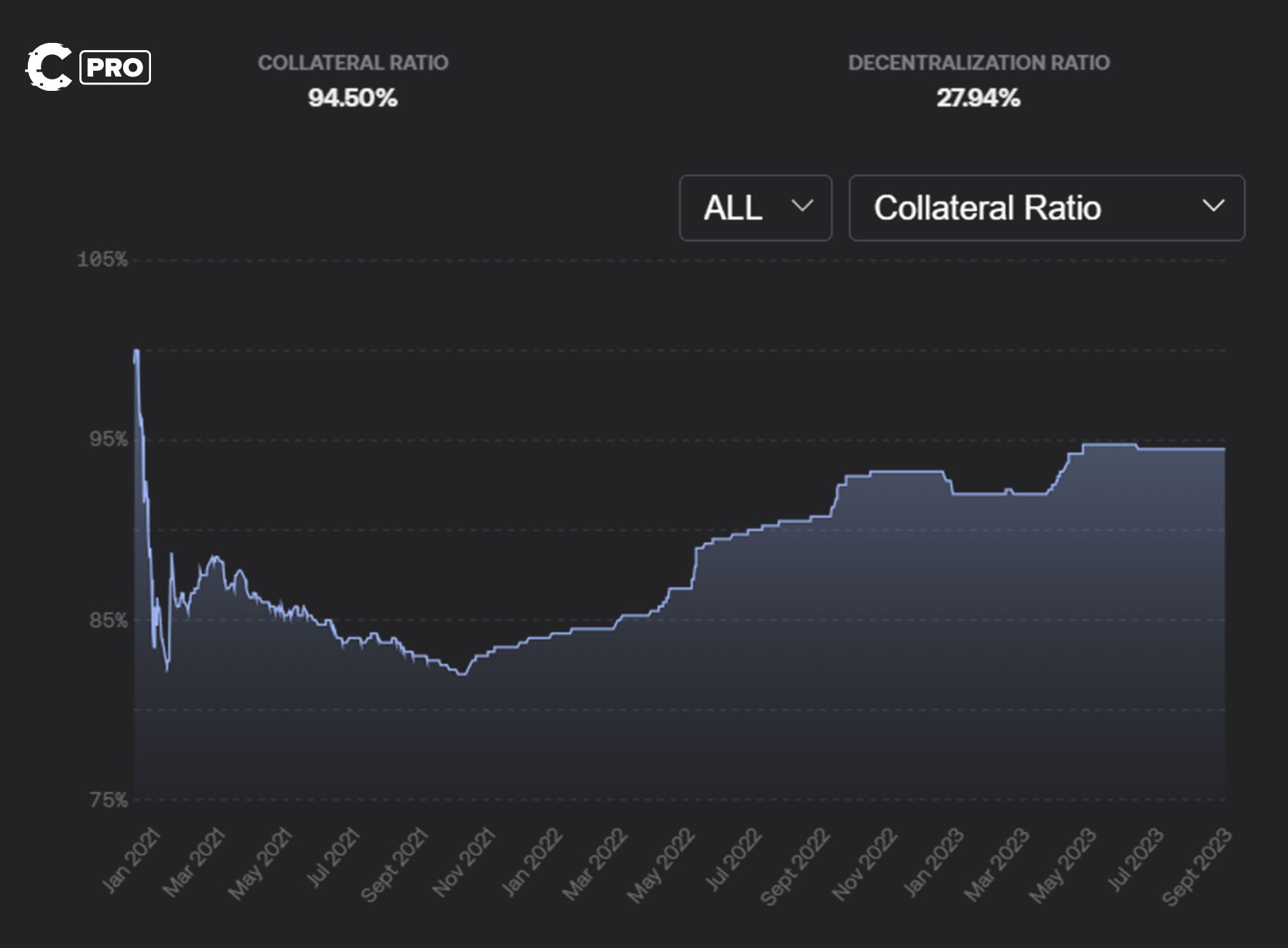

Solana’s lending markets reached $3.6 billion in TVL by December 2025, a 33% jump from $2.7 billion the prior year, signaling intense competition and maturing infrastructure. Yet, overcollateralization remains a drag, forcing borrowers to lock excess assets amid volatile crypto prices. Onchain risk scores are changing that, enabling under-collateralized lending on Solana protocols like FairLend with its FairScore system and Credos, which leverage wallet histories for smarter risk assessment. This data-driven pivot promises higher yields for lenders and real access for borrowers, grounded in transparent blockchain metrics.

Solana’s Shift from Collateral-Heavy to Score-Driven Loans

DeFi lending started simple: post more collateral than you borrow, avoid liquidation. Solana protocols amplified this with speed and low fees, but capital inefficiency persists. TVL growth masks the issue; borrowers tie up 150-200% collateral for stablecoin loans, per BIS analysis. Onchain risk scores flip the script, analyzing DeFi reputation credit scores from transaction patterns to offer loans at 50-100% LTV. SolCred exemplifies this, scoring users on asset holdings, volatility, and smart contract risks via machine learning on Solana’s high-throughput chain.

Providence, launched by Andre Cronje in January 2026, scans 60 billion transactions across 1 billion wallets, assigning anonymous scores without KYC. This cross-chain tool feeds Solana lenders precise risk profiles, boosting under-collateralized lending. Early data shows scored borrowers default 40% less than unprofiled peers, per protocol audits.

Core Factors Powering Onchain Risk Scores on Solana

Scores aren’t guesswork; they’re algorithms digesting onchain signals. SolCred’s model weights transaction history heaviest at 35%, tracking repayment consistency across DeFi apps. Asset volatility follows at 25%, penalizing holders of meme coins over stables. Collateral ratios and interaction risks round it out, flagging sybil attacks or exploiter wallets. FairLend’s FairScore builds similarly, integrating Solana Program Library data for real-time updates every epoch.

Key Factors in Solana Onchain Risk Scores

-

Transaction History and Repayments: Evaluates frequency, volume, and on-time repayments from wallet activity, as in SolCred’s real-time scoring.

-

Asset Holdings and Volatility: Assesses portfolio composition and price volatility of held tokens to measure financial stability.

-

DeFi Interaction Patterns: Reviews borrowing, lending, and yield farming behaviors for risk signals, per SolCred’s DeFi behavior analysis.

-

Collateralization History: Tracks past loan-to-value ratios and liquidation events to predict default risk.

-

Smart Contract Risk Exposure: Gauges interactions with audited vs. risky contracts, highlighting vulnerability in SolCred models.

Credos pushes further, blending offchain signals like Chainlink oracles for hybrid scores, though purists argue pure onchain trumps all for verifiability. Lenders set dynamic rates: prime scores snag 5% APR, risky ones pay 15%. Loopscale’s orderbook model supercharges this, letting lenders bid custom LTVs based on scores, ditching rigid pools for precise matching.

Real-World Impact: Protocols Leading the Charge

FairLend and Credos anchor Solana’s under-collateralized wave, but SolCred steals headlines with its whitepaper-backed system. Deployed live, it underwrites $50 million in loans at under 100% collateral, yielding lenders 12% average returns versus 8% in overcollateralized setups. RociFi’s Polygon success hints at Solana ports, analyzing fraud and reputation for seamless bridges.

Loopscale complements this by introducing orderbook lending on Solana, where lenders post limit orders tied to score thresholds, achieving 20% better capital utilization than pool models. Early metrics from Solana Compass show $100 million matched in Q1 2026, with defaults under 2% for scores above 750. This precision matching underscores how onchain risk scores Solana protocols turn raw blockchain data into actionable lending edges.

Metrics That Matter: Yield and Default Benchmarks

Lenders chasing yields favor under-collateralized setups for their asymmetry: same risk, higher returns. SolCred reports 12-15% APRs on scored loans versus 7-9% overcollateralized, backed by 40% lower default rates from Providence-integrated profiles. FairLend’s FairScore, drawing from Solana Program Library interactions, flags 15% more risky wallets preemptively. Credos experiments with hybrid models, pulling Chainlink feeds for volatility-adjusted scores, though oracle risks linger. Across these, TVL efficiency jumps 50%, freeing billions for productive DeFi use rather than idle collateral.

Comparison of Solana Under-Collateralized Lending Protocols

| Protocol | TVL | APR/Yield | Default Rate | LTV | Key Features |

|---|---|---|---|---|---|

| SolCred | $50M | 12% | 1.5% | N/A | Real-time on-chain credit scoring with ML, transaction history, DeFi behavior |

| FairLend | N/A | 11% | N/A | up to 90% | FairScore on-chain risk assessment |

| Credos | N/A | 13% | N/A | N/A | Hybrid on-chain/off-chain scores |

| Loopscale | N/A | N/A | N/A | N/A | Orderbook model, 20% utilization boost, customizable terms |

These figures aren’t hype; they’re audited onchain, verifiable via Dune dashboards. Yet, skeptics highlight pitfalls: pro-cyclical biases amplify downturns, as falling asset values tank scores indiscriminately. ChainScore Labs warns of oracle manipulations skewing inputs, potentially inflating bad loans. Solana’s speed mitigates some latency issues, but incomplete data from new wallets remains a blind spot, favoring established players.

Navigating Risks: Building Resilient Scores

Robustness demands layered defenses. Protocols like SolCred incorporate sybil resistance via interaction depth scoring, while Providence’s 60 billion transaction dataset dwarfs Ethereum rivals, capturing Solana-specific patterns like high-velocity trades. Lenders mitigate via dynamic LTVs: 80% for 800 and scores, dropping to 50% below 600. Insurance pools, funded by yield premia, cover 70% of projected losses, per GARP risk frameworks adapted for DeFi.

FairLend and Credos innovate here too. FairLend’s epoch-updated FairScore reacts to Solana’s 400ms blocks, refreshing risks in seconds. Credos layers reputation from cross-protocol repayments, rewarding consistent borrowers with escalating limits. Loopscale’s granular orders let markets price risks directly, echoing CeFi sophistication without centralization. This evolution positions under-collateralized lending Solana as a yield powerhouse, outpacing Ethereum’s clunkier models.

Looking ahead, integration with Solana’s Firedancer upgrade promises sub-100ms scoring, unlocking flash loans with credit checks. As TVL swells past $5 billion, expect FairLend, Credos, and peers to dominate, blending DeFi reputation credit scores with orderbook precision for a collateral-light future. Lenders gain yields; borrowers, access; the ecosystem, efficiency. Onchain risk scores aren’t just tools, they’re the unlock for Solana DeFi’s next growth phase.