In the world of decentralized finance (DeFi), the traditional model for borrowing has a major flaw: it demands that users deposit more collateral than they borrow. This over-collateralization is great for protecting lenders, but it leaves out a massive group of potential borrowers who simply don’t have enough idle crypto to lock up. It’s a capital efficiency nightmare and a major barrier to DeFi’s broader adoption. But now, onchain risk scores are shaking things up, promising to unlock under-collateralized loans and open the doors to trillions in new capital flows.

Why Over-Collateralization Holds DeFi Back

Let’s be real: requiring users to post $1,500 in ETH just to borrow $1,000 stablecoins is not exactly inclusive. This model was born out of necessity because blockchains are pseudonymous – there’s no easy way to verify someone’s real-world identity or credit history. If you default, the protocol needs enough collateral on hand to cover losses instantly and automatically.

The result? Only whales or well-capitalized users can participate meaningfully. Everyday users, small businesses, and even emerging market participants are left on the sidelines. Meanwhile, all that locked-up collateral sits idle – not earning yield or fueling innovation elsewhere. Inefficient capital is a problem that DeFi must solve if it wants to compete with traditional finance on a global scale.

The Rise of Onchain Risk Scores

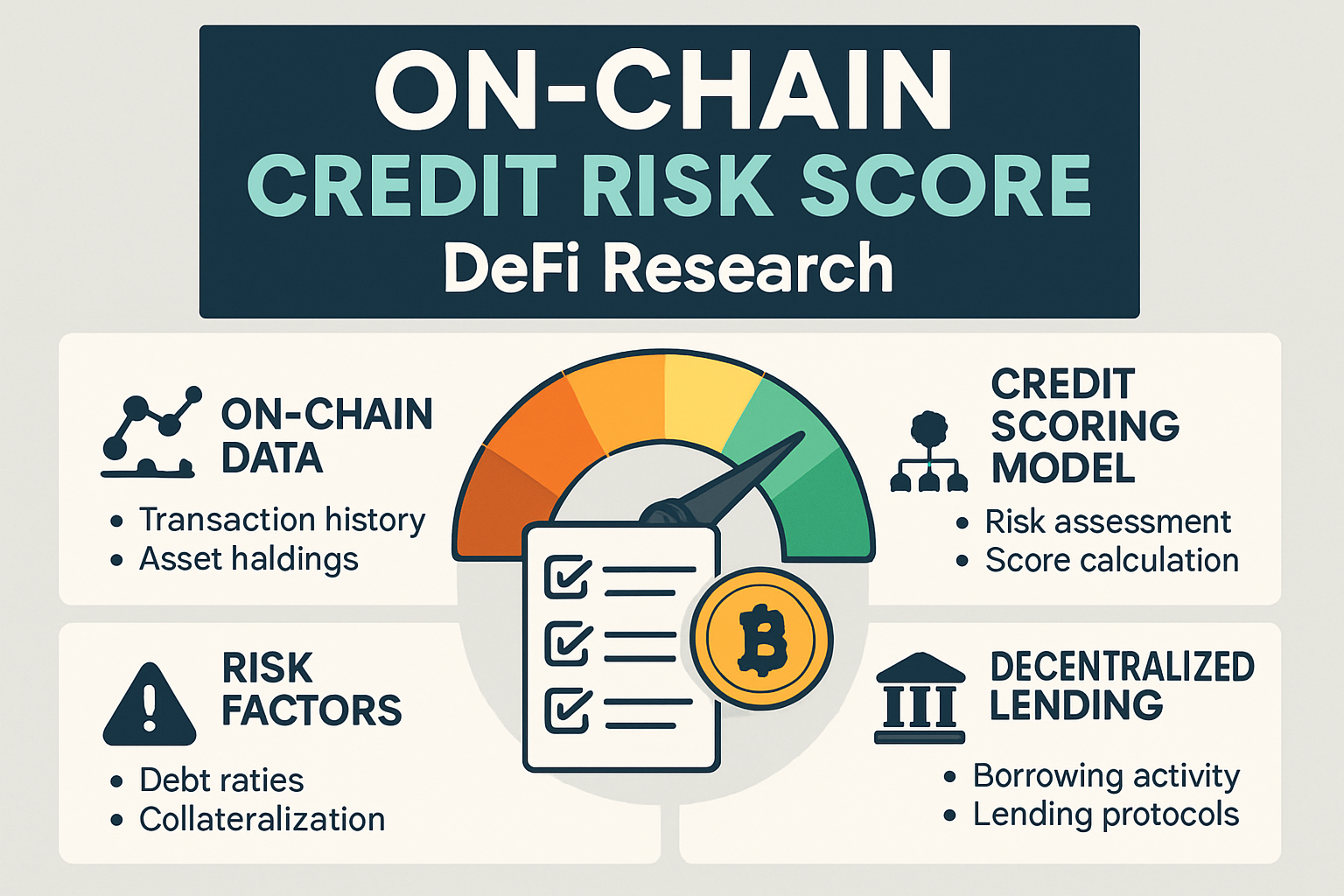

This is where onchain risk scores enter the chat. Instead of treating every wallet as an unknown risk, these scores analyze your historical blockchain activity – everything from repayment patterns and liquidation events to your interactions across protocols. The goal? Quantify your likelihood of repaying loans using hard data rather than assumptions.

Projects like Cred Protocol, Spectral, and RociFi are leading the charge here. For example:

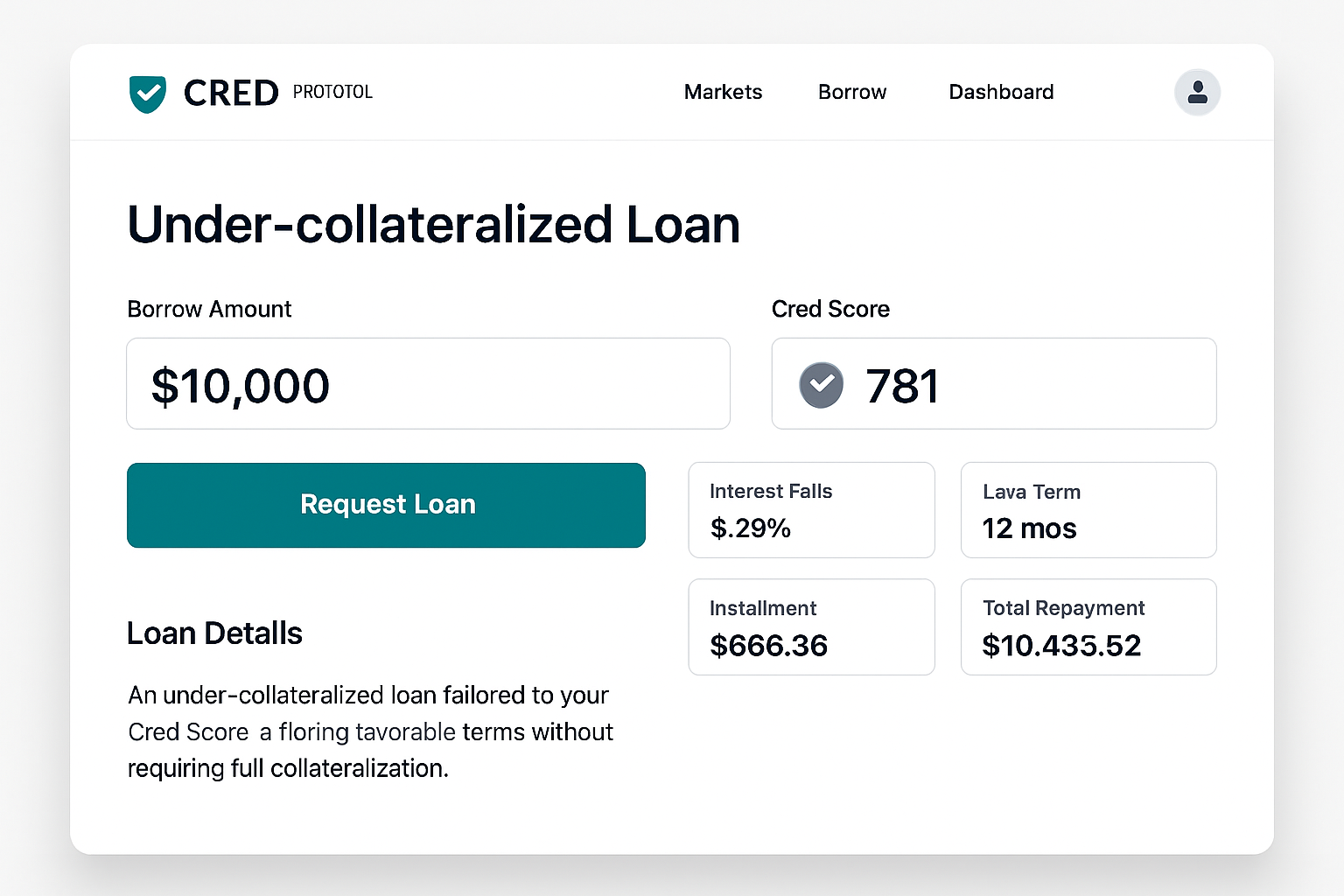

- Cred Protocol: Builds decentralized credit profiles based on your on-chain behavior so you can access loans with less (or even zero) collateral if you’ve proven trustworthy.

- Spectral: Uses its Multi-Asset Credit Risk Oracle (MACRO) score – think of it as an on-chain FICO score ranging from 300-850 – letting lenders make nuanced decisions instead of one-size-fits-all rules.

- RociFi: Categorizes borrowers into pools based on their score; higher-trust users get better terms and lower collateral requirements.

This isn’t just theory – academic research backs up these models too! The On-Chain Credit Risk Score (OCCR) framework quantifies wallet risks so protocols can safely adjust loan-to-value ratios without exposing themselves to catastrophic defaults.

A New Era for Inclusive Crypto Lending

The beauty of these systems is that they’re transparent and composable by design. Your repayment history follows your wallet wherever you go in DeFi – no centralized gatekeepers required. This means protocols can finally offer under-collateralized loans, tailoring interest rates and collateral requirements based on actual user behavior instead of blanket policies.

Lenders benefit from more granular risk assessment, while borrowers gain access without tying up all their assets as deadweight collateral. It’s a win-win that could bring vast new liquidity into DeFi markets and empower millions who were previously excluded from crypto credit altogether.

If you want a deeper dive into how these innovative systems work under the hood, check out our guide: How On-Chain Risk Scores Enable Under-Collateralized Loans in DeFi.

Let’s talk about the practical impact. With onchain risk scores, DeFi lending starts to look a lot more like traditional finance – but with all the transparency and programmability that crypto-native users expect. Borrowers who’ve demonstrated responsible on-chain behavior can negotiate better rates, longer terms, and lower collateral requirements. This is a massive shift: instead of being punished for not being a whale, your good behavior is finally rewarded.

For lenders, these scores are a game-changer. Instead of treating every borrower as an existential threat, they can price risk dynamically and tap into new markets. Imagine being able to offer under-collateralized loans to users with proven repayment histories from around the globe – all without relying on opaque credit bureaus or intrusive KYC checks. That’s not just capital efficiency; that’s financial inclusion at scale.

How Protocols Are Putting Onchain Credit Scoring to Work

Here’s how a typical flow works in today’s most advanced protocols:

Real-World Use Cases of Under-Collateralized DeFi Loans

-

Cred Protocol: Empowers users with decentralized credit scores, allowing borrowers to access under-collateralized loans based on their on-chain reputation—opening DeFi lending to a wider audience.

-

RociFi: Utilizes on-chain risk scores to sort borrowers into pools with different collateral requirements, enabling personalized, under-collateralized crypto loans tailored to each user’s creditworthiness.

-

Spectral: Provides a Multi-Asset Credit Risk Oracle (MACRO) score that lets DeFi lenders offer loans with reduced collateral, based on a borrower’s blockchain activity and repayment history.

-

Credora: Partners with DeFi protocols to deliver real-time on-chain credit assessments, powering institutional-grade under-collateralized lending and improving capital efficiency.

-

Academic Research (OCCR Score): DeFi protocols are adopting the On-Chain Credit Risk Score (OCCR Score) from academic studies to dynamically adjust loan terms, making under-collateralized lending safer and more scalable.

1. You connect your wallet to a lending dApp like Cred or RociFi. 2. The protocol analyzes your wallet’s activity – repayments, defaults, liquidations, and cross-protocol interactions. 3. It generates an onchain risk score for you in real time. 4. Based on this score, you’re offered personalized loan terms: higher LTV ratios, lower interest rates, or even zero-collateral options if you’re deemed low-risk. 5. If you repay successfully? Your score improves further – opening up even better opportunities next time.

This isn’t just theory anymore; protocols are already issuing millions in under-collateralized loans using these models today.

The Road Ahead: Challenges and Opportunities

Of course, it’s not all smooth sailing yet. There are still open questions around privacy (how much of your financial history should be public?), sybil resistance (how do we prevent users from gaming the system with multiple wallets?), and the interoperability of credit scores across different blockchains and dApps.

But the momentum is undeniable. As more protocols adopt decentralized identity solutions and standardized scoring frameworks, we’ll see even greater portability for credit histories across DeFi ecosystems. This means your hard-earned reputation isn’t locked to one platform – it becomes an asset you can leverage anywhere in crypto.

The bottom line? Onchain risk scores are transforming the DeFi lending landscape by making under-collateralized loans safer for lenders and dramatically more accessible for borrowers worldwide. We’re just scratching the surface of what’s possible as these systems mature – but one thing is clear: capital efficiency and inclusivity are no longer mutually exclusive in crypto finance.