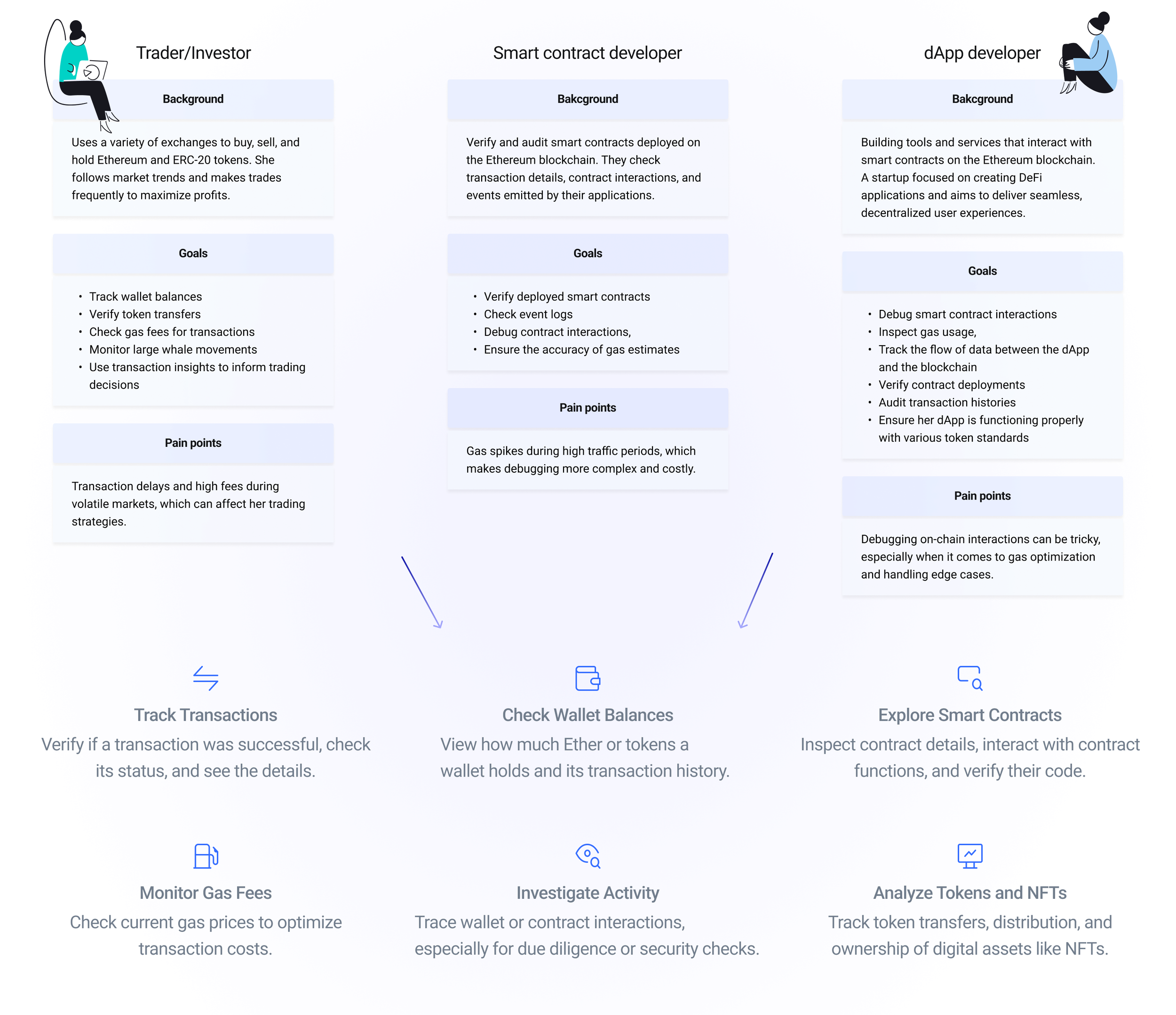

Decentralized finance (DeFi) lending is undergoing a seismic shift as onchain risk scores mature from simple credit proxies into robust, programmable risk intelligence. No longer confined to blunt overcollateralization, DeFi protocols are now leveraging blockchain-native data to unlock under-collateralized lending, dynamic loan terms, and real-time risk management. This transformation is not just technical – it’s fundamentally reshaping how capital flows through crypto markets and how trust is established between pseudonymous actors.

From Static Credit Scores to Programmable Risk Intelligence

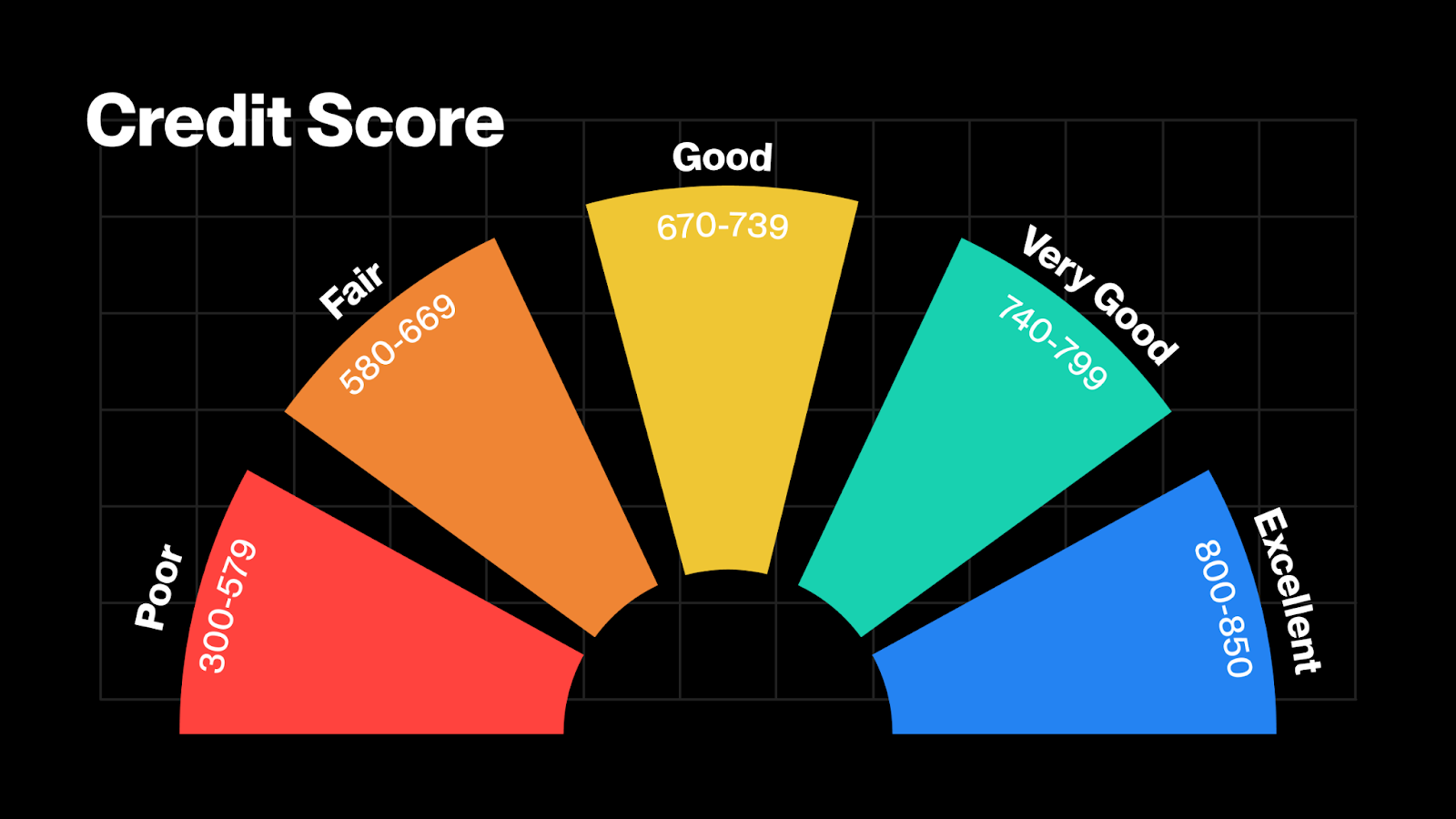

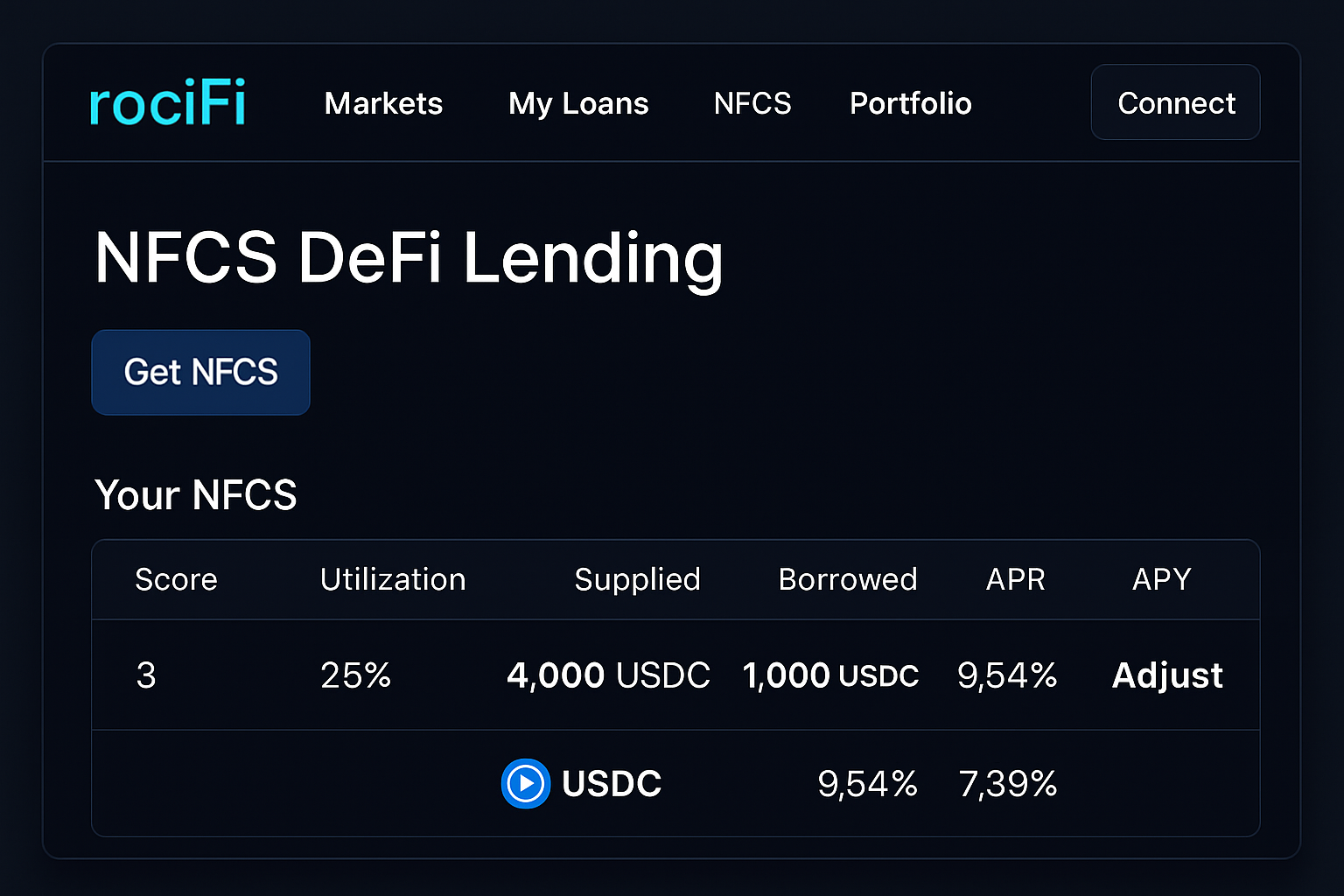

Traditional credit scoring relies on opaque, centralized data and backward-looking models. In contrast, onchain risk scores synthesize transparent transaction histories, wallet behaviors, protocol interactions, and even peer-backed borrower networks. Platforms like RociFi have pioneered the Non-Fungible Credit Score (NFCS), which assigns users a score from 1 to 10 based on their likelihood of repaying under-collateralized loans. These scores aggregate activity from major protocols such as Aave and Compound, providing a holistic picture of user reliability.

This evolution enables programmable risk intelligence: smart contracts can automatically adjust loan-to-value ratios, interest rates, or liquidation thresholds based on real-time borrower profiles. The result? DeFi lending platforms can offer tailored terms that better reflect actual user risk – not just one-size-fits-all collateral demands.

The Capital Efficiency Revolution in DeFi Lending

The implications for capital efficiency are enormous. Historically, most DeFi lending required borrowers to lock up more collateral than the value of their loan – a model that limited participation and left trillions in potential liquidity untapped (learn more about under-collateralized crypto loans). With onchain risk scores guiding decisions, high-quality borrowers can now access higher loan-to-value ratios while lenders get programmable protection against default.

Top 5 Benefits of Onchain Risk Scores in DeFi Lending

-

Enables Under-Collateralized Lending: Onchain risk scores, such as RociFi’s Non-Fungible Credit Score (NFCS), allow DeFi platforms to offer under-collateralized loans by accurately assessing borrower risk based on blockchain activity, moving beyond traditional over-collateralization models.

-

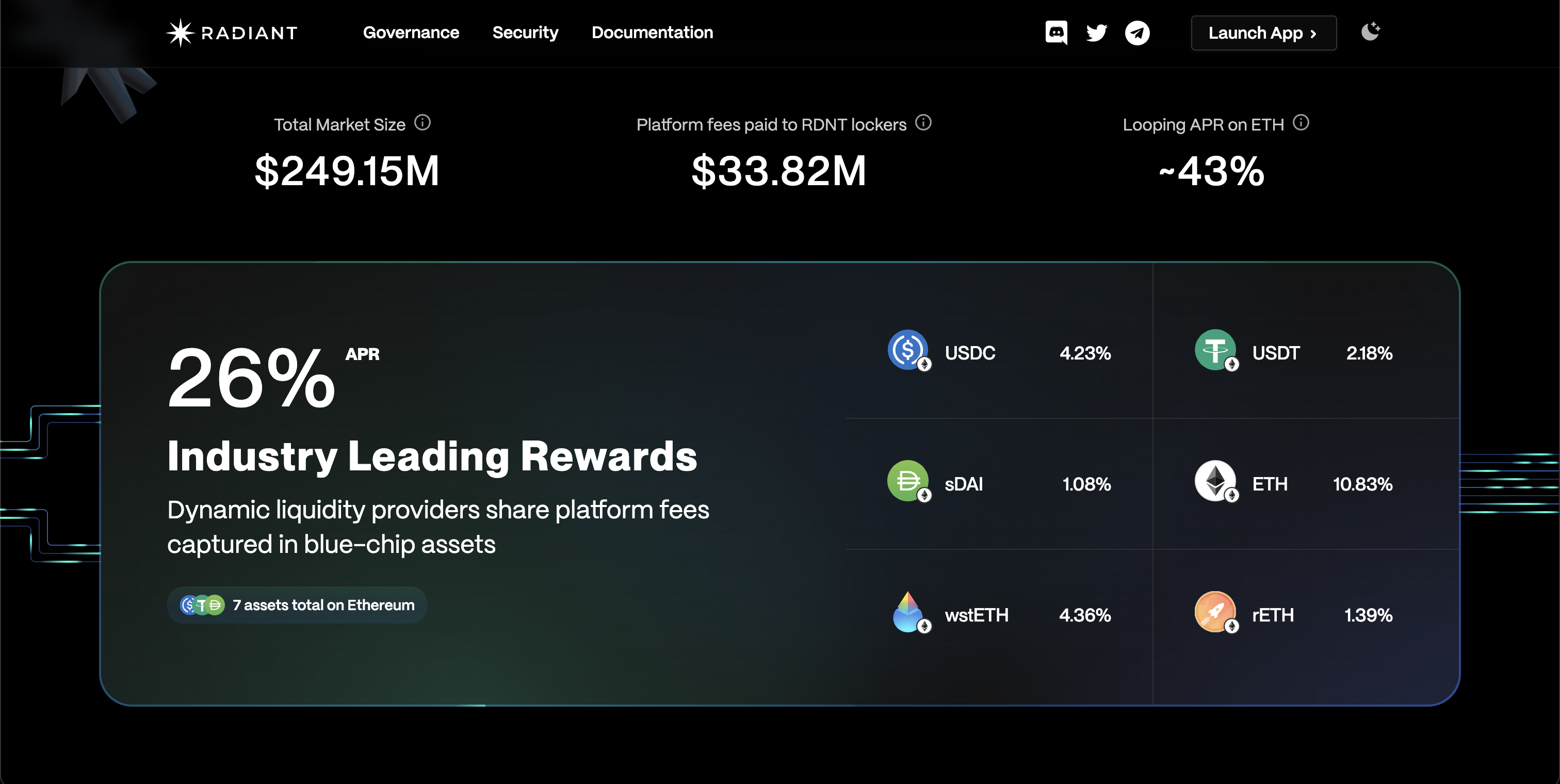

Boosts Capital Efficiency: By aligning loan terms with individual risk profiles, platforms like Radiant Capital can provide higher loan-to-value (LTV) ratios to trustworthy borrowers, maximizing the productive use of capital within the ecosystem.

-

Improves Transparency and Trust: Onchain risk assessments are derived from publicly accessible blockchain data, ensuring transparent and tamper-resistant evaluations that foster greater trust between lenders and borrowers.

-

Enables Programmable and Dynamic Risk Management: Smart contracts can automatically adjust interest rates, collateral requirements, and liquidation thresholds in real time, based on up-to-date risk scores, enhancing platform resilience and adaptability.

-

Expands Financial Inclusion: By leveraging decentralized identity and onchain behavior, these risk scores provide access to credit for users without traditional credit histories, opening DeFi lending to a broader global audience.

This shift is already visible in platforms like Radiant Capital, where RociFi’s NFCS enables dynamic loan terms that reward trustworthy behavior with better rates and lower collateral requirements. As capital becomes more efficiently allocated based on real-time user data rather than static collateral ratios alone, both sides of the market benefit: lenders see reduced losses while borrowers gain access to flexible financing options previously reserved for the traditional banking elite.

How Onchain Data Powers Smarter Risk Modeling

The backbone of these advances is the tamper-resistant transparency of blockchain data. Every wallet interaction – from liquidity provision to timely repayments – feeds into sophisticated models that quantify creditworthiness probabilistically rather than deterministically. The On-Chain Credit Risk Score (OCCR Score), detailed in recent research (see further analysis here), exemplifies this approach by weighting multiple behavioral signals across protocols.

This granular modeling allows for innovations like:

- Peer-backed borrower graphs: Mapping relationships between wallets to infer trust networks

- DAO-tuned yield ceilings: Adjusting maximum yields dynamically based on aggregate portfolio risk

- Stablecoin correlation triggers: Automating liquidation or margin calls when stablecoin prices deviate beyond set thresholds

Together these tools create a more resilient ecosystem where risks are surfaced early and managed proactively – all without sacrificing the openness or composability that make DeFi unique.

As programmable risk intelligence matures, the boundaries of what’s possible in decentralized lending are expanding rapidly. DeFi lending risk modeling is no longer theoretical; it’s being operationalized by protocols that integrate real-time onchain data, AI-driven analytics, and user-centric privacy controls. This convergence is setting new standards for both borrower inclusion and lender protection.

AI Integration and Next-Gen Risk Management

The next frontier for onchain risk scores is the fusion of blockchain transparency with artificial intelligence. By leveraging AI, DeFi platforms can analyze complex behavioral patterns, flag anomalous activity instantly, and even personalize loan offers down to the individual wallet. Platforms are already experimenting with AI-powered dynamic collateralization, where a user’s loan terms shift automatically as their onchain reputation evolves. The result is a lending environment that adapts in real time to both market volatility and individual borrower actions.

This approach also enhances security: automated systems can detect coordinated attacks or risky behaviors before they escalate into protocol-wide issues. For lenders, this means less exposure to tail risks; for borrowers, it translates to fairer access based on merit rather than arbitrary thresholds.

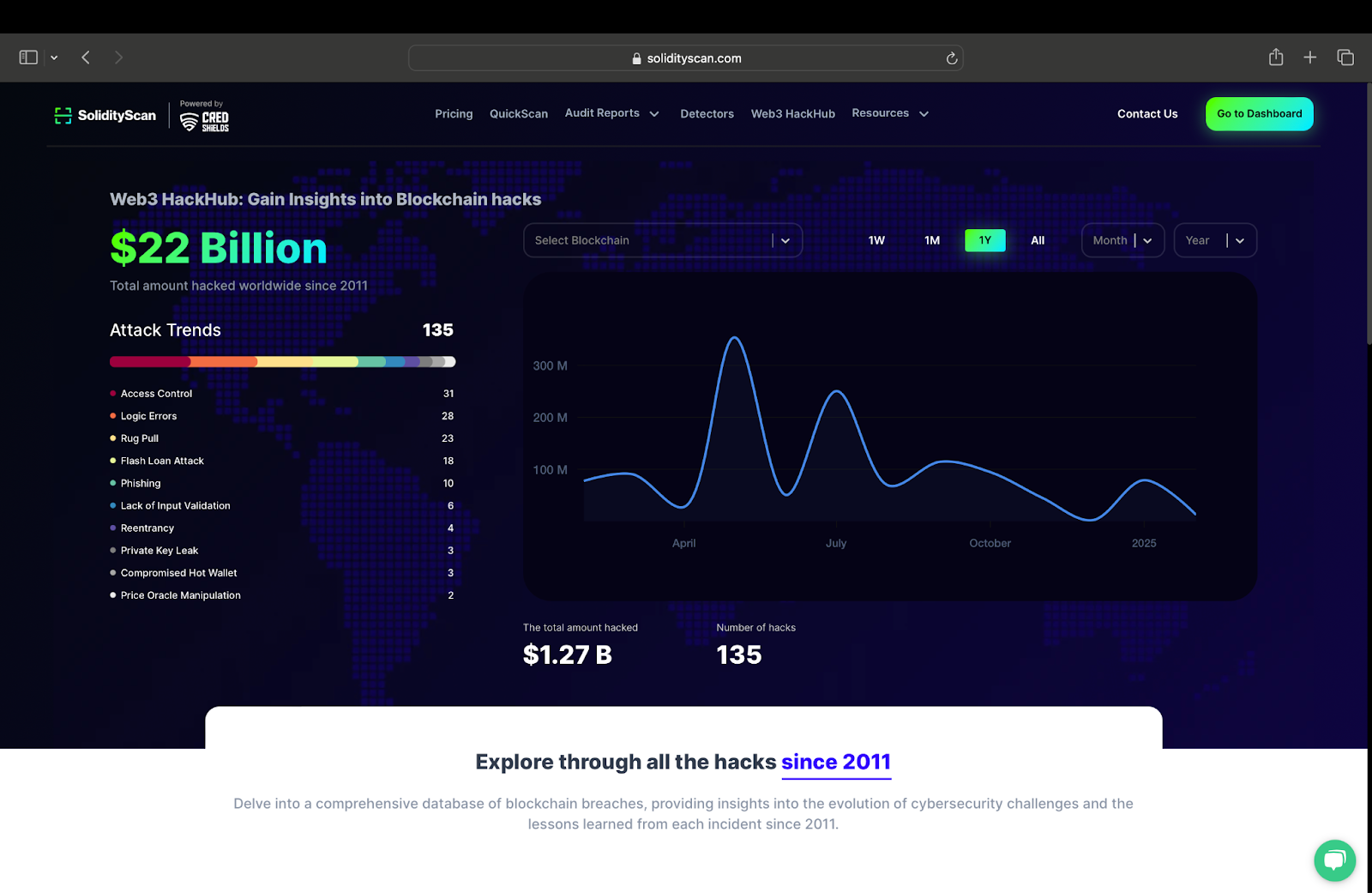

Challenges and the Road Ahead

Despite these advances, several hurdles remain before onchain risk scores become ubiquitous. Data privacy is a key concern, while blockchain is transparent by design, users still need assurances that their financial histories won’t be misused or deanonymized. Protocols are responding with privacy-preserving technologies such as zero-knowledge proofs and decentralized identity frameworks, giving users more control over their data.

Another challenge is standardization. With multiple scoring models emerging across platforms, the industry needs common benchmarks so lenders can compare risk profiles reliably across protocols. Open-source initiatives and cross-protocol collaborations are underway to address this gap and ensure interoperability without sacrificing innovation.

The Opportunity: Trillions in Untapped Liquidity

If these challenges are met head-on, the impact could be transformative. By enabling under-collateralized lending at scale, programmable risk intelligence has the potential to unlock trillions of dollars in dormant crypto assets, capital that’s currently sidelined due to blunt collateral requirements or lack of trust between counterparties.

Key Hurdles to Mainstream Onchain Credit Scoring Adoption

-

Data Privacy Concerns: Onchain risk scores rely on transparent blockchain data, raising privacy issues for users who may not want their financial histories publicly accessible. Balancing transparency with privacy remains a significant challenge.

-

Risk of Manipulation: Borrowers may attempt to game onchain metrics by creating artificial transaction histories or using multiple wallets, undermining the reliability of credit assessments.

-

Limited Offchain Data Integration: Most current systems, such as RociFi‘s NFCS, primarily assess onchain activity, missing valuable offchain financial data that could enhance creditworthiness evaluations.

-

Regulatory Uncertainty: Evolving regulations around decentralized identity and financial data create uncertainty for platforms aiming to integrate onchain credit scoring at scale.

-

User Education and Trust: Many potential users lack familiarity with programmable risk intelligence and may distrust automated, blockchain-based credit scoring methods, slowing mainstream adoption.

The ripple effects would extend far beyond crypto-native markets: improved capital efficiency could catalyze new forms of peer-to-peer finance, enable DAOs to deploy treasuries more productively, and give global users access to credit products that were previously out of reach.

Programmable risk intelligence isn’t just about minimizing losses, it’s about building a more inclusive financial system where opportunity flows as freely as information.

Lenders who embrace these tools will not only reduce their downside, they’ll gain first-mover advantage in an ecosystem poised for exponential growth. Borrowers who build strong onchain reputations will find themselves welcomed into a new era of open finance where trust is earned transparently rather than assumed by default.