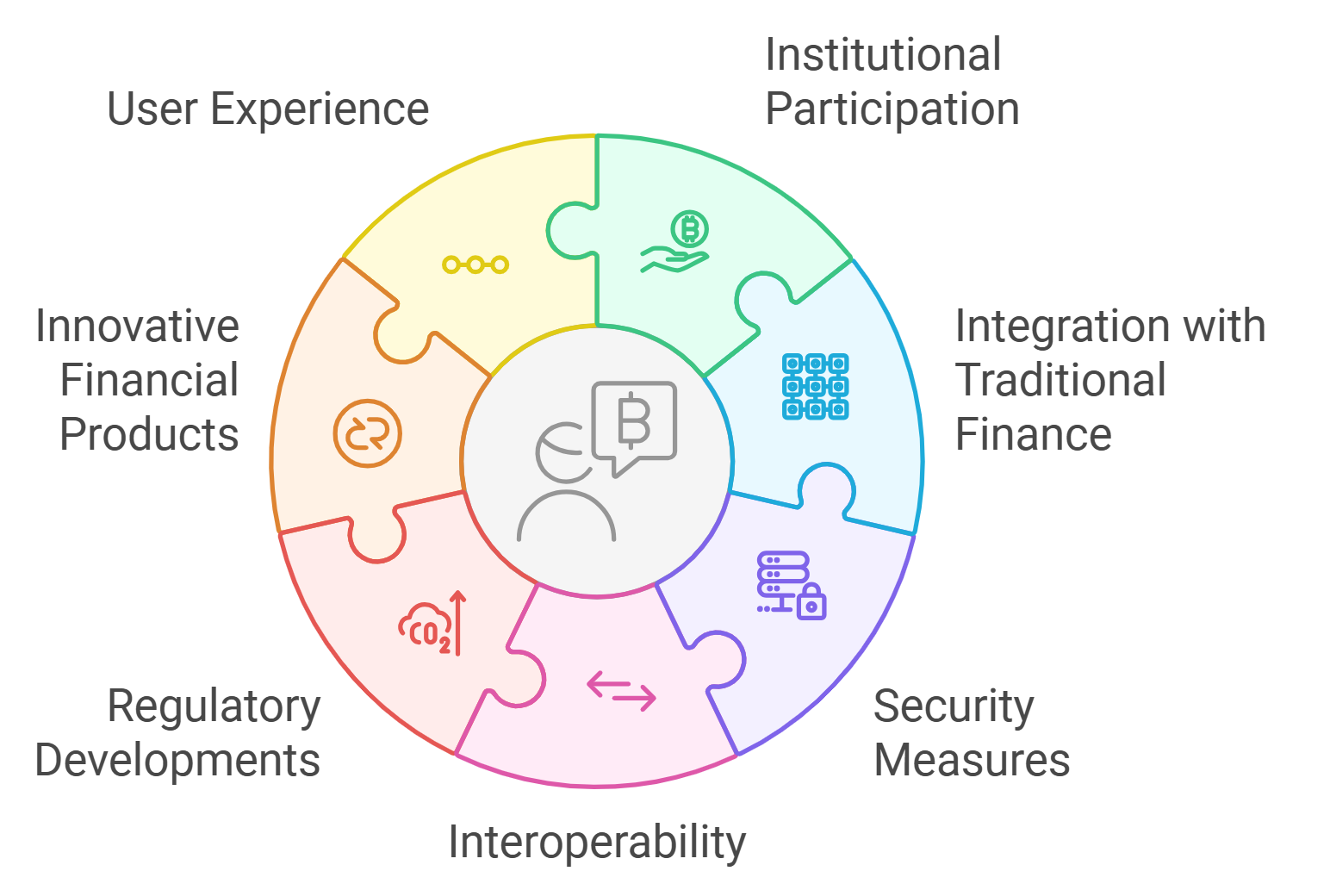

Undercollateralized DeFi lending has emerged as a major innovation in decentralized finance, enabling borrowers to access capital without posting excessive collateral. However, with less collateral backing each loan, the risk of default and forced liquidation increases for lenders. This is where onchain risk scores are transforming the landscape, providing a data-driven approach to credit assessment and risk management in crypto lending markets.

Why Liquidation Risk Matters in Undercollateralized Lending

In traditional DeFi protocols, overcollateralization (often requiring 150% or more of the loan value) is used to protect lenders from losses if asset prices drop. When collateral falls below a set threshold, automated liquidations occur to recover funds. While this system minimizes bad debt, it also restricts capital efficiency and excludes many potential borrowers.

Undercollateralized lending flips this paradigm by letting users borrow with less than full collateral coverage. The tradeoff: higher risk of non-repayment and liquidation events. According to ProTechBro, this model introduces significant risks for lenders since their ability to recoup funds after a default is limited.

The Emergence of Onchain Risk Scores

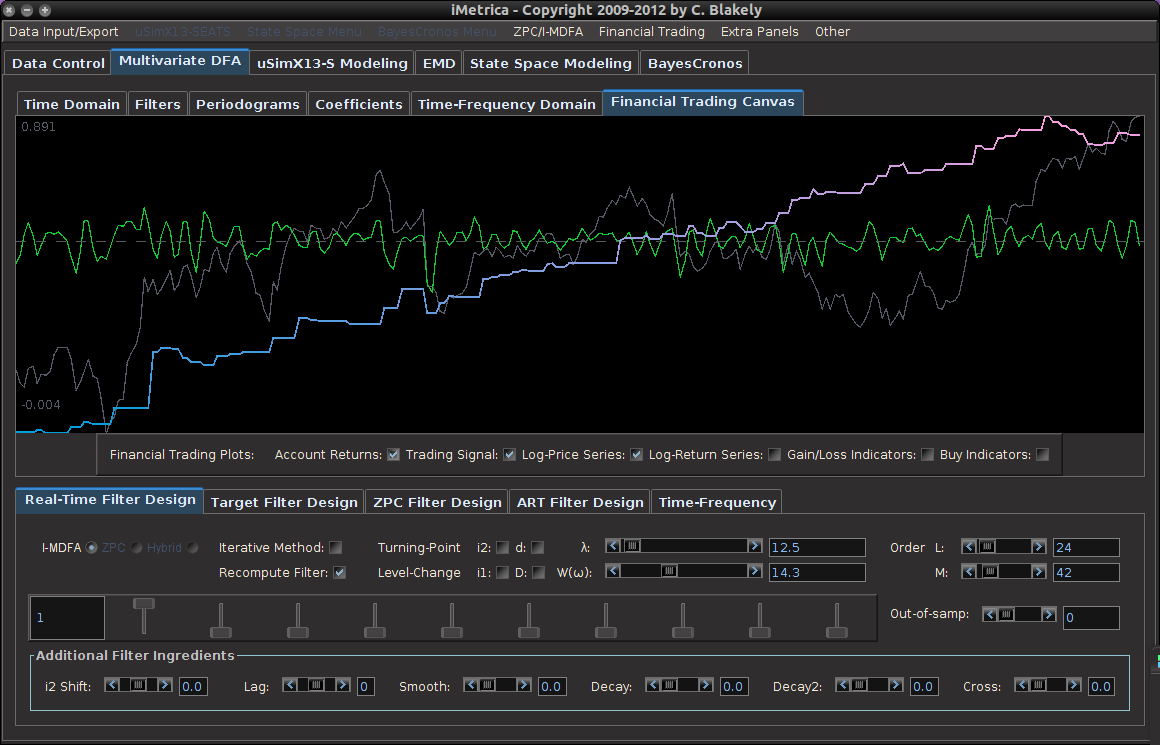

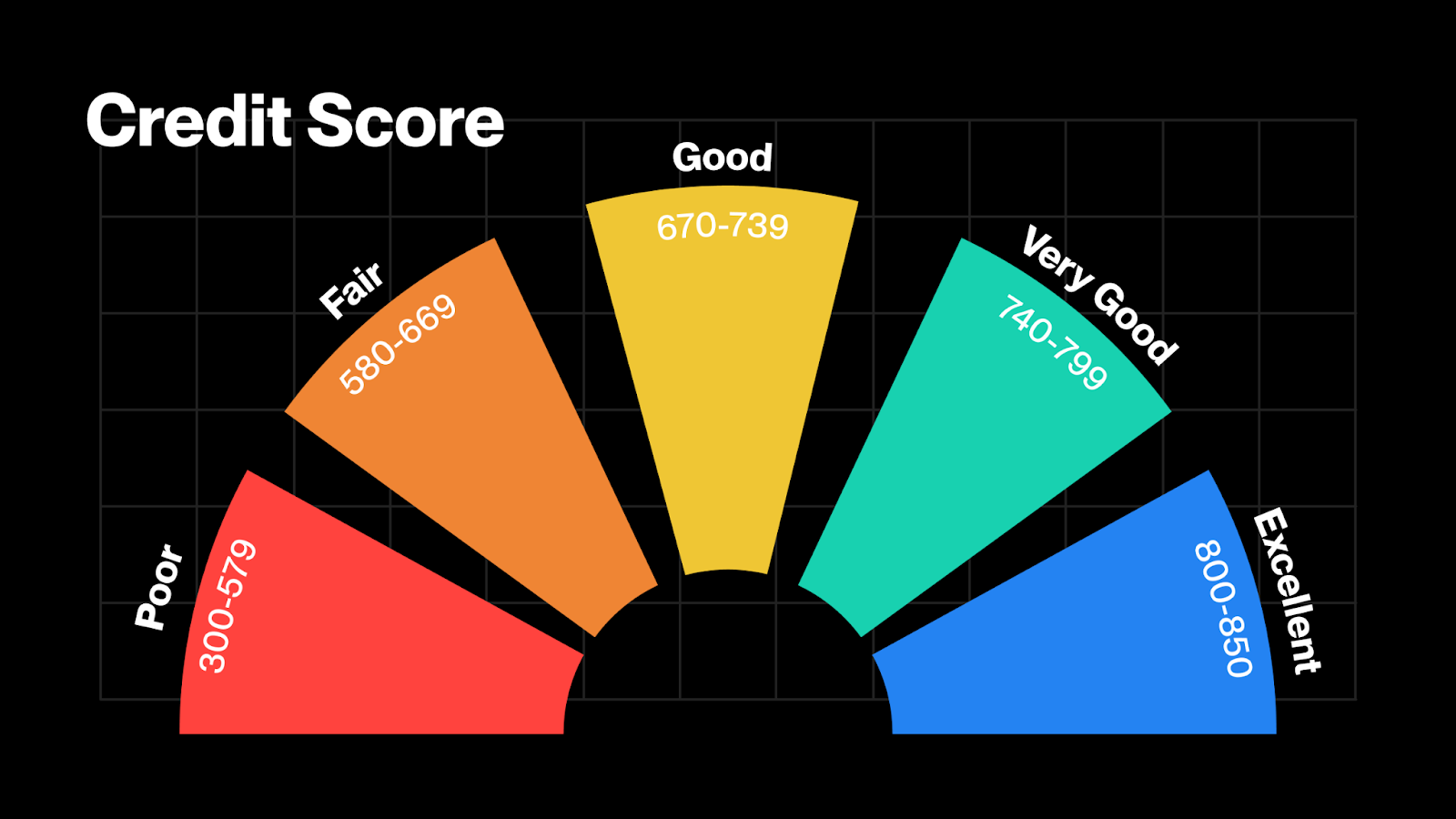

Onchain risk scores analyze a borrower’s wallet activity, transaction history, and interactions with various protocols to estimate their likelihood of default or liquidation. Unlike traditional credit checks, these scores leverage transparent blockchain data that cannot be easily manipulated or hidden.

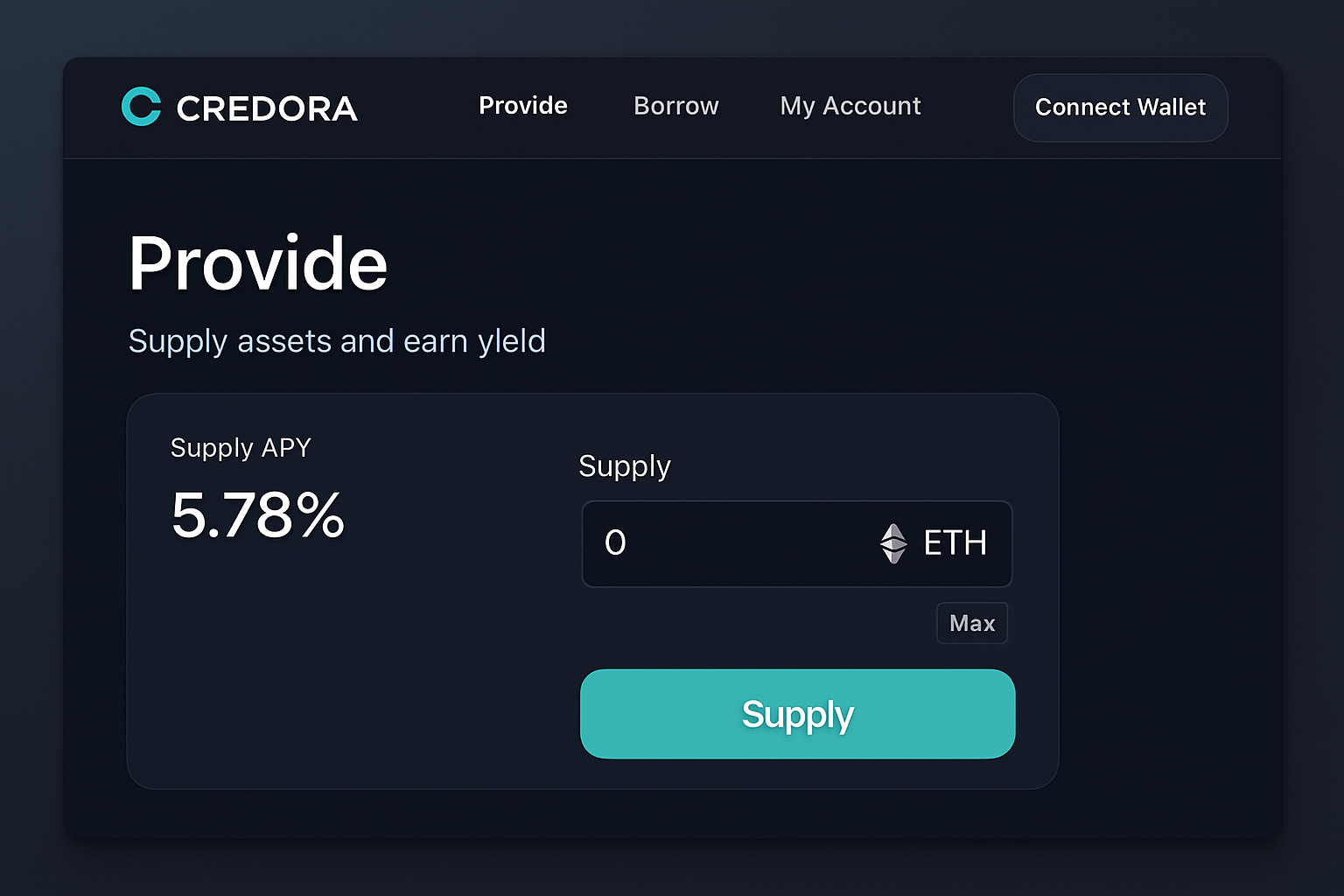

The latest research on On-Chain Credit Risk Scores (OCCR) demonstrates that these metrics can estimate the probability that a specific wallet will face liquidation upon opening any borrow position (arXiv). Protocols like Credora and Spectra aggregate repayment histories, prior liquidations, and other onchain behaviors into dynamic credit profiles. This allows for real-time updates to borrower risk assessments as new activity occurs.

How Onchain Risk Scores Reduce Liquidation Events

The integration of decentralized credit scoring mechanisms yields several critical advantages for both lenders and borrowers:

Key Ways Onchain Risk Scores Lower DeFi Liquidation Risks

-

Improved Credit Assessment: Onchain risk scores analyze a borrower’s transaction history and protocol interactions, enabling platforms like Cred Protocol and Credora to more accurately gauge creditworthiness and reduce default risk.

-

Real-Time Risk Monitoring: Protocols such as Spectral Finance use dynamic, onchain data to update borrower risk profiles instantly, allowing lenders to adjust loan terms or collateral requirements proactively.

-

Optimized Collateral Requirements: By leveraging onchain credit metrics, platforms can set individualized loan-to-value (LTV) ratios, minimizing unnecessary liquidations and improving capital efficiency for borrowers with strong onchain reputations.

-

Enhanced Transparency and Trust: Onchain scores provide verifiable, tamper-proof risk assessments, increasing transparency for both lenders and borrowers and reducing information asymmetry in under-collateralized lending markets.

-

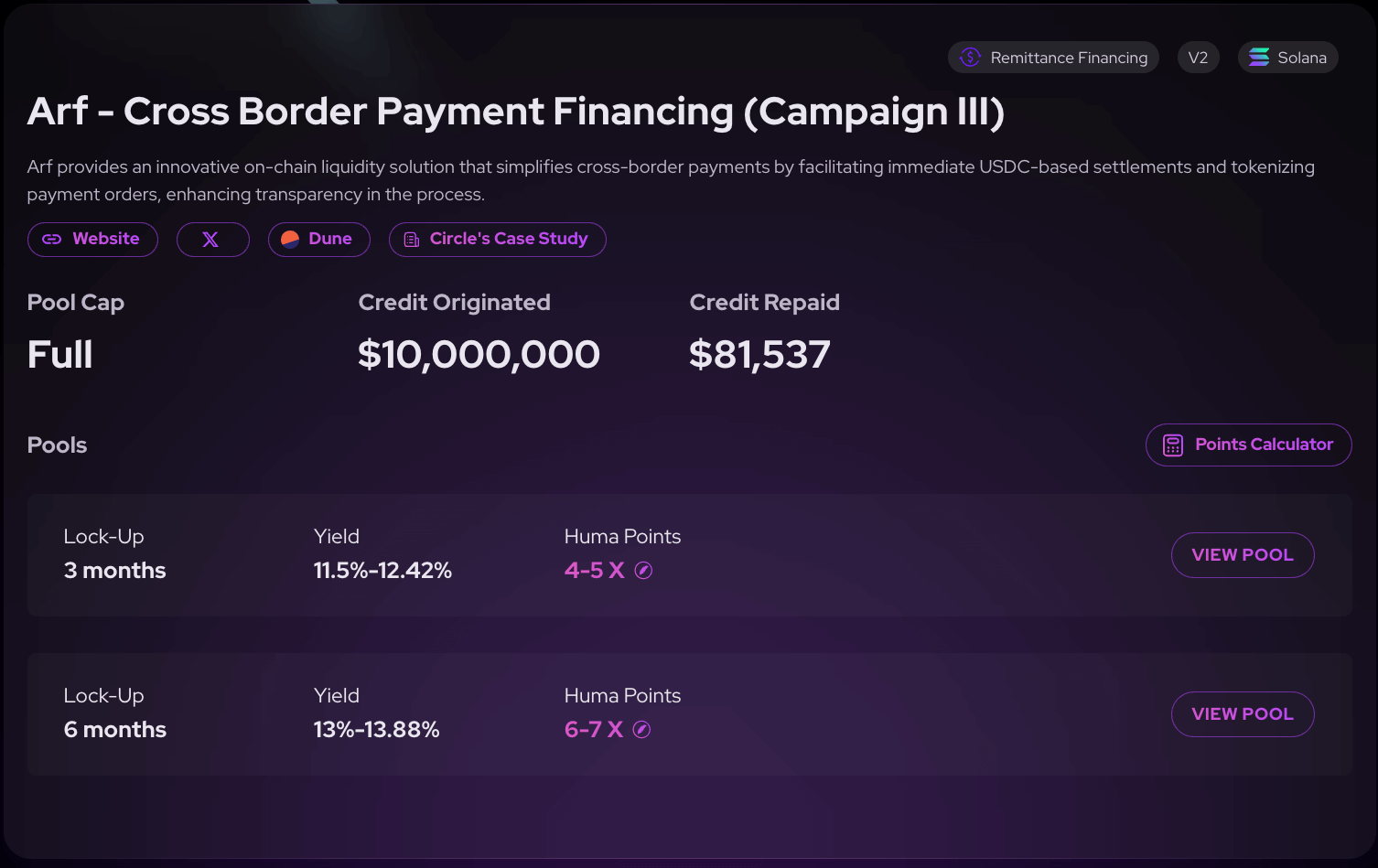

Broader Access to Under-Collateralized Loans: Borrowers with high onchain risk scores can access loans with lower collateral requirements, as seen with protocols like Huma Finance, expanding financial inclusion while maintaining risk controls.

- Enhanced Credit Assessment: Lenders can review historical repayment patterns and protocol interactions before approving loans, filtering out high-risk borrowers early in the process.

- Dynamic Loan Terms: Platforms can adjust interest rates or required collateral ratios in real time based on up-to-date risk profiles, reducing exposure as soon as borrower behavior changes.

- Reduced Forced Liquidations: By accurately calibrating loan-to-value (LTV) ratios according to each user’s track record, protocols minimize the frequency of sudden liquidations caused by market volatility or underperformance.

- Improved Capital Efficiency: Trusted borrowers with strong on-chain reputations can access loans with lower collateral requirements, unlocking greater liquidity while keeping systemic risks in check.

This approach marks a shift away from static overcollateralization models toward adaptive systems that reward good behavior and penalize risky actors dynamically. As noted by industry sources such as Mitosis University, real-time updates are essential for maintaining robust DeFi risk management frameworks amid continuously evolving user activity and market conditions.

Despite the clear benefits, there are still hurdles to overcome in the widespread adoption of onchain risk scores for undercollateralized DeFi lending. One major challenge is the lack of standardized methodologies for calculating these scores across different protocols. Without industry-wide benchmarks, lenders may struggle to compare risk profiles or set consistent loan terms, potentially leading to inefficiencies or mispriced risk.

Another concern is data privacy. While blockchain transparency enables open credit assessment, it also exposes user histories to public scrutiny. Pseudonymous addresses help protect identities, but sophisticated analytics may still link wallets to real-world entities, raising questions about user confidentiality and regulatory compliance.

Protocols Leading the Way in Decentralized Credit Scoring

Several platforms are pioneering practical applications of onchain risk scoring in live markets. Protocols like Credora, Spectra, and Cred combine payment history, liquidation records, and even off-chain attestations to create comprehensive borrower profiles (arXiv). These systems allow lenders to tailor loan offers dynamically, rewarding reliable users with lower collateral requirements and penalizing risky wallets with higher rates or stricter terms.

This approach not only reduces DeFi liquidation risk but also enhances market liquidity by bringing more participants into the fold. As highlighted by recent research, such as that from GARP and Chainrisk, integrating credit scores into lending platforms increases transparency and minimizes counterparty risk, two persistent challenges in decentralized finance.

The Path Forward: Toward Safer Undercollateralized Lending

The evolution of decentralized credit scoring is already reshaping how DeFi protocols manage undercollateralized loans. By leveraging immutable blockchain data and machine learning models trained on borrower behavior, these systems can flag emerging risks before they result in losses or forced liquidations.

- Protocols can set adaptive liquidation thresholds: Instead of rigid LTV ratios for all users, platforms can calibrate requirements to each borrower’s unique history and current market conditions.

- Lenders gain more granular control: Real-time updates allow for proactive responses, such as adjusting interest rates or requiring additional collateral, when a borrower’s score deteriorates.

- Borrowers benefit from increased access: Users with strong repayment histories can unlock capital at more favorable terms without punitive overcollateralization demands.

The long-term vision is a robust crypto lending ecosystem where trust is algorithmically quantified rather than assumed, a system where everyone from retail users to institutions can participate securely. As more protocols adopt transparent and interoperable risk scoring frameworks, we can expect both default rates and unnecessary liquidations to decline sharply.

Leading DeFi Protocols Using On-Chain Risk Scores

-

Credora integrates on-chain credit analytics to assess borrower reliability, enabling under-collateralized lending for institutional and DeFi borrowers. Its risk engine analyzes wallet activity and repayment history to dynamically adjust credit limits.

-

Spectra (formerly Spectral Finance) utilizes on-chain credit scoring (MACRO scores) to evaluate borrower risk, facilitating under-collateralized loans. The protocol leverages transparent blockchain data to inform lending decisions and reduce default risk.

-

Goldfinch offers under-collateralized loans by combining on-chain risk assessment with off-chain data, targeting emerging markets and institutional borrowers. Its protocol uses borrower reputation and payment history to manage lending risk.

-

Maple Finance provides under-collateralized lending to institutional borrowers, using a mix of on-chain analytics and delegate-based risk assessment. The protocol tracks borrower performance and adjusts terms based on real-time risk profiles.

-

TrueFi implements on-chain credit scoring and rigorous borrower vetting to support under-collateralized lending. The protocol leverages blockchain data and borrower history to minimize liquidation risk and optimize loan terms.

The integration of advanced onchain analytics into DeFi lending platforms signals a new era where data-driven insights drive smarter decisions for both borrowers and lenders. While challenges remain around standardization and privacy, the direction is clear: decentralized credit scoring will be central to unlocking trillions in liquidity for crypto markets while safeguarding against systemic risks.