In the ever-evolving tapestry of decentralized finance, a quiet revolution is underway, one that promises to unshackle borrowing from the heavy chains of overcollateralization. Picture this: a world where your wallet’s onchain repayment history speaks louder than stacks of locked-up assets. By 2026, undercollateralized DeFi loans are no longer a fringe experiment but a maturing force, propelled by sophisticated onchain risk scores that dissect repayment patterns, transaction velocities, and even liquidation scars etched into the blockchain. I’ve spent years dissecting market cycles, from commodity booms to crypto winters, and this shift feels like the natural crescendo of DeFi’s ambition, to mirror real-world credit while staying true to trustless principles.

The old guard of DeFi lending clung to overcollateralization like a lifeline, demanding borrowers lock up 150% or more in value to secure a loan. It worked, sure, minimizing defaults in a permissionless wild west. But at what cost? Capital sat idle, yields stagnated for lenders, and vast swaths of users, those without bloated portfolios, were sidelined. Enter onchain repayment history, the ledger of truth that captures every borrow, repay, and default in immutable ink. Protocols now mine this data to forge DeFi credit scores, enabling reputation-based lending crypto that rewards reliability over riches.

The Mechanics of Onchain Repayment Histories in Action

At its core, an onchain repayment history is a behavioral biography. Smart contracts track metrics like repayment timeliness, loan-to-value ratios navigated, frequency of interactions across protocols, and recovery from liquidations. Aggregate this with wallet age, asset diversity, and even offchain signals ported via zero-knowledge proofs, and you birth a risk score, think FICO for the blockchain. zScore exemplifies this, blending AI neural nets with retroactive lending data to correlate high scores with pristine repayment records. Early tests show borrowers with top-tier zScores default at rates dwarfed by the overcollateralized baseline.

DeFi lending is no longer an experiment in collateralized leverage; it’s evolving into the architecture of a programmable financial system.

This isn’t pie-in-the-sky theory. Platforms like Credora and Spectra have pioneered hybrid models, fusing onchain purity with selective offchain oracles for richer profiles. Lenders, in turn, calibrate terms dynamically: a 950-score wallet might snag a 90% LTV loan, while a middling 700 gets 60%. The result? Capital efficiency soars, yields entice institutions, and borrowing democratizes. Yet, as a macro analyst who’s seen bubbles burst, I caution that this hinges on data quality, sybil attacks or oracle manipulations could poison the well.

From Data to Decisions: Building Robust Onchain Risk Scores

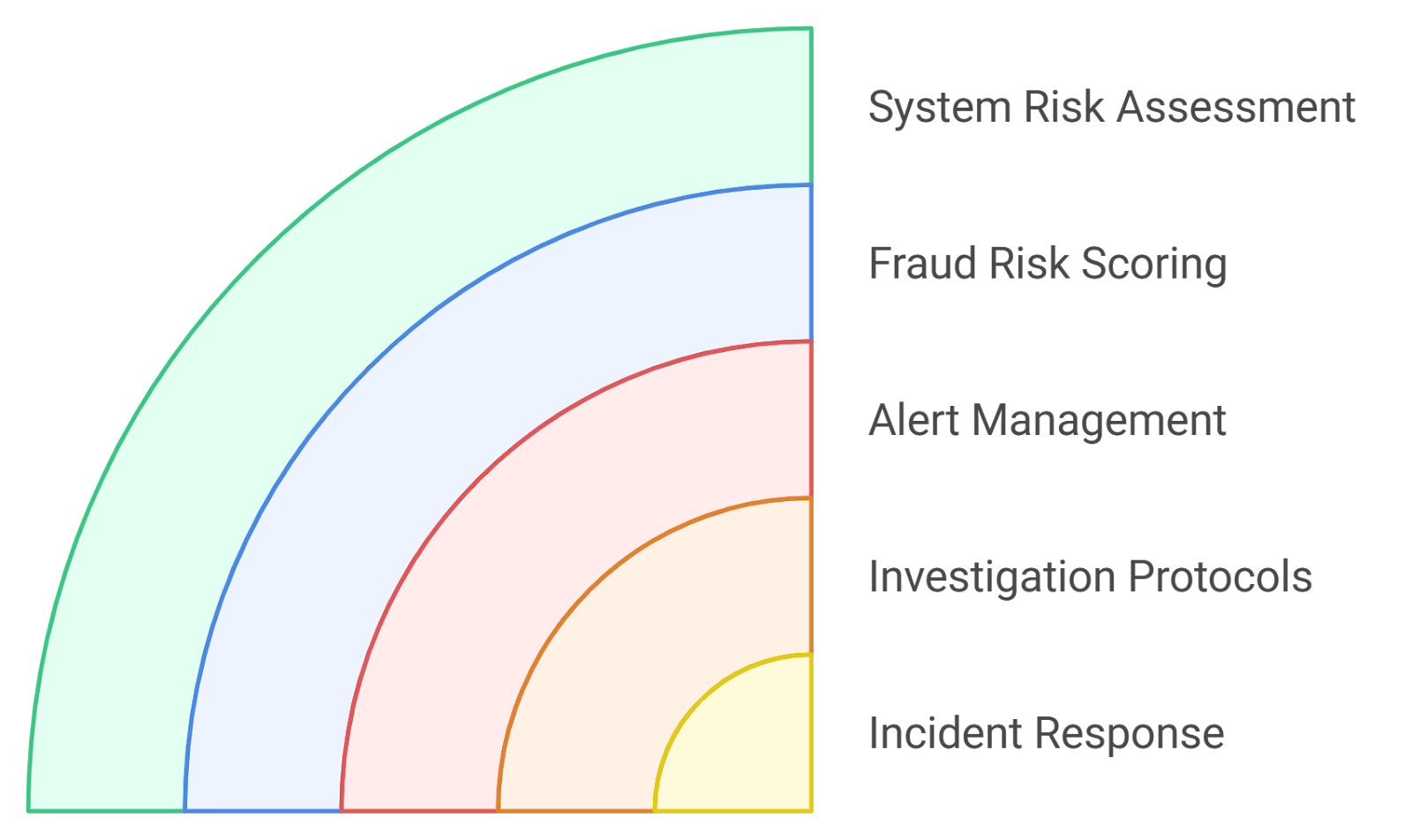

Crafting these scores demands nuance. It’s not just ‘did they repay?’ but ‘how swiftly, under what market stress, across how many cycles?’ Advanced systems layer in velocity scores, gauging fund flows to detect wash trading, and peer graphs, mapping wallet networks for collusion risks. By 2026, integration with decentralized identity (DID) adds verified human signals, curbing multi-wallet gaming.

Consider the lender’s lens: in overcollateralized regimes, risk is blunt-force, liquidated on dips. Undercollateralized flips the script to probabilistic, where scores predict default probability. A table of real-world analogs underscores this: protocols offering undercollateralized lending protocols report 20-30% higher utilization rates, per recent Chainlink and Mitosis analyses. But here’s my take, true maturity comes when these scores forecast macro downturns, factoring in wallet exposure to volatile assets like memecoins or leveraged positions.

Navigating Risks in the Undercollateralized Era

Optimism tempered: undercollateralized loans amplify defaults without backstops. Historical exploits like bZx remind us smart contracts aren’t infallible; a flaw in risk logic could cascade losses. Lenders counter with insurance pools, dynamic interest rates that spike for risky profiles, and onchain oracles for real-time adjudication. zScore’s correlation data bolsters confidence, yet black swan events, say, a sector-wide oracle failure, loom. In my view, hybrid models blending scores with minimal collateral buffers will dominate, evolving DeFi toward institutional-grade resilience.

These safeguards are evolving rapidly, with protocols like those powered by Chainlink’s DECO introducing verifiable offchain credentials to fortify onchain signals without compromising decentralization. Lenders pool resources into shared risk vaults, where premiums scale with borrower scores, creating a self-sustaining safety net. From my vantage in global markets, this mirrors credit default swaps in traditional finance, but transparent and programmable, a step toward true capital market parity.

Real-World Protocols Pioneering the Shift

Credora stands out as a trailblazer, delivering wallet-specific risk scores that blend onchain repayment history with private data disclosures, enabling undercollateralized lending at loan-to-values up to 90%. Their model has facilitated millions in loans across Ethereum and Layer 2s, with default rates hovering below 1% for prime borrowers. Spectra takes a purer onchain approach, analyzing transaction graphs to score liquidity provision and borrowing streaks, rewarding consistent actors in liquidity pools. Then there’s zScore, pushing boundaries with AI-driven predictions that forecast repayment under simulated stress tests, drawing from years of retroactive data.

Key Features of Top Protocols

-

Credora: Delivers wallet-specific credit scores by blending private off-chain data with onchain repayment history, enabling nuanced risk assessment for undercollateralized DeFi loans.

-

Spectra: Focuses on pure onchain transaction analysis, evaluating borrowing behavior, liquidations, and repayment history to generate trustless credit signals.

-

zScore: Leverages AI neural networks and ZK proofs to port real-world credentials onchain, strongly correlating high scores with reliable repayment patterns in lending protocols.

These aren’t isolated; integration across ecosystems amplifies impact. Imagine Aave or Compound embedding zScores natively, auto-adjusting rates per wallet. Early adopters report utilization jumps of 25%, unlocking idle capital for higher yields. For borrowers, it’s liberation: a bootstrapped developer with spotless repayment history accesses funds without liquidating their ETH position during a dip. I’ve watched commodities markets reward steady hands through cycles; DeFi’s onchain risk scores do the same, fostering long-term alignment over speculative flips.

Unlocking Trillions: The Economic Horizon

Zoom out to the macro canvas, and the stakes dazzle. Onchain Foundation projections peg undercollateralized DeFi at trillions in TVL by decade’s end, fueled by reputation-based lending crypto that scales globally without KYC friction. Visa’s crypto arm echoes this, eyeing stablecoin lending as the gateway, where scores supplant collateral for unsecured tranches. Yet, cycles teach caution: bull euphoria could inflate scores, breeding complacency. Protocols must bake in macro overlays, weighting exposure to BTC dominance or stablecoin depegs.

On-chain credit scores enable lenders to offer under-collateralized loans based on repayment history. Borrowers with strong reputations. . .

Institutional inflows hinge on this maturity. Pension funds, wary of overcollateralization’s drag, eye DeFi for alpha, but demand audited scores and recourse layers. By fusing DID with repayment histories, we edge toward that trust, potentially mirroring TradFi’s $100 trillion credit markets. My 18 years tracking flows convince me: DeFi’s edge lies in verifiability, turning every wallet into a living resume.

For everyday users, the transformation is profound. Traders sidestep liquidations via scored lines of credit; DAOs fund operations on collective reputation; even NFT artists borrow against future royalties inferred from sales velocity. Risks persist, but layered defenses, social recovery, slashing mechanisms, AI anomaly detection, tilt odds favorably.

As DeFi matures, onchain repayment history emerges as the great equalizer, distilling human reliability into code. We’ve traded collateral excess for probabilistic precision, venturing closer to a financial system where merit, not means, dictates access. Watch this space; the protocols scoring it today will redefine tomorrow’s markets.