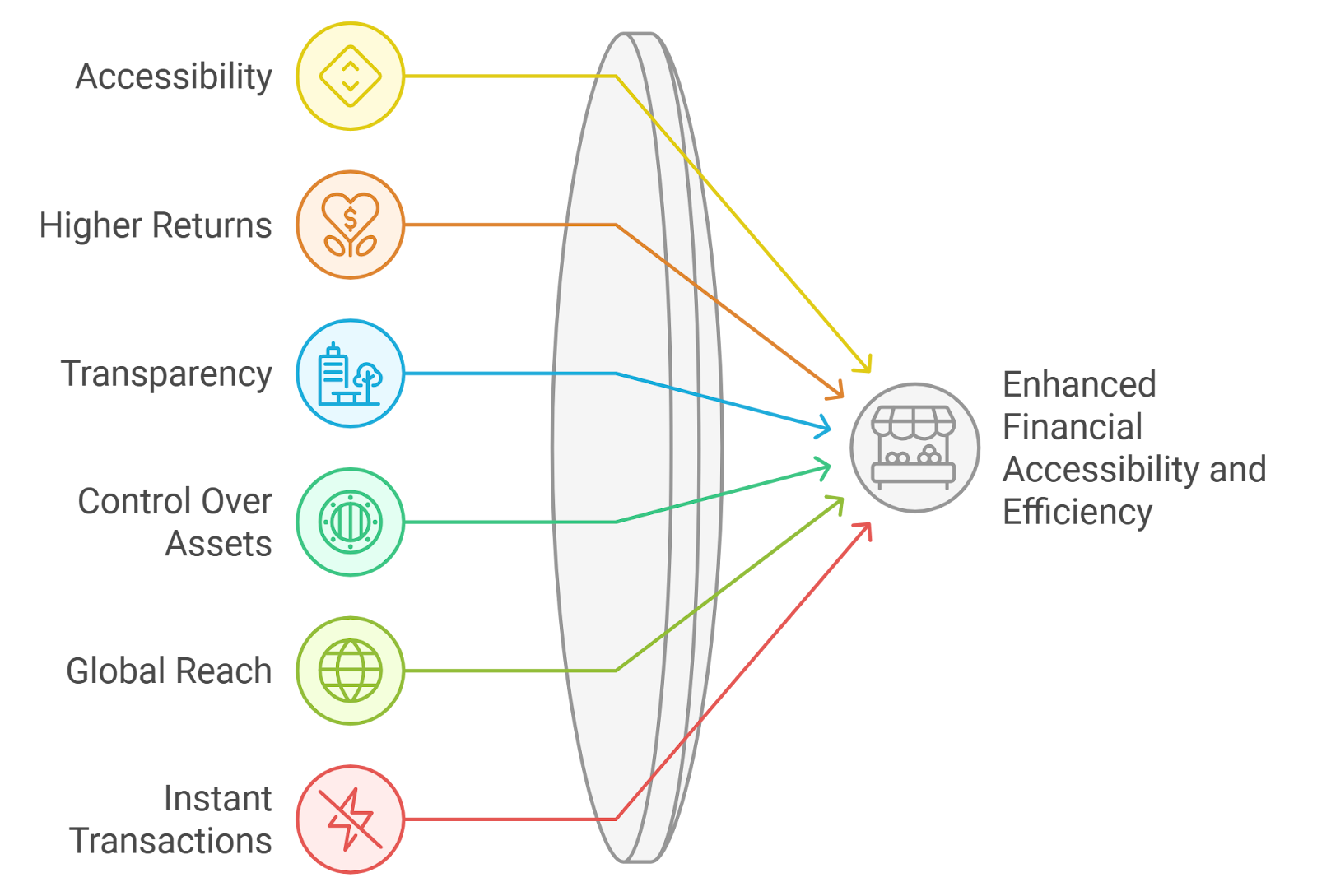

Decentralized Finance has long been constrained by over-collateralized lending models, where borrowers must lock up assets worth 150% or more of the loan value to mitigate default risks. Enter on-chain risk scores, a transformative innovation that analyzes wallet histories to enable under-collateralized DeFi loans at ratios as low as 71%, without relying on Decentralized Identity (DID) verification. This shift promises 10x capital efficiency, unlocking trillions in dormant liquidity for the crypto economy.

Breaking Free from Over-Collateralization Constraints

Traditional DeFi protocols like Aave and Compound demand excessive collateral to protect lenders against volatility and defaults. This approach, while secure, ties up vast amounts of capital; for a $10,000 loan, borrowers might deposit $15,000 in ETH, rendering much of DeFi’s potential idle. On-chain risk scores upend this by quantifying borrower reliability through transparent blockchain data.

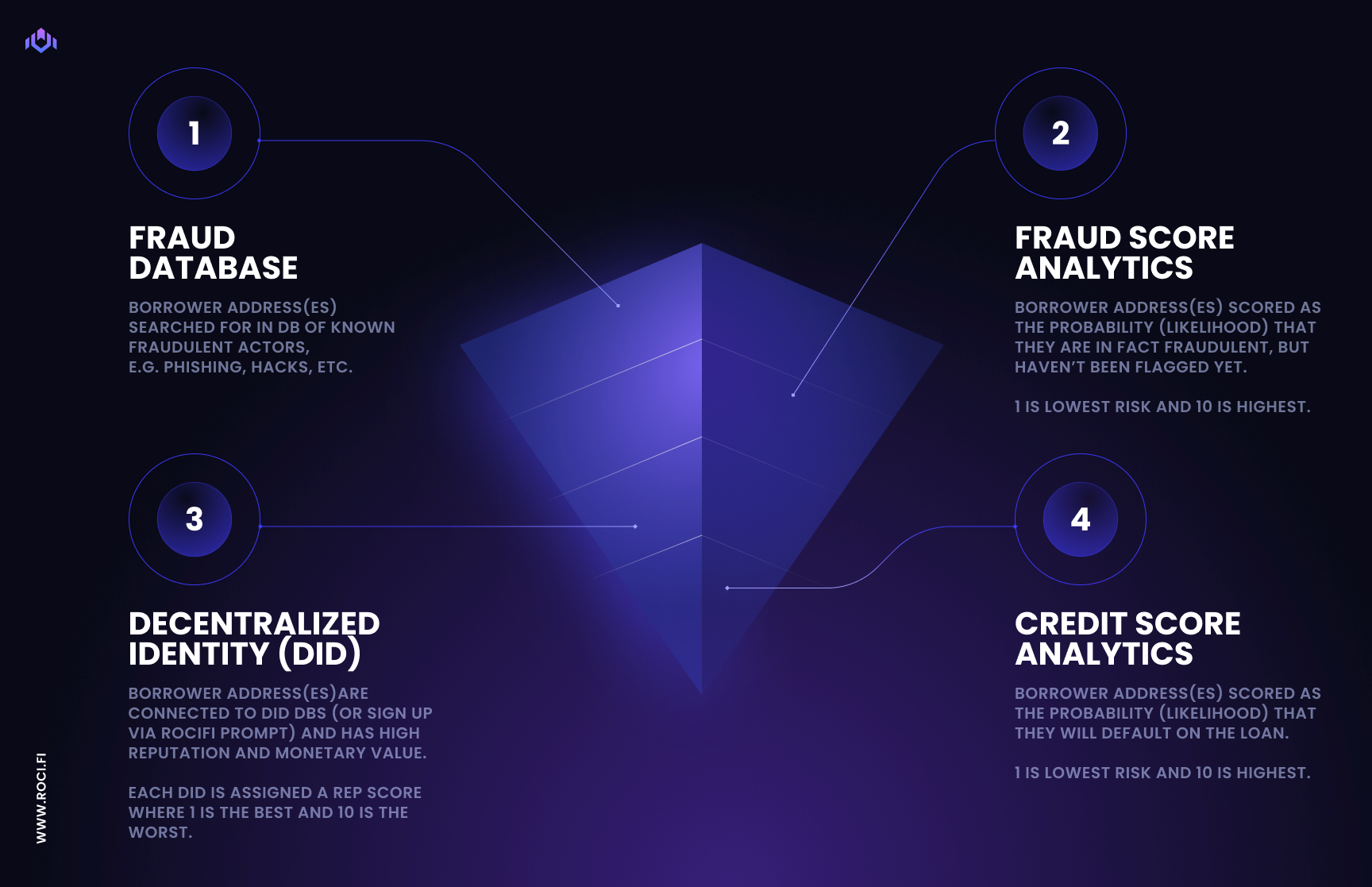

Protocols such as RociFi lead the charge, evaluating factors like repayment histories, transaction frequency, and wallet age to generate dynamic scores. As highlighted in recent analyses from the Onchain Foundation, these scores pave the way for under-collateralized alternatives, drawing parallels to TradFi credit bureaus but powered by immutable ledgers. The result? Borrowers access funds with collateral closer to 70-80% of loan value, freeing capital for productive use.

Crypto repayment histories form the backbone here. Every interaction on-chain, successful repayments, liquidity provision, or even NFT flips, contributes to a verifiable profile. This data-driven DeFi credit scoring reduces reliance on oracles or off-chain inputs, minimizing manipulation risks.

Mechanics of On-Chain Risk Assessment

At its core, an on-chain risk score aggregates behavioral signals into a composite metric, often expressed as a 0-1000 scale akin to FICO but derived solely from blockchain activity. Machine learning models process inputs like:

- Historical loan repayments and delinquencies

- Wallet diversification and asset volatility exposure

- Interaction with reputable protocols

- Transaction velocity and gas efficiency patterns

Research from arXiv papers on On-Chain Credit Risk Scores (OCCR) demonstrates how these models predict default probabilities with precision rivaling centralized systems. For instance, a wallet with consistent USDC repayments across multiple lenders scores higher, qualifying for reduce collateral DeFi terms.

Without DID verification, pseudonymity remains intact, yet trust emerges from data. If repayment risk spikes, say, due to a wallet’s sudden high-risk trades, smart contracts trigger margin calls or auto-liquidations instantaneously, as noted in Medium analyses on on-chain risk control.

Over-Collateralized vs Under-Collateralized DeFi Loans

| Type | Collateral Ratio | Pros | Cons | Example Protocols |

|---|---|---|---|---|

| Over-Collateralized | 150-200% | • High security for lenders • Permissionless access • No credit scoring required |

• Capital inefficient • High upfront capital barrier |

Aave, Compound, MakerDAO |

| Under-Collateralized | 70-100% | • 10x capital efficiency • Broader borrower access • Leverages on-chain risk scores • No DID verification |

• Higher default risk • Relies on risk models • Smart contract vulnerabilities |

RociFi |

Protocols Pioneering the Under-Collateralized Frontier

RociFi exemplifies this evolution, deploying risk scores to offer loans at 71% collateralization, a stark contrast to legacy models. Their system scans on-chain footprints to underwrite credit, enabling borrowers to leverage 10x more efficiently. Similarly, emerging platforms from ChainScore Labs incorporate social credit scoring from transaction graphs, syndicating risk across pools.

Huma Finance and Mitosis University resources underscore how blending on-chain and selective off-chain signals (without DID) empowers decentralized platforms. Credit histories etched on blockchains create public ledgers of behavior, fostering a merit-based lending ecosystem. Visa’s insights on stablecoin lending further reveal opportunities, as lower collateral needs stabilize rates amid ETH/BTC volatility.

Challenges loom, including model standardization and oracle dependencies, but ongoing refinements promise scalability. By 2026, as per updated contexts, these mechanisms could mobilize trillions, mirroring TradFi’s efficiency on-chain.

Standardizing these scores across chains remains crucial, yet the momentum is undeniable. Protocols are iterating rapidly, integrating cross-chain data via bridges and layer-2 solutions to enrich wallet profiles without compromising speed or cost.

Risk Mitigation in a Permissionless World

Under-collateralized lending thrives on proactive safeguards. Smart contracts embedded with score thresholds adjust loan-to-value ratios dynamically; a dip below 80% might prompt partial repayments or additional collateral deposits. This mirrors TradFi covenants but executes trustlessly.

I view these mechanisms as disciplined necessities. From my analysis of arXiv’s OCCR models, incorporating wallet diversification, say, balanced holdings in stablecoins versus volatile alts, slashes predicted default rates by up to 40%. Lenders syndicate exposure across pools, much like ChainScore Labs advocates, distributing tail risks while rewarding pristine crypto repayment histories.

Vulnerabilities persist, particularly in nascent smart contracts. Audits from firms like Trail of Bits and formal verification are non-negotiable. Yet, on-chain transparency allows real-time monitoring, where any anomaly in a borrower’s on-chain risk scores triggers community alerts or automated halts.

Key Advantages of On-Chain DeFi Loans

-

Capital Efficiency: Borrowers secure loans with minimal collateral, like RociFi’s 71% ratios, unlocking capital for other uses without over-collateralization.

-

Broader Access: On-chain risk scores evaluate transaction history, enabling loans without DID verification, as in Huma Finance protocols.

-

Lower Costs: Reduced collateral needs lower interest rates and fees, improving affordability in volatile DeFi markets.

Real-World Impact: Case Studies and Metrics

Consider RociFi’s deployment: borrowers with scores above 750 secure loans at 71% collateralization, unlocking $5 million in pilots across Base and Optimism. Repayment rates hover at 98%, per their dashboards, validating the model’s rigor.

Huma Finance pushes further, blending on-chain signals with minimal off-chain proofs for real-world assets (RWAs). Their platform records each repayment on-chain, building ledgers that feed into universal scores. As RWA. io notes, this bridges TradFi behaviors to DeFi, where a wallet’s history of timely USDC returns predicts future fidelity.

Capital efficiency soars. In over-collateralized setups, $1 million in ETH supports roughly $666,000 in loans at 150% ratios. Flip to 71%: that same capital backs $1.41 million, over 2x immediately, compounding to 10x as recycled capital fuels chain reactions of lending. Multiply by DeFi’s $100 billion TVL, and trillions beckon, echoing Onchain Foundation projections.

Stablecoin dynamics amplify this. Visa’s research shows lending rates stabilizing as collateral burdens ease, decoupling from ETH/BTC swings. Borrowers retain upside in their holdings, aligning incentives for long-term protocol health.

Building Your On-Chain Credit Profile

For users eyeing these opportunities, discipline pays. Start with consistent interactions: provide liquidity on Uniswap, repay small test loans on Spark, diversify beyond meme coins. Track your score via tools like those at cryptocreditscore. org, where on-chain risk scores demystify the process.

Avoid red flags, frequent liquidations or bridge exploits signal distress. Over time, a robust profile unlocks prime rates, turning pseudonymity into a competitive edge. Lenders, meanwhile, should layer scores with pool diversification, targeting 70-90% ratios for balanced yields.

This ecosystem demands continuous learning. Monitor updates from Mitosis University and Chainlink’s DECO for evolving standards. As scores mature, expect interoperability via ERC-standards, cementing DeFi credit scoring as the bedrock of scalable finance.

The pivot to under-collateralized models redefines DeFi’s promise: efficiency without excess, trust via data, growth unbounded. Wallets with proven histories will lead, capitalizing on a ledger that never forgets success.