In decentralized finance (DeFi), the practice of over-collateralization has long been a double-edged sword. While it provides lenders with security, it also locks up capital and excludes borrowers who lack substantial crypto assets. As DeFi matures, the emergence of onchain risk scores is reshaping this landscape, making under-collateralized lending not only viable but increasingly attractive for both users and protocols.

Why Over-Collateralization Limits DeFi’s Potential

Traditional DeFi lending protocols require borrowers to deposit more collateral than the value of their loans. This system, while effective at minimizing default risk, significantly reduces capital efficiency. Funds that could otherwise be deployed productively are instead locked away as idle collateral. For many users, especially those without large crypto holdings, access to credit remains out of reach.

The result is a paradox: DeFi promises open access to financial services, yet its reliance on over-collateralization undermines inclusion and restricts growth. The need for a more nuanced approach to credit risk assessment is clear.

The Rise of Onchain Risk Scores in Crypto Credit Assessment

Onchain risk scores address these inefficiencies by quantifying borrower creditworthiness based on transparent, immutable blockchain data. Unlike traditional credit scoring, which relies on opaque off-chain metrics and centralized agencies, onchain risk scores analyze:

- Historical transaction data

- Loan repayment behavior

- Interactions with multiple protocols

- Wallet-specific activity across chains

This approach enables lenders to offer under-collateralized or even zero-collateral loans without sacrificing prudent risk management. By leveraging decentralized identity (DID) frameworks and privacy-preserving attestations, these systems can maintain user confidentiality while providing verifiable reputational data.

Pioneering Protocols: Cred Protocol, RociFi, and Spectral

A number of projects are advancing the frontier of under-collateralized lending in DeFi:

Top DeFi Protocols Using Onchain Risk Scores

-

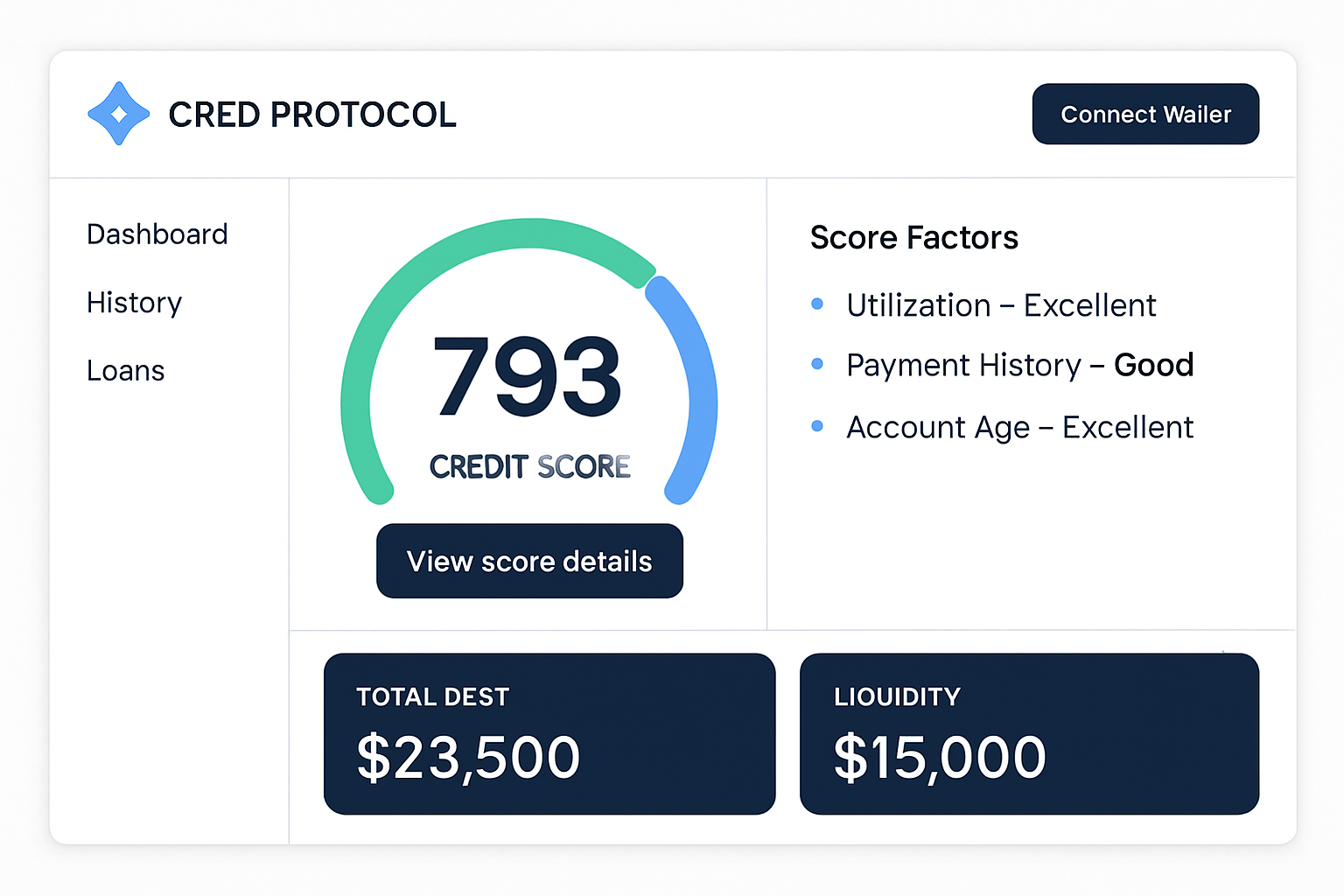

Cred Protocol builds decentralized credit scores by analyzing users’ on-chain activity, enabling under-collateralized lending and expanding access to DeFi credit markets.

-

RociFi utilizes a combination of decentralized identity and on-chain reputation to issue non-fungible credit scores (NFCS), allowing users to access zero or under-collateralized loans based on their historical blockchain behavior.

-

Spectral offers the Multi-Asset Credit Risk Oracle (MACRO) score, which evaluates wallet creditworthiness using on-chain transaction data and issues Non-Fungible Credits (NFCs) that represent a user’s unique risk profile.

Cred Protocol quantifies lending risk by building decentralized credit scores from users’ historical repayment data. By rewarding responsible borrowing behavior, Cred aims to expand access to capital throughout the DeFi ecosystem.

RociFi takes this further by combining DID and behavioral analytics across multiple blockchains. Borrowers receive an NFCS (Non-Fungible Credit Score) between 1 (lowest risk) and 10 (highest), unlocking tailored loan terms based on their demonstrated trustworthiness.

Spectral’s MACRO score, modeled after FICO’s familiar range (300-850), distills complex wallet activity into an easily interpretable number encapsulated in Non-Fungible Credits (NFCs). Each NFC is unique to a wallet address, enabling portable reputation across platforms.

The Mechanics Behind Onchain Credit Scoring Systems

The core innovation lies in transforming raw blockchain data into actionable insights for lenders. Algorithms parse transaction histories, tracking timely repayments, defaults, liquidations, and protocol interactions, to construct dynamic profiles that evolve with each user’s activity. This continuous feedback loop incentivizes positive borrower behavior while equipping lenders with granular tools for pricing risk.

This new paradigm is already catalyzing real-world impact within DeFi communities. As more protocols adopt these mechanisms, we are witnessing the first steps toward a more inclusive financial system where reputation, not just collateral, unlocks opportunity.

For lenders, the shift to onchain risk scores means they can segment borrowers by risk tier and adjust loan terms with far greater precision. Risk-adjusted interest rates, flexible collateral requirements, and dynamic credit limits become possible, all rooted in a transparent and auditable data trail. This not only boosts capital efficiency but also encourages responsible participation, borrowers who consistently repay are rewarded with better terms, while risky behavior is swiftly reflected in their score.

Borrowers benefit from greater access and autonomy. Instead of being penalized for a lack of assets or off-chain credit history, users can build reputation directly through their onchain actions. This opens DeFi lending to new demographics, small traders, emerging market participants, and even DAOs, who were previously sidelined by rigid collateral demands.

Challenges: Privacy, Security, and Adoption

Despite the advantages, several hurdles remain before under-collateralized DeFi lending achieves mainstream adoption. The most pressing is privacy. While onchain data is transparent by design, protocols must balance this openness with user confidentiality. Privacy-preserving technologies such as zero-knowledge proofs and selective disclosure are being explored to ensure sensitive information does not become a liability.

Security is another critical concern. Manipulation of transaction histories or Sybil attacks (where one entity controls many wallets) could undermine the integrity of credit scores. Robust identity solutions, such as decentralized identifiers (DIDs) combined with verifiable credentials, are essential to mitigating these risks.

Finally, adoption hinges on interoperability and standardization across protocols. For onchain risk scores to reach their full potential, they must be portable between platforms and recognized by multiple lenders, a challenge that will require industry-wide collaboration.

What’s Next for Under-Collateralized Lending?

The momentum behind DeFi credit scoring is unmistakable. As protocols like Cred Protocol, RociFi, and Spectral refine their models and expand integrations, we can expect to see:

Key Innovations in Onchain Risk-Driven DeFi Lending

-

Cred Protocol: Pioneering decentralized credit scoring, Cred Protocol enables under-collateralized lending by analyzing borrowers’ on-chain behaviors, such as repayment history and protocol interactions. Their system quantifies risk, allowing lenders to offer loans with reduced collateral requirements.

-

RociFi: RociFi integrates decentralized identity with on-chain reputation, issuing a non-fungible credit score (NFCS) based on a user’s historical activity across multiple blockchains. This allows for zero and under-collateralized lending, expanding access to capital within DeFi.

-

Spectral: With its Multi-Asset Credit Risk Oracle (MACRO) score, Spectral brings FICO-like scoring to DeFi. The MACRO score, ranging from 300 to 850, is derived from on-chain transaction data and encapsulated in unique Non-Fungible Credits (NFCs) tied to wallet addresses.

-

Privacy-Preserving Credit Transfer: Innovations such as privacy-preserving FICO score transfer are emerging, enabling users to port traditional credit scores on-chain without compromising sensitive data. This bridges real-world creditworthiness with DeFi lending platforms.

-

Ethereum Attestation Service (EAS): Projects are leveraging Ethereum Attestation Service to create verifiable, privacy-conscious attestations of borrower data. This enhances trust and scalability for under-collateralized lending pools in DeFi.

The implications are profound: trillions of dollars in real-world assets could eventually flow into DeFi as trustless reputation systems replace static collateral requirements (learn more here). This would unlock capital currently sitting idle while fostering a more resilient global financial network.

The journey is just beginning. As the technology matures, and as regulators take notice, the next wave of DeFi growth will be shaped not just by code or liquidity but by the sophistication of its crypto credit risk assessment. For users willing to embrace transparency and cultivate an onchain reputation, the future promises unprecedented access to decentralized financial services.