Decentralized Finance (DeFi) is in the midst of a seismic shift. The days when you needed to lock up more collateral than you wanted to borrow are fading. Thanks to innovations like decentralized identity (DID) and onchain credit scores, under-collateralized lending is finally finding its footing in crypto. But how do these systems work, and why are they such a big deal for DeFi’s future?

From Over-Collateralization to True Credit Markets

Let’s start with the basics. Traditional DeFi lending protocols, like Aave and Compound, have always played it safe: you deposit $1,000 in ETH to borrow maybe $600 in USDC. This over-collateralization model protects lenders, but it’s a capital efficiency killer and leaves out millions who don’t have big crypto stacks to lock up.

Enter under-collateralized lending crypto protocols. These emerging platforms use DID for crypto lending and onchain repayment history to unlock loans based on trust and reputation, not just wallet balances. The endgame? Bringing trillions in untapped value into DeFi, as highlighted in recent market analyses. Learn more about how DID and onchain risk scores are reshaping DeFi lending here.

What is Decentralized Identity (DID) in DeFi?

Decentralized identity in DeFi is all about giving users control over their digital identity without relying on a single authority. Instead of handing your data to a bank or a credit bureau, you build a tamper-proof profile using blockchain credentials. These credentials can include everything from your transaction history and DAO participation to Web3 social profiles.

Platforms like Spectral and Reputation DAO are already leveraging DID-powered credit systems to offer under-collateralized loans. With DID, lenders get a much richer picture of who they’re dealing with, while borrowers keep their privacy intact. It’s a win-win that’s reimagining trust in an industry built on pseudonymity.

Onchain Credit Scores: The New Standard for DeFi Risk Assessment

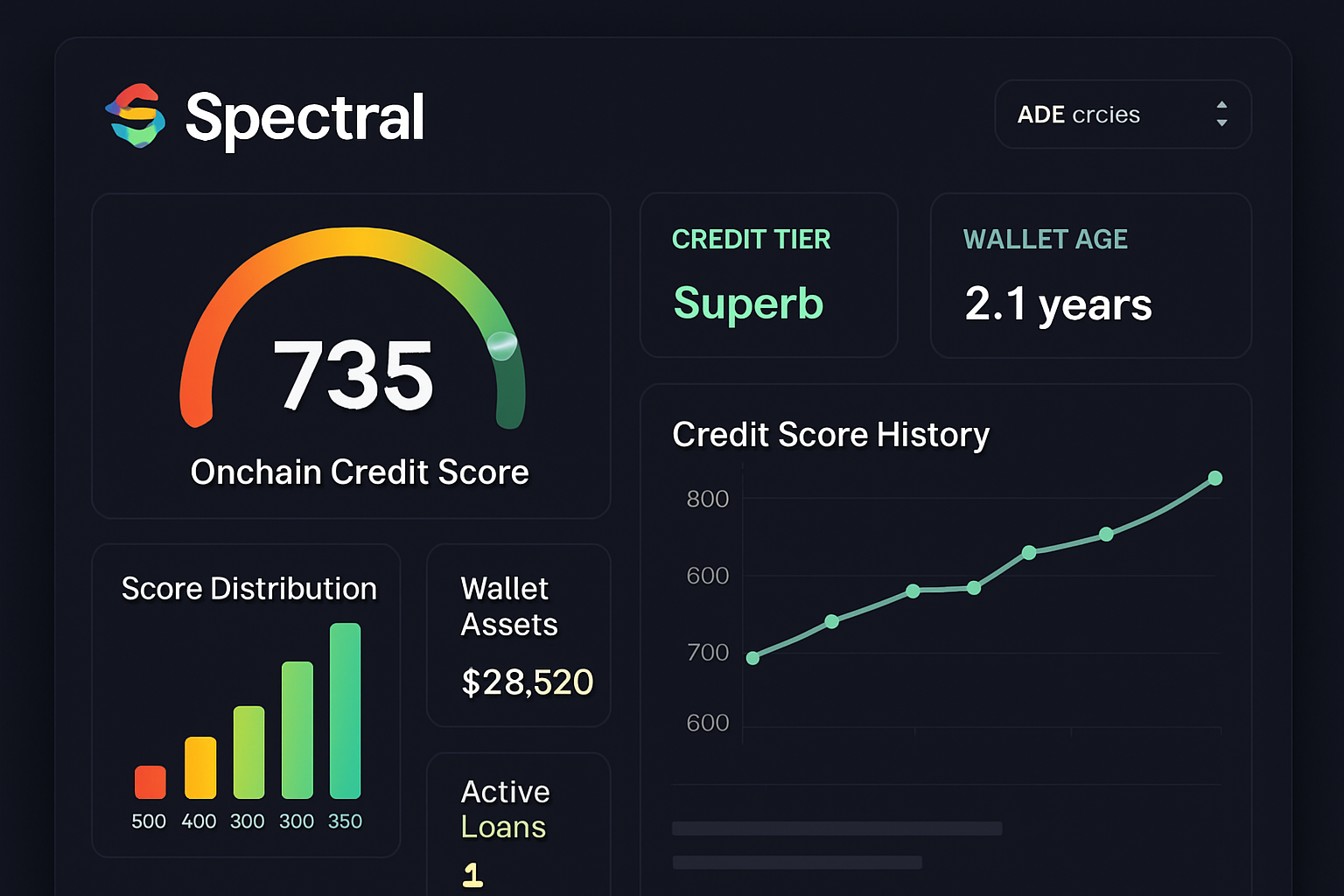

Now, let’s talk about onchain credit scores. Unlike traditional credit scores, these are generated by analyzing your wallet’s onchain behavior. Did you pay back your last loan on time? How often do you interact with protocols? What does your asset mix look like? All of this data feeds into a dynamic, privacy-preserving risk score.

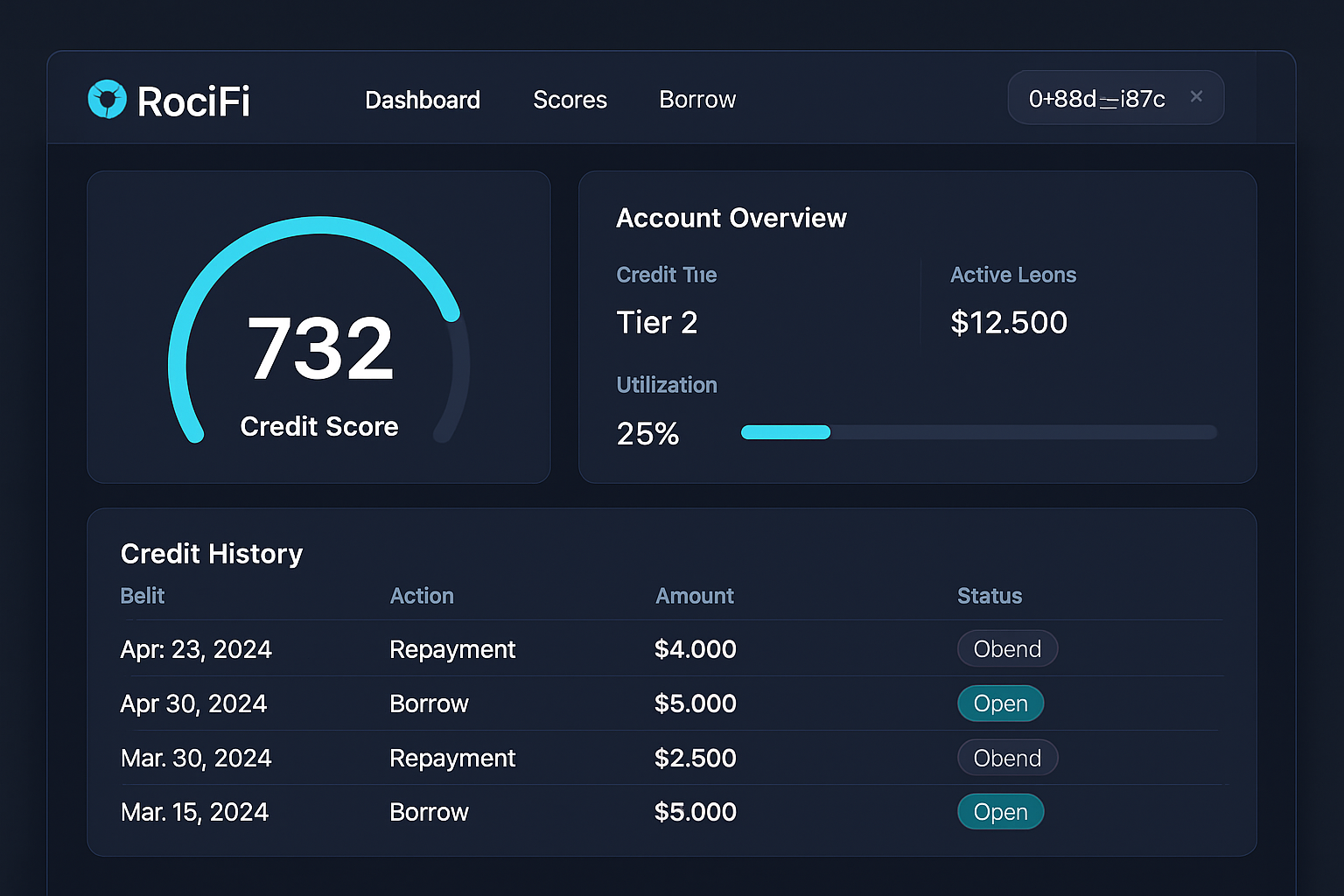

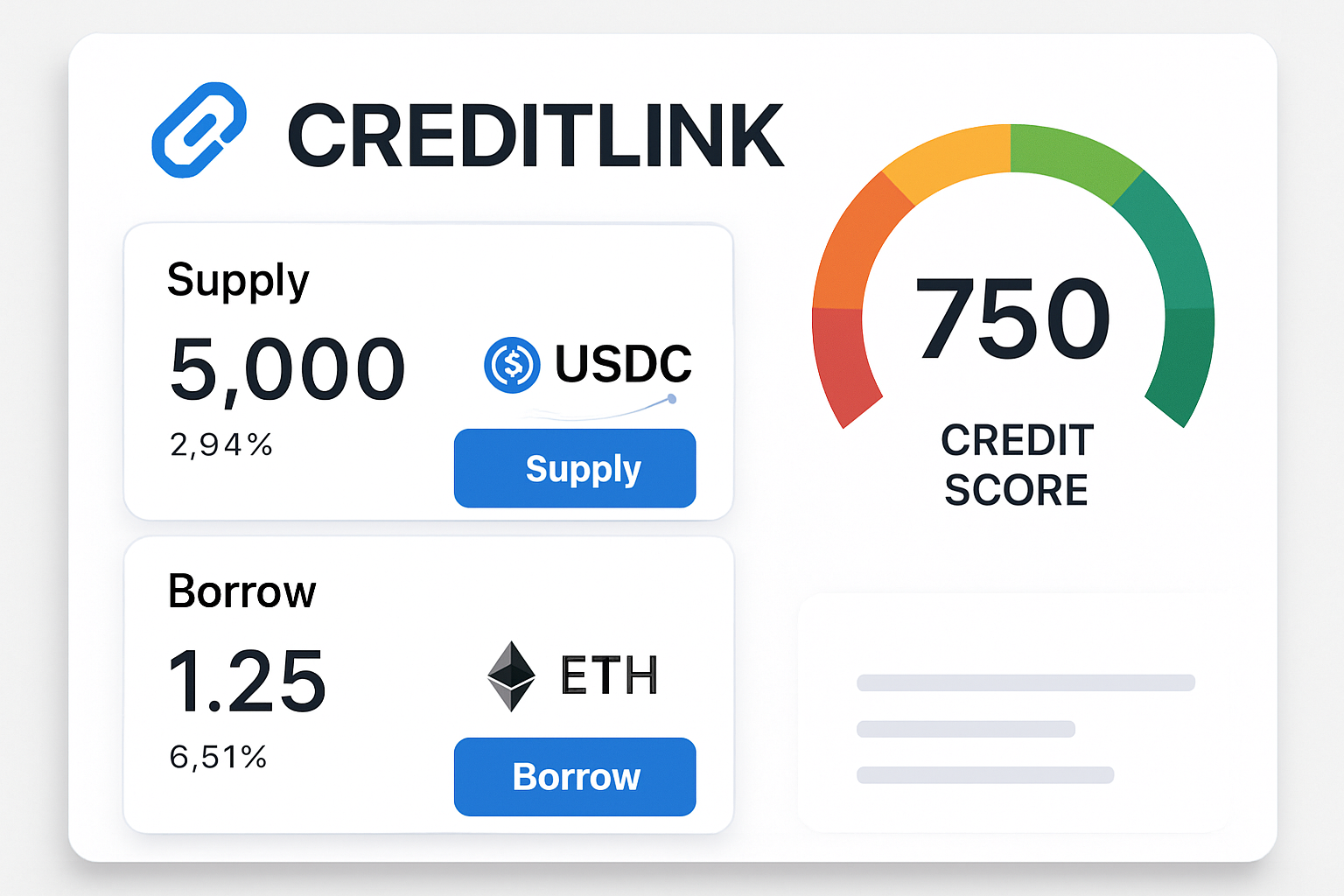

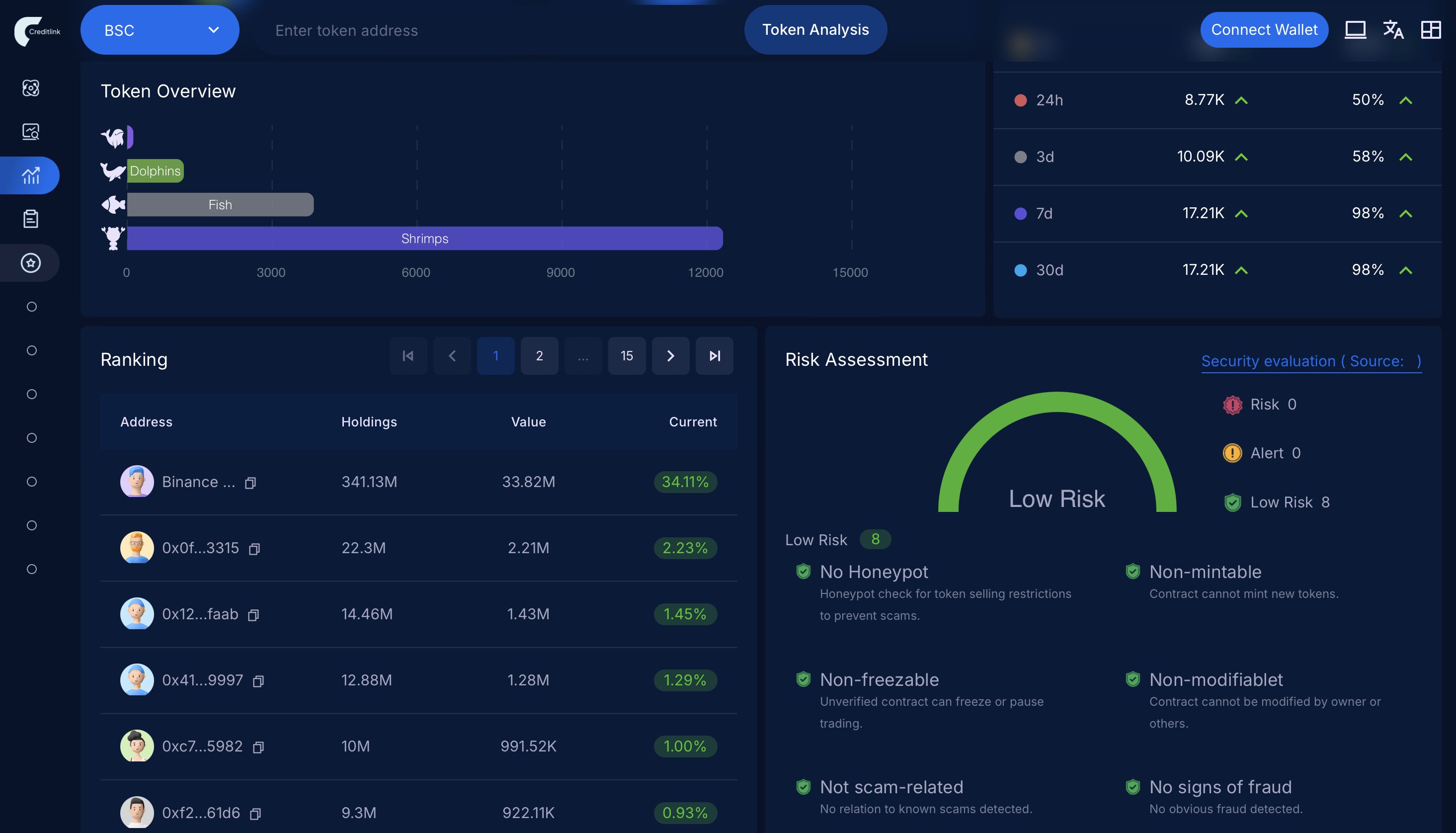

Protocols like RociFi use a non-fungible credit score (NFCS) model, where each wallet gets a unique, updatable credit score NFT. Others, like Creditlink, use privacy-preserving mechanisms to adjust collateral requirements based on your score. The result? Users with strong onchain histories can access loans with far lower collateral ratios, while lenders get more granular tools for DeFi risk assessment.

Top Platforms for Onchain Crypto Credit Scoring

-

RociFi: Leverages Decentralized Identity (DID) and on-chain behavior to issue Non-Fungible Credit Scores (NFCS), enabling under-collateralized lending based on wallet activity and repayment history.

-

Spectral Finance: Uses advanced machine learning to analyze on-chain data and assign Soulbound Credit Scores (Spectral Scores) to wallets, facilitating risk assessment for DeFi lenders.

-

Reputation DAO: Builds reputation-based credit scoring using DIDs and aggregated on-chain data, helping DeFi protocols offer loans with reduced collateral requirements.

-

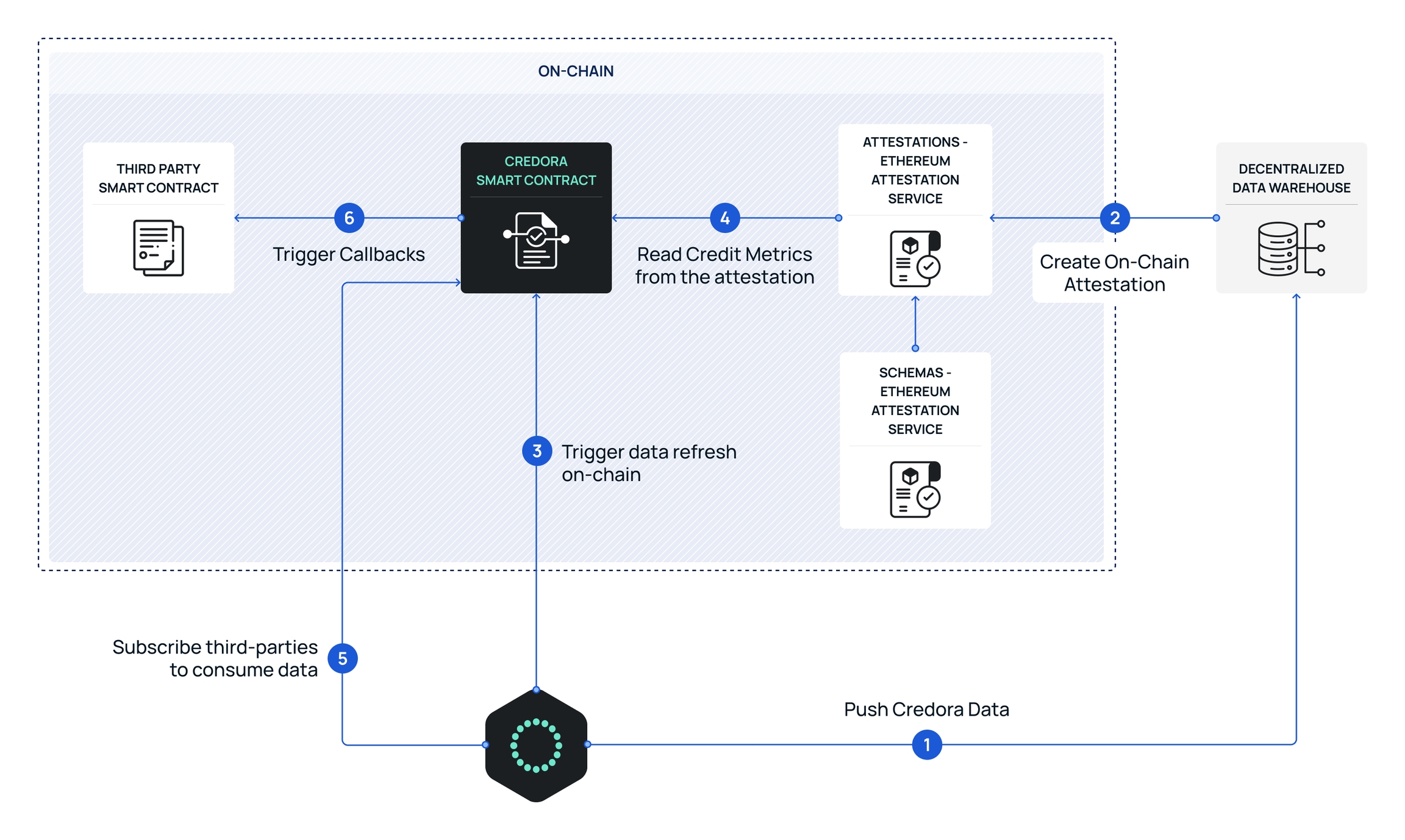

Credora: Provides real-time, privacy-preserving credit analytics by combining off-chain and on-chain data, allowing institutional and retail borrowers to access under-collateralized loans.

-

Creditlink: Implements a trustless credit scoring system using DID and on-chain activity, dynamically adjusting collateral needs based on user creditworthiness.

This approach doesn’t just improve capital efficiency. It also levels the playing field for users globally, especially those who’ve been excluded from TradFi due to lack of conventional credit histories. By tapping into blockchain data, crypto credit scoring platforms are bridging the gap between traditional and decentralized finance.

But it’s not all smooth sailing. As under-collateralized lending grows, the DeFi ecosystem faces some unique hurdles. Sybil attacks: where one user spins up multiple wallets to game the system, remain a real risk. That’s why many protocols are doubling down on verifiable credentials and social graph analysis as part of their DID stack. By weaving together transaction history, DAO voting patterns, and even NFT ownership, these platforms can spot suspicious patterns and reward genuine reputation-building.

Real-World Impact: Financial Inclusion and Better Yields

The practical upside? Financial inclusion is finally within reach for millions who’ve been sidelined by traditional banking. If you’re an active DeFi participant with a strong onchain repayment history, you can now access credit based on merit, not just the size of your wallet. This is huge for users in emerging markets or anyone building a digital reputation from scratch.

Lenders aren’t left out either. With more accurate DeFi risk assessment tools, they can tailor interest rates and loan terms to each borrower’s actual risk profile. This means better yields for lenders willing to take calculated risks, and less idle capital sitting around doing nothing.

We’re also seeing creative partnerships between protocols. Some platforms are using cross-chain identity proofs or even requiring ownership of specific NFTs as part of the underwriting process. This multi-layered approach makes it harder for bad actors to slip through the cracks while keeping friction low for legitimate borrowers. If you want a deep dive on how these mechanisms work, check out this guide on decentralized identity and under-collateralized lending.

What’s Next? The Road Ahead for Under-Collateralized Lending

The momentum behind DID for crypto lending and onchain credit scores is only accelerating. As more protocols integrate these technologies, expect to see:

Key Trends Shaping Under-Collateralized Lending in DeFi

-

Privacy-Preserving Credit Assessment: Solutions like Creditlink are advancing privacy-preserving mechanisms, allowing users to prove creditworthiness without exposing sensitive personal data, thus balancing transparency and confidentiality.

-

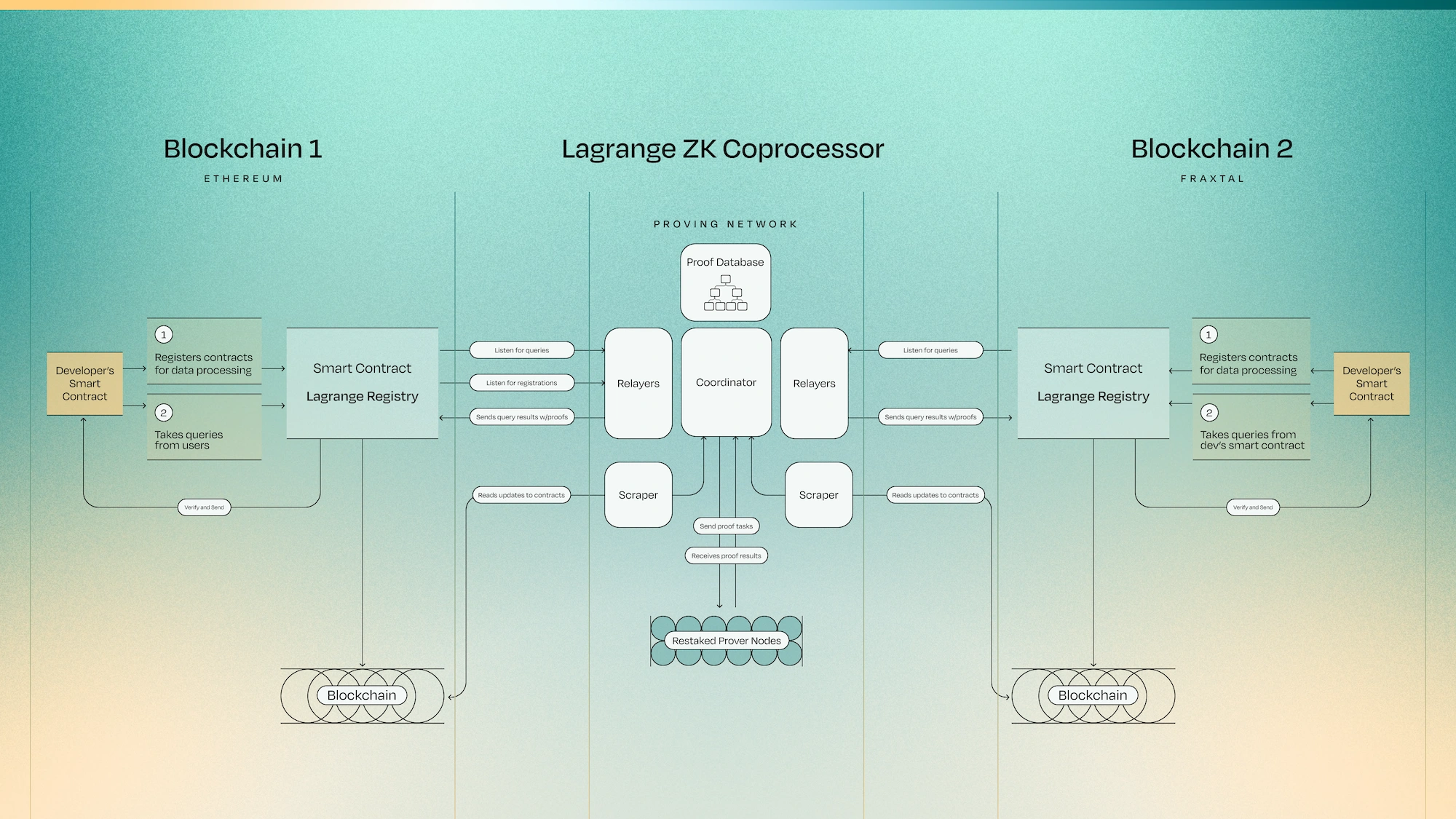

Cross-Chain Credit Interoperability: Innovations from Lagrange Labs are enabling credit data to move seamlessly across blockchains, allowing borrowers to use their credit history on multiple DeFi platforms and chains.

-

Enhanced Risk Management and Sybil Resistance: Protocols are adopting advanced analytics and decentralized reputation systems to detect sybil attacks and improve risk assessment—making under-collateralized lending safer and more scalable.

- Lower collateral requirements: Borrowers with high credit scores may soon see collateral ratios drop even further, freeing up billions in liquidity.

- Broader adoption: More DAOs and Web3 communities are rolling out reputation-based lending, making DeFi accessible beyond just traders and whales.

- Smarter risk management: Lenders get granular data-driven insights, while privacy tech ensures user data stays secure.

The bottom line? We’re witnessing DeFi evolve from a playground for over-collateralized loans into a true alternative credit market, one where your digital reputation matters as much as your crypto stack. As DID systems mature and onchain credit scoring becomes standard, expect this trend to accelerate, and keep an eye out for new players pushing the envelope even further.

If you want to stay ahead of the curve, and maybe get first dibs on lower-collateral loans, start building your onchain reputation today.