Decentralized finance (DeFi) is rapidly evolving, and the integration of decentralized identity (DID) for crypto lending is at the heart of this transformation. Traditionally, DeFi lending protocols have relied on over-collateralization to mitigate risk, requiring users to lock up assets worth more than the loan itself. While effective for protecting lenders, this model restricts access for many potential borrowers and limits capital efficiency. The emergence of onchain risk scoring powered by DID is changing this paradigm, making under-collateralized credit in DeFi both viable and scalable.

How Decentralized Identity Reshapes Crypto Credit Risk Assessment

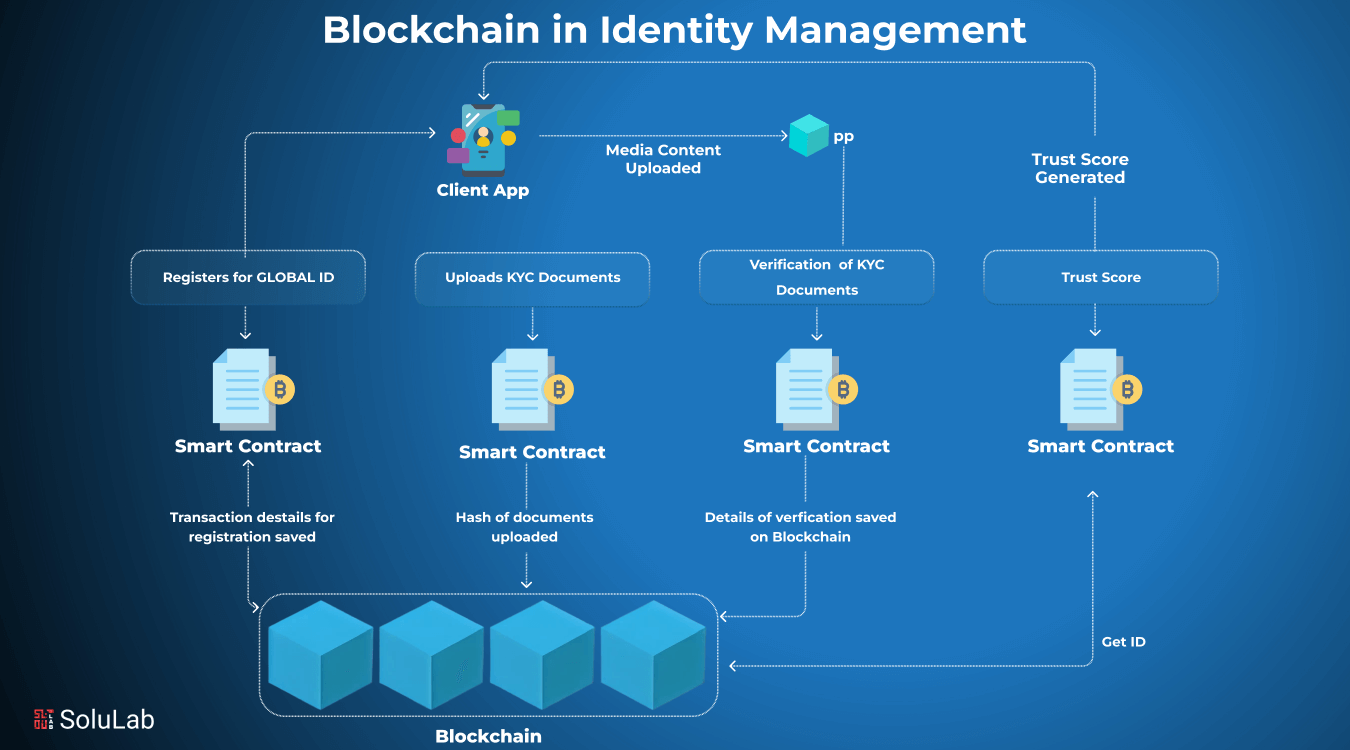

DID enables individuals to establish verifiable digital identities that aggregate multiple data points from both on-chain and off-chain sources. This includes transaction histories, DAO participation, NFT ownership, and even social media activity. By consolidating these elements into a single digital profile controlled by the user, DeFi platforms can generate nuanced onchain credit scores that reflect real financial behavior instead of mere wallet balances.

For example, RociFi’s innovative approach leverages DID to connect diverse identity data such as Twitter and GitHub accounts with blockchain activity. Their system produces a non-fungible credit score (NFCS), ranging from 1 to 10 – with 1 representing the lowest credit risk. This multi-faceted assessment provides lenders with a richer picture of borrower reliability beyond what legacy systems or simple wallet analytics can offer (source).

The Mechanics Behind Onchain Risk Scoring for Under-Collateralized Loans

The core breakthrough lies in how DID-based frameworks enable dynamic crypto credit risk assessment. Instead of demanding blanket collateral requirements, protocols like Creditlink introduce trustless scoring mechanisms that analyze users’ historical repayment patterns and overall on-chain activity (source). These scores are dynamic: as users repay loans responsibly or participate constructively in DAOs, their creditworthiness improves – often resulting in reduced collateral requirements or even zero-collateral loans for top scorers.

This approach not only increases capital efficiency but also aligns incentives toward responsible financial behavior within the ecosystem. Borrowers are motivated to maintain positive reputations since their access to favorable loan terms depends directly on their on-chain actions.

Key Benefits of DID-Powered Onchain Risk Scoring in DeFi Lending

-

Enhanced Creditworthiness Assessment: DID enables DeFi platforms to verify and aggregate diverse identity data—such as on-chain transaction history, DAO participation, and social profiles—creating a holistic and accurate credit risk profile for borrowers. This approach is exemplified by RociFi, which utilizes DID to generate non-fungible credit scores (NFCS) based on multi-chain activity.

-

Enables Under-Collateralized and Zero-Collateral Loans: By leveraging DID-based risk scores, DeFi protocols like Creditlink can tailor collateral requirements to individual risk profiles. Borrowers with strong on-chain reputations may qualify for loans with reduced or even zero collateral, increasing capital efficiency.

-

Promotes Financial Inclusion: DID-powered risk scoring opens DeFi lending to users without large crypto holdings by allowing access to credit based on digital reputation and verifiable on-chain behavior, not just asset size.

-

Incentivizes Responsible On-Chain Behavior: Since DID-based scores reflect a user’s historical actions, borrowers are motivated to maintain positive financial habits and responsible participation in the ecosystem to secure better loan terms.

-

Privacy-Preserving and Trustless Verification: Platforms such as Creditlink utilize privacy-preserving mechanisms to assess creditworthiness without exposing sensitive personal data, maintaining user autonomy and security while enabling risk assessment.

Paving the Way for Financial Inclusion and Capital Efficiency

The adoption of DID in DeFi credit scoring marks a significant shift toward inclusion. Many users who lack large crypto holdings but have robust digital reputations can now access loans they previously couldn’t obtain. As highlighted by platforms like Spectra and Credora, combining repayment history with decentralized reputation systems expands access while still managing risk (source). This evolution empowers individuals globally, especially those underserved by traditional finance, to participate in new economic opportunities.

The result is an ecosystem where trust is established through transparent, verifiable data rather than opaque institutional processes. By reducing reliance on excessive collateralization and focusing on holistic reputation metrics, DeFi can unlock trillions in value for crypto markets and drive sustainable growth across blockchain finance.

As the infrastructure for under-collateralized credit DeFi matures, the practical implications extend far beyond just technical innovation. We now see a competitive landscape where lending protocols race to refine their onchain risk scoring models, leveraging DID to deliver more tailored, risk-adjusted loan products. This not only benefits borrowers, who gain access to capital with less friction, but also lenders, who can make more informed decisions based on transparent, auditable data.

One of the most compelling aspects of DID-powered credit scoring is its potential to bridge the gap between on-chain and off-chain identities. For instance, protocols may incorporate verified employment records, educational credentials, or even real-world asset ownership into a user’s DID profile. This hybrid approach could further enhance risk assessment accuracy while preserving user privacy through zero-knowledge proofs and selective disclosure mechanisms.

Moreover, the integration of onchain risk scoring with decentralized identity is catalyzing the emergence of secondary markets for credit scores themselves. Borrowers with strong on-chain reputations may be able to tokenize their scores as NFTs, using them as collateral or even transferring reputation across platforms. This composability unlocks new forms of financial engineering and deepens liquidity within DeFi lending markets.

Challenges and Future Directions

Despite these advances, several challenges remain. The reliability of DID frameworks depends on the integrity of underlying data sources and the robustness of privacy protections. Sybil resistance – ensuring that a single user cannot create multiple identities to game the system – is a persistent concern that requires ongoing innovation in identity verification and social graph analysis.

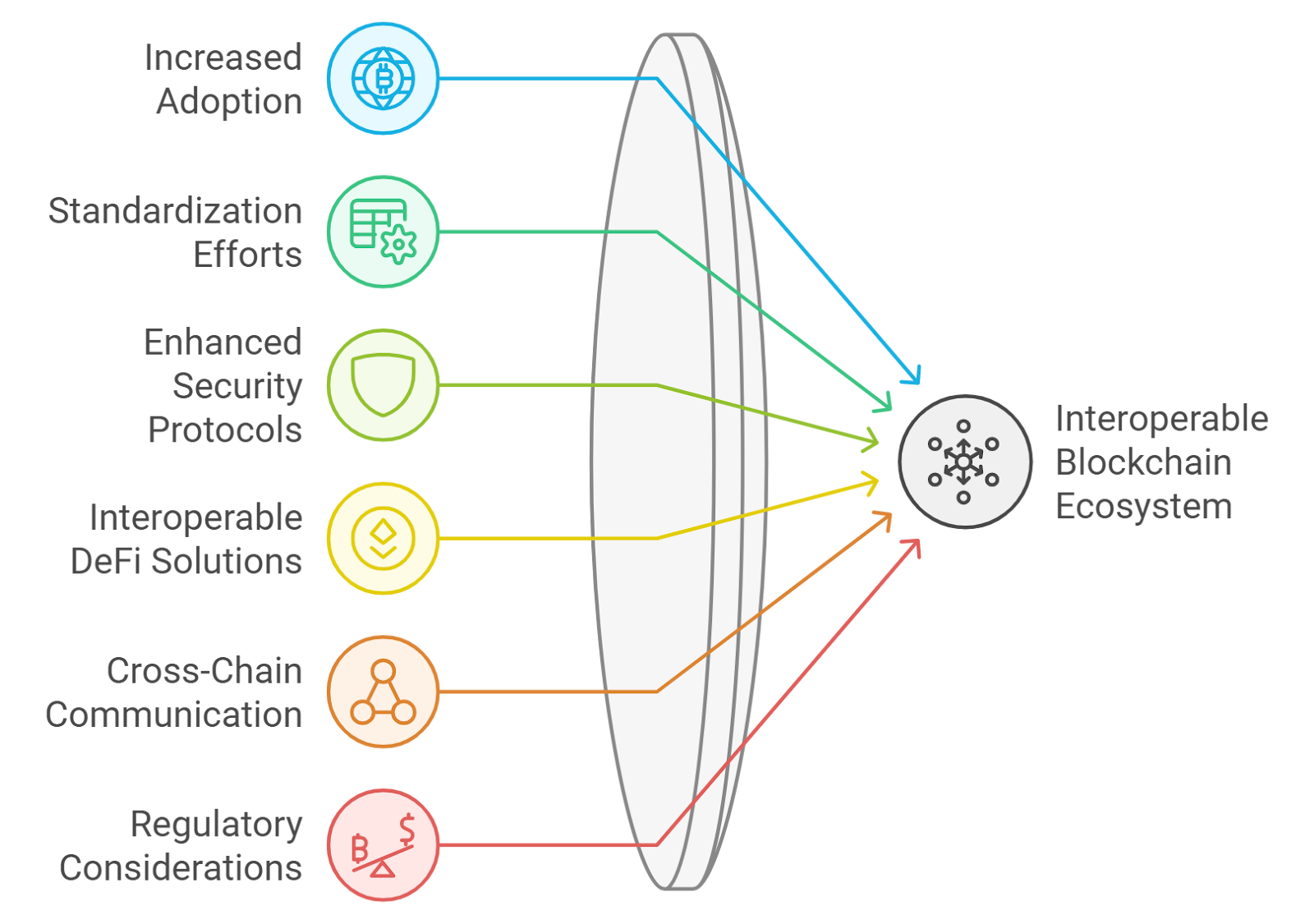

Additionally, regulatory clarity around decentralized identity and credit scoring is still evolving. As institutional players enter DeFi, interoperability between DID systems and traditional KYC/AML requirements will become increasingly important. Projects that can balance compliance with decentralization will be best positioned for long-term success.

Key Challenges for DID Adoption in DeFi Lending

-

Interoperability Across Chains: DID solutions often lack seamless compatibility between different blockchains, making it difficult to aggregate and verify identity data for multi-chain lending protocols.

-

Privacy vs. Transparency Trade-offs: Balancing user privacy with the need for transparent credit assessment remains a challenge, as revealing too much personal data can compromise anonymity while too little may hinder accurate risk scoring.

-

Limited Standardization: The absence of universally accepted DID standards leads to fragmentation, with platforms like RociFi, Creditlink, and others developing proprietary systems that may not communicate effectively.

-

Onboarding and User Experience: Setting up and managing a decentralized identity can be complex for users unfamiliar with blockchain technology, which may slow adoption in mainstream lending applications.

-

Data Quality and Verifiability: Ensuring that on-chain and off-chain data linked to a DID is accurate, up-to-date, and tamper-proof is crucial for reliable credit scoring, yet remains a persistent technical hurdle.

-

Regulatory Uncertainty: The evolving regulatory landscape around digital identity, privacy, and financial services creates uncertainty for DeFi platforms integrating DID, potentially limiting institutional participation.

Looking ahead, collaboration across protocols, standards bodies, and user communities will be vital. Open-source DID standards, cross-chain interoperability, and community-driven governance can help ensure that DID in DeFi credit scoring remains transparent, fair, and accessible to all participants.

The trajectory is clear: by embedding decentralized identity at the core of credit risk assessment, DeFi is poised to deliver a more inclusive, efficient, and trustless financial system. As these systems mature, expect to see a steady influx of new users, capital, and institutional adoption – validating the promise that onchain credit risk assessment can truly unlock trillions in value for the digital economy.