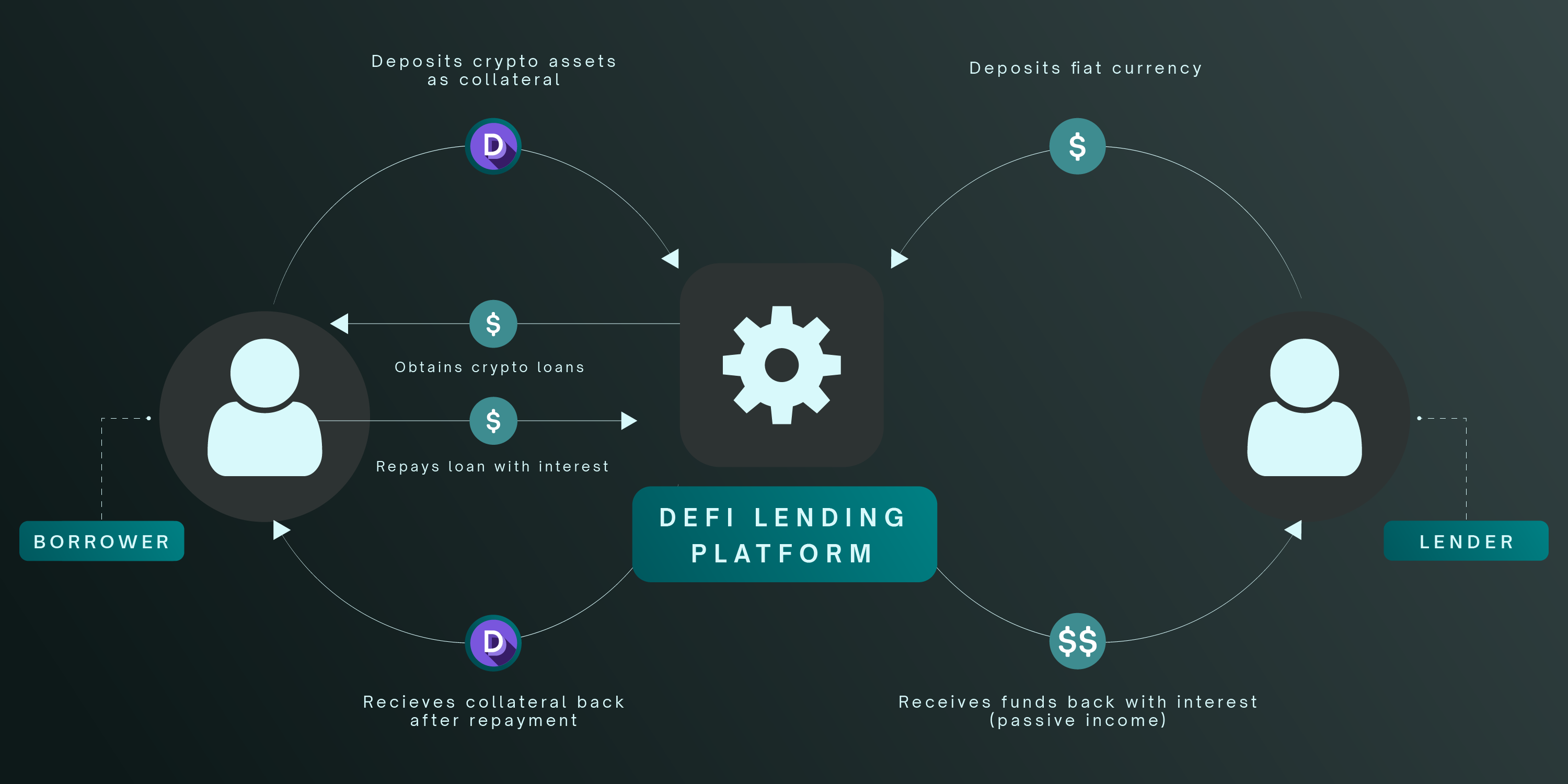

In the evolving landscape of decentralized finance, under-collateralized DeFi loans represent a pivotal shift toward greater capital efficiency and inclusivity. Traditional lending protocols demand borrowers lock up assets worth 120% to 300% of the loan value, creating barriers for those without substantial holdings. On-chain risk scores, derived from transparent blockchain data, offer a compelling alternative by evaluating onchain repayment history and behavioral patterns to minimize collateral needs while managing default risks effectively.

This approach draws from real-world blockchain activity, where every transaction leaves an immutable record. Protocols now analyze wallet histories to generate crypto credit scoring metrics, enabling lenders to extend credit with confidence. As DeFi matures, these scores could unlock trillions in idle capital, but only if implemented with nuance to address inherent data limitations.

Breaking Free from Over-Collateralization Constraints

Over-collateralized loans have defined DeFi since its inception, prioritizing lender protection through excess deposits. A borrower seeking $10,000 might post $15,000 in ETH, vulnerable to liquidation if prices dip. This model suits volatile crypto markets but stifles broader adoption; many users lack the upfront assets to participate meaningfully.

Enter on-chain risk scores, which quantify creditworthiness via historical performance. Smart contracts pull data on past borrowings, repayments, and interaction frequency across chains. For instance, consistent on-time repayments signal reliability, justifying collateral ratios as low as 50% or less for top-tier wallets. Recent developments, like those integrating decentralized identity, further refine this by layering verifiable off-chain proofs without compromising pseudonymity.

Decoding the Mechanics of On-Chain Credit Assessment

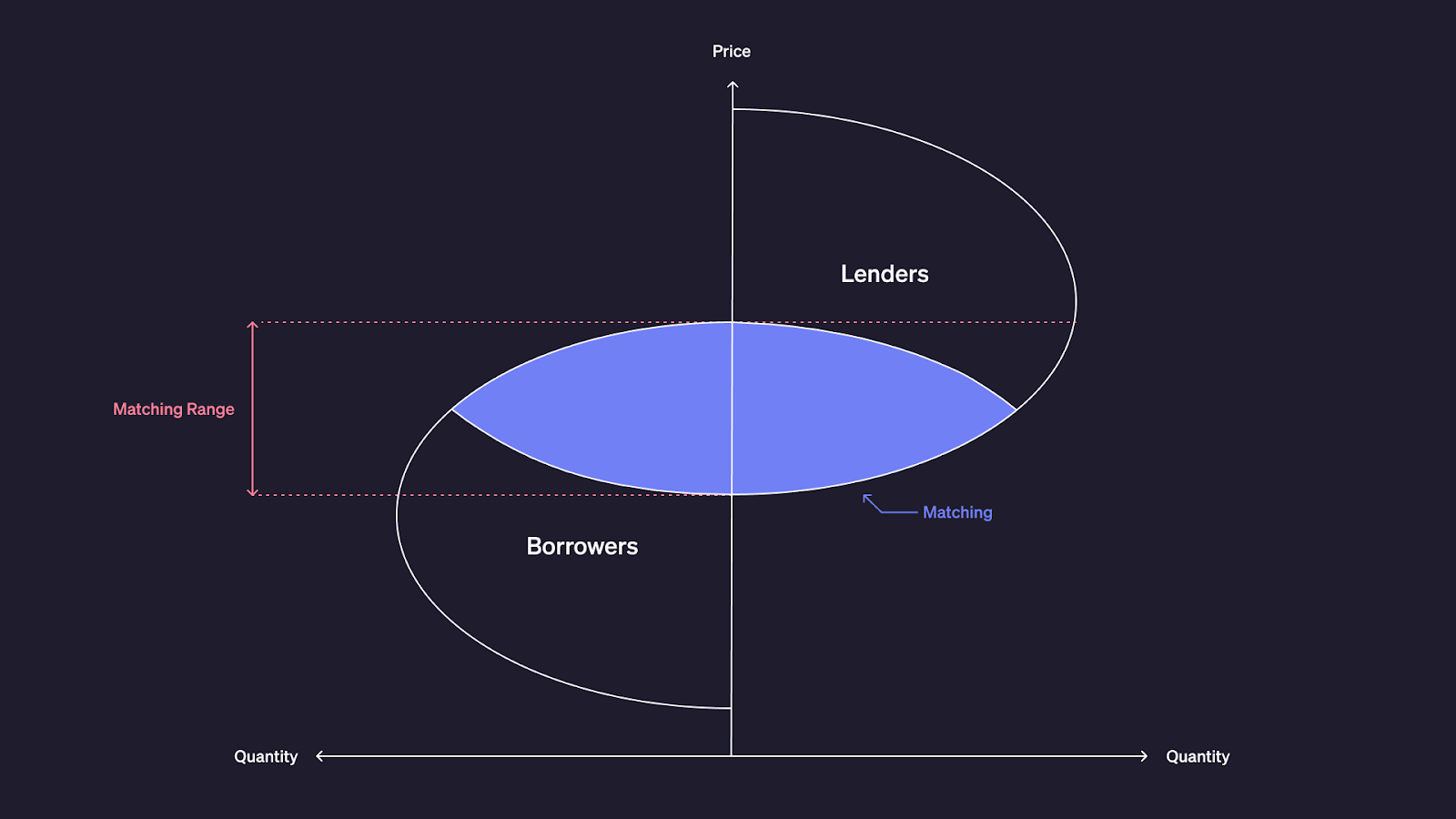

At its core, crypto credit scoring leverages blockchain’s transparency. Protocols scan wallets for metrics like loan-to-value ratios in prior deals, default rates, and transaction velocity. An arXiv paper on On-Chain Credit Risk Scores highlights how these inputs form an OCCR Score, aiding protocols in risk stratification.

Smart contracts automate this process in real-time. They aggregate data from oracles and subgraphs, weighting factors such as repayment timeliness and portfolio diversity. A user with frequent small loans repaid promptly might score higher than one with sporadic large borrowings, even if collateral was ample before. This data-driven lens reduces reliance on blunt over-collateralization, fostering DeFi lending collateral reduction.

Key On-Chain Risk Factors

-

Transaction History: Analyzes frequency, volume, and patterns of past blockchain transactions to gauge user activity and reliability in DeFi protocols.

-

Repayment Patterns: Reviews history of loan repayments, including timeliness and consistency, to predict future creditworthiness.

-

Wallet Age: Considers the maturity of the wallet address, as older wallets often indicate established, low-risk behavior.

-

Interaction Diversity: Assesses engagement across multiple DeFi platforms and protocols for a holistic view of financial behavior.

-

Default Incidence: Tracks past defaults or near-defaults to quantify historical risk of non-repayment.

Yet, this isn’t foolproof. Purely on-chain views miss off-chain realities, like centralized exchange ties or macroeconomic pressures. Protocols counter this with hybrid models, incorporating zero-knowledge proofs for income verification or bank balances, as explored in Chainlink’s DECO framework.

Real-World Factors Shaping Robust Risk Profiles

Effective on-chain risk scores hinge on multifaceted analysis. Transaction history reveals patterns: high-volume traders often exhibit lower default risks due to liquidity access. Repayment history stands paramount; even partial successes build positive signals over time.

Consider wallet maturity: seasoned addresses with years of activity inspire more trust than nascent ones. Diversity in DeFi interactions, from lending on Aave to yield farming on Uniswap, indicates sophistication and reduces single-protocol dependency risks. Sources like Huma Finance emphasize how these patterns mirror traditional credit bureaus but with blockchain’s verifiability.

In practice, scores might range from 0-1000, with thresholds dictating loan terms. A 850 and score could unlock 0% collateral for stablecoin loans at competitive rates around 6.7% APR, aligning with Visa’s on-chain lending observations. Lenders benefit too, as diversified borrower pools enhance protocol liquidity and yields.

Building on these metrics, protocols are pioneering under-collateralized DeFi loans that reward proven behavior, potentially slashing collateral needs by half for reliable borrowers. This shift not only democratizes access but also aligns incentives, encouraging users to cultivate strong onchain repayment history profiles over time.

Navigating Limitations and Enhancing Accuracy

Despite their strengths, on-chain risk scores face scrutiny for incompleteness. Blockchain data excels at capturing DeFi interactions but ignores off-chain realities, such as traditional debts or income volatility. A wallet with flawless crypto repayments might belong to someone burdened by fiat obligations, underscoring the need for hybrid assessments. I advocate for layered verification, where protocols blend on-chain signals with privacy-preserving off-chain inputs to paint fuller risk pictures.

Oracle dependencies add another layer of vulnerability. Manipulated price feeds have plagued DeFi, enabling exploits that undermine lending stability. Robust protocols counter this through decentralized oracles and multi-source validation, ensuring scores reflect genuine market conditions. Recent analyses from Chainscore Labs highlight how algorithmic scoring’s fragility demands such safeguards, preventing over-optimism in DeFi lending collateral reduction strategies.

Zero-knowledge proofs emerge as a game-changer here. Borrowers can attest to off-chain creditworthiness, like steady income or bank balances, without exposing details. Chainlink’s DECO exemplifies this, feeding verified data into smart contracts for nuanced crypto credit scoring. This fusion minimizes blind spots, allowing lenders to confidently offer loans at 50-100% collateral for high scorers.

Practical Implementations and Protocol Innovations

Forward-thinking platforms are operationalizing these concepts. RoFiFi on Polygon deploys under-collateralized credit via on-chain histories, rewarding repeat performers with favorable terms. Mitosis University details how such protocols mix on- and off-chain data, issuing loans based on holistic profiles rather than asset piles alone. Third-party assessors, per CoinGecko insights, dominate this space outside flash loans, providing standardized scores that protocols trust.

Consider a borrower with an 900 and OCCR Score: they might secure a $50,000 stablecoin loan at 6.7% APR with just 20% collateral, repayable via automated deductions from yields. Lenders gain from higher utilization rates, often yielding 5.0% APY as Visa notes for on-chain markets. This efficiency cycle boosts liquidity, drawing institutions wary of pure over-collateralization.

Advantages of On-Chain Risk Scores

-

Capital Efficiency: Reduces collateral needs from 120-300% over-collateralization, freeing capital for broader DeFi use (source).

-

Broader Access: Enables borrowing for users without substantial crypto assets by evaluating transaction history.

-

Automated Assessments: Smart contracts analyze real-time on-chain data like repayment history for instant scoring.

-

Privacy via ZK: Zero-knowledge proofs verify off-chain credit data without exposing personal information.

-

Reduced Liquidations: Accurate risk profiles minimize defaults and forced collateral sales.

Yet, success hinges on adoption. Wallets must build histories through small, consistent interactions, fostering a virtuous loop. Developers play a key role, embedding scoring oracles into lending primitives for seamless integration.

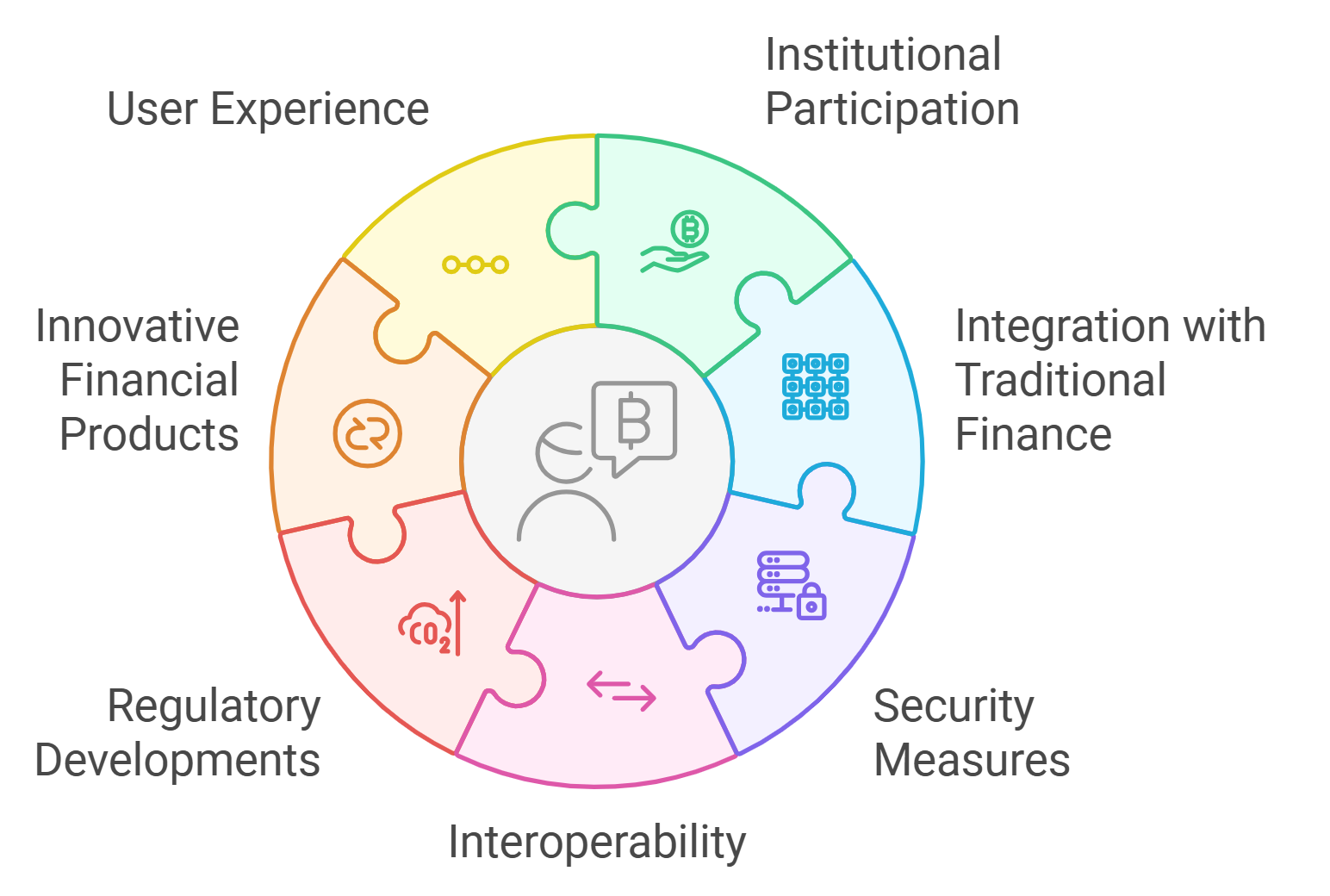

Pioneering Sustainable DeFi Credit Ecosystems

Looking ahead, on-chain risk scores could redefine DeFi as a mature credit market. By minimizing collateral barriers, they unlock idle assets for productive use, echoing traditional finance’s evolution but with blockchain’s edge. ESG integration, a personal focus of mine, fits naturally: scores can penalize high-emission chains or reward sustainable yields, aligning profitability with responsibility.

Challenges persist, oracle risks, data silos across chains, regulatory scrutiny, but solutions abound. Cross-chain aggregators unify histories, while DID frameworks like those at cryptocreditscore. org enable verifiable identities. For more on practical pathways, explore this guide or details on slashing collateral via scores at this resource.

Ultimately, thoughtful deployment of these tools promises a DeFi landscape where trust stems from action, not just assets. Lenders and borrowers alike stand to thrive, provided we prioritize security and comprehensiveness in every score calculation. As strategies refine, expect wider proliferation of under-collateralized DeFi loans, propelling the sector toward trillions in unlocked value.