In the early days of decentralized finance, crypto lending was synonymous with overcollateralization. Borrowers would routinely lock up $10,000 in ETH to access a $6,000 loan, a model that preserved protocol solvency but left trillions of dollars in untapped capital on the sidelines. The landscape is shifting, however, as decentralized identity (DID) and onchain risk scores emerge as the twin engines powering a new era of undercollateralized crypto loans. Instead of relying solely on asset pledges, DeFi protocols are now weaving together digital reputation and transparent onchain behavior to unlock credit for users who were previously boxed out by high collateral demands.

The Problem With Overcollateralization: Capital Inefficiency

For all its innovation, DeFi’s early lending protocols, think Compound and Aave, were built on a logic of mistrust. Users could borrow only by providing more value in collateral than they received as a loan. This approach secures lenders against default but suffocates capital efficiency, preventing broader financial inclusion and limiting the real-world impact of decentralized credit.

As protocols matured and user sophistication grew, so did frustration with this model. Why should someone with years of responsible DeFi usage or significant DAO participation be treated the same as an anonymous wallet with no history? Traditional finance answers this question with credit bureaus and FICO scores. In crypto, the answer is taking shape through DID systems and onchain risk scores.

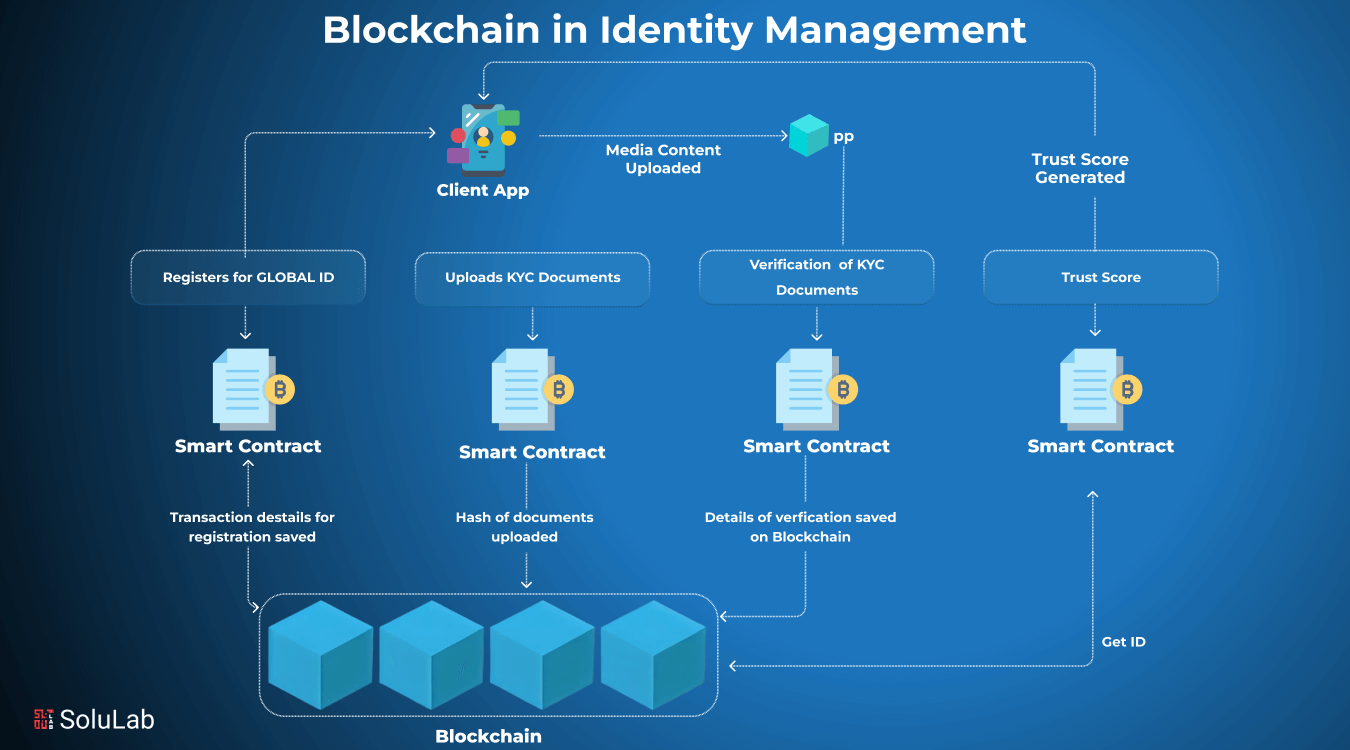

DID: Building Trust Without Central Authorities

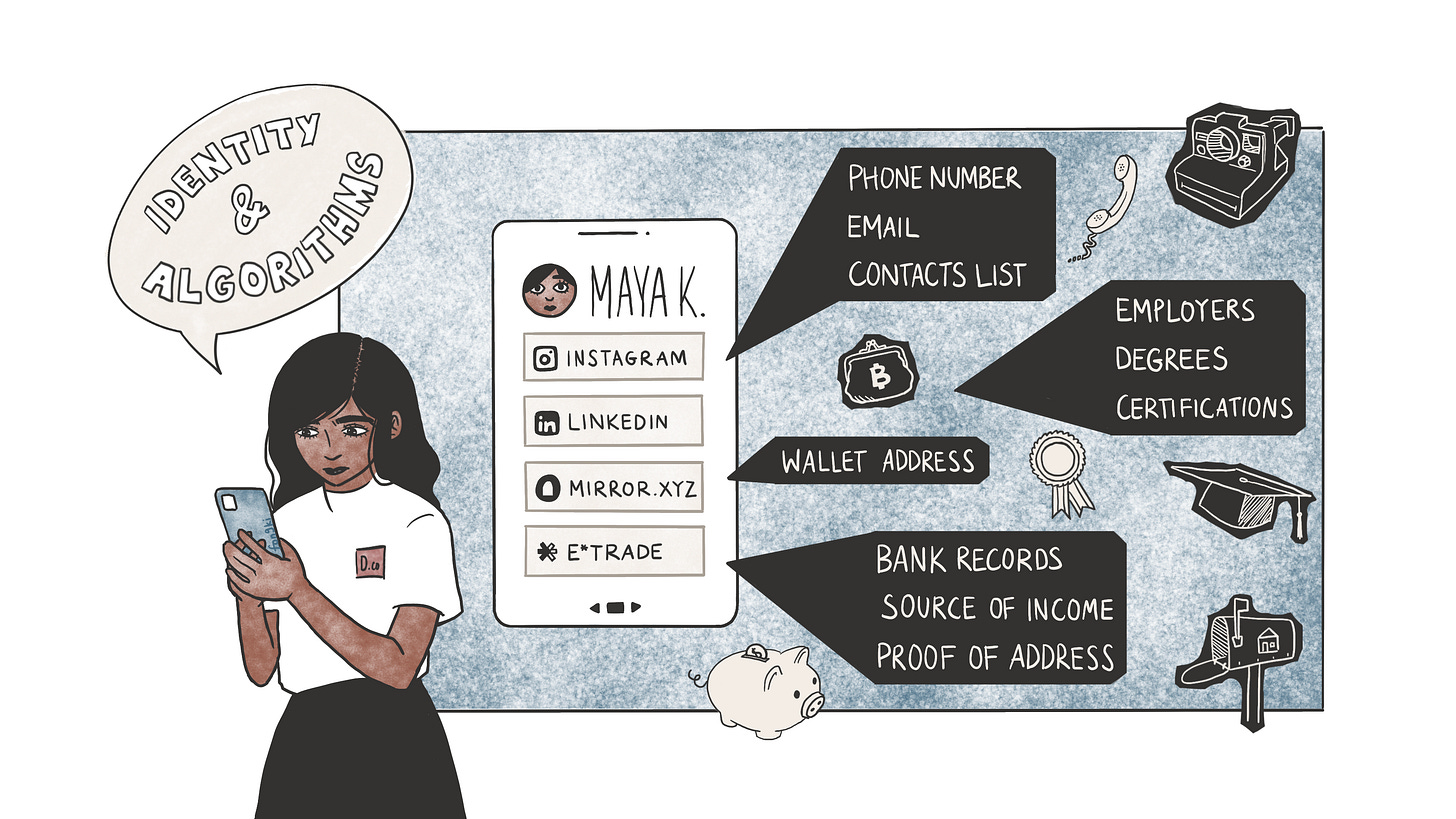

Decentralized identity for crypto lending is about more than pseudonymous wallet addresses. DID frameworks let users assemble a mosaic of verifiable credentials, social media profiles, DAO memberships, NFT holdings, that collectively establish digital trustworthiness. Imagine a borrower whose address shows regular payroll deposits from a reputable Web3 company or active governance participation in major DAOs; such signals can now serve as proxies for reliability.

This transformation is not just theoretical. Platforms like RociFi are pioneering mechanisms where borrowers mint non-transferable tokens representing their credit score, a concept known as Non-Fungible Credit Score (NFCS). These tokens are tied to both DID credentials and historic blockchain activity, allowing lenders to assess risk based not just on assets locked but also on reputation earned.

Onchain Risk Scores: Quantifying Reputation at Scale

The next crucial piece is onchain risk scores DeFi. Where traditional credit bureaus rely on opaque data sources and proprietary algorithms, onchain scoring leverages blockchain’s radical transparency. Every transaction, be it prompt loan repayment or participation in yield farming, is recorded immutably. Protocols like RociFi analyze this data across multiple chains to generate granular risk profiles.

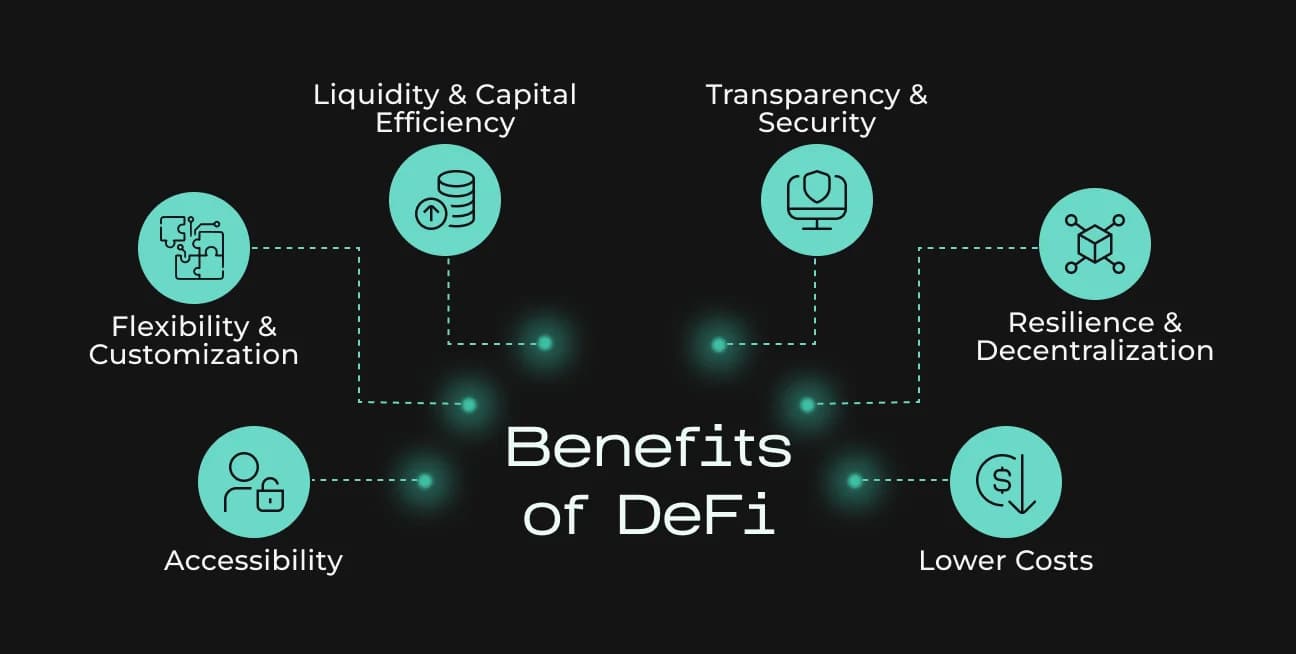

Key Benefits of Onchain Credit Assessment in DeFi Lending

-

Enables Undercollateralized Loans: Onchain credit assessments empower borrowers to access loans with less collateral by leveraging their decentralized identity (DID) and on-chain risk scores, moving beyond the traditional overcollateralized DeFi model. This opens up lending to a broader user base and increases capital efficiency. Learn more about RociFi’s approach

-

Improves Borrower Access and Inclusivity: By utilizing verifiable on-chain activity and digital reputations, platforms like RociFi and Huma Finance allow borrowers without traditional credit histories to prove trustworthiness, expanding financial inclusion in the DeFi ecosystem.

-

Enhances Lender Risk Management: Lenders can evaluate borrower risk using transparent, real-time on-chain credit scores (such as RociFi’s Non-Fungible Credit Score), enabling more informed lending decisions and potentially reducing default rates.

-

Promotes Capital Efficiency: With accurate on-chain credit assessments, DeFi protocols can allocate capital more efficiently, reducing the need for excessive collateral and unlocking greater liquidity for both borrowers and lenders.

-

Introduces Social Recourse and Reputation Incentives: Integration of DID and risk scores means that loan defaults can negatively impact a borrower’s public reputation and digital asset standing, incentivizing responsible borrowing and timely repayments.

-

Supports Permissionless and Transparent Lending: Onchain credit systems operate without centralized intermediaries, ensuring that lending criteria and risk assessments are transparent, auditable, and accessible to all participants in the DeFi space.

This approach does more than just replace FICO; it reimagines what it means to be “creditworthy” in an open financial system. For example, if you have repaid five loans across three different protocols without incident, and your DID ties you to an active role in Web3 communities, you are far less risky than an address with no such history or credentials.

The Road to Trillions: Why Undercollateralized Crypto Loans Matter Now

The implications are profound. As highlighted by recent research from Onchain and Galaxy Digital, unlocking undercollateralized lending could bring trillions of dollars into DeFi by making capital accessible to those who have digital reputations but lack vast crypto reserves. This shift isn’t just about higher yields, it’s about democratizing access to financial opportunity while maintaining robust risk controls.

Lenders gain new tools to price risk dynamically rather than relying solely on blunt collateral ratios; borrowers get rewarded for responsible behavior rather than punished for lacking assets. In short, the fusion of DID in decentralized finance with actionable risk scoring is setting the stage for permissionless credit at global scale, a leap that could finally make good on DeFi’s promise of open finance for all.

Yet, as with any paradigm shift, the road to undercollateralized crypto loans is not without its challenges. The promise of onchain credit assessment is only as strong as the data and incentives underpinning it. Ensuring that DIDs remain secure and resistant to Sybil attacks – where one user masquerades as many to game the system – is a foundational requirement. Similarly, protocols must constantly refine their risk models to account for emerging behaviors and edge cases, such as flash loan exploits or orchestrated defaults.

Privacy is also a double-edged sword. While transparency is crucial for lenders, borrowers are rightfully concerned about exposing sensitive information or being permanently penalized for early missteps. The most promising DID architectures allow users to selectively disclose credentials, proving they meet certain criteria (like never defaulting on a loan) without revealing every detail of their financial history. This balance between privacy and accountability will define which platforms earn user trust in the long run.

Real-World Impact: Case Studies in Action

Some of the most compelling examples come from protocols actively deploying these innovations. RociFi’s NFCS model, for instance, has already enabled thousands of wallets to access loans with less collateral by leveraging their onchain reputations. Meanwhile, platforms like Wildcat are experimenting with customizable vaults where borrowers can showcase unique combinations of DID credentials and repayment histories to negotiate better terms.

These advances aren’t limited to individual users. Institutional lenders are beginning to adopt onchain risk scores DeFi tools to underwrite larger loans for DAOs, Web3 startups, and even traditional businesses seeking blockchain-based credit lines. The result is a growing ecosystem where reputation becomes portable capital – a key that unlocks liquidity across protocols and use cases.

Looking Ahead: What’s Next for DID and Onchain Credit?

The next wave of development will focus on interoperability and standardization. For undercollateralized crypto loans to reach their full potential, DID systems must be recognized across chains and platforms, allowing users to build credit histories that travel with them throughout the DeFi universe. Industry groups are already collaborating on open standards for verifiable credentials, ensuring that a reputation earned in one protocol can be trusted elsewhere.

Key Challenges Hindering DID Adoption in Crypto Lending

-

Data Privacy and Security Concerns: Ensuring that decentralized identity data remains secure and private is a significant challenge. While DIDs provide users with more control, breaches or leaks of sensitive identity data can undermine trust and expose users to risks such as identity theft or financial loss.

-

Manipulation of On-Chain Risk Scores: On-chain credit scoring systems, like RociFi, rely on analyzing users’ historical blockchain activity. However, sophisticated actors may attempt to game these systems by creating artificial transaction histories or using multiple wallets, potentially leading to inaccurate risk assessments.

-

Lack of Standardization Across Platforms: The absence of unified standards for DIDs and on-chain risk scores creates interoperability issues. Borrowers and lenders may find it difficult to use their digital identities or credit histories across different DeFi protocols, limiting the scalability and effectiveness of undercollateralized lending.

-

Limited Adoption and Network Effects: DID and on-chain risk scoring systems require broad participation to function effectively. Without widespread adoption by both users and platforms, the data available for risk assessment remains fragmented, reducing the reliability and utility of these systems in the crypto lending space.

-

Regulatory Uncertainty: The evolving regulatory landscape around digital identities, privacy, and financial services creates uncertainty for DeFi projects integrating DID and risk scoring. Compliance requirements may differ across jurisdictions, posing challenges for global platforms and potentially stifling innovation.

Ultimately, the integration of decentralized identity and transparent risk scoring is transforming DeFi from a walled garden into a global credit network. As more users build portable reputations through responsible participation, we move closer to an ecosystem where access to opportunity isn’t dictated by wealth alone but by provable trustworthiness. For those building or borrowing in this space, now is the time to engage with these tools, not just as passive users but as active architects shaping the future of finance.