Picture this: you’re a DeFi power user with a solid track record of repayments, but you still need to lock up 150-200% collateral just to borrow stablecoins. It’s like showing up to a job interview overqualified but handcuffed. That’s the reality of most DeFi lending today, but on-chain risk scores are flipping the script, using your onchain repayment history to unlock under-collateralized DeFi loans. No more capital sitting idle – just trust built from real blockchain behavior. 🚀

In 2026, as DeFi matures, protocols are ditching the over-collateralized crutch that Aave and Compound popularized. Sources like CoinDesk highlight how risk ratings are becoming the norm, paving the way for trillions in on-chain flows. Why? Because TradFi thrives on unsecured loans, and DeFi’s catching up fast. On-chain reputation scores pull from transaction data, repayment patterns, and even collateral habits to craft a crypto credit scoring profile that’s transparent and tamper-proof.

Breaking Free from Collateral Overload

Over-collateralization made DeFi safe but inefficient. Borrow $1,000 USDC? Cough up $1,500 and in ETH or BTC, praying prices don’t tank. Bitcoin-backed loans hover at 30-70% LTV per Earnpark’s 2026 guide, but that’s still tying up assets. Meanwhile, stablecoin rates swing wild due to volatile collateral like ETH, as Visa notes. This locks out everyday users without fat wallets, stunting growth.

On-chain credit scores enable under-collateralized crypto lending alternatives to overcollateralized DeFi loans. (Onchain Foundation)

Enter DeFi undercollateralized lending: protocols assessing your history instead. Bankless nails it – TradFi’s mostly unsecured, fixed-rate loans. DeFi’s trillion-dollar shot? Private on-chain credit, per Mary Tran on LinkedIn. It’s capital-efficient, inclusive, and scales with user behavior.

How On-Chain Risk Scores Actually Work

These scores aren’t magic; they’re data-driven dynamite. Think historical repayments, transaction velocity, and interaction patterns distilled into a score. RociFi on Polygon drops Non-Fungible Credit Scores (NFCS) based exactly on this. High score? Borrow with minimal collateral. Low? Stricter terms. It’s dynamic risk management tailored to you.

Medium’s Duredev breaks it down: platforms slash collateral ratios for trustworthy borrowers. SSRN echoes the shift – over-collateralization limits use cases, hampers capital efficiency. But here’s my take: it’s opinionated risk pricing. Lenders set rates by score tiers, borrowers grind for better terms via consistent behavior. Actionable? Start building yours today on testnets.

- Repayment History: On-time pays boost scores big time.

- Transaction Behavior: Frequent, low-risk moves signal reliability.

- Collateral Patterns: Past prudent usage predicts future wins.

Crypto Adventure reminds us DeFi lending’s worth in 2026 hinges on risk controls. Scores deliver that precision.

Real Protocols Pushing the Envelope

RociFi leads with its Polygon rollout, per Bravenewcoin. Borrowers get NFCS dictating terms – high scorers snag low-collateral deals, unlocking liquidity for trades or yields. Chaincatcher flags risks like sybil attacks: one wallet farms credit, rugs, repeats. Solution? Link to DID or light KYC without killing pseudonymity.

Privacy’s key too. Zero-knowledge proofs shield data while proving scores, dodging full exposure. Digitalfinancenews stresses smart contract audits to fend off exploits. It’s not flawless, but beats collateral lockups. Check how on-chain risk scores enable under-collateralized lending in DeFi for deeper dives.

Market buzz? Onchain Foundation predicts trillions via scores. It. com domains tie reputation to lending rates – better score, lower costs. As ratings go mainstream (CoinDesk), expect institutional inflows chasing yields without overkill collateral.

Institutions are eyeing this space hard, with CoinDesk calling risk ratings DeFi’s maturity test. Trillions could flow on-chain once scores standardize, mirroring TradFi’s unsecured lending dominance. But let’s get real – adoption won’t happen overnight. Protocols need battle-tested oracles, audited contracts, and sybil-resistant identity layers to scale.

Tackling the Tough Risks Head-On

Sybil attacks loom large: craft a ‘good’ wallet, borrow big, vanish, rinse with alts. Chaincatcher’s spot-on here. My fix? Decentralized identity (DID) tied to onchain repayment history, verified via zero-knowledge proofs. No full KYC dump, just enough signal for trust. Privacy hawks rejoice – your full history stays foggy, scores shine clear.

Smart contract hacks? Non-starter without top-tier audits. Digitalfinancenews warns of oracle fails and governance messes. Solution: multi-oracle feeds and timelocks. Lenders win with dynamic rates – high-score borrowers snag sub-5% APYs on stablecoins, per it. com’s 2026 outlook. Borrowers grind reps for perks. Actionable tip: Track your score on platforms like cryptocreditscore. org today.

Comparison of Over-Collateralized vs. Under-Collateralized DeFi Loans

| Model | Collateral Req. | Capital Efficiency | Risk Mgt. | Examples | Pros/Cons |

|---|---|---|---|---|---|

| Over-Collateralized | High (typically 150-200%+) | Low 🚫 | Over-collateralization & Automated Liquidations | Aave, Compound | Pros: Simple, secure, no KYC/identity needed Cons: Capital inefficient, excludes borrowers without assets |

| Under-Collateralized | Low/Variable (0-100% based on score) | High ✅ | On-Chain Risk Scores (e.g., NFCS), Repayment History | RociFi | Pros: Capital efficient, broader access Cons: Sybil attacks, privacy issues, scoring vulnerabilities |

Under-collateralized DeFi loans shine in capital efficiency, freeing assets for yields elsewhere. SSRN nails the con: over-collateralization chokes growth. We’re talking real-world wins – traders borrow against rep for momentum plays without liquidation dread.

2026 Roadmap: From Niche to Norm

Fast-forward to 2026: DeFi lending’s worth it if you nail risk controls, says Crypto Adventure. Stablecoin opps explode as Visa predicts, decoupled from ETH/BTC swings. Bitcoin loans at 30-70% LTV? Cute, but scores push under 20% for vets. Bankless sees tokenization fueling this – fixed-rate, unsecured vibes straight from TradFi.

RociFi’s Polygon play proves it works. NFCS adapt in real-time: repay fast, score jumps, terms sweeten. Developers, integrate via APIs for seamless crypto credit scoring. Lenders, underwrite by tiers – low-risk pools at premium yields. Users, build that onchain repayment history now. Protocols like these slash barriers, onboarding millions locked out by collateral walls.

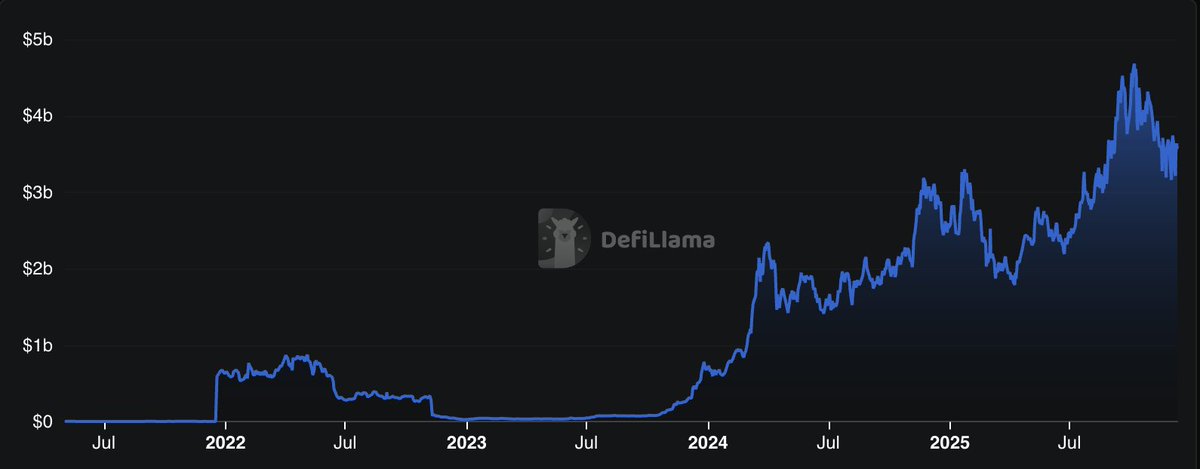

Medium’s Duredev envisions NBFCs issuing blockchain loans via reps. It’s symbiotic: scores lower collateral for trusteds, bootstrap liquidity. My bold call? By EOY 2026, 20% of DeFi TVL shifts under-collateralized, per momentum from CoinDesk ratings push. Volatility? Managed via behavioral data, not just price oracles.

Zero-knowledge tech matures, shielding behaviors while proving solvency. Governance evolves too – DAOs vote score params, keeping it decentralized. Hurdles remain, like cross-chain rep portability, but bridges are closing gaps. Dive deeper at how onchain risk scores enable under-collateralized crypto loans.

Picture fleets of users leveraging reps for leveraged yields, institutions parking billions sans overkill collateral. On-chain risk scores aren’t hype – they’re the unlock for DeFi’s next leg up. Start auditing your wallet history, engage protocols building this future. The capital floodgates? Cracking wide open.