DeFi lending has locked up billions in over-collateralized positions, stifling capital efficiency in a market now valued at $78 billion as of early 2026, with 60% concentrated on Ethereum. Borrowers routinely deposit 120% to 300% collateral to secure loans on dominant protocols like Aave and Compound, which captured 89% of volume in August 2025. This model safeguards lenders but excludes users without hefty crypto holdings, leaving undercollateralized DeFi loans as an untapped frontier. Enter on-chain risk scores: transparent, data-backed assessments drawn from repayment histories and protocol interactions that promise to slash collateral needs while preserving trust.

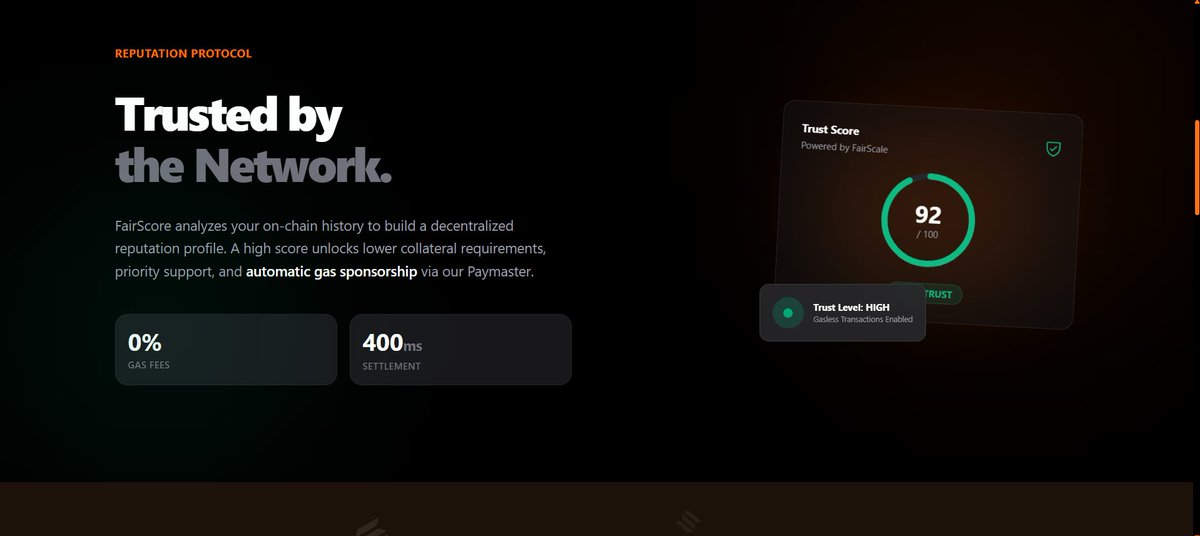

Traditional finance relies on opaque credit bureaus; DeFi flips this with immutable blockchain records. Projects leverage decentralized identity (DID) and tools like Soulbound Tokens or zkKYC to verify reputations without sacrificing privacy. Spectral Finance’s MACRO scores, ranging 300 to 850, mirror FICO by factoring transaction history, liquidations, and credit mix. High scorers access loans at 100% collateral or less, unlocking liquidity for real economic activity over idle vaults.

Why Over-Collateralization Drains DeFi’s Potential

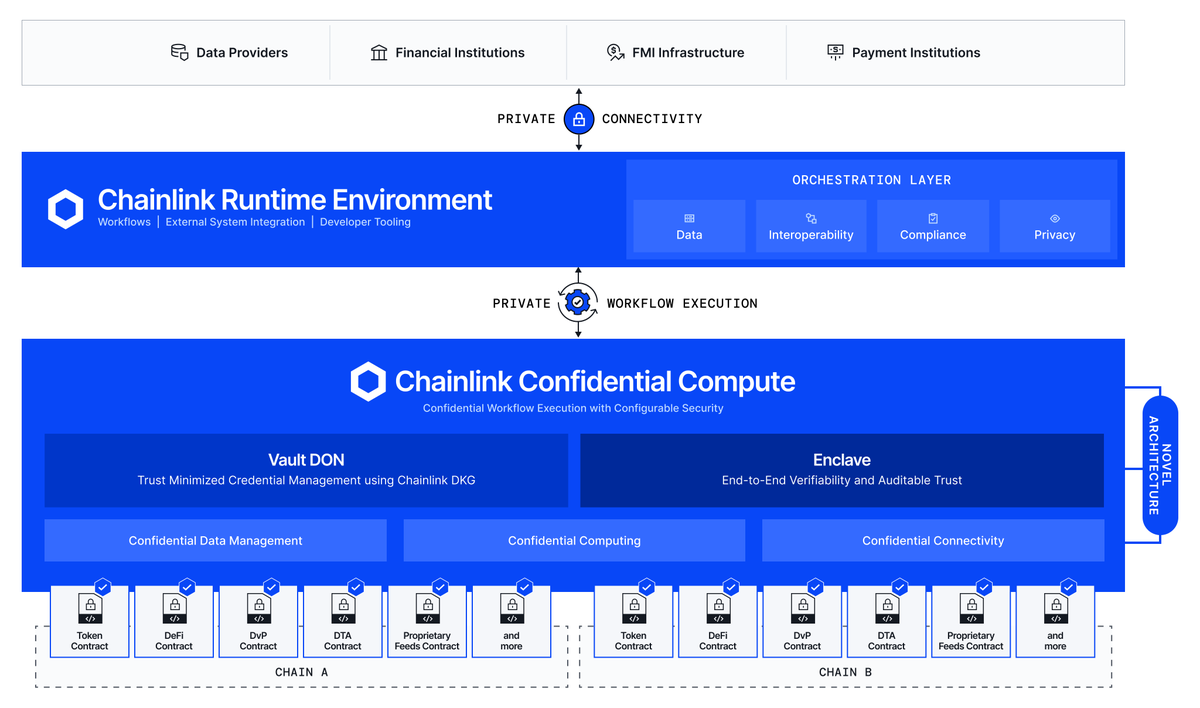

Consider the math: a $100,000 loan at 150% collateral ties up $150,000 in assets, often yielding meager APYs amid volatile markets. This inefficiency hits hardest in the 78% of protocols prone to systemic risk architectures, per recent analyses. Meanwhile, the innovative 22% slice grows disproportionately by embracing nuance. On-chain private lending, as Chainlink defines it, issues undercollateralized DeFi loans via blockchain, targeting institutions weary of TradFi opacity. Yet without credible crypto credit scoring, adoption lags; borrowers with spotless on-chain repayment history still overpay in locked capital.

Onchain credit-based and undercollateralized lending has remained untapped in DeFi. Leveraging. . .

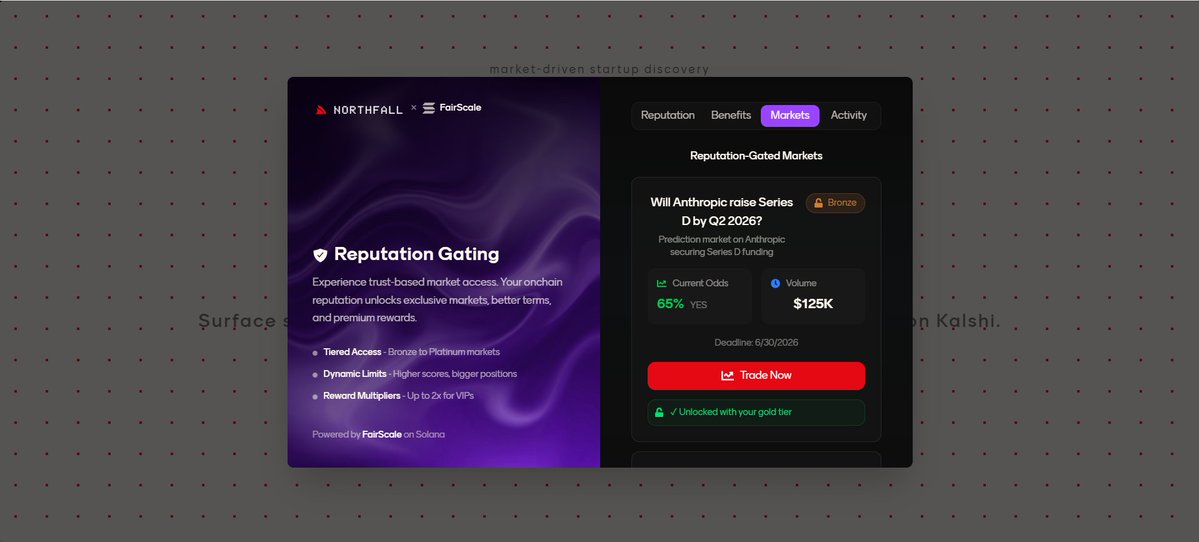

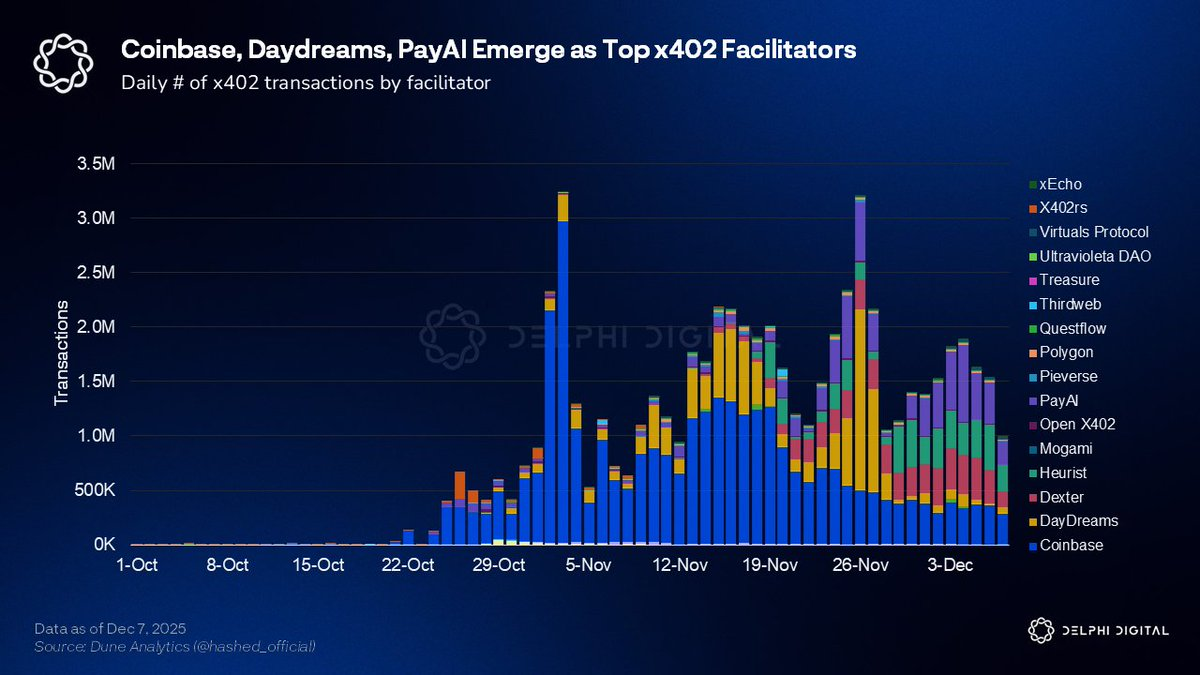

Enterprises shifting billions into on-chain lending recognize this: it touches credit and risk directly, fueling profit engines. But 2026 trends from Bankless highlight gaps, no robust protocol ratings, thin liquidity for long-tail assets. On-chain risk scores bridge these, enabling decentralized lending reputation that scales with network effects.

Dissecting On-Chain Risk Score Mechanics

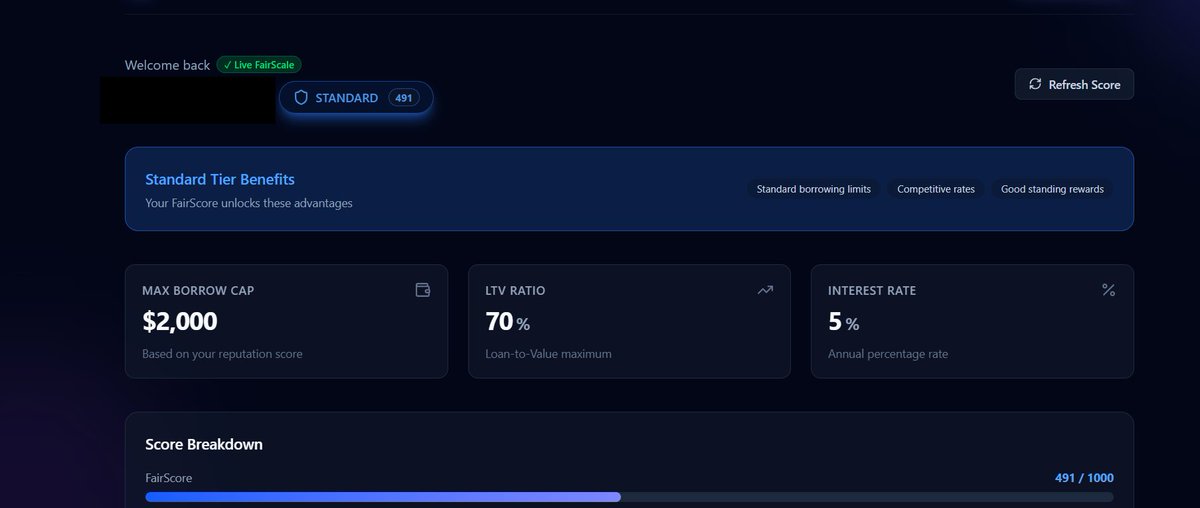

These scores aggregate on-chain signals: repayment timeliness, debt-to-asset ratios, interaction diversity across protocols. Off-chain data integrates via oracles, tempered by zero-knowledge proofs to thwart manipulation. A borrower repaying five Aave loans flawlessly might score 750 and, qualifying for 110% collateral versus 200% for newcomers. Spectral’s Multi-Asset Credit Risk Oracles exemplify this, evaluating liquidations and credit mix for holistic views.

Data from Mitosis University underscores how protocols blend on- and off-chain inputs for issuance. Risks persist, oracle exploits, sybil attacks, but zk tech and DID fortify defenses. AML compatibility arrives without centralization, as Strategic Market Research notes, via risk scoring protocols.

Real-World Impact: Capital Efficiency Unleashed

Imagine a trader with $50,000 in ETH history of timely repayments; traditional DeFi demands $75,000 collateral for a $50,000 borrow. On-chain scores drop this to $55,000, freeing $20,000 for yield farming or RWAs. The $21B RWA wave reshapes lending, per reports, by lowering barriers. Visa highlights stablecoin opportunities beyond payments, where Aave/Compound dominance cedes ground to innovators.

RWA. io protocols compete with TradFi by trimming collateral, fostering accessibility. This shift empowers users, as my risk management lens affirms: proven on-chain repayment history trumps static snapshots. For lenders, granular crypto credit scoring diversifies portfolios beyond blunt over-collateralization. Check deeper mechanics at how-on-chain-risk-scores-enable-under-collateralized-lending-in-defi.

Institutions eyeing on-chain lending see the profit potential in these mechanics, as This Week in Fintech reports billions migrating for direct credit exposure. Yet scaling decentralized lending reputation demands more than scores; it requires seamless protocol integration.

Overcoming Hurdles: Oracle Security and Sybil Resistance

Critics flag oracle manipulation as a vulnerability, where bad actors feed skewed data to inflate scores. Zero-knowledge proofs counter this by verifying computations privately, ensuring scores reflect genuine on-chain repayment history without exposing wallets. Sybil attacks, creating fake identities for score farming, meet defenses in DID frameworks like Soulbound Tokens, which bind non-transferable credentials to addresses. zkKYC adds AML layers, satisfying regulators while preserving decentralization, as Strategic Market Research details.

These safeguards elevate crypto credit scoring from experimental to enterprise-grade. Absent them, the 78% systemic risk in legacy protocols persists; with them, the 22% innovators capture growth, reshaping $78 billion markets.

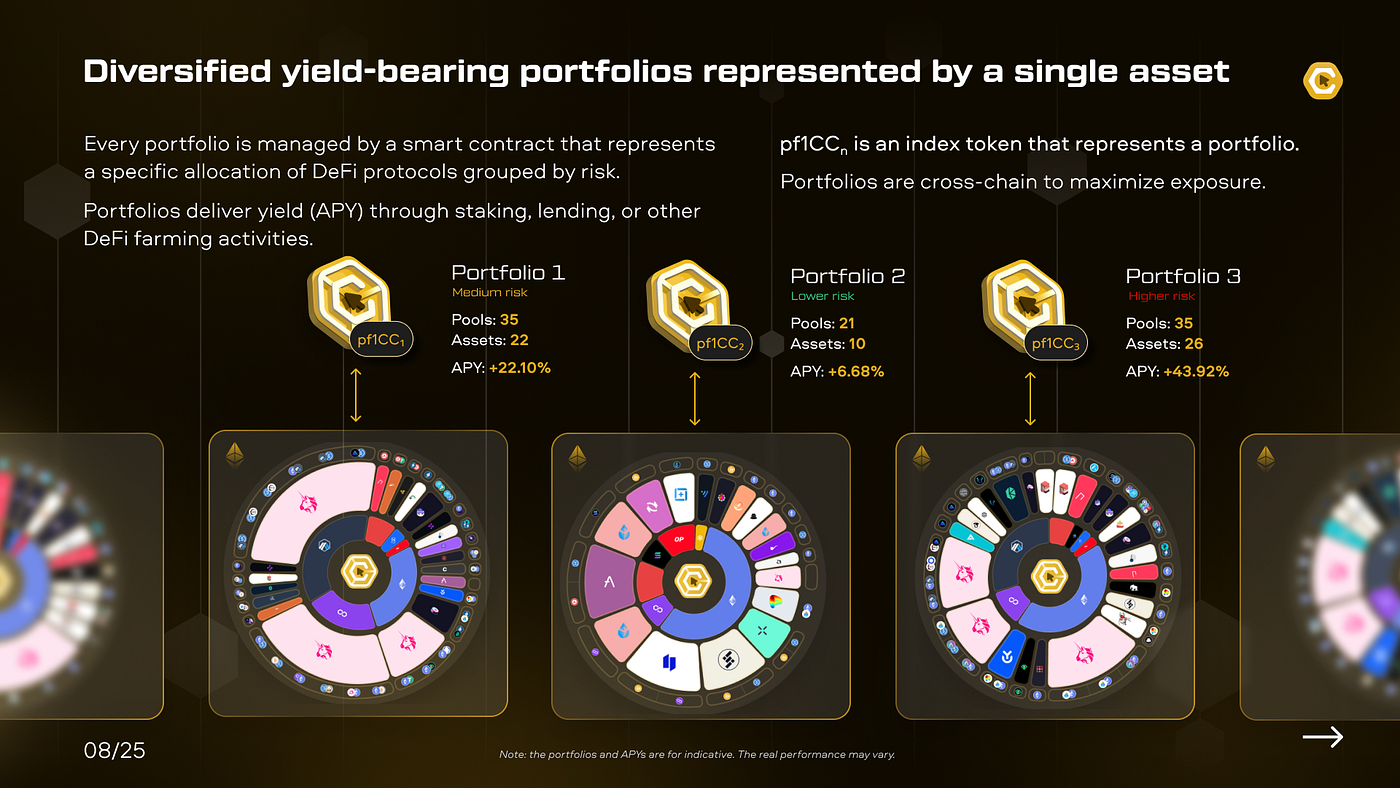

Protocol Spotlight: Pioneers Driving Adoption

Spectral Finance leads with MACRO scores, but others follow. Mitosis protocols blend on- and off-chain data for dynamic limits, while RWA. xyz experiments with real-world asset histories tokenized on-chain. Aave’s forthcoming credit delegation hints at hybrid models, potentially eroding Compound’s volume share beyond 89%. These pioneers prove on-chain risk scores viable, issuing undercollateralized DeFi loans at 80-120% collateral for scores above 700.

Leading Protocols Using On-Chain Risk Scores

| Protocol | Risk Score / Method | TVL | Avg. Collateral Ratio | Score Impact |

|---|---|---|---|---|

| Spectral | MACRO (300-850) | $750M | 110% | High scores (>700) enable 20-50% collateral reduction for proven repayment history |

| Mitosis | Hybrid Data (on/off-chain) | $300M | 120% | Dynamic ratios based on hybrid risk assessment, supporting undercollateralized loans |

| Aave | Credit Delegation | $42B | 125% | Trusted delegates access credit lines with reduced/no collateral, leveraging reputation |

Quantitative edge shines here: a 750 score borrower saves 30% on collateral versus baselines, compounding to millions in unlocked capital across the sector. My risk models, honed over a decade, project 15-20% DeFi TVL growth by mid-2026 from such efficiencies.

Key Borrower Benefits

-

Reduced Collateral (80-150%): On-chain scores like Spectral Finance’s MACRO (300-850 range) enable loans with 80-150% collateral vs. traditional 120-300%, boosting capital efficiency.

-

Faster Access via History: Proven on-chain repayment and transaction data allow instant approvals, bypassing lengthy KYC in protocols like Aave and Compound.

-

Privacy via ZK Proofs: Zero-knowledge proofs verify creditworthiness without revealing sensitive data, as in zkKYC and DID systems.

-

Portfolio Diversification: Lower collateral frees assets for other DeFi opportunities, reducing concentration risk in $78B lending market.

-

Competitive APYs: Risk-assessed borrowers secure better rates in undercollateralized lending, competing with TradFi amid Aave/Compound dominance.

Lenders gain too, diversifying beyond RWAs’ $21 billion wave. Prediction markets and long-tail assets, per DWFLabs and Bankless, unlock with credible ratings, curbing inefficient capital. Enterprises prioritize this ‘real’ crypto layer for its transparency edge over TradFi.

Under-collateralized lending matures as on-chain data accrues, network effects amplifying reputations. Borrowers build legacies through consistent repayments, lenders deploy capital optimally. This evolution, rooted in immutable ledgers, positions DeFi to rival global credit markets. Platforms like cryptocreditscore. org equip you with these tools, turning raw blockchain signals into actionable on-chain risk scores. Explore further via how-onchain-risk-scores-reduce-liquidation-risks-in-under-collateralized-defi-lending or how-on-chain-risk-scores-enable-under-collateralized-crypto-loans-in-2025.

Users with strong profiles stand to gain most, accessing liquidity without vaulting fortunes. As 2026 unfolds, watch undercollateralized protocols surge, fueled by proven histories and smart scoring. The collateral cage breaks, capital flows freer, DeFi delivers on its promise.