Picture this: you want to borrow in DeFi, but you don’t have a whale-sized stash of crypto to lock up as collateral. Traditionally, that’s been a dealbreaker. But 2025 is shaping up to be the year when onchain risk scores flip the script on under-collateralized lending, finally making DeFi more accessible and capital-efficient for everyone, not just the well-heeled.

Why Over-Collateralization Holds DeFi Back

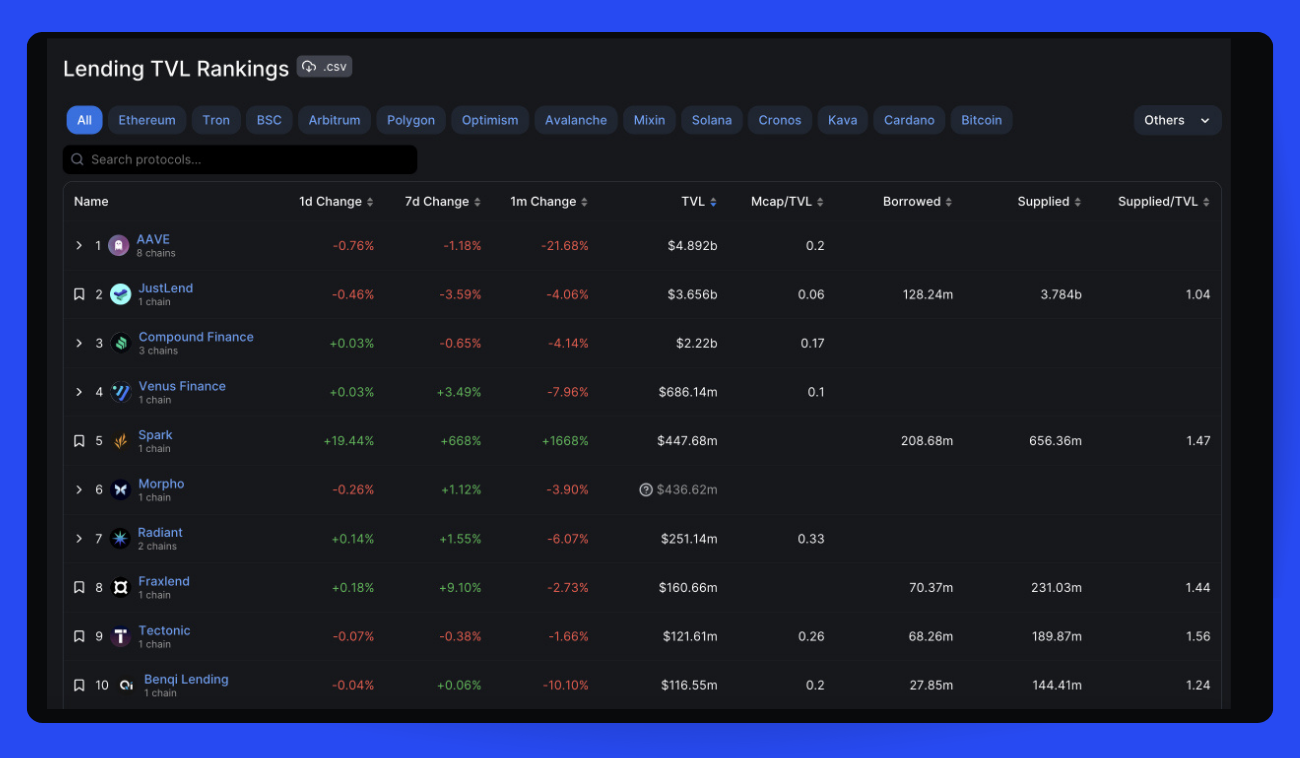

Let’s get real: over-collateralization is both a blessing and a curse. Sure, it protects lenders by requiring borrowers to deposit more than they borrow (sometimes 150% and ), but it also locks out users who don’t have deep pockets. This system ties up billions in idle assets, stifling innovation and limiting the reach of decentralized finance.

The solution? Onchain risk scores. Instead of relying solely on how much crypto you can cough up, these scores analyze your wallet’s behavior, repayment history, transaction patterns, activity across protocols, to assess your creditworthiness. The result is a seismic shift from asset-based to reputation-based lending.

The Rise of Onchain Credit Scoring Protocols

Protocols like RociFi and Spectral Finance are leading the charge with innovative approaches:

Key Features of RociFi and Spectral Finance’s Onchain Credit Models

-

Decentralized Identity (DID) Integration: RociFi leverages decentralized identity solutions to tie credit scores to wallet addresses, ensuring privacy and eliminating the need for traditional KYC processes.

-

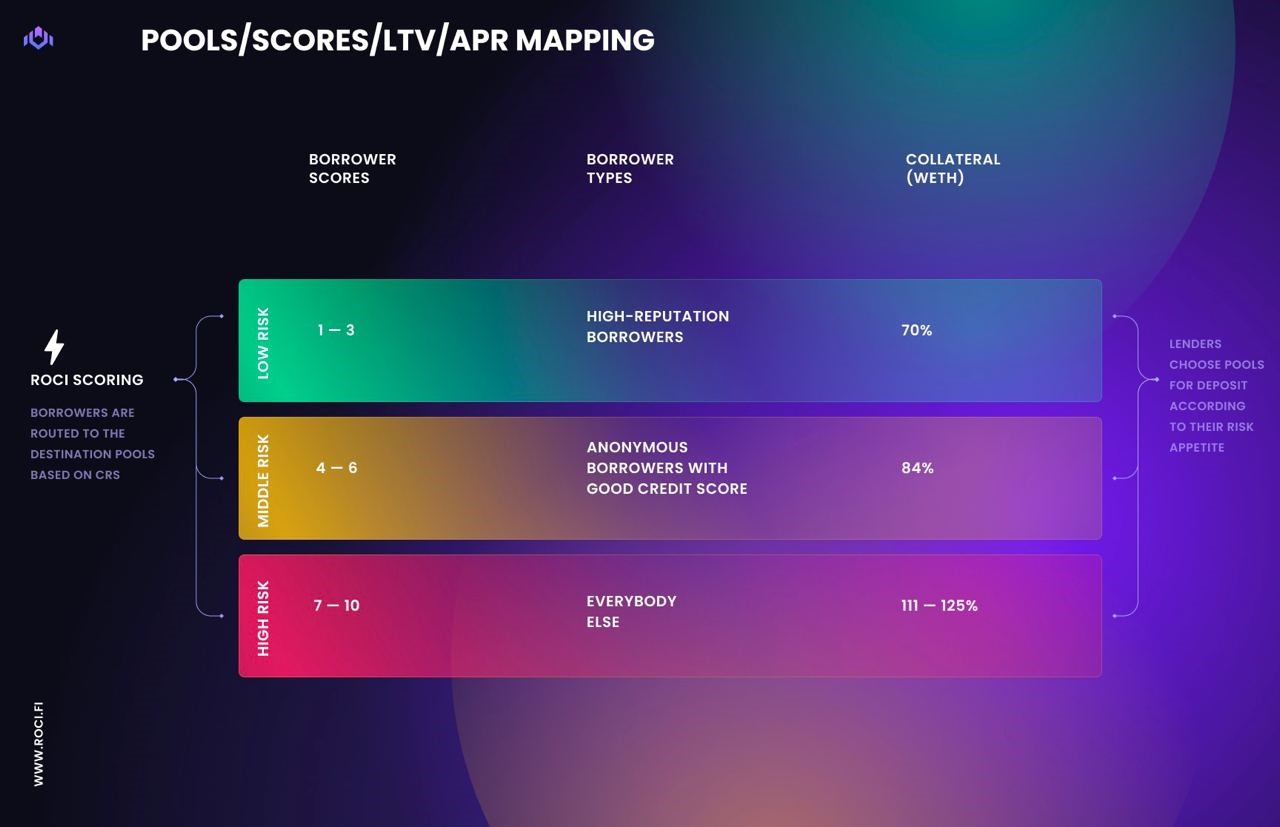

Non-Fungible Credit Scores (NFCS): RociFi issues credit scores as non-fungible tokens, ranging from 1 (lowest risk) to 10, allowing for transparent and portable creditworthiness across DeFi platforms.

-

Multi-Asset Credit Risk Oracle (MACRO) Score: Spectral Finance offers a standardized credit score (300-850), similar to traditional credit ratings, derived from on-chain transaction and repayment histories.

-

Dynamic, Data-Driven Risk Assessment: Both protocols analyze real-time on-chain activity, including transaction volume, borrowing, and repayment behavior, to generate up-to-date credit scores.

-

Enhanced Capital Efficiency: By enabling under-collateralized lending, these models allow borrowers to access funds without locking up excessive assets, boosting capital productivity.

-

Financial Inclusion and Accessibility: Onchain credit scoring empowers users without large crypto holdings to access DeFi loans, expanding participation beyond traditional whales.

-

Transparent and Permissionless Evaluation: Credit scores are generated and verified on-chain, allowing any DeFi protocol to integrate and utilize them for lending decisions without centralized oversight.

RociFi uses decentralized identity (DID) and non-fungible credit scores (NFCS), rating wallets from 1 (lowest risk) to 10 (highest risk). Your score reflects your actual on-chain behavior, not some arbitrary off-chain metric. Lenders use these scores to set loan terms dynamically.

Spectral Finance, meanwhile, has rolled out the Multi-Asset Credit Risk Oracle (MACRO) score, think traditional FICO scores but built for web3 wallets. Ranging from 300 to 850, this score is derived by crunching borrowing/repayment histories across multiple DeFi platforms. It’s all about standardizing risk assessment so lenders can make smarter decisions fast.

How Onchain Risk Scores Supercharge Under-Collateralized Lending

The impact isn’t just theoretical, it’s already transforming how crypto lending works:

- Capital Efficiency: Borrowers no longer need to over-collateralize loans; more funds are put to productive use instead of sitting idle.

- Bigger Pool of Borrowers: Users with solid repayment histories but modest holdings can finally access loans, driving financial inclusion at scale.

- Lender Confidence: Transparent, tamper-resistant on-chain data lets lenders price risk accurately instead of flying blind.

- Dynamically Adjusted Terms: Some protocols even adjust interest rates or collateral requirements in real time based on your evolving score!

This isn’t just hype. According to recent research and industry reports, onchain credit scoring could unlock trillions in value for DeFi. By tying reputation directly to wallet addresses, and not personal identities, these systems keep things open and permissionless while mitigating default risks through transparent data analysis.

The Mechanics: How Does Onchain Risk Assessment Work?

If you’re wondering how these scores are actually calculated under the hood, here’s the quick breakdown:

Key Factors in Calculating Onchain Risk Scores

-

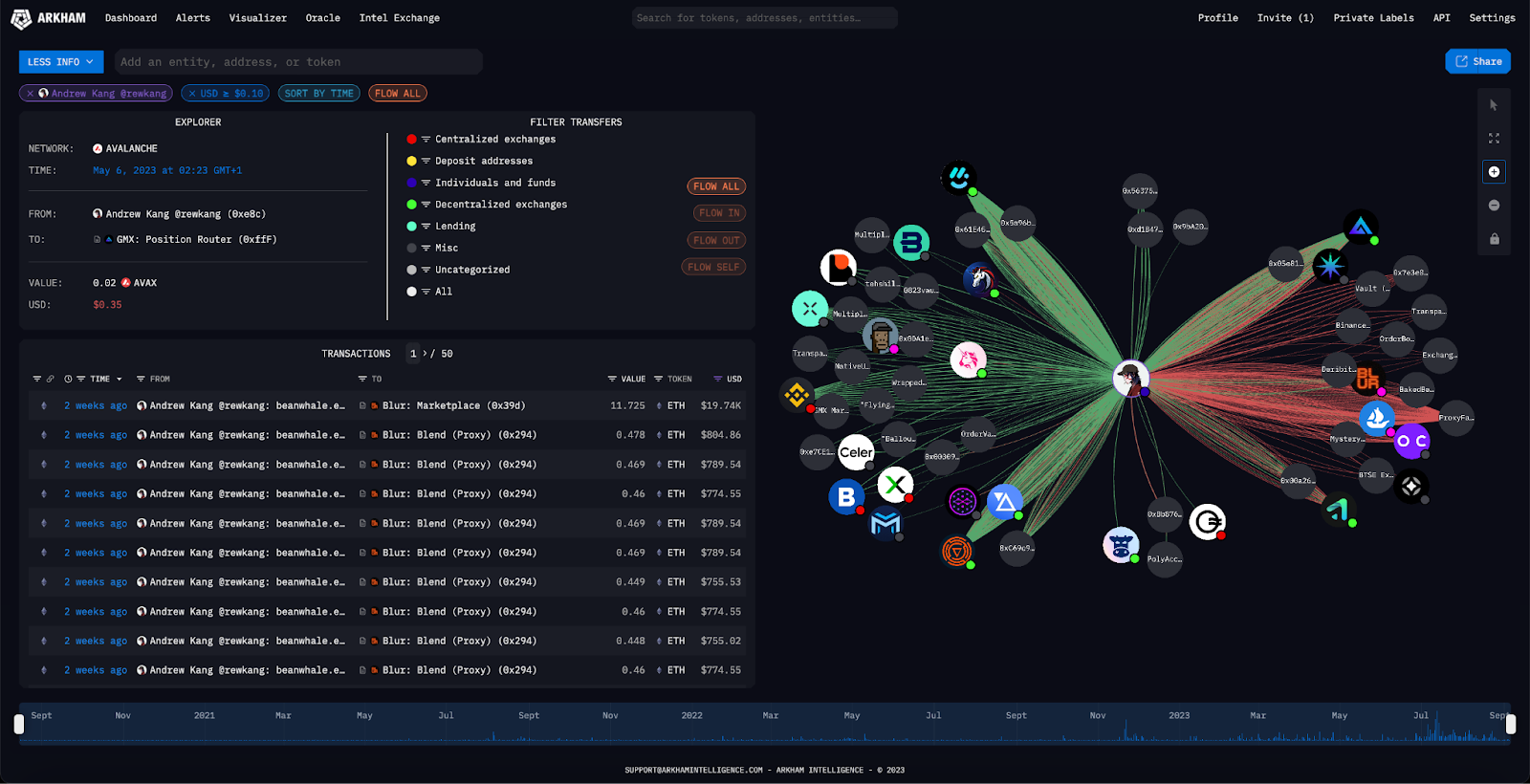

On-Chain Transaction History: Protocols like RociFi and Spectral Finance analyze the borrower’s wallet activity, including the frequency, volume, and types of transactions, to assess reliability and engagement within the DeFi ecosystem.

-

Borrowing and Repayment Behavior: A borrower’s track record of taking out loans and repaying them on time across various DeFi protocols is a critical input for credit scoring models such as Spectral’s MACRO score.

-

Wallet Age and Longevity: Older wallets with a consistent history of activity are often considered less risky, as they indicate established participation in DeFi markets.

-

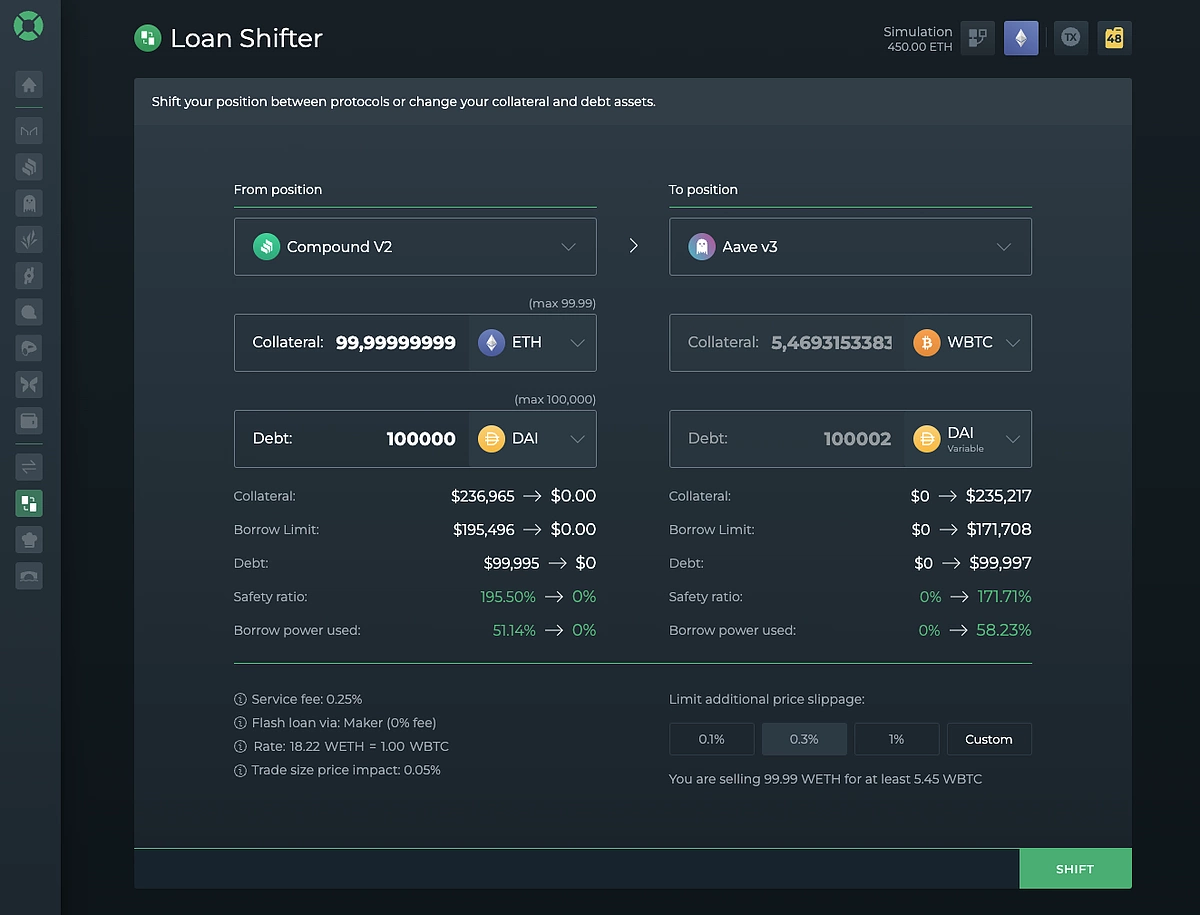

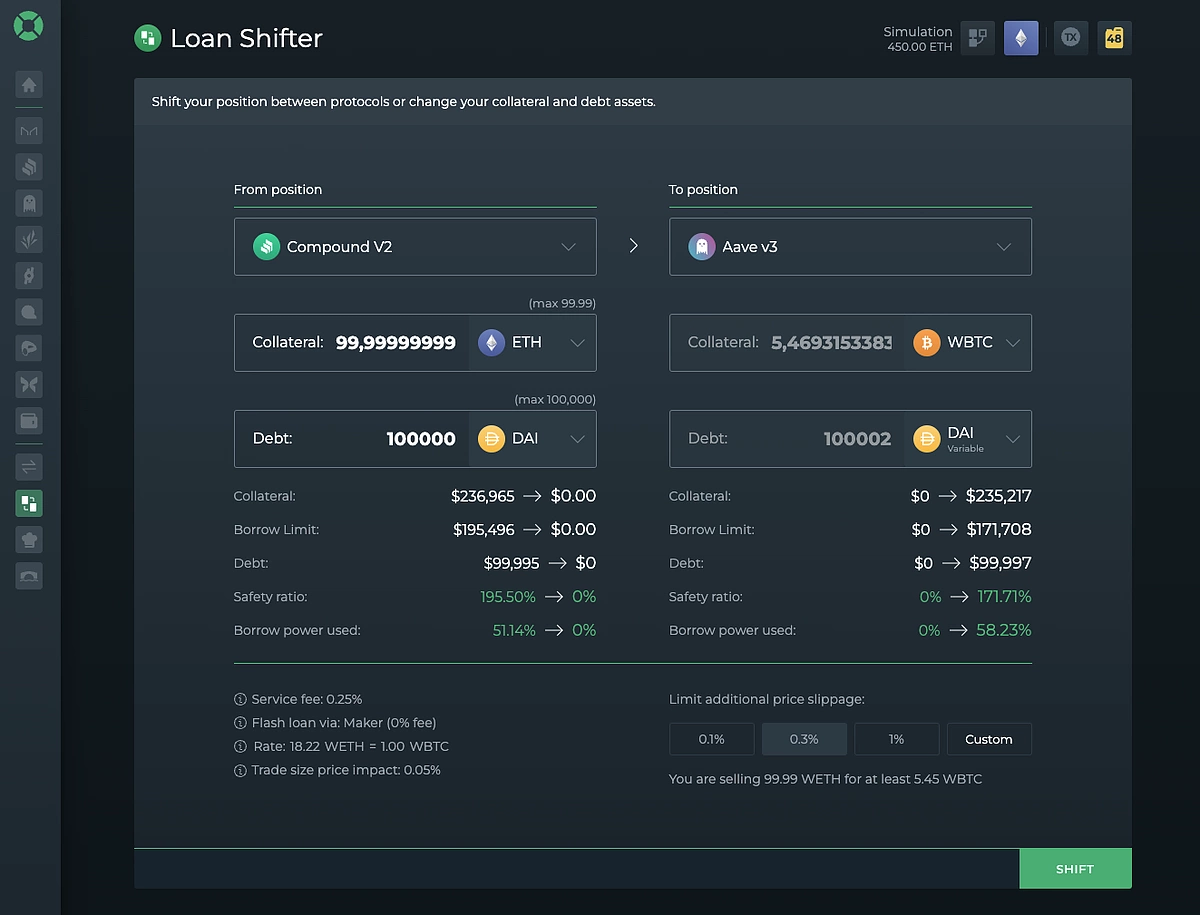

Protocol Diversity: Engaging with multiple reputable DeFi platforms (e.g., Aave, Compound, Uniswap) demonstrates broader experience and reduces the risk of single-platform dependency.

-

On-Chain Reputation and Decentralized Identity (DID): Solutions like RociFi use decentralized identity and reputation metrics to create non-fungible credit scores (NFCS), reflecting a borrower’s trustworthiness based on verifiable on-chain credentials.

-

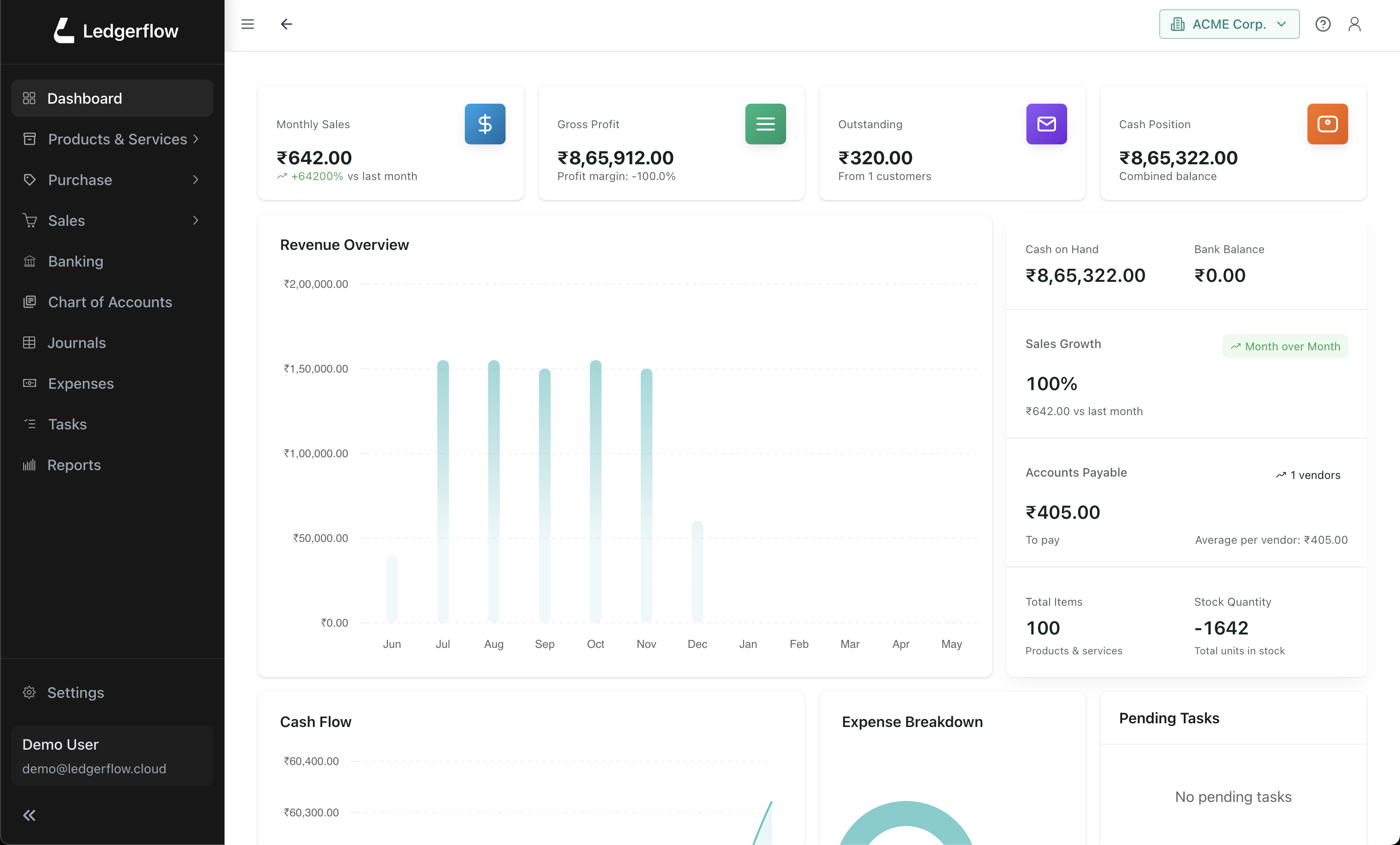

Asset Holdings and Portfolio Health: The value, diversity, and stability of a borrower’s on-chain assets are assessed to determine their overall financial health and ability to repay loans.

-

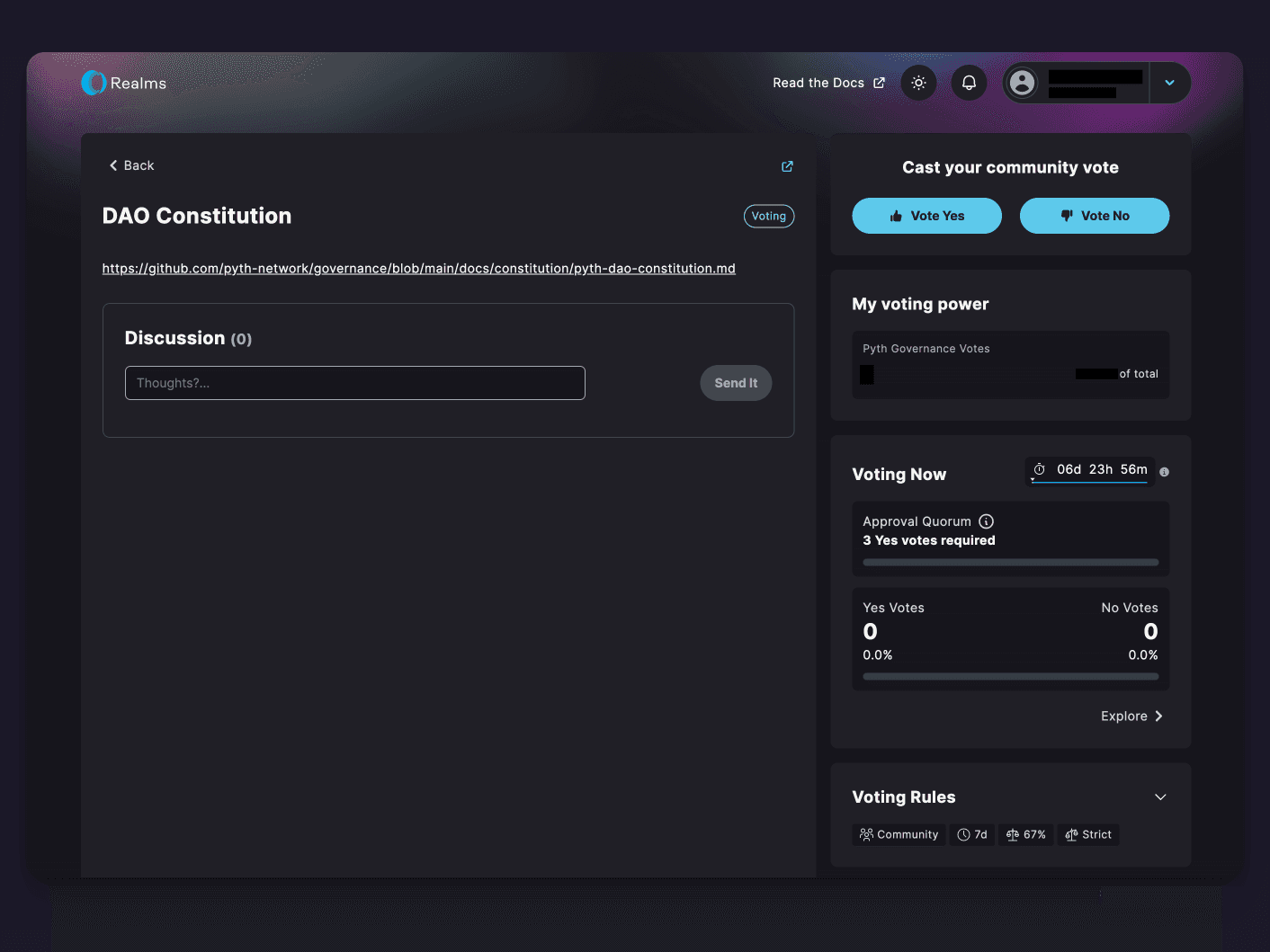

Participation in Governance and Staking: Active involvement in protocol governance and staking can signal a long-term commitment to the ecosystem, positively impacting risk scores.

This process typically involves zero-knowledge proofs (hello privacy!), machine learning models that scour blockchain data for patterns, and decentralized identity frameworks that make Sybil attacks way harder. The end result? A robust system where trust is built, and measured, on-chain without ever needing personal info or KYC docs.

But with all this innovation, there’s a burning question: How do protocols keep the system secure and fair? The answer lies in a blend of smart contract design, privacy tech, and community-driven governance. Zero-knowledge proofs let protocols verify borrower data without exposing sensitive details. Decentralized identity (DID) ensures that each score is tied to a unique wallet’s on-chain history, not just an easily farmable address. And open governance means updates to scoring models or risk parameters are transparent and auditable by the community.

Of course, no system is bulletproof. Attackers may still try to game their scores or launch Sybil attacks by spinning up new wallets. That’s why most leading platforms combine DID frameworks with behavioral analytics, flagging suspicious activity patterns and requiring progressively more robust histories for higher loan tiers. Some even integrate off-chain signals or social reputation as an extra layer of defense.

What This Means for Borrowers and Lenders

If you’re a DeFi user looking to borrow, onchain risk scores mean you’re judged on your actual behavior, not your net worth. Paid back your last three loans on time? That counts for something now! Missed a repayment? That’ll reflect too. For lenders, it’s a game-changer: you can finally calibrate interest rates and collateral requirements based on real-time risk instead of blanket policies.

Actionable Tips to Boost Your DeFi Credit Score

-

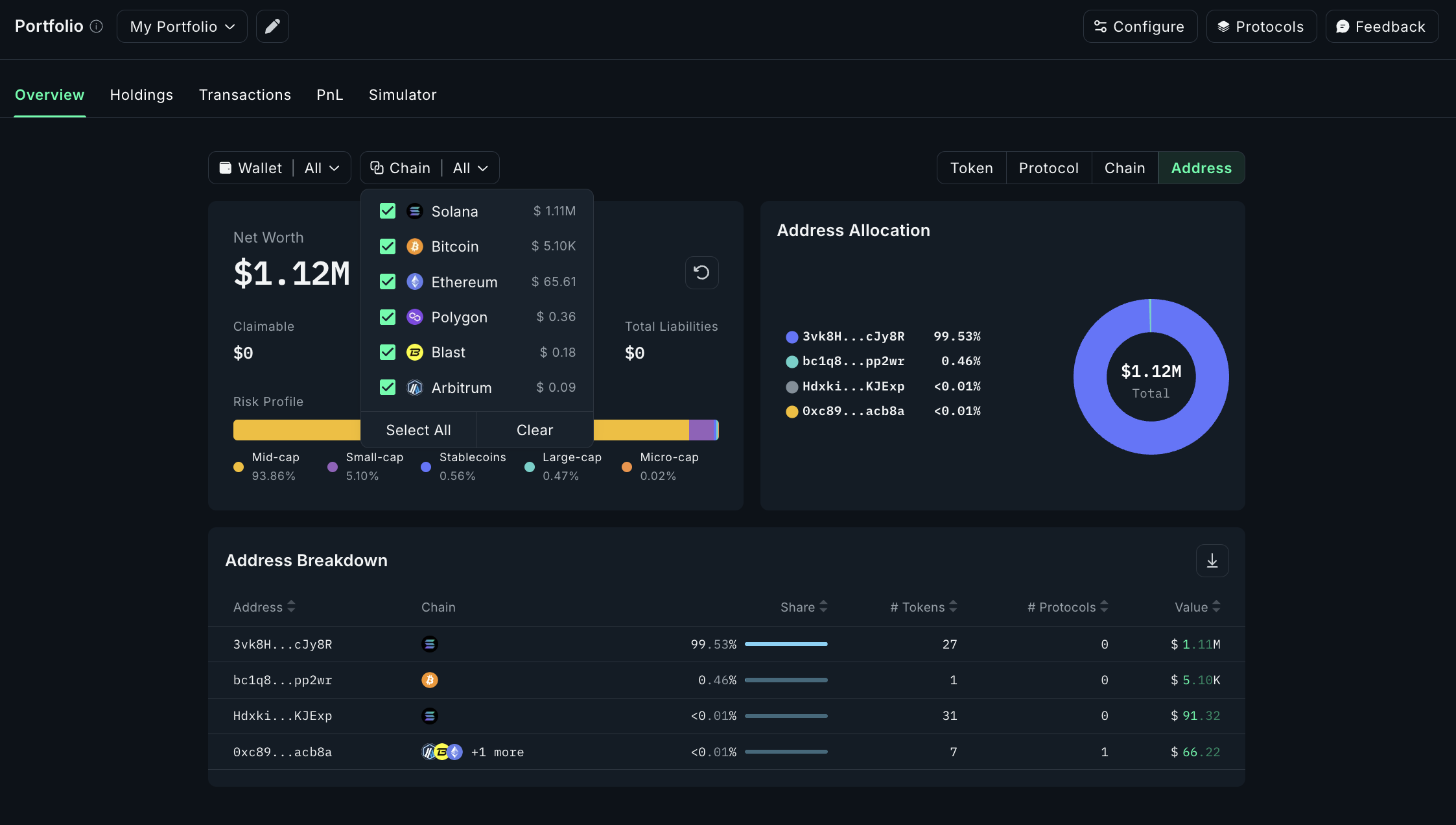

Diversify Your On-Chain Activity: Engage with multiple reputable DeFi protocols (e.g., Uniswap, Curve Finance) to build a well-rounded wallet history. Diverse, active participation signals responsible asset management to credit scoring systems.

-

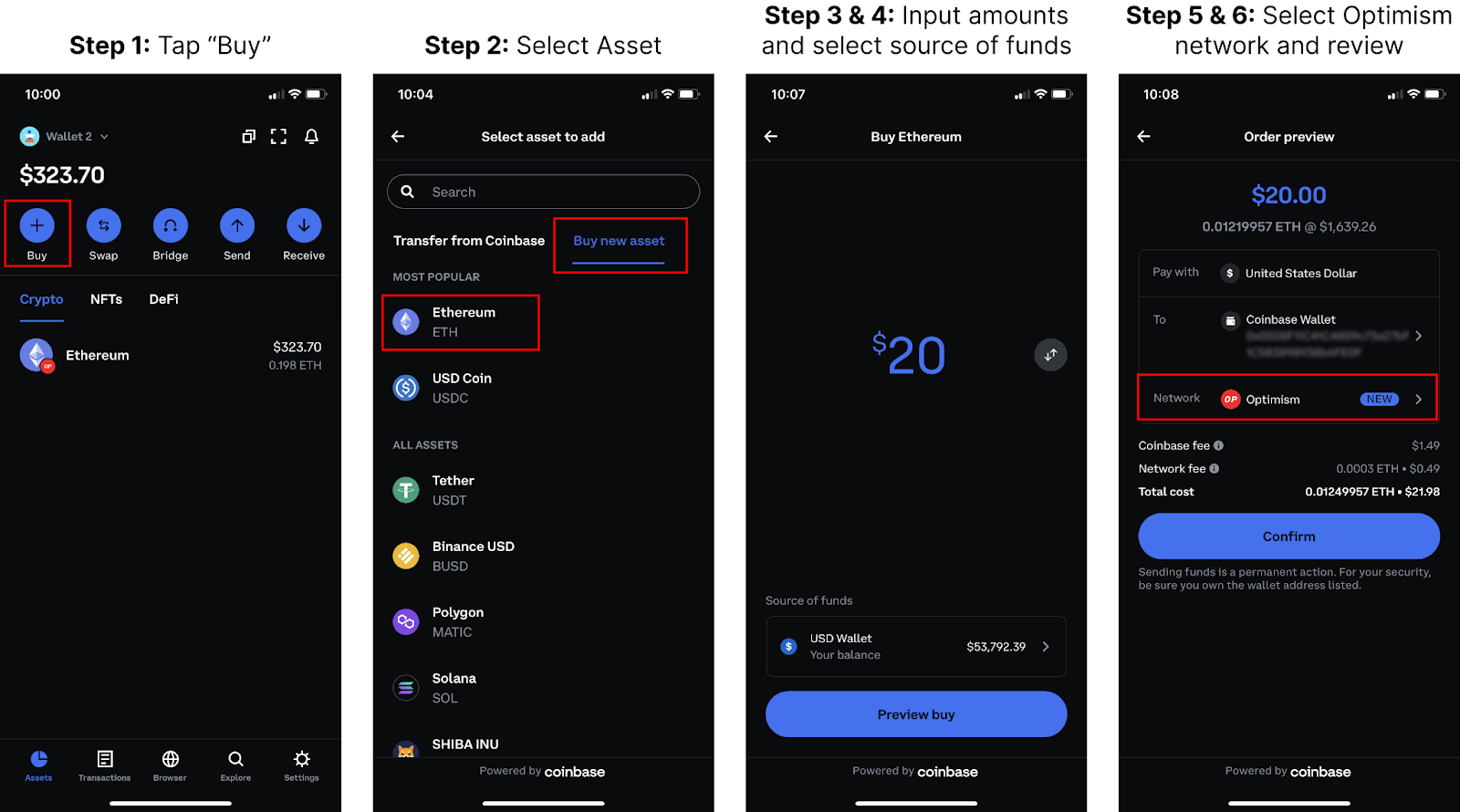

Connect Your Wallet to Onchain Credit Scoring Platforms: Link your wallet to platforms like RociFi and Spectral Finance to generate and monitor your credit score. These platforms use your on-chain data to assess creditworthiness for under-collateralized loans.

-

Keep Wallet Addresses Consistent: Use the same wallet address for borrowing and repayments. Credit scores are tied to wallet addresses, so consistency ensures your positive history is accurately tracked.

-

Engage in Responsible Borrowing: Only borrow what you can repay and avoid defaulting. Responsible borrowing behavior is a key factor in maintaining or improving your onchain risk score.

-

Monitor Your Credit Score Regularly: Stay informed by checking your score on platforms like Spectral Finance or RociFi. Monitoring helps you spot issues early and take action to improve your standing.

-

Participate in Governance and Staking: Active participation in DeFi governance (e.g., voting on Snapshot) and staking can demonstrate long-term engagement, which some scoring models may reward.

This shift doesn’t just help individuals, it supercharges the entire ecosystem. More efficient capital allocation means higher yields for lenders and greater access for borrowers. It also paves the way for new financial products: think unsecured microloans for small DAOs, dynamic credit lines, or even NFT-based credit passports that travel across chains.

“Onchain credit scoring is the missing link between DeFi’s permissionless ethos and real-world usability. ”

Navigating Risks in Onchain Credit Scoring

No innovation comes without risks, and under-collateralized lending is no exception. Protocols must stay vigilant against manipulation attempts, flash loan exploits, or collusion among borrowers. Continuous monitoring of scoring algorithms and rapid response to emerging threats are crucial.

The good news? The transparency of blockchain makes it easier than ever to audit loan performance and flag anomalies in real time. Many platforms also employ circuit breakers, automatic mechanisms that pause lending if default rates spike unexpectedly.

The Road Ahead: What’s Next for Under-Collateralized Lending?

The momentum around DeFi credit scoring isn’t slowing down anytime soon. As more protocols adopt standardized risk assessment tools, and as wallet reputations become portable across platforms, we’ll see a new era of open finance emerge where trust is earned on-chain.

If you’re ready to dive deeper into how these systems work (or want to boost your own wallet’s score), check out our deep-dive guides at /how-onchain-risk-scores-enable-under-collateralized-lending-in-defi. The future of decentralized borrowing is closer than you think, and with smart strategies, anyone can participate!