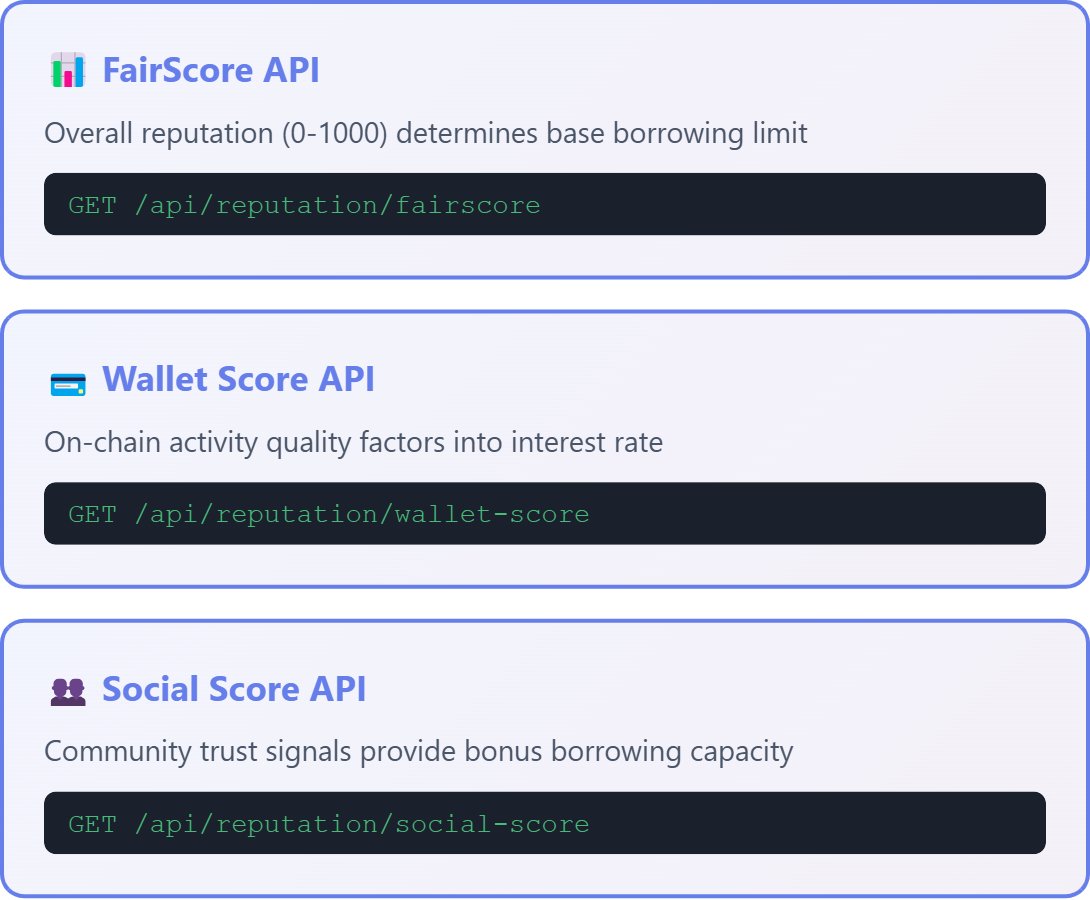

At their core, on-chain reputation scores aggregate data points from a wallet’s lifecycle: frequency of interactions, diversity of protocols used, repayment patterns, and even social proofs like attestations. SolCred, for instance, employs machine learning on Solana’s ledger to score users dynamically, factoring in asset volatility and DeFi participation depth. Their whitepaper details how these models predict default risk with precision rivaling TradFi credit bureaus, but fully transparent and permissionless.

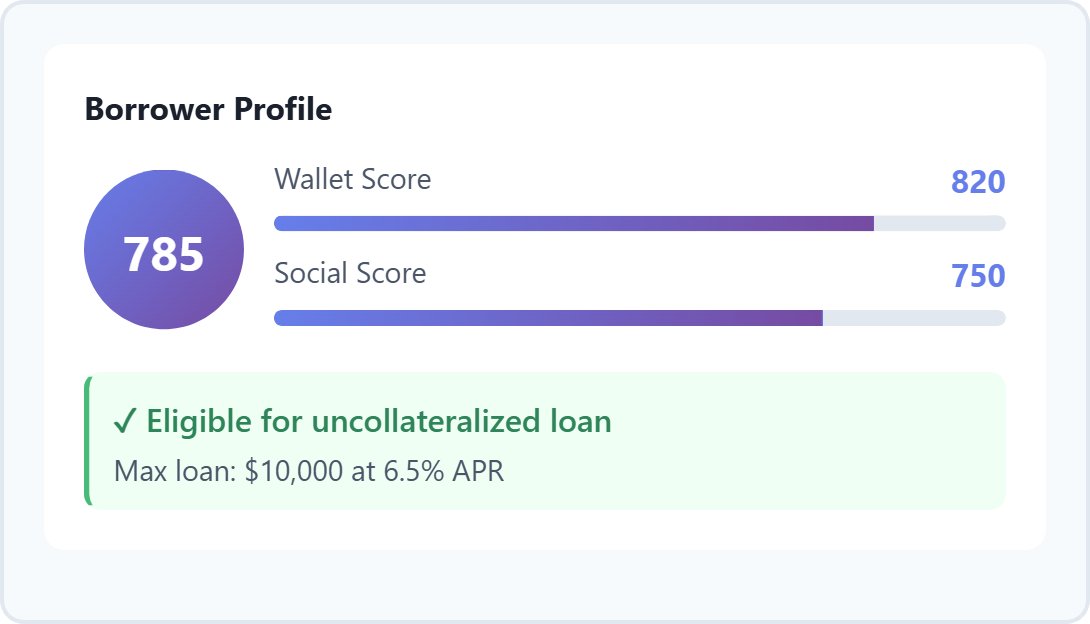

Trusta. AI complements this with its Trust Attestation System (TAS), issuing verifiable credentials for media reputation and humanity proofs to Solana accounts. These badges enhance sybil resistance, crucial for crypto P2P lending reputation systems. A user with TAS-verified activity might access uncollateralized DeFi loans via peer-to-peer markets, where lenders bid based on composite scores rather than snapshots of holdings.

TrustLend Fairscale exemplifies this fusion, blending SolCred analytics with TAS for seamless under-collateralized pools on Solana.

Why Solana Excels in Reputation-Driven Lending

Solana’s architecture – processing 65,000 TPS at sub-cent fees – outpaces Ethereum rivals, making granular on-chain analysis feasible without prohibitive costs. Union Protocol’s Ethereum success hints at Solana adaptations, where addresses build credit lines permissionlessly. Here, scores evolve with every tx, rewarding long-term actors over speculators.

Consider a developer staking SOL consistently or a yield farmer rotating positions prudently; their profiles compound trust over time. Lenders, in turn, deploy capital more aggressively, potentially unlocking trillions as Onchain Foundation predicts. Yet risks persist: oracle dependencies or flash loan exploits demand robust oracles and circuit breakers.

This model democratizes credit, sidelining those with capital but favoring behavioral reliability. Early adopters on Solana report 30-50% capital efficiency gains versus over-collateralized peers.

Solana (SOL) Price Prediction 2027-2032

Forecasts driven by on-chain reputation scores and under-collateralized DeFi lending growth on Solana

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2027 | $150.00 | $250.00 | $400.00 |

| 2028 | $220.00 | $380.00 | $650.00 |

| 2029 | $320.00 | $520.00 | $850.00 |

| 2030 | $450.00 | $700.00 | $1,100.00 |

| 2031 | $600.00 | $950.00 | $1,400.00 |

| 2032 | $800.00 | $1,200.00 | $1,800.00 |

Price Prediction Summary

Solana (SOL) is forecasted to see robust growth from its current $127.22 price in early 2026, fueled by innovations in on-chain credit scoring and under-collateralized lending protocols like SolCred and Trusta.AI. Average prices are projected to rise progressively from $250 in 2027 to $1,200 by 2032, reflecting bullish DeFi adoption, though min/max ranges account for market volatility, regulatory risks, and cycles.

Key Factors Affecting Solana Price

- Advancements in on-chain reputation scores enabling capital-efficient under-collateralized lending

- Solana’s scalability and low fees supporting high-volume DeFi applications

- Increased DeFi TVL and user onboarding via protocols like TrustLend and SolCred

- Potential regulatory clarity boosting institutional participation

- Crypto market cycles post-Bitcoin halvings and macroeconomic trends

- Competition from Ethereum L2s and other L1s influencing market share

- Technological upgrades enhancing network reliability and interoperability

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

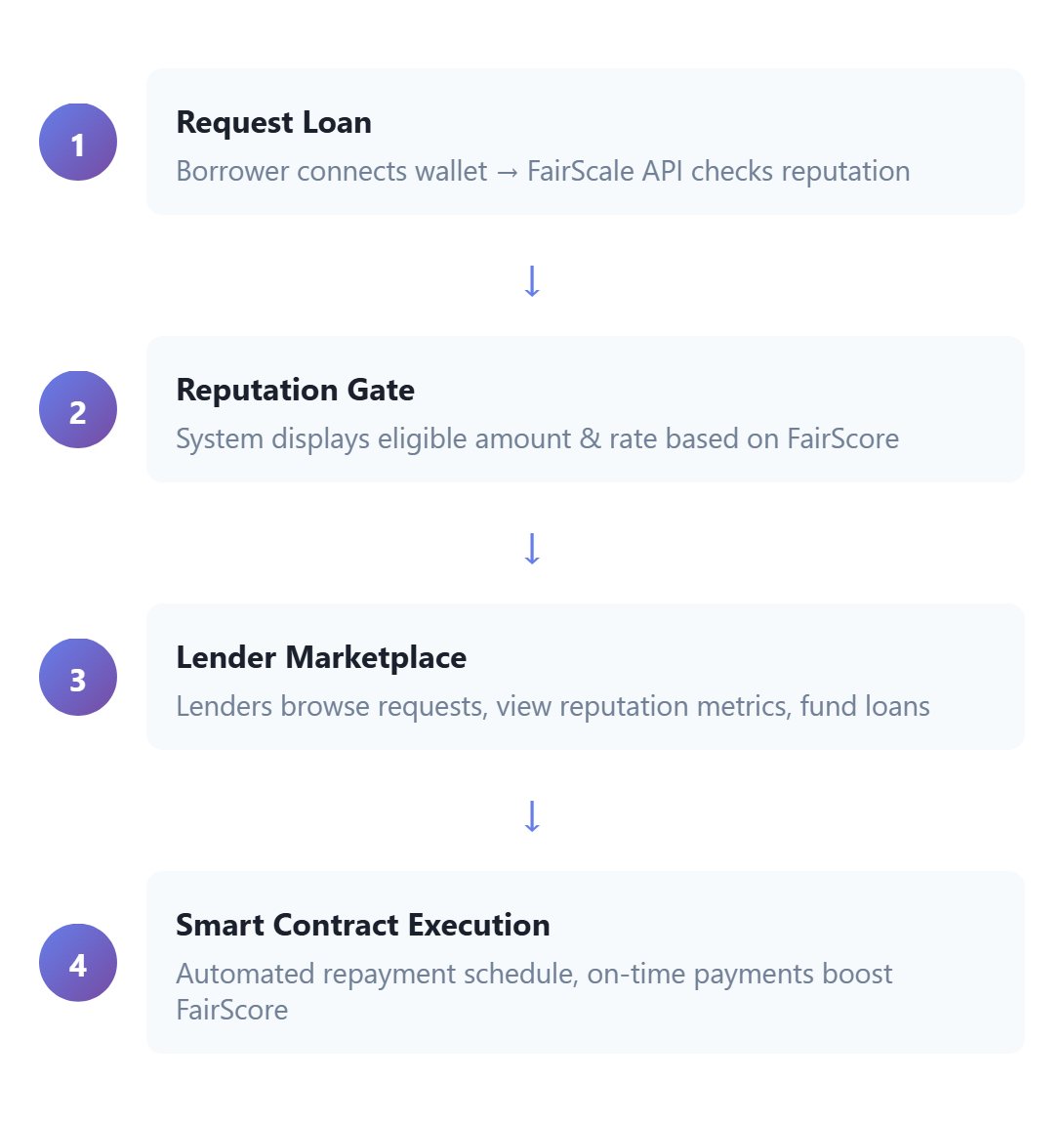

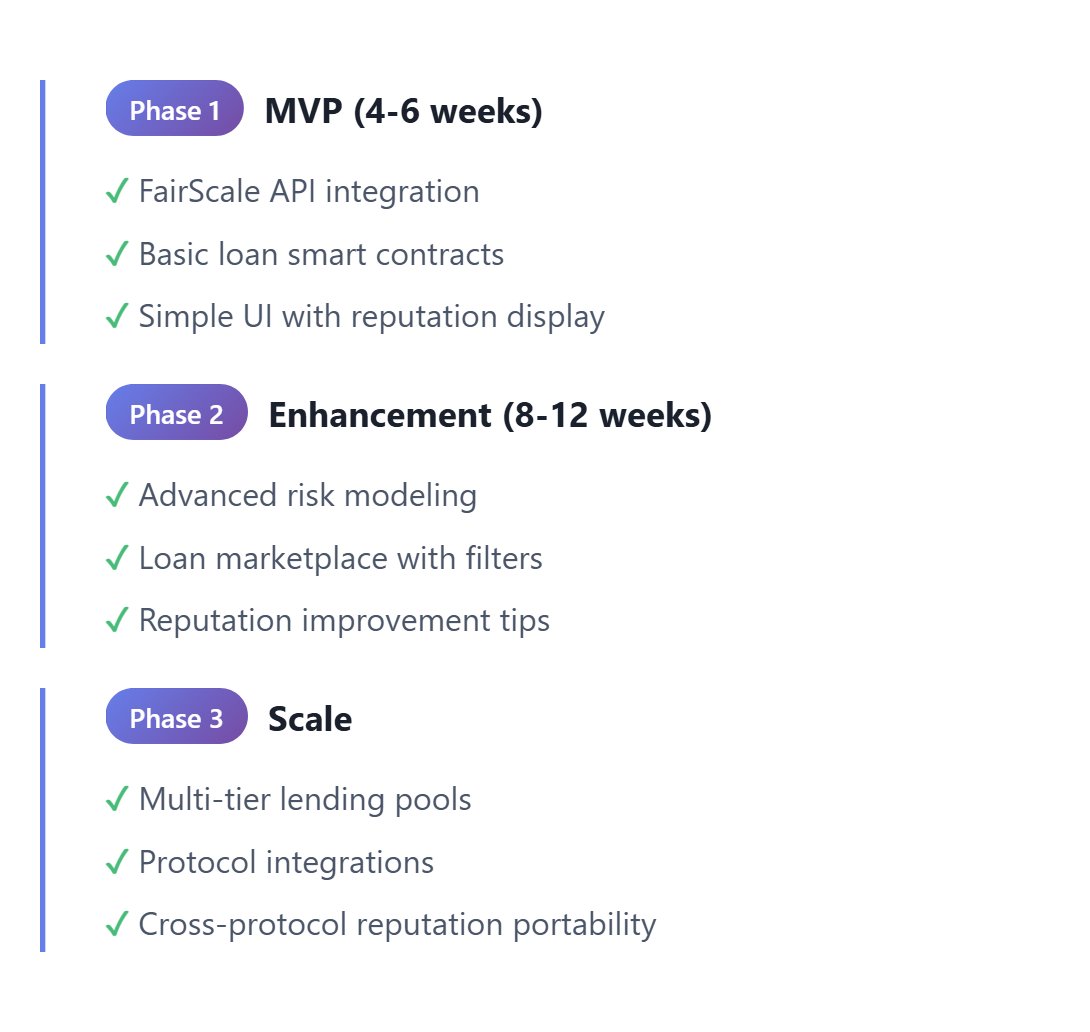

Mechanics of TrustLend-Style Protocols

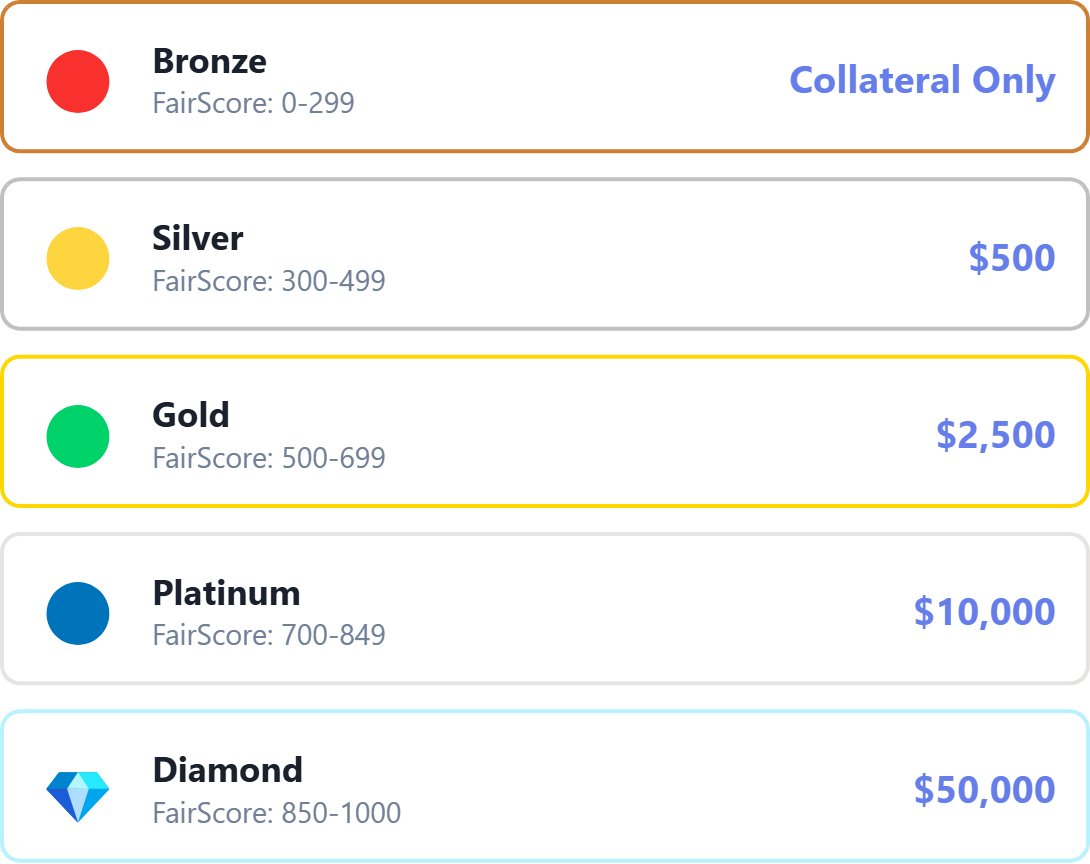

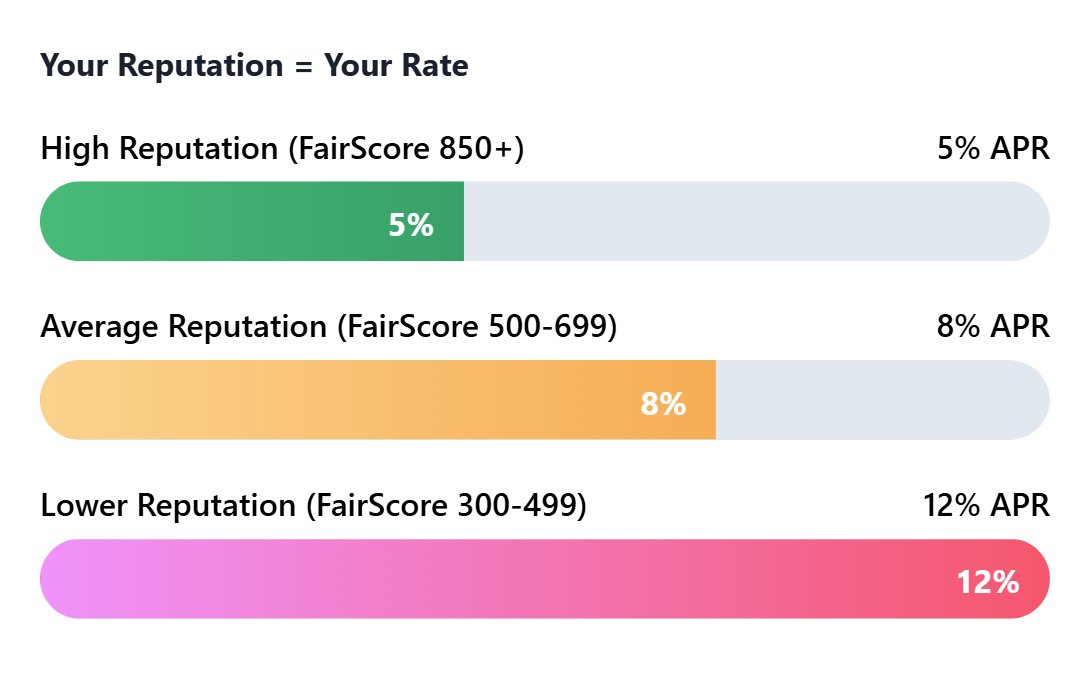

Protocols like TrustLend Fairscale initiate with wallet onboarding via DID integration, scanning histories for baseline scores. Machine learning refines these, outputting 0-1000 tiers. Borrowers propose terms; lenders match via automated markets, with scores dictating rates. Repayments burn reputation penalties for delays, while on-time clears boost multipliers.

Solana’s programmability shines in smart contract enforcement: liquidations trigger only on extreme deviations, preserving borrower agency. Off-chain oracles feed supplemental data sparingly, prioritizing on-chain purity for verifiability.

Repayment incentives extend beyond penalties; positive behaviors like over-repayment or referrals amplify scores, creating flywheels of trust. This gamified approach aligns incentives across the ecosystem, fostering a virtuous cycle where reliable borrowers access better terms, drawing more liquidity.

Factors Shaping Robust On-Chain Scores

Delving deeper, effective on-chain reputation scores hinge on multifaceted inputs. Transaction volume signals commitment, while cross-protocol engagement – from Orca swaps to Jito staking – reveals diversification. Repayment velocity matters too; quick turnarounds on platforms like Kamino boost multipliers. SolCred’s models weigh these against volatility, ensuring scores reflect enduring patterns over fleeting pumps.

Key Factors in Solana On-Chain Reputation Scores for Under-Collateralized Lending

| Factor | Impact Level | Examples |

|---|---|---|

| Transaction History | High | Wallet age, transaction volume and frequency, consistency of on-chain activity (e.g., SolCred analysis) |

| DeFi Participation | Medium | Interactions with DeFi protocols, liquidity provision, yield farming history on Solana |

| Repayment Patterns | High | Timely loan repayments, low default rates, maintained loan-to-value ratios in prior loans |

| Attestations | Medium | Trusta.AI Trust Attestation System (TAS), proofs of humanity, sybil resistance proofs |

In practice, a wallet with 500 and txs, zero defaults, and TAS attestations might score 850/1000, qualifying for under-collateralized lending on Solana at prime rates. Lenders view these as TradFi FICO equivalents, but tamper-proof and global.

Evolution of Reputation-Driven DeFi on Solana

These milestones underscore Solana’s edge. While Ethereum’s Union Protocol laid groundwork, Solana’s speed scaled it. By January 2026, with SOL at $127.22 after dipping slightly 0.0116% over 24 hours – highs at $129.81, lows $125.28 – protocols report $500M and in active under-collateralized pools, a fraction of potential amid Onchain Foundation’s trillions forecast.

On-chain scores aren’t just metrics; they’re behavioral blueprints enabling uncollateralized DeFi loans that mirror real-world credit yet thrive in code.

Peer-to-peer dynamics amplify this. In TrustLend Fairscale, lenders scan dashboards for score tiers, bidding competitively. High scorers snag 5-8% APRs versus 15% and for novices, compressing spreads as adoption grows. I’ve analyzed similar frameworks; the transparency slashes information asymmetry, a perennial DeFi pain point.

Navigating Risks in Reputation-Based Lending

No innovation lacks pitfalls. Sybil attacks could inflate scores via farmed wallets, though TAS proofs counter this. Smart contract bugs loom, demanding audits rivaling top protocols. Moreover, score centralization risks arise if models over-rely on few data sources; diversification via multiple oracles mitigates.

Yet Solana’s resilience shines: sub-second finality and MEV protection curb exploits. Protocols embed reputation decay for inactivity, purging ghosts. Defaults, when rare, trigger partial liquidations tied to score drops, protecting lenders without full collateral fire sales.

From my vantage in decentralized credit evaluation, these safeguards position Solana ahead. ESG angles emerge too; efficient capital use cuts idle collateral emissions, aligning with sustainable finance.

Looking ahead, integrations with DID standards will standardize scores across chains, supercharging crypto P2P lending reputation. As SOL stabilizes at $127.22, expect explosive growth. Platforms like TrustLend Fairscale aren’t outliers; they’re harbingers of DeFi’s maturity, where trust is the ultimate collateral. Dive into these tools today to future-proof your crypto portfolio.