DeFi lending has long been shackled by over-collateralization, demanding borrowers lock up far more value than they borrow just to prove they’re not flight risks. This setup, while secure in theory, starves the ecosystem of capital efficiency and locks out users without hefty crypto stacks. Enter onchain risk scores, a game-changer that leverages transparent blockchain data to enable under-collateralized DeFi loans. By scrutinizing repayment histories and behavioral patterns, these scores build verifiable trust, paired with decentralized identifiers (DIDs) for identity verification without the creep of centralized KYC.

Picture this: a borrower with a spotless record of repaying stablecoin loans across protocols gets approved for a $10,000 USDC draw with only 50% collateral. No more 150-200% overkill. Platforms like RociFi pioneered this on Polygon back in 2022, using Non-Fungible Credit Scores (NFCS) derived purely from onchain behavior. Coinbase’s recent Morpho integration even lets Bitcoin holders borrow up to $100,000 in USDC, blending custodial ease with decentralized rails.

The Capital Trap of Traditional DeFi Collateral Models

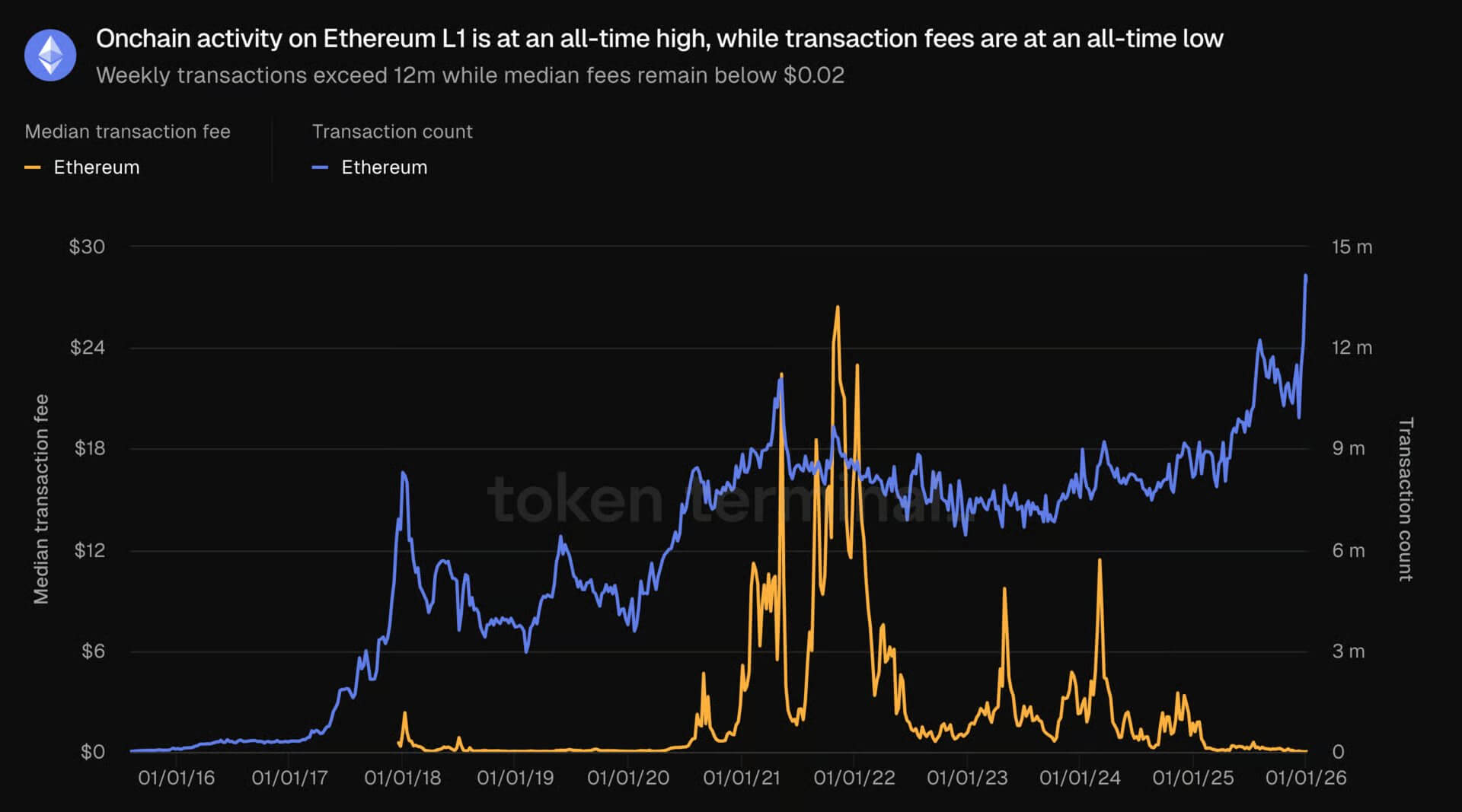

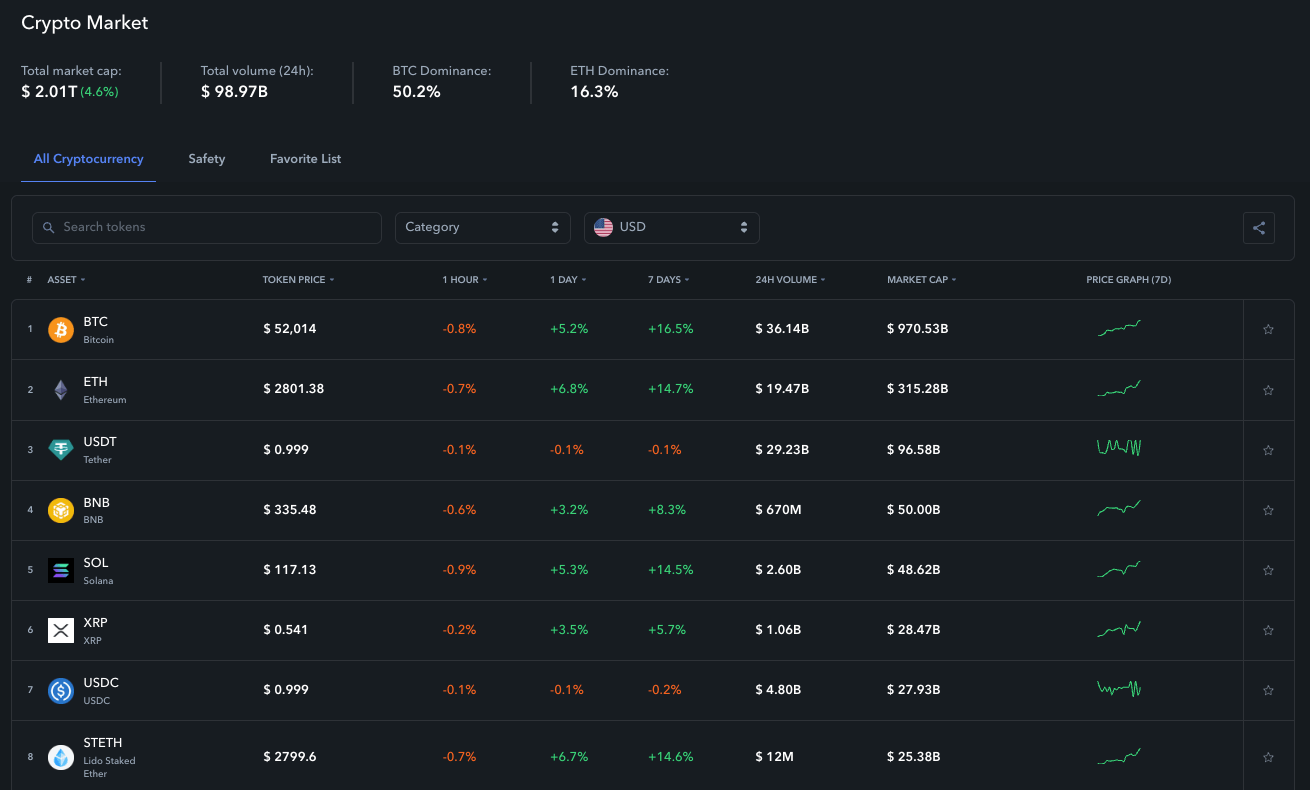

Over-collateralization dominates because anonymity breeds caution. As the Bank for International Settlements notes, it creates procyclicality: booms inflate collateral values, fueling leverage; busts trigger liquidations in cascades. Borrowers tie up billions in idle assets, while lenders earn yields on locked funds rather than circulating capital. Visa’s analysis highlights how stablecoin rates swing wildly due to volatile collateral like ETH or BTC, deterring steady borrowing.

This isn’t sustainable. DeFi’s total value locked hovers in the hundreds of billions, yet under-collateralized lending could unlock trillions, per the Onchain Foundation. I’ve traded through multiple cycles; watching quality borrowers sidelined by collateral demands feels like a relic of 20th-century banking inefficiency ported to blockchains.

Decoding Onchain Risk Scores for Crypto Credit Scoring

Onchain risk scores flip the script by turning public ledgers into credit bureaus. They parse transaction histories: timely repayments on Aave or Compound, liquidity provision in pools, even NFT flips for risk appetite signals. ArXiv papers detail this as systematic analysis of on-chain footprints, yielding scores from 0-1000 that predict default odds better than collateral alone.

Key Onchain Risk Factors

-

Repayment History: Tracks past loan repayments, on-time payments, and defaults from protocols like RociFi to assess borrower reliability.

-

dApp Interactions: Evaluates engagement with lending platforms, liquidity pools, and other DeFi apps for consistent, positive behavior.

-

Wallet Age: Measures how long a wallet has been active, indicating maturity and reduced risk of new, unproven addresses.

-

Transaction Volume: Analyzes frequency and size of transactions to gauge activity level and financial stability.

-

Cross-Protocol Behavior: Reviews actions across multiple DeFi protocols like Morpho for patterns of trust and consistency.

Huma Finance and 8lends emphasize tracking beyond loans: swaps, staking, governance votes all feed into holistic DeFi lending risk assessment. AI integrations, like Kava’s, sharpen this with pattern recognition, spotting sybils or wash traders. The result? Lenders extend credit to proven actors at lower rates, boosting inclusion without reckless exposure.

DIDs and Onchain Repayment History: Forging Pseudonymous Trust

Raw scores need identity anchors. Enter DID decentralized identity, self-sovereign profiles linking wallets to reputations without doxxing. Users control what lenders see: verified repayment streaks across chains, minus personal details. Mitosis University outlines hybrid models blending onchain and offchain data, but pure onchain shines for permissionless access.

RociFi’s NFCS exemplify this: mintable tokens encoding scores, tradeable or stakeable for better terms. No KYC means global reach, from emerging markets to high-net-worth traders. GARP’s risk pros nod to smart contract enforcement as the backstop, with recursive leverage tamed by score-gated LTVs.

Yet balance tempers optimism. Scores falter on new wallets or sybil farms; DIDs must resist collusion. Protocols counter with fraud oracles and behavioral heuristics, refining iteratively. This evolution promises under-collateralized crypto loans that scale DeFi toward mainstream finance.

Real-world deployments prove the viability of this shift. RociFi’s NFCS system, live since 2022, has processed loans with collateral ratios dipping below 50% for top scorers, all while maintaining default rates under 2%. Morpho’s optimizer, now powering Coinbase’s BTC-backed USDC loans up to $100,000, layers onchain scores atop collateral for hybrid safety. These aren’t hypotheticals; they’re battle-tested on Polygon and Ethereum, drawing from vast transaction graphs to calibrate loan-to-value ratios dynamically.

Quantifying the Edge: Metrics That Matter

To grasp the impact, consider hard numbers. Onchain risk scores correlate strongly with repayment success; protocols report 85-95% recovery rates on under-collateralized positions versus liquidation-heavy overcollateral models. This stems from granular onchain repayment history: chains of timely USDC returns signal reliability better than static wallet balances.

| Metric | Over-Collateralized | Under-Collateralized w/Scores |

|---|---|---|

| Capital Efficiency | 150-200% LTV lockup | 50-90% active use |

| Default Rate | <1% (liquidations) | 1-3% (restructured) |

| Accessibility | High-net-worth only | Proven small borrowers |

| Yield for Lenders | Volatile, collateral-tied | Stable, score-adjusted |

Such tables underscore why DeFi TVL could balloon. Lenders deploy capital productively, borrowers access funds without asset dumps, and the ecosystem sidesteps liquidation spirals during downturns. I’ve seen traditional credit markets grind on opaque FICO scores; blockchain’s transparency crushes that with auditable trails.

Navigating Pitfalls: Risks in the Under-Collateral Era

Blind faith would be folly. New users lack histories, inflating their perceived risk and forcing collateral crutches. Sybil attacks, where one actor spins fake wallets, demand vigilant scoring: cross-reference volumes, interaction diversity, even gas patterns. Fraud detection integrates Chainalysis feeds oracles, flagging anomalies before loans issue.

DID decentralized identity helps here, portably verifying humans across chains without custody. Yet procyclicality lingers; bull runs tempt score inflation, bears expose weak links. Protocols like those from 8lends counter with dynamic LTVs, contracting in volatility. GARP warns of recursive leverage, but score thresholds cap it smarter than blind oracles.

Regulatory shadows loom too. Permissionless lending skirts KYC, inviting scrutiny, but self-sovereign DIDs position users as compliant by choice. Balance privacy with accountability; that’s the pragmatic path.

Zoom out, and crypto credit scoring heralds DeFi’s maturation. Platforms blending scores, DIDs, and smart contracts unlock under-collateralized loans for everyday traders, not just whales. Expect integrations with real-world assets, cross-chain portability, and AI-tuned models to dominate by 2026. This isn’t disruption for hype’s sake; it’s efficient finance, rewritten on public ledgers. Lenders gain conviction, borrowers gain wings, and DeFi inches toward trillions in unlocked value. The protocols iterating today will define tomorrow’s standards.