Decentralized Finance (DeFi) lending platforms have become a cornerstone of crypto markets, enabling lenders to earn yield and borrowers to access liquidity without intermediaries. Yet as the sector grows, so does the complexity of risk management. Recent market volatility and evolving regulatory scrutiny have made it clear: effective risk assessment is no longer optional for DeFi lenders. Leveraging on-chain risk assessment tools is now essential to minimize defaults, optimize loan portfolios, and maintain trust in a landscape where Aave (AAVE) currently trades at $299.63 following a 1.42% daily dip.

Integrate Multi-Factor On-Chain Risk Scoring Models

The first pillar of robust DeFi lending is the integration of multi-factor on-chain risk scoring models. Unlike traditional credit checks, these models combine decentralized identity (DID), wallet behavior analytics, and historical repayment data to generate nuanced borrower profiles in real time. DID frameworks empower users to build reputational capital across protocols while preserving privacy, and wallet analytics flag behavioral anomalies that may indicate elevated risk. Historical repayment data – immutable and transparent on-chain – further strengthens predictive accuracy.

Leading industry guidelines, such as those from the Enterprise Ethereum Alliance (EEA DeFi Risk Assessment Guidelines), emphasize that combining multiple data points reduces false positives and enables more equitable access to under-collateralized credit.

Continuously Monitor Borrower Wallet Activity

Static snapshots are insufficient in today’s dynamic crypto environment. Lenders must deploy automated monitoring tools that track borrower wallets for suspicious transactions, sudden asset withdrawals, or interactions with sanctioned addresses. Real-time alerts allow lenders to act swiftly at the earliest signs of default or illicit activity, preserving capital before losses compound.

This practice aligns with recommendations from both regulatory bodies and technical experts: continuous surveillance is critical for anti-money laundering (AML) compliance and for detecting sophisticated attack vectors unique to DeFi protocols (Sanctions.io AML Compliance Guide). By integrating these monitoring systems directly into loan origination workflows, lenders can ensure ongoing vigilance without sacrificing user experience.

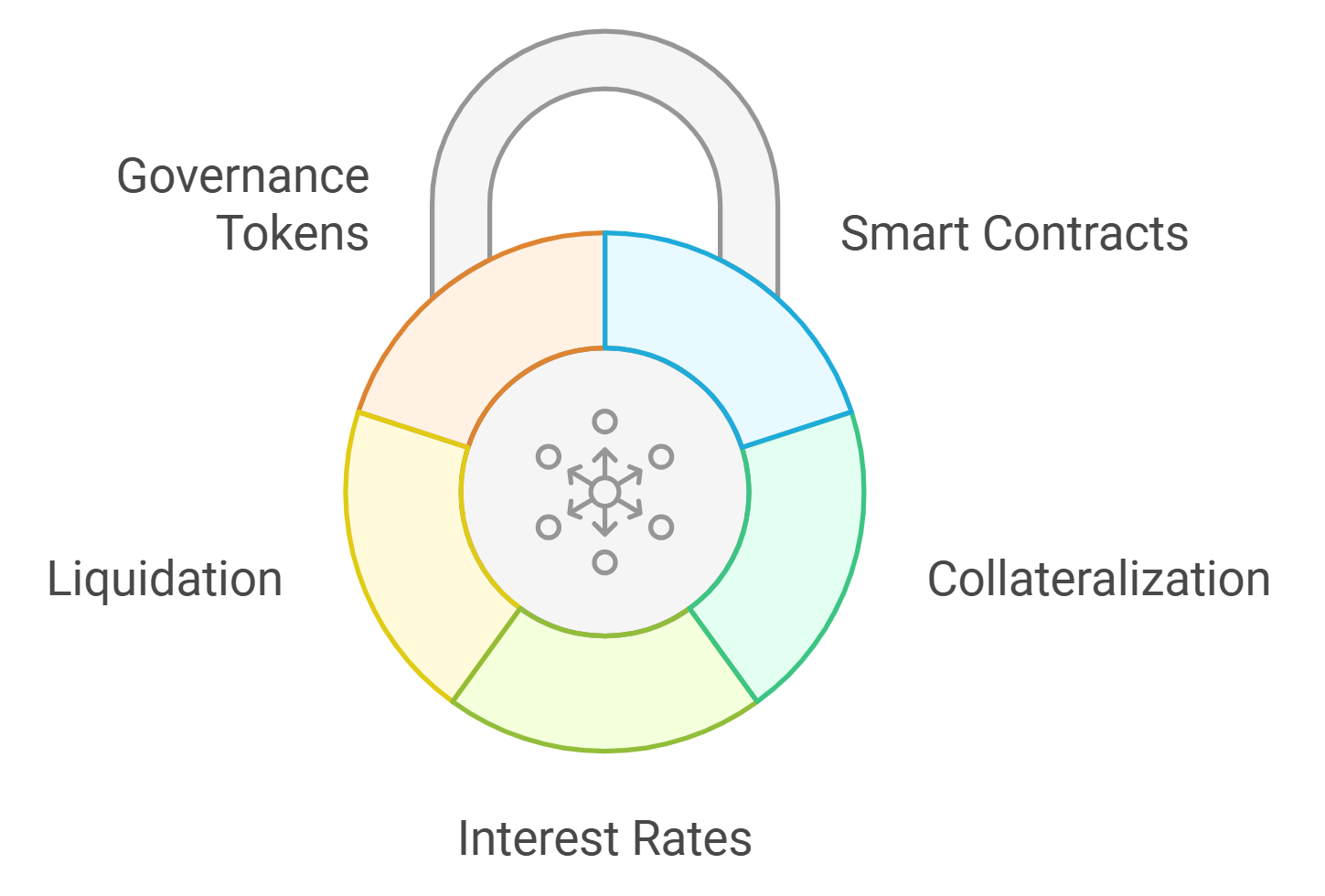

Implement Dynamic Loan-to-Value (LTV) Ratios Based on Risk Scores

Traditional finance often relies on fixed collateral requirements – but DeFi’s transparency allows for far more responsive mechanisms. By tying loan-to-value ratios directly to each borrower’s live on-chain risk score, lenders can dynamically adjust collateral demands or interest rates as user profiles evolve. For example, a borrower with strong DID credentials and consistent repayment history may qualify for lower collateralization thresholds or better rates; conversely, increased volatility or risky wallet activity can trigger higher requirements instantly.

This approach not only protects against sudden defaults but also incentivizes good behavior among borrowers seeking more favorable terms. Dynamic LTV management has been highlighted by sources like GARP (Risk Management: DeFi Lending and Borrowing) as foundational for institutional-grade lending protocols.

Top 5 Best Practices for DeFi Lenders Using On-Chain Risk Tools

-

Integrate Multi-Factor On-Chain Risk Scoring Models: Combine decentralized identity (DID), wallet behavior analytics, and historical repayment data to develop robust, real-time borrower risk profiles. This holistic approach enables lenders to assess creditworthiness more accurately and adapt to evolving borrower behavior. Platforms like Chainlink and Galaxy’s SeC FiT PrO are pioneering such risk frameworks in DeFi.

-

Continuously Monitor Borrower Wallet Activity: Set up automated alerts for suspicious transactions, sudden asset withdrawals, or interactions with sanctioned addresses to detect early warning signs of default or illicit activity. Tools like OpenZeppelin Defender and Tenderly provide real-time monitoring and alerting for on-chain events.

-

Implement Dynamic Loan-to-Value (LTV) Ratios Based on Risk Scores: Adjust collateral requirements and interest rates in real time according to the borrower’s updated on-chain risk assessment, reducing exposure to high-risk borrowers. Leading DeFi platforms like Aave and Compound use dynamic LTV mechanisms to optimize lending safety.

-

Utilize Decentralized Oracles and Third-Party Risk Feeds: Incorporate reputable oracle services and external risk intelligence providers to validate borrower information and market conditions, enhancing the accuracy of credit decisions. Chainlink and API3 are widely used decentralized oracle networks for secure data feeds.

-

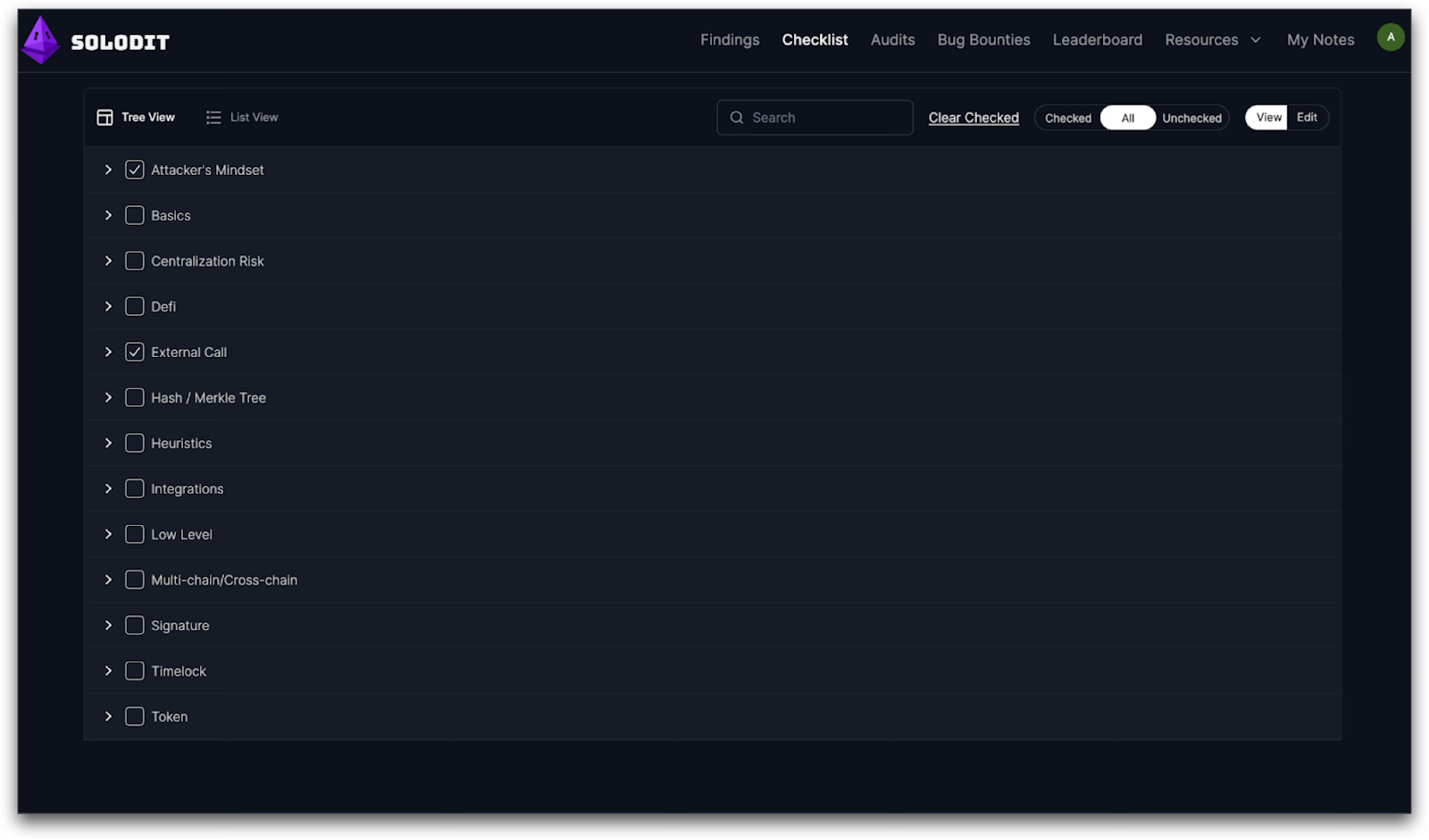

Regularly Audit Smart Contracts and Assessment Algorithms: Engage third-party security experts for periodic reviews of lending protocols and risk scoring tools to ensure transparency, compliance, and resilience against evolving threats. Firms such as Trail of Bits and ConsenSys Diligence are leaders in DeFi smart contract auditing.

Risk mitigation in DeFi lending is not a one-time event but an ongoing discipline. As the on-chain environment evolves, lenders must adapt by integrating advanced tools and processes that prioritize agility, transparency, and security. The following best practices form the backbone of a disciplined approach to crypto loan management in 2025.

Utilize Decentralized Oracles and Third-Party Risk Feeds

Making informed credit decisions requires access to accurate, tamper-resistant data. Decentralized oracles aggregate price feeds and protocol metrics from multiple sources, minimizing the risk of manipulation that can occur with centralized data providers. By integrating reputable oracle services alongside third-party risk intelligence feeds, DeFi lenders can validate borrower information and monitor shifting market conditions in real time.

This dual-layered verification is crucial when managing under-collateralized lending portfolios. For example, sudden market swings impacting Aave (AAVE): currently priced at $299.63: can be detected instantly through robust oracle networks, allowing protocols to adjust parameters before systemic risks escalate. The technical underpinnings of this approach are detailed in frameworks like Chainrisk’s DeFi Lending and Borrowing Risk Framework, which highlights the role of external data providers in strengthening protocol resilience.

Regularly Audit Smart Contracts and Assessment Algorithms

Even the most sophisticated risk models are only as reliable as the code they run on. Regular audits of both smart contracts and proprietary assessment algorithms are non-negotiable for any serious DeFi lender. Engaging independent security experts ensures that vulnerabilities are identified before they can be exploited, whether these lie in lending logic or the mechanisms underpinning dynamic LTV adjustments.

Transparent audit trails not only satisfy compliance requirements but also build trust among institutional partners and retail users alike. This is especially relevant as regulatory focus sharpens around DeFi self-regulation proposals (SEC.gov: DeFi Self-Regulation Proposal). Proactive auditing practices help platforms stay ahead of emerging threats while demonstrating a commitment to operational integrity.

Cross-Protocol Risk Management: Building a Resilient Portfolio

Effective risk management extends beyond individual loans or users, it encompasses portfolio-wide strategies that account for interdependencies across protocols and assets. By synthesizing insights from multi-factor scoring models, wallet monitoring systems, dynamic LTV engines, decentralized oracles, and regular audits, lenders create a holistic defense against both known and emergent risks.

This integrated methodology is increasingly recognized as industry standard among leading practitioners and is echoed throughout current research from Moody’s (Block by Block: Assessing Risk in Decentralized Finance). Lenders who combine these best practices not only reduce default rates but also position themselves for sustainable growth as institutional adoption accelerates.

Discipline remains paramount: In an ecosystem where market conditions can shift rapidly, as reflected by Aave’s recent 1.42% daily dip, staying methodical with risk assessment is essential for long-term success.