Decentralized Finance (DeFi) has brought forth a new era of financial inclusivity, enabling borderless lending and borrowing without the need for traditional intermediaries. Yet, despite its transformative potential, DeFi lending remains constrained by the dominance of over-collateralization. In most protocols, users must lock up assets worth more than their loan amount to mitigate risk, which severely limits capital efficiency and excludes those without significant crypto holdings.

The Bottleneck: Over-Collateralization in DeFi Lending

Over-collateralization was a necessary safeguard in early DeFi because on-chain identities were pseudonymous and lacked verifiable credit histories. This model, while effective at protecting lenders from default, creates substantial barriers for borrowers. Many users are unable to access credit unless they already possess considerable crypto assets, stalling broader adoption and keeping DeFi’s promise of open finance out of reach for millions.

Recent market analysis underscores the magnitude of this issue. As highlighted in Chainlink’s exploration of under-collateralized lending, unlocking this segment could bring trillions of dollars into the decentralized economy. The challenge: how can protocols safely extend credit without demanding excessive collateral?

Decentralized Identity: The Gateway to Under-Collateralized Crypto Lending

Decentralized identity (DID) is emerging as a foundational solution to this impasse. Unlike conventional identity systems that rely on centralized databases and third-party verification, DIDs empower individuals to control their own identity data on the blockchain. This paradigm enables users to build portable reputations based on verifiable credentials and on-chain activity, without exposing sensitive personal information or relying on legacy institutions.

![]()

The implications for under-collateralized crypto lending are profound:

- Onchain risk scores: Platforms such as RociFi and Credora analyze wallet histories, loan repayments, protocol interactions, even liquidation events, to generate dynamic risk scores tied directly to wallet addresses (RociFi blog). These scores serve as transparent proxies for creditworthiness in place of traditional FICO scores.

- Verifiable credentials: DID frameworks allow borrowers to present cryptographically secure proof of income or employment from trusted issuers, without revealing unnecessary personal data (Chainlink blog). Lenders can verify these claims instantly on-chain.

- Self-sovereign identity (SSI): SSI puts users in full control over what data they share with each protocol or counterparty. This aligns perfectly with DeFi’s ethos while enabling granular trust decisions at scale.

Pioneering Protocols: Use Cases in Action

Lending protocols are already leveraging decentralized identity tools to offer more nuanced risk assessment and unlock new forms of credit:

Leading DeFi Projects Using Decentralized Identity for Under-Collateralized Lending

-

RociFi leverages decentralized identity and on-chain reputation to generate non-fungible credit scores (NFCS), enabling users to access under-collateralized loans based on their DeFi activity and creditworthiness.

-

Credora provides real-time, privacy-preserving credit scoring using both on-chain and off-chain data, allowing institutional and retail borrowers to obtain loans with reduced collateral requirements.

-

Spectra (formerly Spectral Finance) uses machine learning to analyze wallet activity and assign on-chain credit scores, facilitating under-collateralized lending and improved risk assessment for DeFi protocols.

-

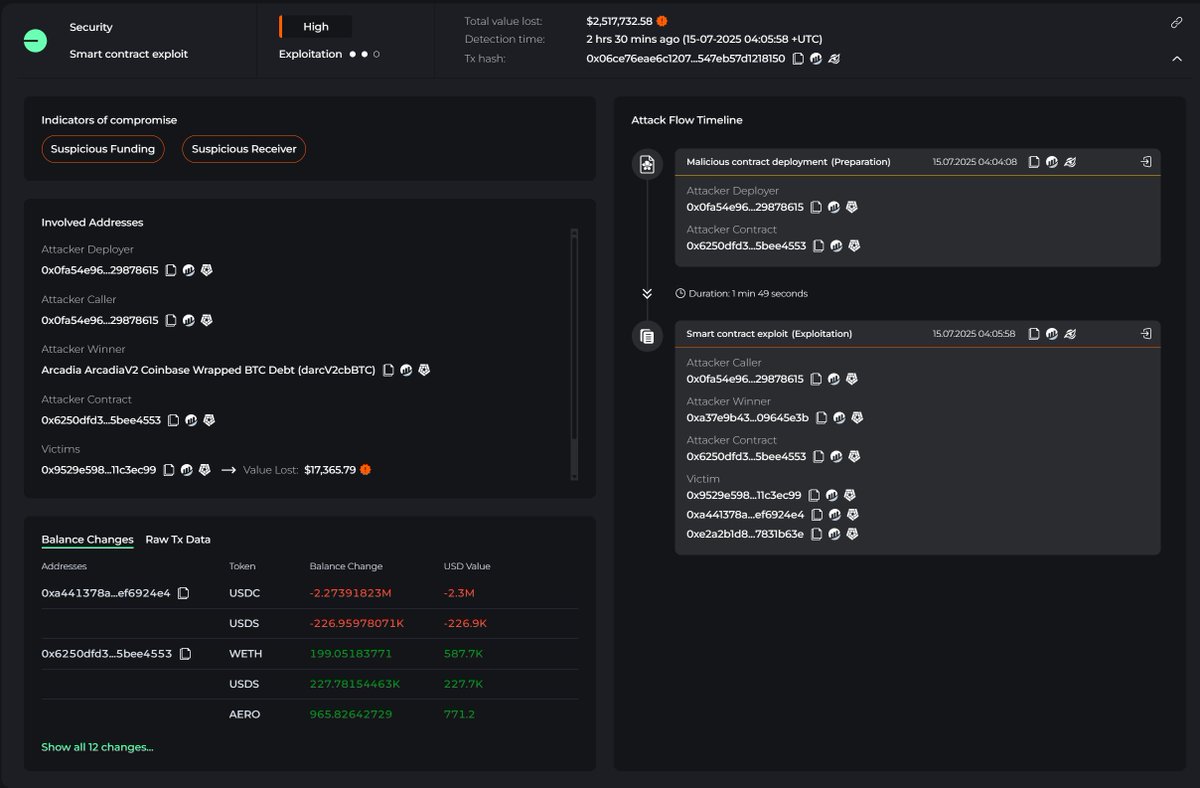

Arcadia Finance integrates decentralized identity and risk assessment tools to offer under-collateralized loans, focusing on capital efficiency and user privacy within DeFi lending markets.

-

TrueFi enables uncollateralized lending through a combination of on-chain credit scoring and rigorous borrower vetting, supporting both individuals and institutions in accessing capital without excessive collateral.

For example, RociFi‘s Non-Fungible Credit Scores (NFCS) assign unique reputational badges based on wallet behavior across multiple chains. Spectra and Credora similarly blend payment history with liquidation records to create robust borrower profiles that travel seamlessly across ecosystems. These innovations enable flexible loan terms, lower collateral requirements for proven borrowers, while maintaining transparency and minimizing systemic risk.

The Mechanics Behind Onchain Risk Scores

The core advantage of DID-powered systems lies in their ability to aggregate diverse signals into actionable credit assessments:

- Repayment history: Every successful loan repayment is recorded immutably on-chain and factored into future borrowing capacity.

- Diversified protocol engagement: Borrowers who interact responsibly across multiple platforms demonstrate reliability beyond a single ecosystem.

- KYC portability: Some networks now support portable KYC solutions that let users prove compliance once and reuse verified credentials everywhere within the idOS network or similar frameworks.

This shift towards transparent yet privacy-preserving credit scoring marks a fundamental evolution in how trust is built within DeFi, reducing reliance on blunt collateral ratios while opening doors for millions previously excluded from crypto lending markets.

However, the journey toward widespread adoption of under-collateralized crypto lending is not without obstacles. Risk management remains paramount. While onchain risk scores and decentralized identity in DeFi provide powerful new tools for credit assessment, protocols must constantly refine their models to account for emerging threats, such as Sybil attacks and identity spoofing. Security audits, robust governance mechanisms, and ongoing research into behavioral analytics are essential to maintain trust and stability as these systems scale.

Navigating Challenges: Privacy, Interoperability, and Regulation

One critical consideration is privacy. DID frameworks enable selective disclosure of information, but the handling of sensitive data must comply with evolving regulatory standards around the world. As highlighted by research from TU Delft Repository, smart contracts enforce lending rules transparently but cannot alone guarantee compliance with off-chain legal requirements. Thus, a hybrid approach, combining onchain risk scores with verifiable off-chain credentials, will likely define the next phase of under-collateralized lending innovation.

Interoperability also plays a decisive role. For decentralized identity solutions to reach their full potential, standards must be adopted across protocols so that a user’s reputation or KYC status can move seamlessly between platforms. Initiatives like the idOS network credit scoring framework aim to address this by building open infrastructure for portable identity and trust signals throughout DeFi.

“The future of DeFi lending is not just about capital efficiency, it’s about creating reputational capital that moves with you across the entire ecosystem. “

Unlocking New Opportunities for Borrowers and Lenders

The impact of DID for crypto loans is already tangible. Borrowers with strong onchain reputations can access loans at lower collateralization ratios or even on an unsecured basis. Lenders benefit from diversified risk pools and improved yield opportunities compared to traditional over-collateralized markets. As more users build verifiable histories through responsible borrowing behavior, and as protocols improve their ability to detect malicious actors, the cost of capital in DeFi will continue to fall.

This evolution is particularly significant as institutional participation increases. With transparent audit trails and privacy-preserving compliance tools, large-scale lenders can confidently allocate capital within DeFi’s under-collateralized markets, a trend already visible in recent market data (DL News). The convergence of decentralized identity technology with advanced risk analytics stands poised to bring trillions in liquidity into crypto markets over the coming years.

Actionable Steps for DeFi Users

For those looking to participate:

- Borrowers: Start building your onchain reputation by repaying loans promptly across multiple protocols.

- Lenders: Evaluate platforms offering transparent risk scoring and ensure they integrate robust DID solutions.

- Developers: Contribute to open-source standards for interoperable identity frameworks in DeFi.

Looking Forward: The Future of Under-Collateralized Lending in DeFi

The integration of decentralized identity technologies marks a pivotal shift away from rigid collateral requirements toward a more nuanced, and ultimately more inclusive, credit paradigm. As projects like RociFi, Spectra, Credora, and others demonstrate real-world viability at scale, expect rapid innovation at the intersection of privacy tech, onchain analytics, and user-controlled reputation.

The result? A financial system where trust is algorithmically earned yet individually owned, empowering millions worldwide with access to credit previously out of reach. For those navigating this new landscape, staying informed about advances in onchain risk scores and DID frameworks will be key to maximizing opportunity while minimizing exposure.