Ethereum is trading at $3,210.79 as of November 2025, a figure that not only anchors the current DeFi landscape but also underscores the market’s maturity and volatility. Yet, beneath these price swings, a quieter revolution is underway: the rise of on-chain reputation as the backbone for under-collateralized loans in DeFi. This shift is transforming how trust, risk, and opportunity are distributed across decentralized finance.

Why Over-Collateralization Became a Bottleneck

For years, protocols like Aave and Compound have dominated on-chain lending, accounting for 89% of volume in August 2025, by requiring borrowers to lock up more collateral than they borrow. This approach is simple but exclusionary. If you don’t already have substantial crypto assets, you’re sidelined from meaningful participation in DeFi lending markets.

The rationale was clear: without credit bureaus or legal recourse, over-collateralization was the only defense against default. But this model stifles capital efficiency and limits access to users who could be creditworthy but asset-light. The result? Billions in idle capital and untapped demand for loans that could fuel real economic activity.

The Mechanics of On-Chain Reputation

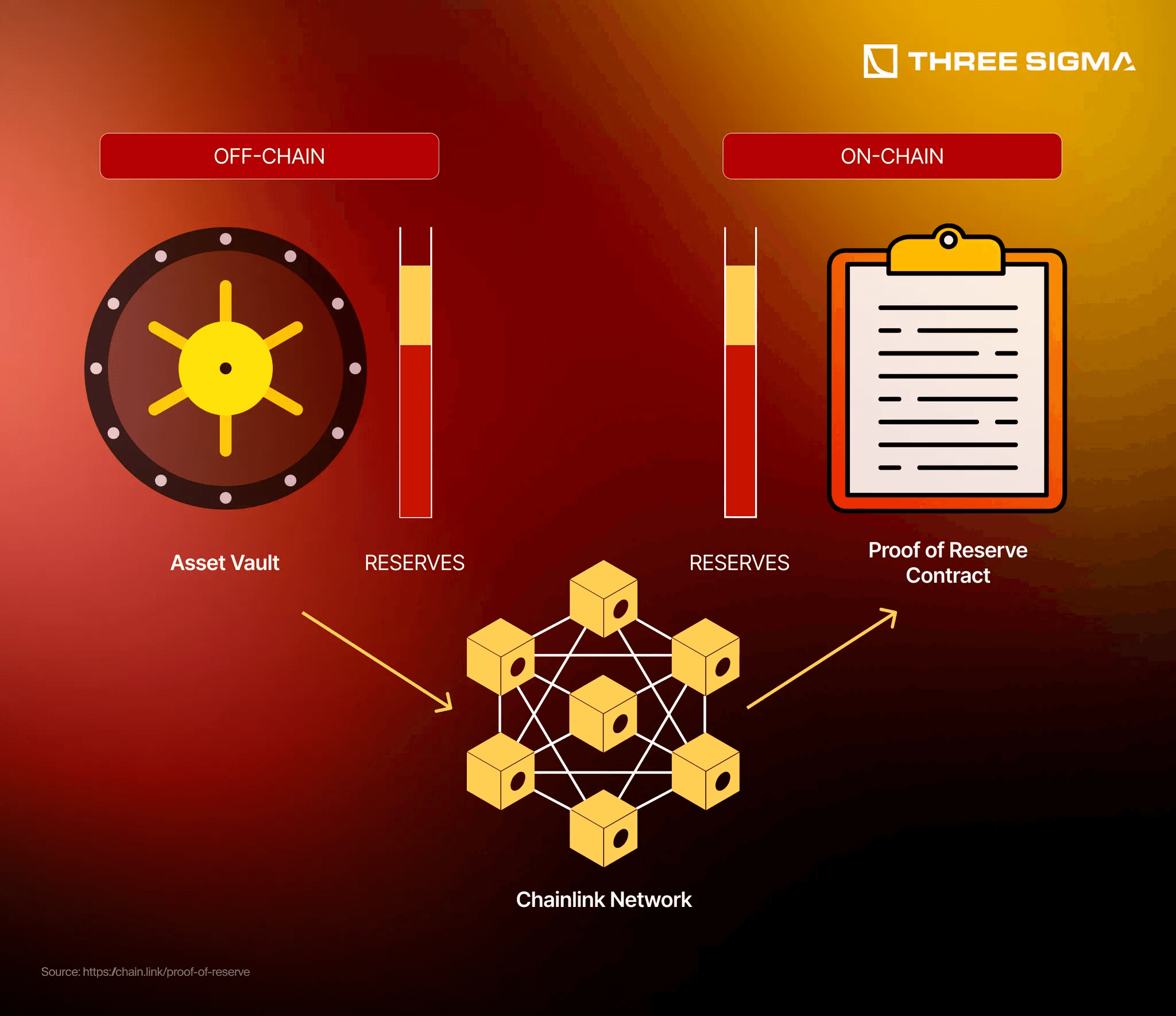

On-chain reputation flips this paradigm by using blockchain data as a digital credit footprint. Every action, repaying loans, participating in governance votes, providing liquidity, is recorded immutably on-chain. Protocols now analyze these histories to generate dynamic risk scores that reflect real behavior rather than static balances.

This is more than just an echo of traditional credit scoring; it’s an evolution. Decentralized identity (DID) frameworks let users aggregate their transaction history across multiple wallets and protocols without sacrificing privacy or control. As a result, borrowers can build portable reputations that unlock access to under-collateralized lending pools across DeFi.

Leading platforms like Credora, Reputation DAO, and RociFi are pioneering these mechanisms, some even integrating off-chain data for a fuller picture of borrower reliability.

2025: The Year Undercollateralized Lending Went Mainstream

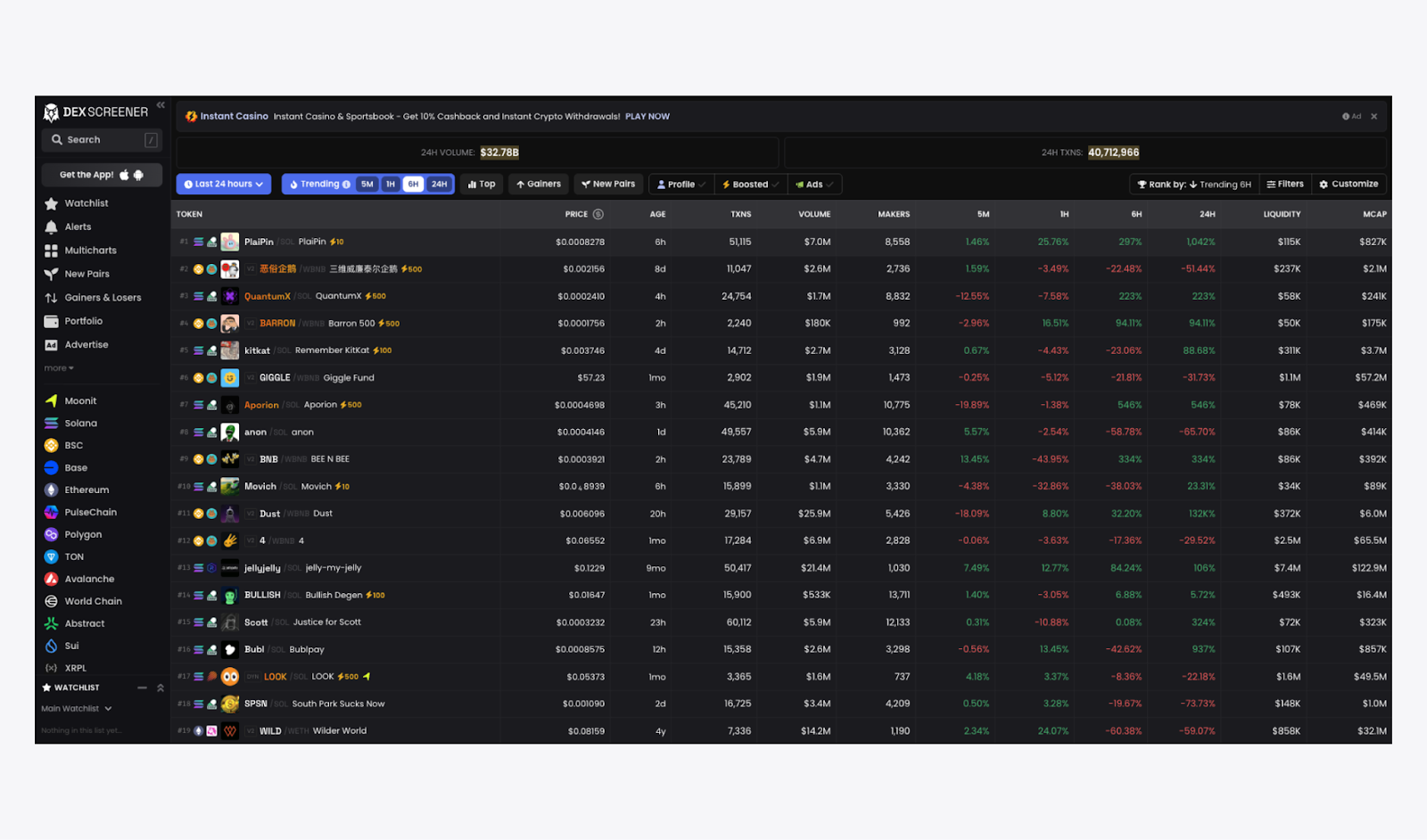

This year marks an inflection point for under-collateralized loans in crypto. AI-powered analytics now parse millions of wallet interactions to deliver real-time DeFi credit scores. Borrowers with strong repayment histories can secure loans with little, or even zero, collateral at competitive rates.

- Lending pools: New protocols offer specialized pools where only users with verified on-chain reputations can borrow under-collateralized funds.

- Decentralized credit bureaus: Entities like Reputation DAO aggregate user histories into standardized risk profiles composable across multiple platforms.

- DID integration: Borrowers can prove their identity and reliability without revealing personal information, a boon for privacy-conscious users worldwide.

- Hybrid scoring: Some platforms combine traditional credit data with blockchain behavior for nuanced risk assessment, a bridge between old finance and new rails.

This isn’t just theory, Maple Finance’s $12 billion loan book (with a 99% repayment rate) demonstrates institutional appetite for blockchain-native private credit models built on transparent reputation systems.

The Risks Lurking Behind Innovation

No innovation comes without tradeoffs. Undercollateralized lending introduces elevated default risks; if a borrower walks away from an unsecured loan, there’s no collateral to liquidate as recourse. This puts enormous pressure on the accuracy and resilience of onchain risk models, and exposes lenders to potential protocol exploits or market manipulation events.

The lack of global standards for evaluating decentralized identity or scoring methods also creates friction; what counts as trustworthy behavior on one chain may not translate elsewhere. And while smart contract audits have improved dramatically since 2020, complex multi-protocol integrations remain vulnerable to bugs or attacks.

If you want to dive deeper into how these innovations work, and why they matter, you’ll find more resources at CryptoCreditScores.org.

As the DeFi ecosystem matures, the interplay between on-chain reputation and under-collateralized lending is catalyzing a new era of financial inclusion. Now, users who once stood on the margins, those lacking deep crypto reserves but boasting impeccable repayment records, are finally able to access capital on fairer terms. This democratization of credit is not just a technical achievement but a profound shift in how trust and risk are allocated in digital markets.

What Borrowers and Lenders Need to Know in 2025

If you’re considering borrowing through these new under-collateralized pools, your blockchain behavior matters more than ever. Timely repayments, responsible leverage, and even positive participation in governance can all boost your on-chain reputation score. For lenders, the calculus is also changing: instead of fixating solely on collateral ratios, you must weigh a borrower’s entire digital footprint, sometimes even across multiple blockchains or protocols.

Platforms like RociFi and Reputation DAO are leading this charge by offering transparent dashboards where both borrowers and lenders can monitor evolving risk scores. The integration of decentralized identity (DID) ensures that users retain sovereignty over their data while still proving creditworthiness to counterparties.

This shift has already begun reshaping lending rates and risk premiums across the market. Borrowers with stellar on-chain histories are now seeing APRs rivaling those offered for over-collateralized loans, a testament to the growing confidence in these new models. Meanwhile, lenders are diversifying their portfolios by allocating capital to both traditional and reputation-based pools, hedging against systemic risks tied to price volatility or protocol exploits.

The Road Ahead: Interoperability, Standards, and Global Reach

The next frontier for on-chain reputation DeFi lies in interoperability. As more protocols adopt standardized risk scoring frameworks, and as DID solutions mature, users will be able to port their reputations seamlessly across ecosystems. Imagine building credit on Ethereum at $3,210.79, then accessing favorable loan terms on an emerging Layer 2 or even a non-EVM chain without starting from scratch.

Efforts are underway to develop open-source standards for risk assessment and privacy-preserving computation, ensuring that user data remains secure while still enabling robust credit analysis. These advances will be critical as regulators begin scrutinizing decentralized lending more closely and as institutional capital continues pouring into the space.

The Human Element: Trust Without Borders

Ultimately, what makes this evolution remarkable isn’t just technological progress, it’s the reimagining of trust itself. In traditional finance, trust is local: built through face-to-face relationships or national institutions. In DeFi’s new paradigm, trust becomes global, encoded in transparent smart contracts and shaped by collective behavior visible for all to see.

This doesn’t mean risks disappear; rather, they become more legible and manageable with the right tools. For users willing to cultivate their digital reputations, and for developers focused on security-first design, the future of under-collateralized loans looks increasingly accessible.

The journey isn’t finished yet, but as more protocols join this movement and as real-world assets flow onto blockchains via tokenization initiatives like Maple Finance’s $12 billion portfolio, the foundation is set for trillions in untapped value to enter decentralized markets (learn more here). Whether you’re a borrower seeking opportunity or a lender searching for yield beyond over-collateralization’s limits, now is the time to engage with these evolving systems.