Let’s be real: Decentralized Finance (DeFi) is rewriting the rules of lending, but there’s one big roadblock provides trust. In traditional finance, creditworthiness is built on years of repayment history and a whole lot of paperwork. In DeFi, it’s all about code, collateral, and transparency. But what if you could build trust in crypto lending without over-collateralizing every loan? That’s where transparent on-chain repayment histories step up to the plate.

Why On-Chain Repayment History Is a Game Changer

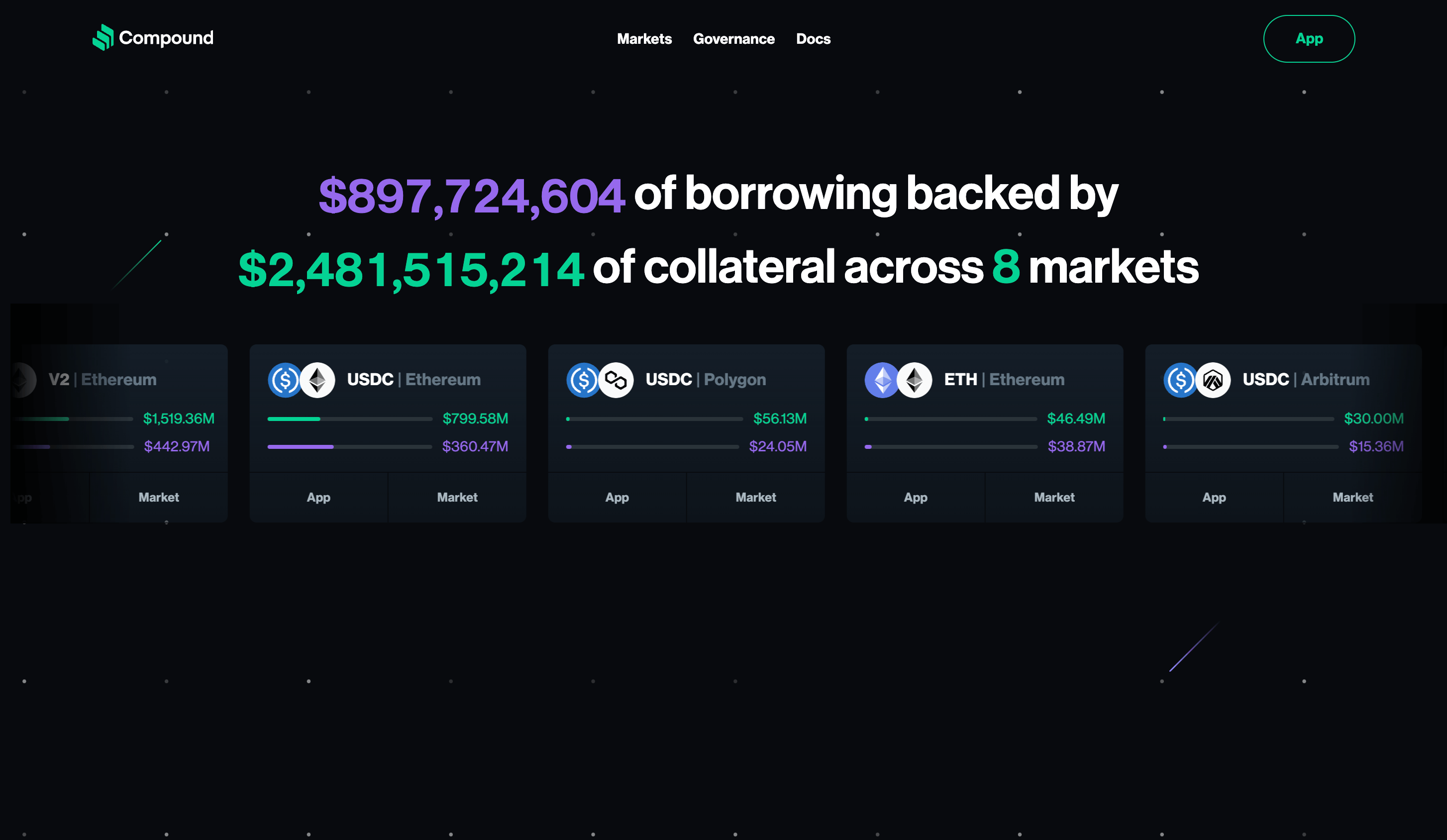

Over-collateralization has been the norm in DeFi lending for years. Borrowers often have to lock up assets worth more than their loan, limiting capital efficiency and excluding those without hefty portfolios. Enter on-chain repayment histories: by recording every payment (and default) directly on the blockchain, anyone can verify a borrower’s reputation instantly. This isn’t just theory, it’s already reshaping how lenders assess risk and borrowers access capital.

Imagine a world where your crypto lending reputation is as portable as your wallet address, and just as transparent. Lenders no longer have to fly blind or rely solely on collateral; they can check a borrower’s immutable record of repayments, late fees, and successful payoffs right on-chain. This shift is unlocking new opportunities for under-collateralized lending and making DeFi way more inclusive.

The Protocols Leading the Way

A few innovative protocols are taking this vision from whitepaper to reality:

Leading DeFi Protocols Shaping On-Chain Repayment Histories

-

Creditcoin: Pioneering transparent on-chain credit by recording real-world loan repayments directly to the blockchain, Creditcoin partners with fintech lenders to build immutable borrower histories—enabling unsecured and under-collateralized lending, especially in emerging markets.

-

TrueFi: This platform brings under-collateralized lending to DeFi by tracking borrower performance and repayments on-chain, using transparent credit ratings to assess reliability and open access to capital for more users.

-

Goldfinch: Focused on real-world impact, Goldfinch enables uncollateralized loans to businesses—mainly in emerging economies—by combining off-chain verification with on-chain repayment records, fostering trust and financial inclusion.

-

Teller: Leveraging Chainlink’s DECO protocol, Teller enables privacy-preserving access to off-chain credit data, allowing borrowers to prove creditworthiness and log repayments on-chain without sacrificing privacy.

-

PACT Protocol: By tokenizing loans as unique NFTs, PACT Protocol records each repayment on-chain, ensuring real-time transparency and automating fund distribution to stakeholders based on smart contracts.

-

3Jane: Utilizing zero-knowledge proofs, 3Jane securely links on-chain and off-chain credit data, enabling precise, privacy-focused credit assessments and tracking repayments to support under-collateralized lending.

- Creditcoin: Partners with fintech lenders to record real-world loan performance directly on-chain. Every successful repayment becomes part of an open, cryptographically-secured credit history, especially powerful in emerging markets where traditional credit systems fall short.

- Teller: Uses Chainlink’s DECO protocol to pull off-chain credit data into DeFi, without sacrificing privacy. This means you can prove your TradFi reliability while keeping your sensitive info safe from prying eyes.

- PACT Protocol: Tokenizes loans as NFTs (yes, really!), then logs each payment or missed installment right onto the blockchain for all stakeholders to see in real time.

This isn’t just about fancy tech, it’s about empowering users who’ve been locked out by legacy systems or high collateral requirements. Transparent records mean more people get access to credit while lenders have better tools for risk assessment.

The Double-Edged Sword: Benefits and Challenges Ahead

No innovation comes without trade-offs! While transparent repayment histories supercharge trust and expand access, there are some hurdles that still need tackling:

- Default Risk: Without large collateral buffers, lenders must rely more heavily on accurate risk assessment, and yes, some defaults will happen (source). But with every successful repayment logged publicly, good actors stand out fast and bad actors lose credibility just as quickly.

- Smart Contract Vulnerabilities: More complex systems mean more potential attack vectors. Rigorous security audits are non-negotiable (source). If you’re building or using these platforms, always DYOR!

- No Universal Score Yet: The industry still needs standardized frameworks for evaluating crypto lending reputation across chains and protocols (source). Expect lots of experimentation here over the next year!

The Big Picture: More Trust Means More Opportunity

The rise of transparent on-chain repayment histories is transforming not just who can borrow, but how lenders decide who gets access at all. As major protocols push forward with new models for recording and sharing borrower data securely, we’re seeing the early stages of a decentralized credit system that rivals anything TradFi has built, only faster, fairer, and way more open.

What’s most exciting? This transparency is already attracting new capital and fresh participants to DeFi. Lenders are gaining the confidence to offer under-collateralized loans, knowing they can verify a borrower’s real-time credit behavior. Borrowers, meanwhile, are building reputations that travel with them across protocols and even chains, no more starting from scratch every time you want a loan.

And let’s not forget the ripple effects: as these systems mature, expect broader financial inclusion and more competitive rates for everyone involved. The days of one-size-fits-all collateral rules are numbered. With transparent on-chain repayment histories, we’re moving toward a world where your digital reputation is your passport to opportunity, not just in DeFi, but across the entire crypto economy.

How to Get Involved: Next Steps for DeFi Users

You don’t have to be a protocol developer to benefit from this shift! Here’s how you can plug into the future of blockchain transparency and crypto lending reputation right now:

How to Leverage On-Chain Repayment History in DeFi

-

Choose DeFi platforms with on-chain credit tracking. Start by selecting reputable lending protocols like Creditcoin, TrueFi, or Goldfinch that record and display repayment histories on-chain. These platforms offer transparent borrower records, making it easier for both lenders and borrowers to assess trustworthiness.

-

Build your on-chain credit profile by repaying loans on time. Every timely repayment you make is immutably recorded on the blockchain, enhancing your creditworthiness for future loans. Consistent positive history can unlock access to under-collateralized or even uncollateralized loans on platforms like TrueFi and Goldfinch.

-

Monitor your credit reputation using blockchain explorers and dashboards. Use tools like DeBank or Dune Analytics to track your on-chain activity and repayment history. These platforms visualize your borrowing and repayment data, helping you understand and improve your credit profile.

-

Leverage your positive repayment history to negotiate better loan terms. As your on-chain credit profile grows, use it to access lower collateral requirements or improved interest rates on participating DeFi platforms. Some protocols may even offer exclusive lending pools for users with strong repayment records.

-

Protect your credit profile by practicing good security hygiene. Since your on-chain reputation is tied to your wallet, secure your private keys and use hardware wallets when possible. Avoid risky protocols and always verify smart contract security to prevent hacks or accidental loss that could impact your repayment record.

- Borrow Smart: Look for platforms that log repayments transparently and reward good behavior with better terms.

- Lend Wisely: Use real-time on-chain data (like that provided by Creditcoin, Teller, or PACT) to assess borrower risk before committing capital.

- Track Your Reputation: Monitor your own wallet’s on-chain credit profile, think of it as your decentralized FICO score!

- Diversify: Spread your activity across multiple protocols supporting transparent histories for maximum exposure and learning.

The momentum is building fast. According to recent research from Galaxy (source) and Amberdata, DeFi lending volumes continue surging as trust frameworks improve. And with multi-chain coverage expanding, it’s never been easier to track historic performance or compare yields in real time.

What’s Next?

The next wave? Expect rapid innovation around privacy-preserving credit scoring (think zero-knowledge proofs), cross-protocol reputation portability, and even integration with traditional financial data, all while keeping user control front and center. As these tools become the norm, under-collateralized lending could unlock trillions in untapped value (source).

If you’re ready for more actionable insights or want to see how your own wallet stacks up, check out our resources at cryptocreditscore. org, your hub for everything under-collateralized credit and on-chain risk scores!