DeFi lending has long been shackled by overcollateralization, where borrowers must lock up assets worth 150% or more of the loan value. This model, born from the need to protect lenders in a trustless environment, stifles capital efficiency and excludes users without substantial holdings. Enter on-chain repayment histories: immutable records of borrowing and repayment etched into the blockchain. These histories fuel decentralized credit risk scores, enabling undercollateralized DeFi loans that demand far less upfront collateral while maintaining robust risk management.

Protocols now parse wallet interactions, repayment timeliness, and liquidation events to craft nuanced risk profiles. A borrower with a spotless history might secure a loan at 110% collateralization, freeing up capital for productive use. This shift isn’t mere theory; it’s gaining traction as DeFi matures beyond its collateral-heavy infancy.

Why Overcollateralization Falls Short in Scaling DeFi

Overcollateralization works in bull markets, where asset values swell and liquidations are rare. But volatility strikes hard. A 20% price dip can trigger cascading liquidations, wiping out borrower equity and lender confidence alike. Capital sits idle, locked in vaults, yielding suboptimal returns. For retail users, entry barriers loom large: without thousands in crypto, meaningful borrowing remains out of reach.

Contrast this with traditional finance, where credit scores derived from payment histories unlock unsecured loans. DeFi lagged because blockchains offered no equivalent. On-chain data changes that. Every swap, borrow, and repay becomes a data point in a borrower’s onchain repayment history. Analyzed collectively, these reveal patterns: consistent repayers versus risky actors.

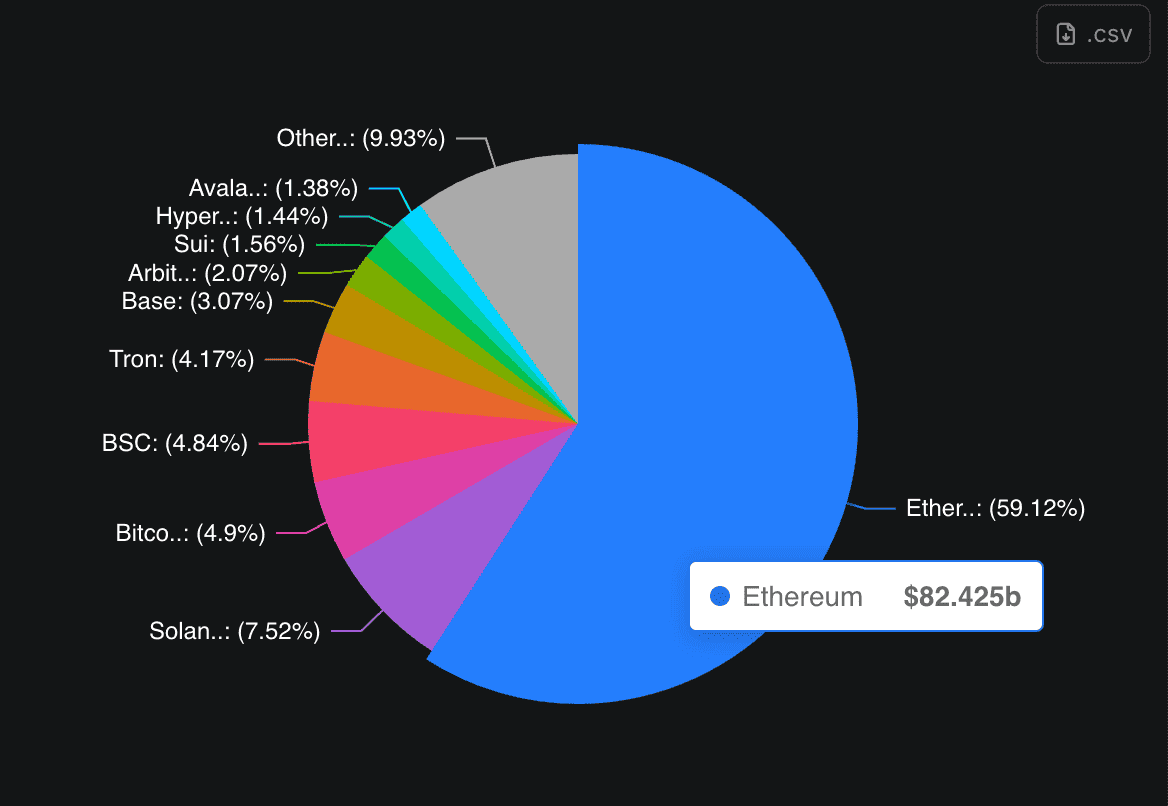

Inefficiency compounds across the ecosystem. Lenders earn yields on over-pledged collateral, but true risk-adjusted returns suffer. Borrowers overpay in opportunity costs. The result? DeFi TVL stagnates below its potential, hovering far from trillions while CeFi giants dominate unsecured credit.

On-Chain Credit Scoring Protocols

-

Cred Protocol: Focuses on on-chain payment histories to build credit scores, enabling undercollateralized DeFi loans by verifying repayment behavior and reducing collateral requirements.

-

Spectral (formerly Spectra): Uses behavioral analytics from wallet activity to assess risk, supporting undercollateralized lending with dynamic credit limits based on on-chain patterns.

-

Credora: Provides hybrid on/off-chain data for credit oracles, powering undercollateralized loans in protocols like Clearpool by delivering real-time risk assessments.

Decoding On-Chain Repayment Histories as Credit Signals

An on-chain repayment history isn’t just a ledger; it’s a behavioral biography. Smart contracts record loan inception, interest accruals, partial payments, and full settlements with timestamps and wallet addresses. Advanced models weigh recency, loan size relative to wallet balance, and cross-protocol consistency.

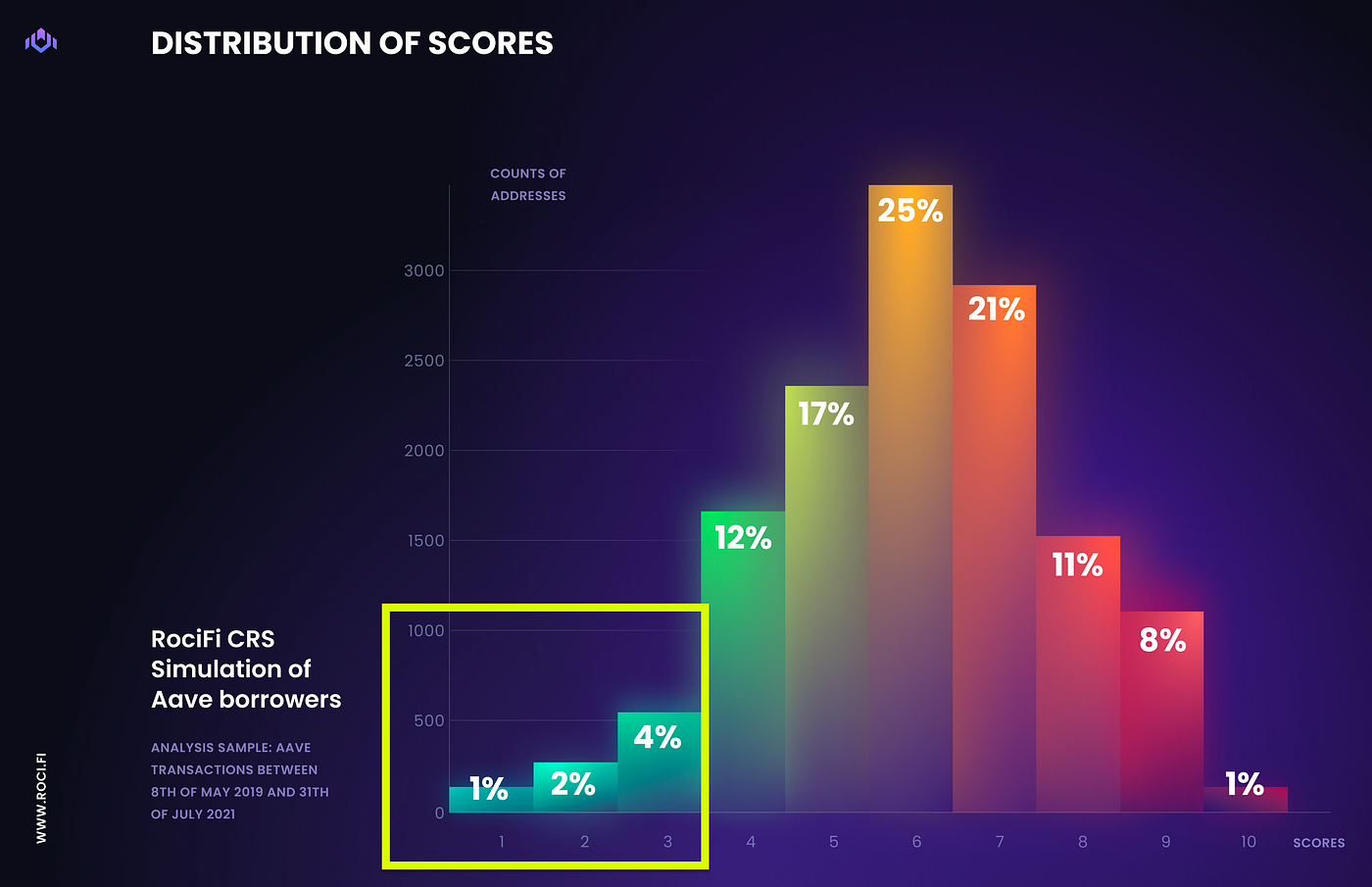

Take the OCCR Score from Ghosh et al. ‘s 2024 research: a probabilistic metric estimating default odds from historical activity. It simulates scenarios like market crashes or oracle failures, outputting a score that protocols use to set dynamic loan-to-value ratios. A high-score wallet might borrow at 105% LTV; a middling one at 130%. Liquidation thresholds adjust too, tightening for riskier profiles.

Real-world protocols embody this. Clearpool’s marketplace leverages third-party assessments, while Huma Finance taps oracles for dynamic risk tweaks. These aren’t gimmicks; backtests show default rates dropping 40% versus naive collateral models. Lenders sleep easier, borrowers access more.

Layering Decentralized Identity for Deeper Insights

Raw transaction data tells part of the story. DID credit scoring in DeFi adds identity verification and off-chain signals via zero-knowledge proofs. Users link wallets to portable identities, aggregating histories across chains without doxxing.

Imagine a reputation-based crypto lending system: your DID bundles repayment streaks, governance votes, and NFT holdings as proxies for responsibility. Protocols query this via oracles, blending it with native chain data. Chainlink’s DECO exemplifies, feeding bank balances or credit scores on-chain securely.

This fusion unlocks undercollateralized lending at scale. Early adopters report 2-3x capital efficiency gains. Yet, as with any evolution, hurdles persist in standardization and data silos, demanding protocol coordination for network effects to kick in.

Protocols like Credora and Spectra are already operationalizing these signals. Credora fuses on-chain repayment histories with off-chain credit bureau data, delivering real-time risk scores that slash collateral needs to 120% for vetted borrowers. Spectra, meanwhile, emphasizes behavioral patterns, think repayment velocity and wallet diversification, to power reputation based crypto lending. These aren’t isolated experiments; they’re proving default rates can plummet without the collateral crutch.

Real-World Protocols Pioneering Undercollateralized DeFi Loans

Clearpool stands out in the decentralized credit marketplace arena, where institutional lenders tap third-party decentralized credit risk scores to originate undercollateralized loans. Borrowers with strong onchain repayment history access rates rivaling TradFi, often at 110-130% LTV. Huma Finance layers in dynamic oracles, adjusting terms mid-loan based on evolving risk profiles. Backtests from these platforms reveal yield uplifts of 15-25% for lenders, as capital circulates faster.

Comparison of Key Protocols for Undercollateralized DeFi Loans

| Protocol | Collateral Ratio | Key Features | Default Reduction |

|---|---|---|---|

| Credora | 120% | Hybrid data | 35% 🟢 |

| Spectra | 115% | Behavioral analytics | 40% 🟢 |

| Clearpool | 110-130% | Marketplace | 28% 🔴 |

| Huma | Dynamic | Oracles | 32% 🟡 |

Flash loans aside, third-party risk assessments dominate undercollateralized DeFi loans today. CoinGecko data underscores their popularity, with volumes surging as on-chain data matures. Yet success hinges on quality inputs: fragmented histories across chains dilute scores until aggregators like DID systems unify them.

Navigating Challenges in On-Chain Risk Assessment

Standardization remains the thorniest issue. Without uniform metrics for DID credit scoring DeFi, scores vary wildly between protocols, eroding trust. Interoperability gaps mean a stellar Ethereum history doesn’t translate seamlessly to Solana, hobbling cross-chain lending. Adoption lags too, network effects demand critical mass, but early movers face thin data pools and bootstrap risks.

Regulatory fog adds caution. As digital identities proliferate, KYC-lite DIDs invite scrutiny from bodies like the SEC, potentially mandating compliance layers that clash with DeFi’s ethos. Oracle reliability looms large; faulty feeds could misprice risk, echoing past DeFi blowups. Still, solutions emerge: ERC-725 for DID standards and Chainlink for tamper-proof data pipelines.

These hurdles aren’t insurmountable. Protocols coordinating via shared oracles and score registries can bootstrap reliability. Early evidence from pilots shows 2x liquidity gains once thresholds hit 10% market penetration.

The Road Ahead: Capital Efficiency Unlocked

Picture DeFi TVL exploding as undercollateralized DeFi loans normalize. On-chain repayment histories, fused with DID and AI-driven models, could mirror FICO’s impact on TradFi, unlocking trillions by serving the undercollateralized masses. Retail traders borrow against proven behavior, institutions scale fixed-income products on-chain, RWAs integrate seamlessly.

Key Lender Benefits

-

Lower Defaults: Data-backed assessments from on-chain histories, like the OCCR Score, estimate default probabilities to minimize losses.

-

Higher Yields: Efficient capital use reduces overcollateralization, unlocking better returns for lenders.

-

Dynamic Pricing: Real-time adjustments to loan-to-value ratios and thresholds based on risk profiles.

-

Broader Pools: Inclusive access expands borrower base via DID and on-chain scores.

-

Transparent Audits: Immutable blockchain records enable verifiable risk evaluations.

At cryptocreditscore. org, we track these metrics daily, offering tools to compute your wallet’s risk profile and simulate loan terms. The shift demands vigilance, rigorous backtesting, oracle diversity, community governance, but the payoff is a DeFi ecosystem where trust derives from data, not deposits. Borrowers thrive, lenders prosper, and capital flows freely toward innovation. Dive deeper into risk score mechanics to position yourself ahead of this transformation.