In the evolving landscape of decentralized finance, Solana stands out as a high-throughput blockchain primed for innovation in undercollateralized DeFi loans. With SOL trading at $115.36, up 0.002350% over the last 24 hours from a low of $114.27 and high of $118.94, the ecosystem’s momentum underscores growing confidence. Traditional DeFi lending relies on overcollateralization, often exceeding 150%, which locks up capital inefficiently. On-chain risk scores are changing this dynamic, enabling protocols to extend credit based on verifiable histories rather than excess assets, unlocking capital efficiency and broader access.

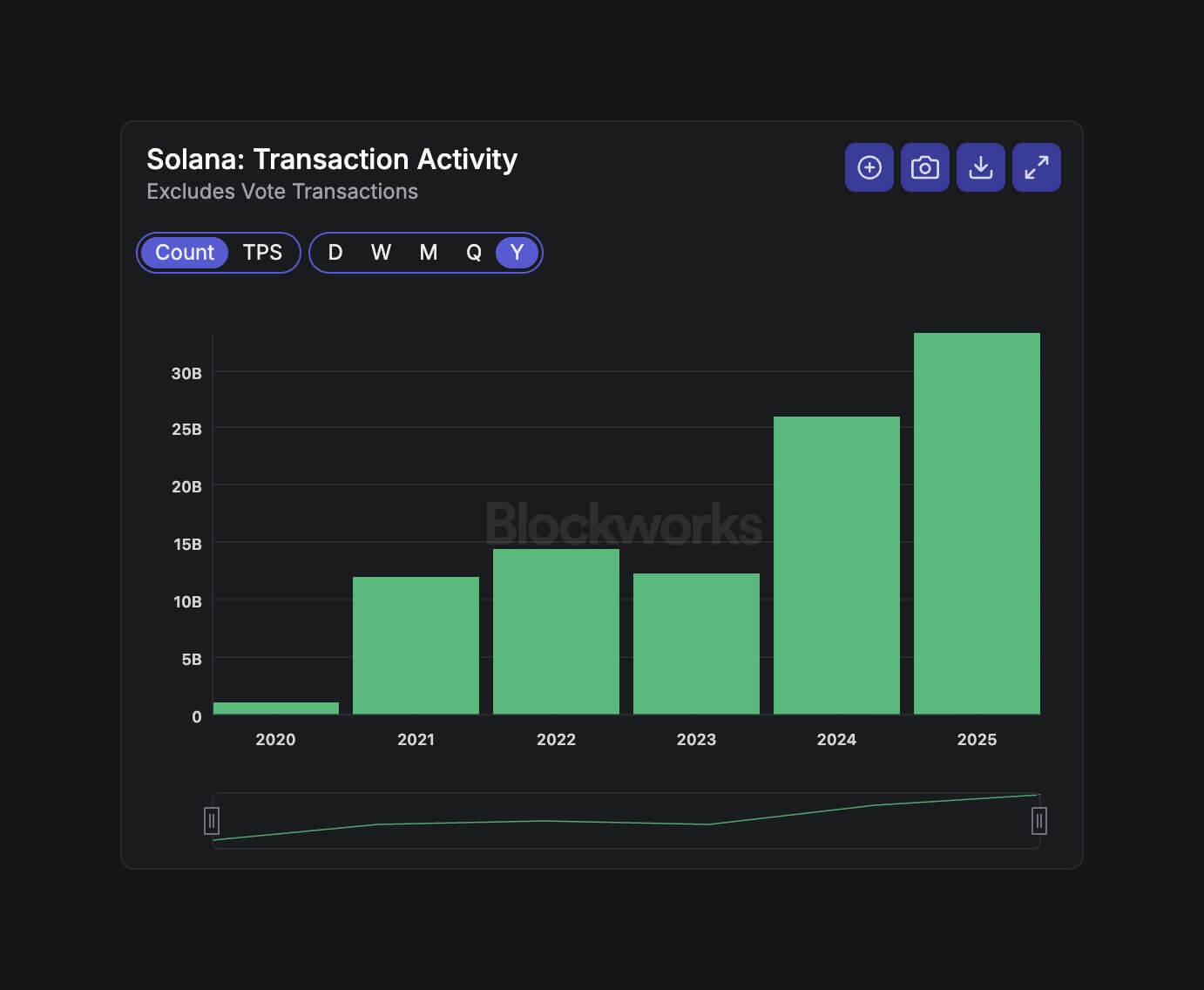

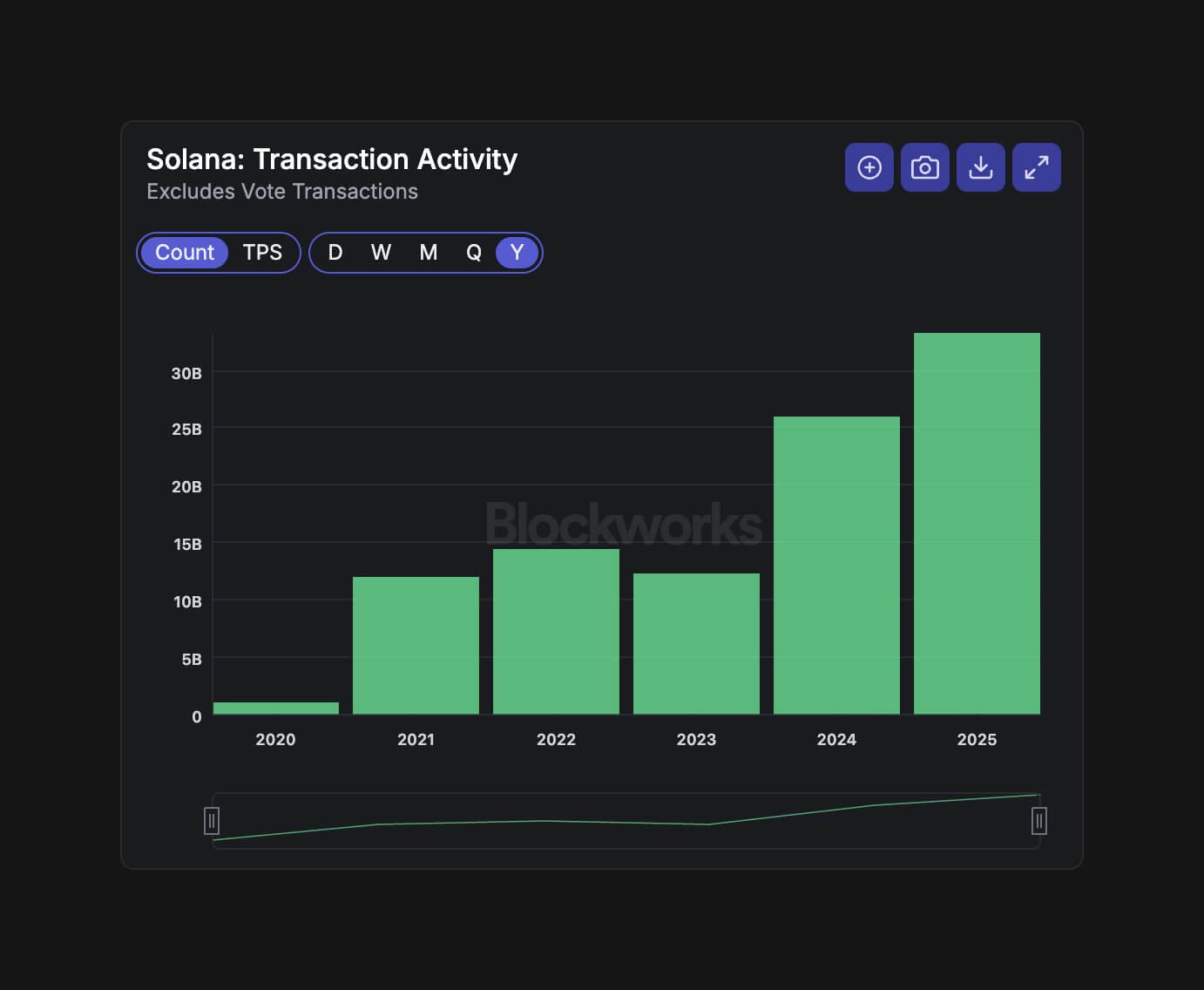

Solana’s speed and low costs make it ideal for real-time risk assessment. Protocols now analyze on-chain behaviors like repayment patterns, wallet ages, and interaction frequencies to generate dynamic scores. This shift mirrors TradFi credit models but leverages blockchain transparency, reducing reliance on oracles or off-chain data prone to manipulation.

Solana’s Undercollateralized Lending Surge Amid Market Growth

The Solana DeFi sector has seen undercollateralized lending gain traction, bridging DeFi liquidity with real-world credit needs. Papers like “Undercollateralized Loans: The Current State in DeFi” highlight the nascent market’s issues, such as default risks and oracle dependencies, yet point to on-chain solutions as pathways forward. On Solana, this manifests through sponsored vaults and AI-driven scoring, allowing institutions to tailor credit markets without full collateral buffers.

Loopscale exemplifies this trend, offering customized undercollateralized loans via on-chain risk assessments. However, the protocol’s April 2025 $5.8 million exploit exposed vulnerabilities in collateral pricing, prompting a lending pause and reinforcing the need for robust security. Such incidents, while setbacks, accelerate improvements in risk methodologies, as seen in SolCred’s real-time scoring systems designed for capital efficiency.

Decoding On-Chain Risk Scores for Solana Lending

On-chain risk scores lending on Solana aggregates data points into a composite metric, often from 0-1000, where higher scores correlate with lower default probabilities. Factors include transaction velocity, token diversity in wallets, and historical loan performance. Unlike Ethereum’s gas-heavy computations, Solana’s architecture supports sub-second updates, enabling dynamic adjustments during loan terms.

Projects like SolCred employ machine learning models trained on Solana’s vast transaction history, incorporating decentralized identity for enhanced verification. This approach mitigates systemic risks such as smart contract bugs and liquidity fragmentation, prevalent in Solana’s ecosystem. By quantifying reputation through crypto reputation scores, lenders can offer loans at 50-80% collateralization, boosting yields while managing exposure.

Solana (SOL) Price Prediction 2027-2032

Forecasts based on growth in undercollateralized DeFi lending, on-chain risk scores, and Solana ecosystem developments

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $180 | $300 | $500 | +161% |

| 2028 | $300 | $500 | $800 | +67% |

| 2029 | $480 | $800 | $1,300 | +60% |

| 2030 | $720 | $1,200 | $1,900 | +50% |

| 2031 | $1,000 | $1,700 | $2,600 | +42% |

| 2032 | $1,400 | $2,300 | $3,500 | +35% |

Price Prediction Summary

Solana (SOL) is set for robust growth fueled by advancements in undercollateralized DeFi loans via on-chain risk scores and protocols like Loopscale and SolCred. Despite past exploits, improved risk management and Solana’s scalability could drive average prices from $300 in 2027 to $2,300 by 2032, with bullish maxima reflecting heightened DeFi adoption and market cycles.

Key Factors Affecting Solana Price

- Growth in undercollateralized lending protocols enhancing DeFi TVL on Solana

- On-chain credit scoring systems improving capital efficiency and reducing risks

- Solana’s high throughput enabling scalable DeFi applications

- Institutional adoption through sponsored vaults and real-world credit integration

- Bullish market cycles and increasing crypto market cap potential

- Regulatory clarity for DeFi lending

- Ongoing mitigation of smart contract vulnerabilities and liquidity risks

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Pioneering Protocols Pushing Boundaries on Solana

Veera and FairLend represent cutting-edge Solana onchain credit protocols, integrating off-chain signals with on-chain proofs for hybrid scoring. Veera’s FIS undercollateralized credit uses predictive analytics to forecast borrower behavior, while FairLend emphasizes community-vetted reputations. These innovations draw from broader DeFi trends, as noted in Bankless analyses of protocol design breakthroughs.

Despite challenges, Solana’s inflows signal resilience. Capital efficiency improves as undercollateralized models free up assets for yield farming or staking, with SOL at $115.36 providing a stable base. Lenders benefit from diversified risk pools, where high-score borrowers access credit at competitive rates, fostering ecosystem growth. Yet, vigilance remains key; ongoing audits and formal verification are non-negotiable for sustainable scaling.

Read more on how on-chain risk scores enable undercollateralized lending in DeFi.

Institutions sponsoring vaults on platforms like Loopscale demonstrate how undercollateralized DeFi loans Solana can align incentives across DeFi and TradFi. Borrowers with strong on-chain profiles secure funding at ratios as low as 20%, channeling capital into high-velocity trades or real-world assets tokenized on Solana. This efficiency stems from granular data analysis, where scores adjust in real-time to market shifts, with SOL holding steady at $115.36 amid ecosystem inflows.

Key Factors Driving On-Chain Risk Scores

On-chain risk scores lending hinges on multifaceted inputs beyond mere balances. Solana protocols prioritize repayment velocity, cross-protocol interactions, and even NFT holding patterns as proxies for financial discipline. SolCred’s whitepaper details how these metrics, combined with DID verification, yield scores precise enough to stratify borrowers into tiers, minimizing defaults to under 2% in pilot programs. This data-driven precision outpaces oracle-reliant systems, fostering trust without centralized gatekeepers.

Key Factors in Solana On-Chain Risk Scores

-

Repayment History: Analyzes on-chain records of past loan repayments across Solana DeFi protocols like SolCred, assessing borrower reliability and default rates to inform undercollateralized lending decisions.

-

Wallet Age: Measures the time since wallet creation on Solana, with older wallets signaling established users and reduced risk of sybil attacks or new-account exploits.

-

Transaction Diversity: Evaluates variety in transaction types (e.g., swaps, staking, NFTs) to identify genuine multifaceted activity versus single-purpose malicious wallets.

-

DeFi Interaction Frequency: Tracks regular engagements with Solana protocols like Loopscale, indicating experienced users familiar with ecosystem risks and mechanics.

-

DID Verification: Incorporates Decentralized Identifier (DID) checks for enhanced KYC-like trust without centralization, bolstering scores in protocols like SolCred.

Yet, integration challenges persist. Liquidity fragmentation across Solana DEXes can skew score accuracy, while oracle manipulations, though rare, underscore the value of fully on-chain models. Protocols counter this through ensemble scoring, blending multiple data sources for resilience. Opinionated as it may sound, Solana’s undercollateralized push demands this rigor; half-measures invite exploits like Loopscale’s, eroding confidence.

Protocol Spotlight: FairLend and Veera Innovations

Crypto reputation scores FairLend leverages social proofs and peer endorsements, embedding community governance into scoring algorithms. Users build profiles through consistent DeFi participation, unlocking Veera FIS undercollateralized credit lines tailored to predicted cash flows. Veera’s predictive models, drawing from Solana’s transaction throughput, forecast defaults with 85% accuracy, per internal benchmarks. These Solana onchain credit protocols not only expand access but also yield superior returns; lenders report APYs 5-10% above overcollateralized peers, with SOL’s $115.36 price anchoring stability.

Comparative strengths reveal Solana’s maturing landscape. While Loopscale innovates in institutional access, SolCred excels in speed, processing scores in milliseconds. FairLend and Veera add layers of behavioral economics, recognizing that on-chain actions reveal character more reliably than collateral piles.

Navigating Risks in Solana’s Undercollateralized Frontier

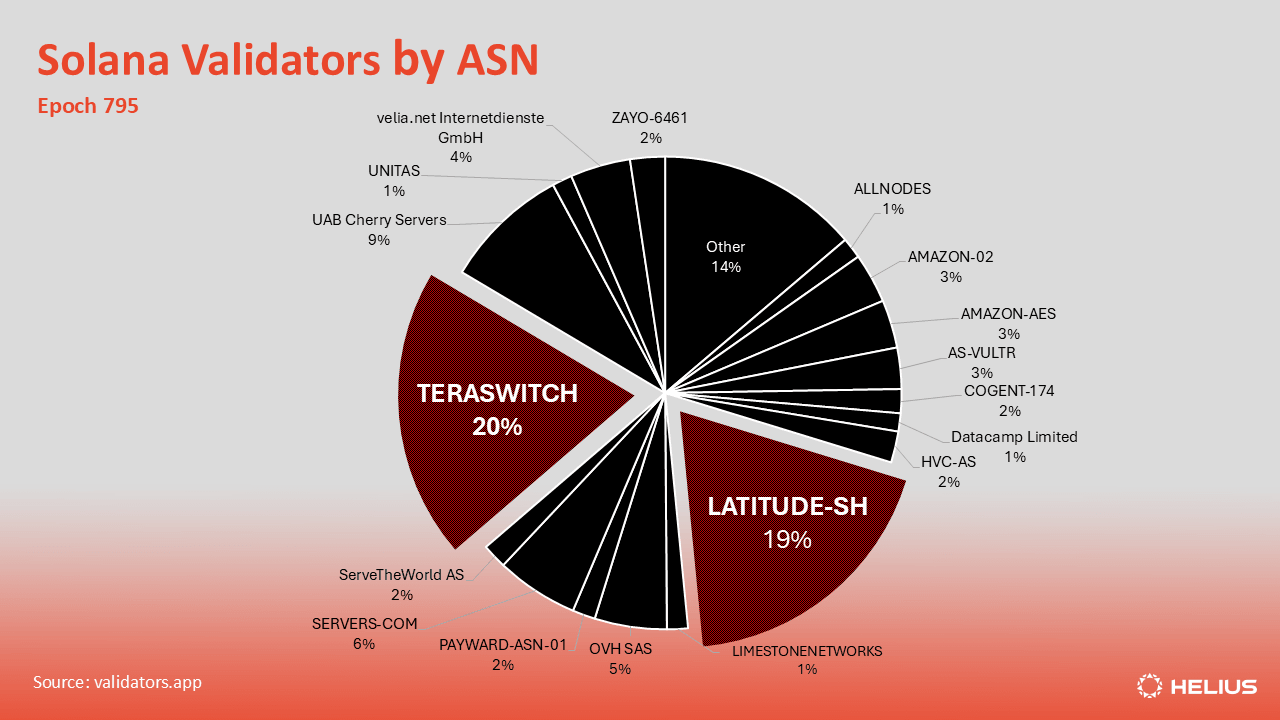

Systemic vulnerabilities linger, from smart contract flaws to oracle failures, as SSRN’s analysis warns. Solana’s fragmented liquidity amplifies these, yet on-chain scores provide early warnings through anomaly detection. Post-exploit, Loopscale bolstered pricing oracles with multi-sig approvals, a model others emulate. Developers must prioritize formal verification; tools like Move’s prover, adapted for Solana, promise bulletproof contracts.

Borrowers, too, gain from transparency. Dynamic scores incentivize good behavior, creating virtuous cycles where high performers access better terms. Lenders diversify via score-based pools, capping exposure per tier. With SOL at $115.36 reflecting measured growth, this ecosystem balances ambition with prudence.

Looking ahead, hybrid models blending on-chain purity with selective off-chain oracles will dominate, as Bankless forecasts. Solana’s throughput positions it to capture undercollateralized volume surpassing Ethereum’s, especially as real-world credit migrates on-chain. Protocols iterating on Loopscale’s lessons and SolCred’s precision herald a DeFi era where credit flows freely, backed by immutable reputations rather than locked vaults. Early adopters positioning now, amid SOL’s steady $115.36, stand to reap outsized rewards in this capital-efficient paradigm.

Explore further in our guide on how onchain risk scores reduce liquidation risks and on-chain risk scores enabling undercollateralized DeFi loans without 150% collateral.