Under-collateralized lending is rapidly shifting from a speculative concept to a credible pillar within decentralized finance (DeFi). In Q2 2025, crypto-collateralized lending expanded by $11.43 billion ( and 27.44%), reaching $53.09 billion in open borrows, according to Galaxy Research. This resurgence, following a slight dip in Q1, underscores growing appetite for more efficient, inclusive lending models that transcend the rigid over-collateralization of early DeFi protocols.

Why Under-Collateralized Lending Is Gaining Traction

Traditional DeFi lending has long relied on strict over-collateralization – often requiring users to lock up 125% to 150% of their loan value in crypto assets. While effective at protecting lenders, this model locks out borrowers who lack substantial crypto holdings and stifles capital efficiency across the ecosystem. The result: DeFi’s promise of democratized finance is diluted by barriers echoing those of legacy banking.

The landscape is now evolving. As noted by Reflexivity Research, under-collateralized lending is no longer a “moon-shot idea”; it’s an emergent asset class with genuine product-market fit and accelerating institutional interest.

Key Trends Shaping the Future of On-Chain Credit

Top 5 Under-Collateralized DeFi Lending Trends for 2025

-

On-Chain Credit Scoring: Protocols like Cred Protocol are pioneering decentralized credit scoring by analyzing users’ on-chain transaction history and behavioral data. This enables more accurate risk assessment and opens the door for under-collateralized loans to users with limited traditional credit backgrounds.

-

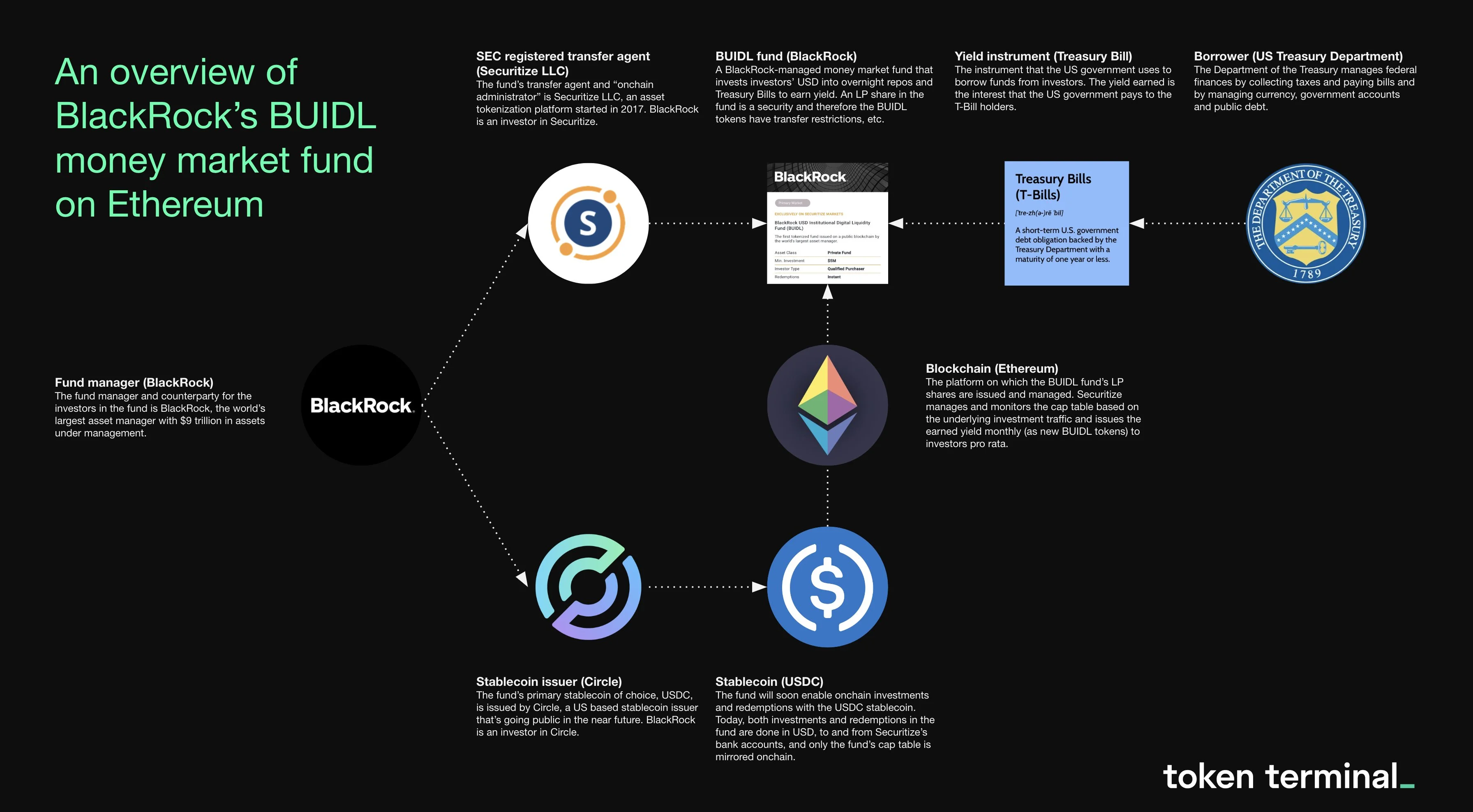

Institutional Adoption & Hybrid Models: Major financial institutions, exemplified by Project Guardian (Singapore) and BlackRock’s BUIDL tokenized fund, are integrating DeFi lending into traditional finance. Hybrid models now combine partial collateral with reputation or AI-based credit scoring, balancing risk and capital efficiency.

-

Integration of Real-World Assets (RWAs): Leading DeFi protocols are expanding collateral options by tokenizing real-world assets such as real estate, commodities, and invoices. This trend attracts a broader borrower base and enhances the practical utility of on-chain lending.

-

Automated Risk Management: Advances in smart contract technology are improving risk management through automated liquidation and monitoring processes. Newer protocol versions now feature enhanced mechanisms to mitigate risk and promote financial stability in under-collateralized lending.

-

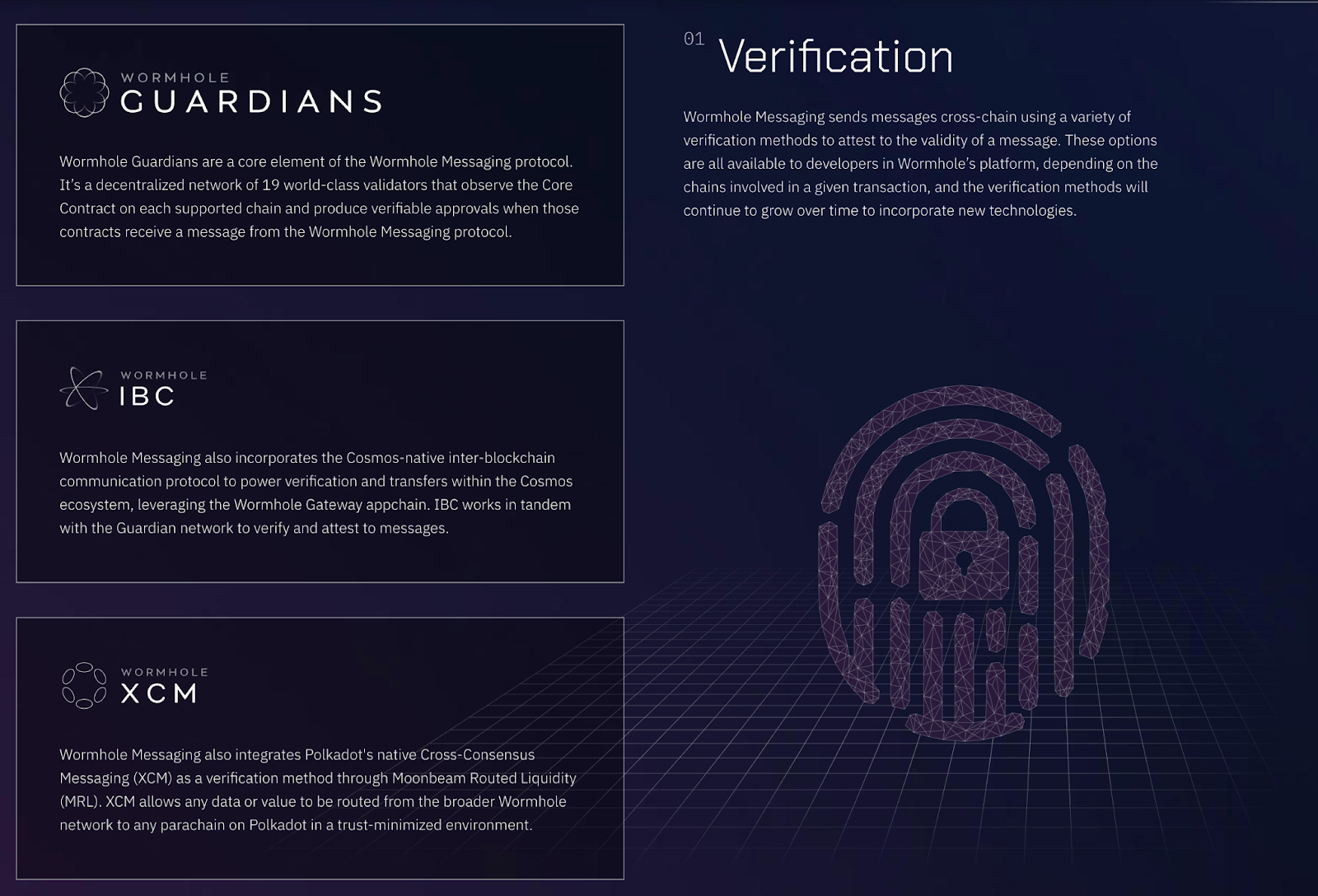

Cross-Chain Lending & Interoperability: The emergence of cross-chain lending protocols is enabling the use of assets from multiple blockchains as collateral. This interoperability increases flexibility and efficiency, allowing for broader participation in DeFi lending markets.

Several critical trends are converging to drive this transformation:

- On-Chain Credit Scoring: Protocols such as Cred Protocol are pioneering decentralized credit scoring by analyzing users’ on-chain activities and repayment behaviors. This innovation enables risk assessment without traditional financial data, making under-collateralized loans accessible even for those without a conventional credit history. Learn more about Cred Protocol’s approach here.

- Hybrid Collateral Models: New protocols are blending partial collateral requirements with reputation systems or AI-driven risk analytics. This hybridization seeks to balance lender protection with borrower inclusivity, lowering entry barriers while maintaining prudent risk controls.

- Integration of Real-World Assets (RWAs): Expanding beyond digital tokens, some platforms now accept tokenized real estate, commodities, or invoices as collateral – broadening participation and anchoring DeFi closer to tangible economic activity.

- Automated Risk Management: Advances in smart contracts have led to more sophisticated liquidation mechanisms and dynamic risk parameters that adjust based on market conditions, reducing systemic vulnerabilities.

- Cross-Chain Interoperability: Lending protocols are increasingly bridging assets across blockchains, allowing users to leverage collateral from multiple ecosystems and enhancing overall liquidity.

The Role of Blockchain Data in Next-Gen Credit Models

The linchpin of these emerging trends is transparent blockchain data. Every transaction, repayment event, or default is immutably recorded on-chain – providing a rich dataset for risk modeling far superior in granularity and timeliness compared to traditional credit bureaus. On-chain analytics empower both lenders and borrowers with real-time insights into counterparties’ financial behaviors.

This evolution is not just technological but cultural: reputation within the DeFi community increasingly hinges on wallet-level transparency and verifiable track records rather than opaque personal identifiers or legacy credit scores.

Institutional Adoption Accelerates Innovation

The growing participation of institutional players marks another inflection point for under-collateralized lending trends. Initiatives like Singapore’s Project Guardian and BlackRock’s BUIDL tokenized fund illustrate how regulated entities are weaving DeFi capabilities into traditional finance workflows – often through compliance-ready infrastructure that blends KYC/AML requirements with permissionless innovation (see analysis here). These hybrid approaches signal rising confidence among large lenders while setting new standards for risk management and regulatory alignment.

Key Metrics Comparison: Leading Under-Collateralized Lending Protocols (Q3 2025)

| Protocol | Total Value Locked (TVL) 💰 | Average Interest Rate (%) 📈 | Default Rate (%) ⚠️ |

|---|---|---|---|

| Goldfinch | $380M | 12.5% | 2.1% |

| Maple Finance | $290M | 10.8% | 1.4% |

| TrueFi | $210M | 9.7% | 1.9% |

| Centrifuge | $160M | 8.9% | 1.2% |

| Cred Protocol | $95M | 11.2% | 2.5% |

With institutional engagement on the rise, the sector is witnessing a measurable uptick in both capital inflows and product sophistication. The Q2 2025 surge to $53.09 billion in open borrows (up 27.44% from the prior quarter) is not merely a cyclical bounce, but a reflection of structural changes in how risk, collateral, and reputation are being evaluated on-chain. As compliance-ready protocols mature, expect further convergence between DeFi and traditional markets, particularly as real-world assets (RWAs) become normalized within lending pools.

Yet, this expansion is accompanied by new layers of complexity. Cross-chain lending and composability introduce novel risks: smart contract exploits, oracle failures, and governance attacks remain persistent threats. Automated risk management tools, now leveraging AI and real-time blockchain analytics, are essential for monitoring these exposures dynamically. Protocol upgrades increasingly feature adaptive liquidation engines and predictive risk scoring models that respond to market volatility with greater agility than ever before.

NFTs, Novel Collateral Types, and User Experience

The collateral landscape itself is diversifying rapidly. While tokenized RWAs are gaining traction among institutions, retail users are experimenting with NFTs as loan security, a trend that would have seemed speculative just a year ago. Platforms accepting NFT collateral must contend with unique challenges around valuation and liquidity; still, their adoption underscores a broader movement toward composable finance where virtually any digital asset can be leveraged for credit.

User experience is also evolving: embedded lending flows, streamlined onboarding via decentralized identity (DID), and seamless cross-chain interactions are reducing friction for both borrowers and lenders. These improvements are critical for scaling under-collateralized lending beyond crypto-native audiences into mainstream financial activity.

What’s Next? Navigating Risk as the Market Matures

Despite impressive growth metrics, under-collateralized DeFi lending faces headwinds around systemic risk management and regulatory clarity. As highlighted by Digital Finance News, mechanisms for borrower accountability remain an ongoing challenge, especially as protocols scale globally. Expect continued experimentation with DID frameworks, multi-factor risk assessment models, and insurance primitives tailored to DeFi-specific risks.

For market participants, from protocol developers to institutional allocators, the imperative is clear: leverage blockchain data to build robust risk metrics while advocating for transparent governance and user protection standards. The next phase of emerging DeFi lending will likely be defined by those who can balance innovation with discipline, creating sustainable credit markets that thrive on both efficiency and trust.

Actionable Strategies for Lenders in Under-Collateralized DeFi

-

Leverage On-Chain Credit Scoring Protocols: Utilize platforms like Cred Protocol to assess borrower risk using decentralized, on-chain credit scores. This enables more informed lending decisions and expands access to creditworthy users lacking traditional credit histories.

-

Adopt Hybrid Collateral Models: Explore lending frameworks that combine partial collateralization with reputation or AI-driven credit scoring, as seen in emerging institutional-grade solutions like Project Guardian and BlackRock’s BUIDL tokenized fund. These models balance risk and capital efficiency, attracting a wider borrower base.

-

Integrate Real-World Assets (RWAs) as Collateral: Expand lending options by accepting tokenized RWAs—such as real estate, commodities, and invoices—through established protocols. This strategy diversifies collateral pools and enhances loan practicality for both lenders and borrowers.

-

Implement Automated Risk Management Tools: Utilize advanced smart contract features and protocol upgrades that offer dynamic liquidation and risk monitoring, as highlighted in recent DeFi lending research. Automation helps mitigate default risk and ensures protocol solvency.

-

Participate in Cross-Chain Lending Platforms: Engage with cross-chain protocols that enable asset interoperability across multiple blockchains. This approach, supported by platforms like LayerZero and Wormhole, increases collateral flexibility and broadens lending opportunities.