Imagine unlocking 0% collateral DeFi loans where your on-chain reputation does the heavy lifting, not a mountain of crypto collateral. That’s the game-changing promise of Fuero’s FICO hybrid model, blending traditional credit smarts with blockchain transparency. In a DeFi world still chained to 150% overcollateralization, Fuero is flipping the script on undercollateralized crypto lending, making liquidity accessible without the liquidation headaches.

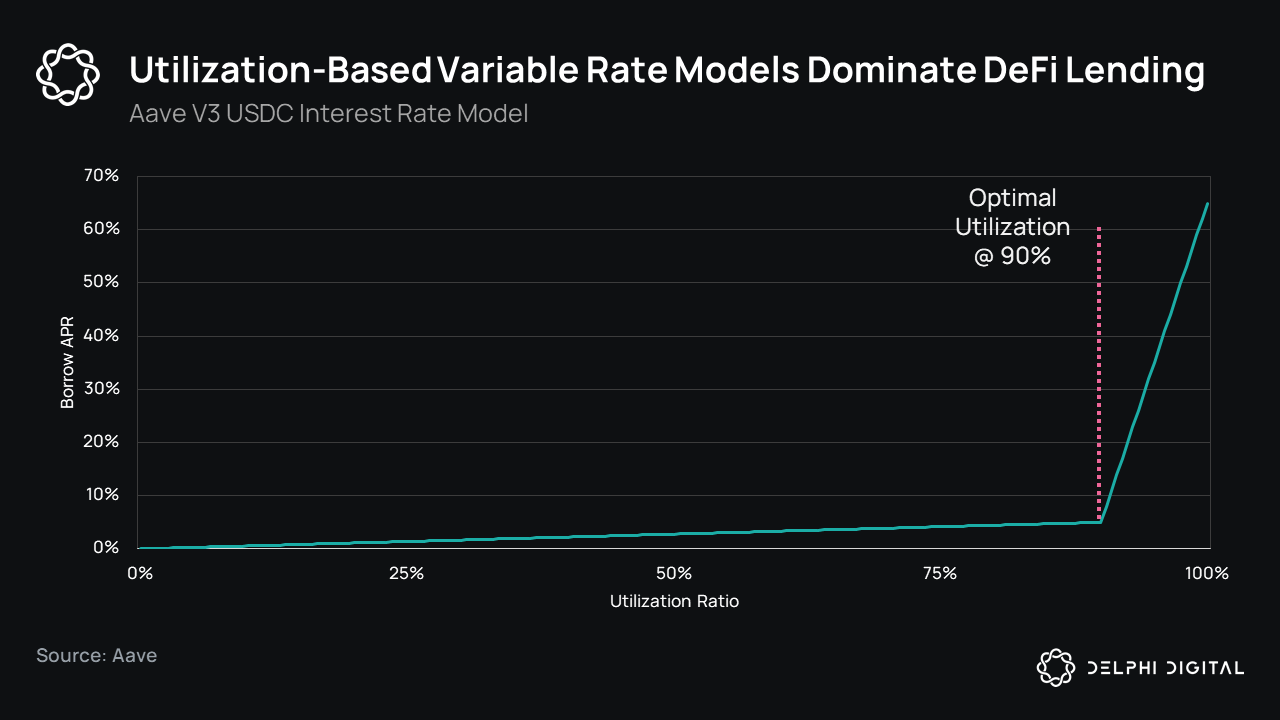

DeFi lending has exploded, but it’s stuck in overcollateralized ruts. Platforms like Aave and Compound demand you lock up 120-150% more than you borrow, per BIS reports. Why? To shield lenders from defaults in crypto’s wild volatility. Yet this setup starves capital efficiency. Borrowers tie up millions just to access a fraction, while lenders earn yields on idle assets. Enter on-chain risk scores – probabilistic gauges of your DeFi behavior, transaction history, and wallet health that slash the need for collateral.

Breaking Free from Overcollateralization Chains

Undercollateralized lending isn’t sci-fi; it’s DeFi’s overdue evolution. Sources like CoinGecko highlight how current loans force excessive deposits, limiting use cases. RociFi on Polygon experiments with machine learning and on-chain data for zero-collateral plays, but Fuero takes it further with a FICO on-chain hybrid. Their model fuses KYC-verified identities, soft credit pulls, and blockchain footprints into a ‘Fuero Profile’ – a privacy shield that proves worthiness sans oversharing.

This hybrid beast assesses risk holistically. Traditional FICO looks at payment history; Fuero layers on-chain metrics like repayment streaks, wallet age, and interaction diversity. Result? Borrowers snag credit lines in crypto with 0% introductory collateral, repay in fiat or stablecoins, and build reputation-based liquidity. No more flash loans or leveraged nightmares – just smooth, trust-backed access.

Fuero’s Blueprint: From KYC to On-Chain Credit Lines

Fuero’s flow is elegantly simple yet powerful. Start with KYC and a soft credit check – think Equifax meets Ethereum. Approved? You get an on-chain credit line, trackable via decentralized identity. Repay on time, and your Fuero Profile swells with proof: linked wallets, credit data, all zero-knowledge encrypted. Lenders peek without prying, pricing risk accurately for higher yields on unsecured loans.

Fuero’s Key Lending Benefits

-

Higher Capital Efficiency: Unlock more borrowing power with 0% collateral loans, beating overcollateralized DeFi norms for max yields.

-

Privacy-Preserving Scores: Build a Fuero Profile linking KYC, credit, and wallets without exposing sensitive data.

-

Seamless Fiat-Crypto Bridges: Repay in fiat or stablecoins via KYC-checked on-chain credit lines, blending TradFi and DeFi effortlessly.

-

Roadmap to Fuero Stable: Future stablecoin backed by diversified credit portfolios, powering a new credit-backed DeFi layer.

ArXiv papers on OCCR Scores back this: on-chain data quantifies default odds better than collateral alone. Fuero amplifies it, targeting DeFi natives tired of overkill requirements. Higher unsecured rates? Sure, but mitigated by granular DeFi credit scoring. Reddit threads on zero-collateral experiments show lenders recovering funds post-default via smart mechanisms, echoing Fuero’s vision.

On-Chain Risk Scores: The Engine of Trustless Credit

At Fuero’s core, on-chain risk scores crunch wallet histories into actionable intel. Factors? Repayment velocity, token diversity, oracle interactions – all probabilistic, dodging oracle failures flagged in Mitosis U analyses. This Fuero lending model pioneers reputation-based liquidity, where your DeFi track record unlocks doors overcollateralization slams shut.

Chainlink’s DECO nods to off-chain needs for true undercollateralization; Fuero delivers on-chain. SSRN notes DeFi’s capital chokehold – Fuero unclogs it, empowering borrowers with real leverage. Early adopters build profiles now, positioning for Fuero Stable: a credit-backed stablecoin diversifying DeFi’s money layer. Lenders, get ready for yields that beat locked-up boredom.

Picture this: you’re a lender eyeing reputation-based liquidity without the constant liquidation watch. Fuero’s scores let you deploy capital smarter, chasing those juicy unsecured yields while smart contracts handle the rest. No more 150% collateral drag – just pure, data-driven decisions. 🚀

Risks? Fuero’s Got ‘Em Covered

Undercollateralized crypto lending amps up the stakes, no doubt. Default risk tops the list, as Mitosis University points out, alongside liquidity crunches and oracle glitches. But Fuero’s FICO on-chain hybrid isn’t blind to this. Their model stress-tests wallets against volatility, factoring in historical defaults from on-chain traces. Lenders set dynamic rates based on real-time DeFi credit scoring, starting higher for newbies but dropping as profiles mature.

Privacy stays ironclad via zero-knowledge proofs in the Fuero Profile. Borrowers link multiple wallets without doxxing, proving solvency through encrypted signals. Chainlink’s DECO vibes? Fuero executes it natively on-chain, dodging off-chain pitfalls. Hedera notes unsecured loans pack higher rates for that risk premium – Fuero channels it into sustainable yields, not reckless bets.

Overcollateralized DeFi (Aave/Compound) vs. Fuero Undercollateralized

| Collateral Req | Risk Model | Capital Efficiency | Yields | Default Protection |

|---|---|---|---|---|

| 120%-150%+ 📈 | Collateral ratios & automated liquidations | Low 📉 (excess collateral locked) | Moderate (lower risk) | Overcollateralization & liquidations 🛡️ |

| 0% 🚫 | FICO Hybrid (on-chain scores + KYC + credit data) | High 📈 (no collateral needed) | Higher (risk premium) | On-chain risk scores & Fuero Profile 🛡️ |

SSRN’s take on DeFi’s capital inefficiency? Fuero obliterates it. Borrowers access funds without overlocking assets, freeing crypto for trading or staking. Lenders? They diversify across scored profiles, mimicking TradFi portfolios but with blockchain speed. Early tests from RociFi-like protocols show recovery mechanisms kicking in post-default, recovering 50% and for providers – Fuero aims higher with AI-tuned scores.

Lenders’ Playbook: Max Yields, Min Drama

Want in as a lender? Fuero’s protocol lets you pool funds into scored buckets. High-score borrowers get prime rates; riskier ones pay up, balancing the pool. On-chain transparency means you track every repayment, building conviction. Pair it with on-chain risk scores, and you’re golden – no more blind lending.

Borrowers, your move: KYC up, soft pull your credit, snag that line. Repay in USDC or fiat rails, watch your score climb. It’s actionable AF – start small, scale with proof. Fuero’s roadmap teases Fuero Stable, collateralized by diversified loans. Imagine stablecoins earning from credit spreads, looping back into DeFi liquidity. Game over for overcollateralization.

Medium’s Isaac Tham nails it: undercollateralized setups boost yields by unlocking idle capital. Fuero hybridizes it perfectly, blending FICO reliability with blockchain verifiability. BIS data on 120-150% mins? That’s yesterday’s news.

Reddit’s zero-collateral buzz meets real protocol muscle here. ArXiv’s OCCR Score evolves into Fuero’s engine, probabilistic and predictive. Developers, integrate via APIs for seamless wallets. Traders like me? We’re stacking lines for leveraged plays minus liquidation fear.

DeFi’s maturing fast. Fuero leads with 0% collateral DeFi loans, proving trust scales on-chain. Build your profile today at fuero. xyz, lend smarter, borrow freer. The hybrid future is live – jump in before the yields peak. 💥