For years, decentralized finance (DeFi) lending protocols have operated under a simple but limiting principle: protect lenders by demanding borrowers post more collateral than the value of their loan. While this over-collateralization model has fueled DeFi’s explosive growth, it has also walled off much of the world from crypto credit, trapping capital and stifling inclusion. But a new wave of innovation is turning this model on its head. On-chain risk scores are unlocking under-collateralized loans in DeFi, using blockchain data to assess borrower risk and fuel a more open, efficient financial system.

The Problem: Collateral Walls and Capital Inefficiency

Traditional DeFi lending protocols like Aave and Compound require users to lock up assets worth 120% or more of the loan amount. This protects lenders from defaults but creates two major problems. First, it excludes would-be borrowers who don’t have large crypto holdings. Second, it leads to poor capital efficiency – much of the ecosystem’s liquidity sits idle as locked collateral rather than circulating productively.

These limitations have kept DeFi credit out of reach for many users and businesses who could otherwise be productive borrowers if only they had access to a reliable way to prove their trustworthiness. Enter decentralized credit scoring.

What Are On-Chain Risk Scores?

An on-chain risk score is a quantitative measure of a wallet’s likelihood to repay loans based on transparent blockchain activity. Unlike traditional credit scores that rely on opaque off-chain data and centralized bureaus, these crypto-native scores are built from:

- Wallet transaction history: Patterns in transfers, swaps, staking, and protocol interactions

- Borrowing and repayment behavior: Timeliness and reliability in meeting obligations across multiple platforms

- Liquidation events: Frequency and severity of forced liquidations due to under-collateralization

- Diversity of activity: Engagement with different protocols can indicate sophistication or risk appetite

The key innovation is that all this data is public, auditable, and tied to wallet addresses – not personal identity – preserving privacy while enabling risk assessment at scale.

Pioneers: Protocols Building Decentralized Credit Scores

A handful of projects are leading the charge in bringing these ideas to life:

- Cred Protocol: Develops decentralized credit scores based on repayment history and protocol usage patterns. Their system lets lenders offer personalized terms based on real-time risk assessment.

- Spectral: Introduces the MACRO score – an on-chain analog to FICO – aggregating wallet activities into an actionable metric for lenders.

- RociFi: Blends fraud detection with reputation analytics to assign wallet-level credit ratings that inform under-collateralized loan offers.

This new breed of protocols uses smart contracts to automate both score calculation and lending decisions. The result? Borrowers with strong histories can access loans with lower collateral requirements or even none at all – something previously unthinkable in DeFi.

The Mechanics: How On-Chain Risk Scores Power Under-Collateralized Loans

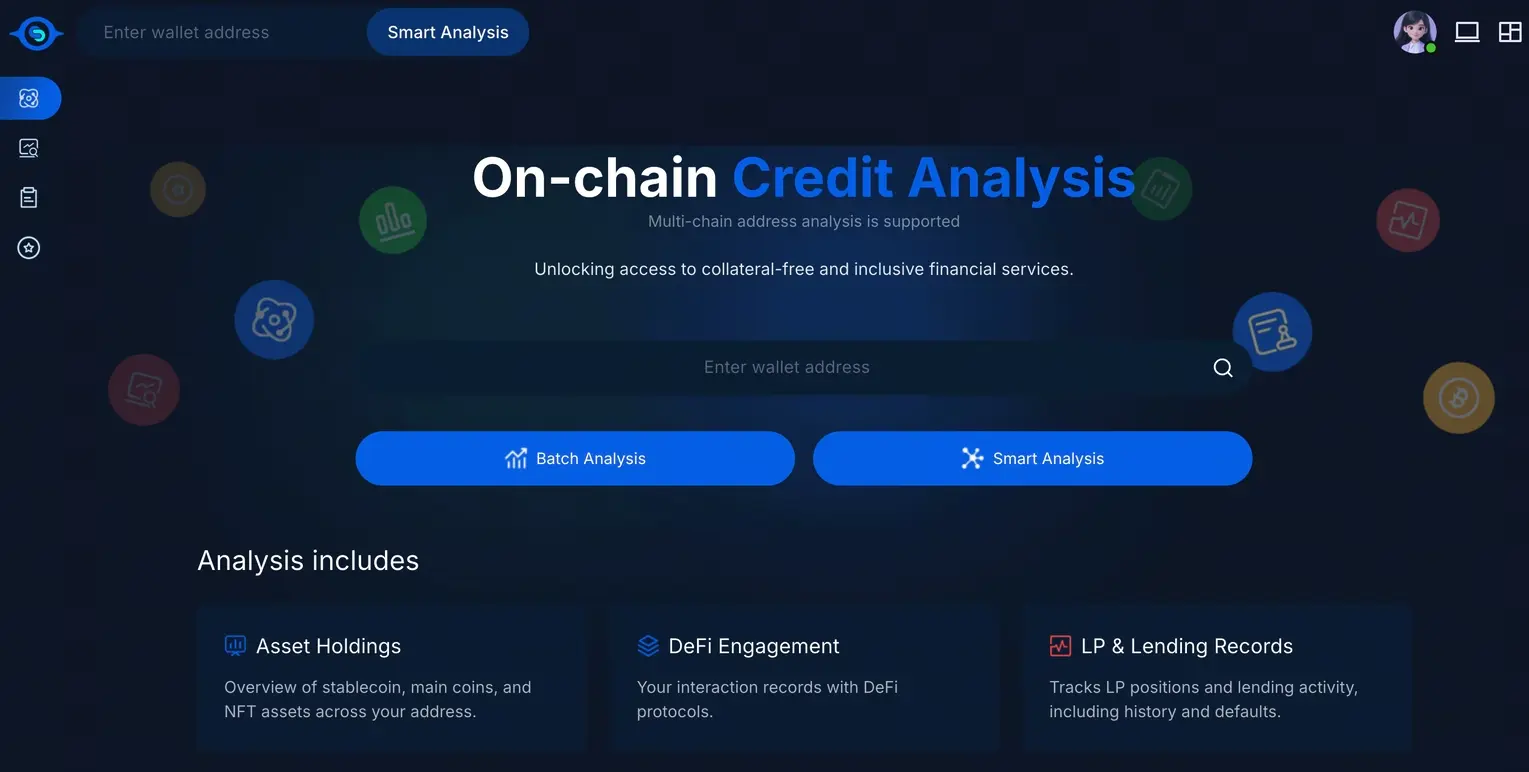

The process starts when a borrower connects their wallet to a participating protocol. The smart contract scans their historical blockchain data – no paperwork required. If their score meets certain thresholds (e. g. , consistent repayments across multiple platforms), they may qualify for an under-collateralized loan with favorable rates or higher loan-to-value ratios.

Lenders benefit too: by adjusting terms dynamically as new data streams in, protocols can maintain healthy risk-adjusted yields even as they expand access. It’s a win-win that brings us closer to true financial inclusion in crypto markets.

Yet, as with any financial innovation, the devil is in the details. The leap from over-collateralized to under-collateralized lending requires not only robust credit scoring but also new forms of risk mitigation and user protections. Protocols are actively experimenting with insurance pools, dynamic interest rates, and even social staking mechanisms to further align incentives and absorb losses when defaults occur. This arms race of risk management is essential for scaling under-collateralized loans beyond niche use cases.

Risks, Rewards, and Real-World Impact

One of the most compelling aspects of on-chain risk scores is their potential to bridge on-chain and off-chain economies. For example, a small business owner in a region with limited access to traditional banking can build a transparent repayment record on DeFi platforms, opening doors to capital previously out of reach. As these systems mature, we’ll see more sophisticated models that blend blockchain data with selective off-chain signals (like verified income streams or KYC credentials) while still preserving user privacy.

The rewards for getting it right are enormous. As highlighted by recent research and industry commentary, unlocking under-collateralized loans in DeFi could bring trillions in new liquidity into crypto markets by putting idle capital to work and extending credit to users who were once invisible to legacy finance. The shift isn’t just technical, it’s philosophical: trust is earned through transparent action rather than inherited privilege or opaque algorithms.

But risks remain. The transparency that makes decentralized credit scoring possible also raises questions about surveillance and wallet deanonymization. If not carefully managed, this could erode the very privacy ethos that makes DeFi attractive. Moreover, score manipulation, such as wash trading or coordinated repayment schemes, poses a real threat if protocols don’t continuously evolve their detection methods.

The Road Ahead: What Will Drive Adoption?

The next chapter for on-chain risk scores will be written by communities willing to experiment at the edges of what’s possible. Key drivers will include:

- User education: Borrowers and lenders alike must understand both the opportunities and pitfalls of under-collateralized lending powered by decentralized credit scoring.

- Protocol composability: Seamless integration with existing DeFi infrastructure will enable on-chain scores to become a core primitive, used everywhere from NFT lending markets to DAO treasury management.

- Evolving standards: Cross-protocol standards for risk scoring will foster interoperability and reduce fragmentation across ecosystems.

The momentum is undeniable: under-collateralized loans are no longer science fiction but an emerging reality reshaping how value moves online. As protocols like Cred Protocol, Spectral, RociFi, and new entrants, continue refining their models, expect rapid iteration on both technology and governance frameworks. Those who can prove trustworthiness transparently will access capital faster than ever before; those who game the system will find themselves locked out as algorithms grow smarter.

This is more than just another DeFi trend, it’s a fundamental reimagining of what it means to be “creditworthy” in an open financial world. The future belongs to those willing to stake their reputation, not just their assets, on the blockchain record.