Decentralized identity (DID) is quietly reshaping the DeFi landscape, unlocking a future where under-collateralized lending is not just possible but practical for everyday users. If you’ve ever been frustrated by the capital inefficiency of over-collateralized loans or the lack of access for underbanked populations, DID might just be the missing piece that brings real-world finance and crypto together.

Why Over-Collateralization Holds DeFi Back

Let’s be real: most DeFi lending protocols still require borrowers to lock up more crypto than they actually borrow. This over-collateralization is a necessary evil to prevent defaults in a world where everyone is pseudonymous. But it’s also a massive drag on capital efficiency and leaves out users who don’t have deep pockets or a big crypto stack to begin with.

So why hasn’t under-collateralized lending taken off yet? The answer is trust. Traditional banks use your credit history, income, and identity to decide if you’re loan-worthy. DeFi can’t rely on those old-school metrics – at least, not until now.

Decentralized Identity: The Trust Engine for DeFi Lending

Decentralized identity in DeFi flips the script. Instead of trusting a centralized authority, DID lets you build a blockchain-based reputation that’s portable, privacy-preserving, and verifiable. Think of your DID as your digital passport: it can contain onchain risk scores, KYC credentials, and even proof of off-chain assets, all controlled by you.

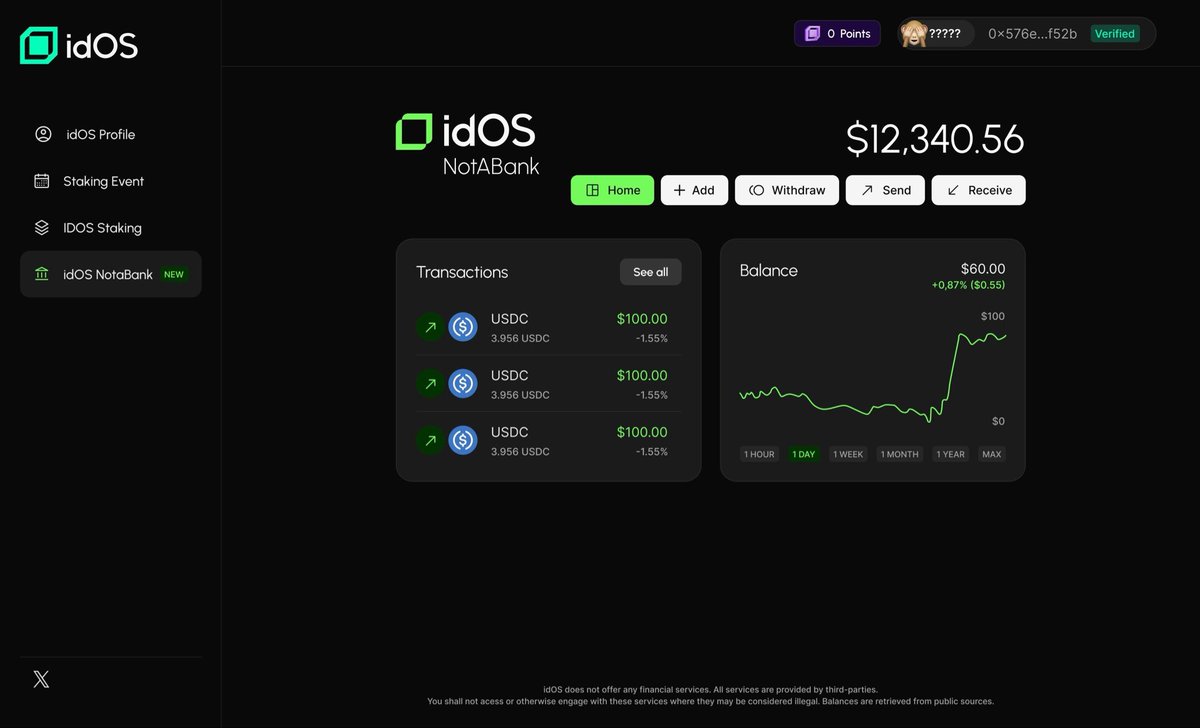

Here’s where it gets interesting: with DID, lenders can assess your crypto creditworthiness using both onchain and off-chain data. Platforms like Arcx’s DeFi Passport and Spectral are already using onchain risk scores to offer tailored loan terms based on your actual repayment history and wallet behavior. This is a game-changer for capital efficiency and opens the door for under-collateralized lending models that look a lot more like traditional finance – but without the middlemen.

Real-World Projects: DID in Action

Let’s zoom in on a few trailblazing projects making decentralized identity in DeFi a reality:

Top Projects Using DID for Undercollateralized DeFi Lending

-

Teller Finance: Teller leverages Chainlink’s DECO protocol to enable privacy-preserving verification of off-chain financial data, like bank balances, letting borrowers prove creditworthiness without exposing sensitive info. This unlocks under-collateralized loans in DeFi.

-

Arcx DeFi Passport (Sapphire v3): Arcx’s Sapphire v3 DeFi Passport assigns users a score (0-1,000) based on on-chain activity, allowing protocols to offer personalized, lower-collateral loans to high-scoring users. This DID-powered passport helps build trust and unlocks better borrowing terms.

-

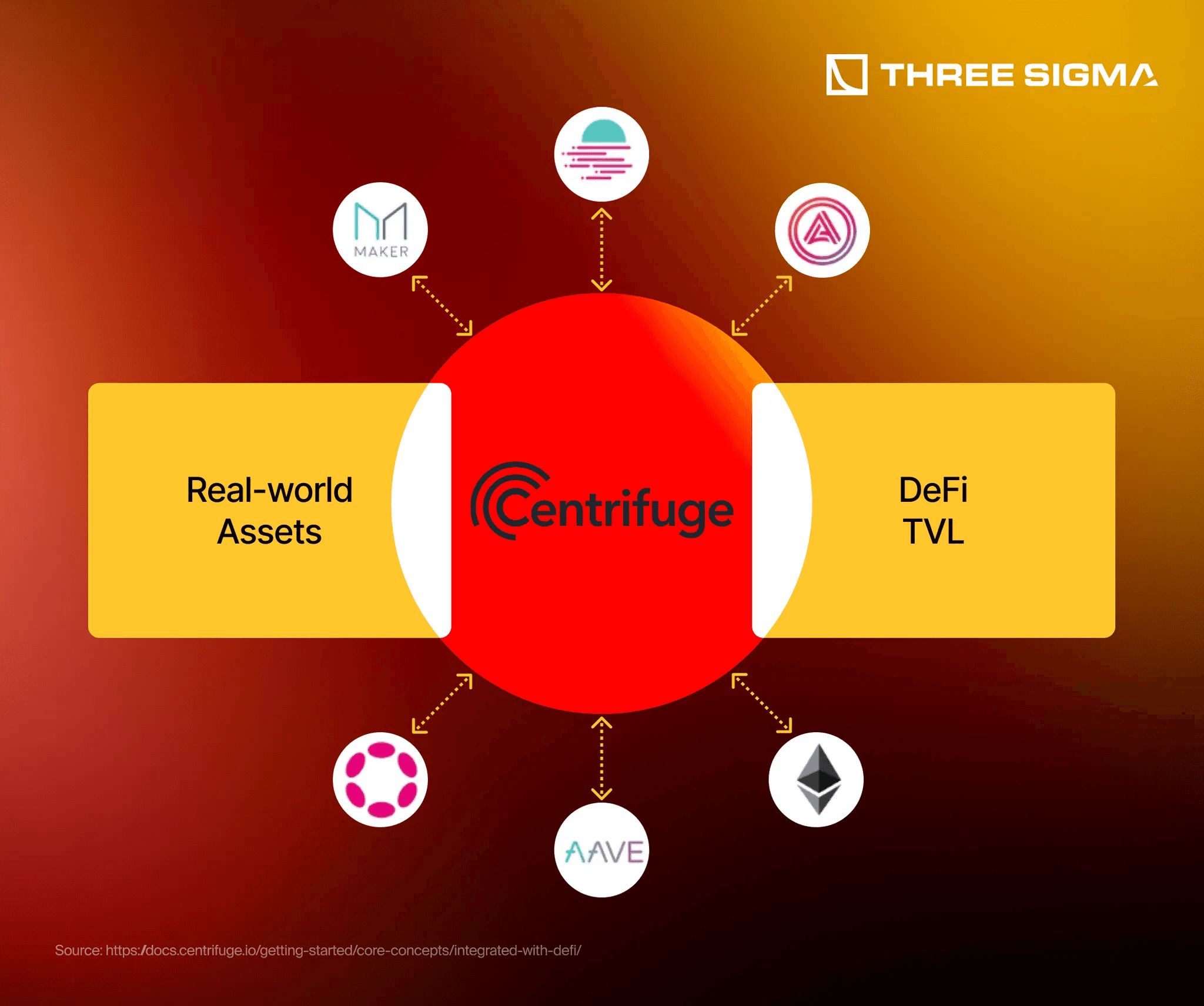

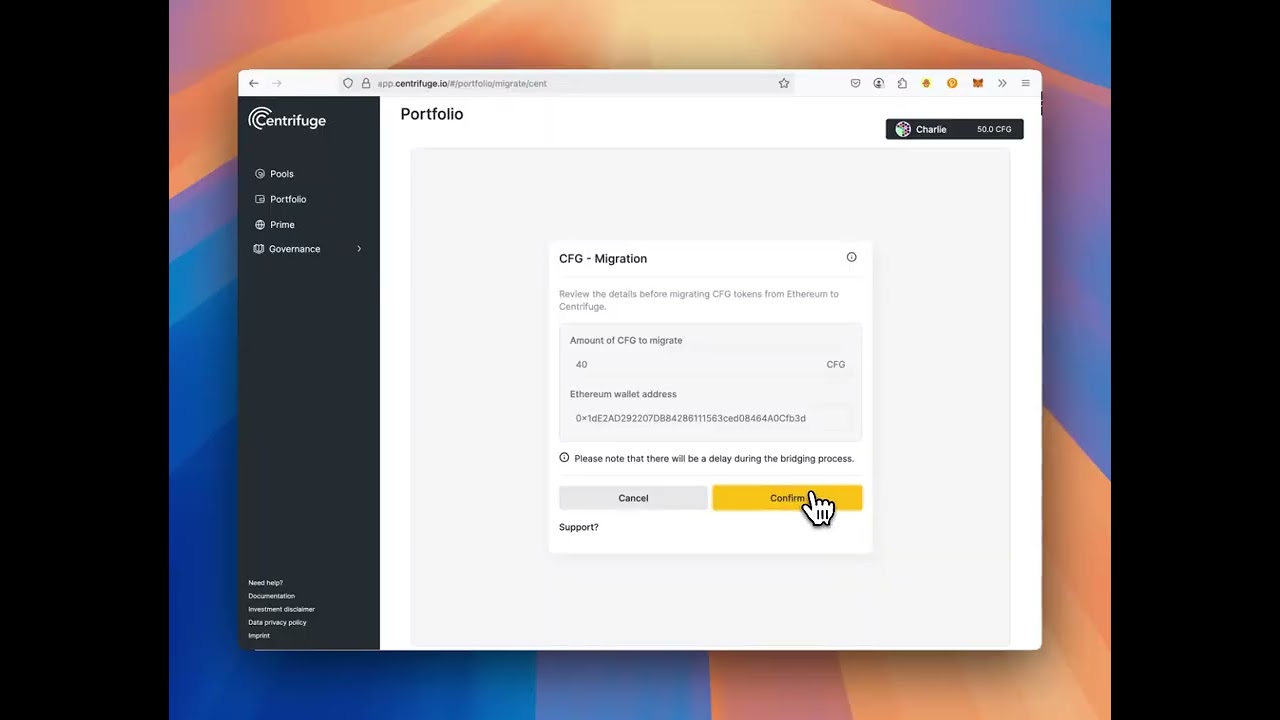

Centrifuge: Centrifuge integrates DID elements and tokenizes real-world assets (RWAs), letting borrowers use these assets as collateral. By evaluating both the asset and the borrower’s identity, Centrifuge brings under-collateralized lending closer to mainstream finance.

-

Spectral Finance: Spectral builds on-chain credit scores using DID frameworks, empowering DeFi lenders to assess risk and extend under-collateralized loans based on a borrower’s blockchain reputation.

-

Reputation DAO: Reputation DAO creates decentralized identity-based credit systems that aggregate on-chain behavior to generate trust scores, enabling under-collateralized lending for users with solid reputations.

Teller Finance is working with Chainlink’s DECO protocol to verify off-chain data like bank balances without exposing sensitive info. This lets borrowers prove their creditworthiness and unlock under-collateralized loans – all while maintaining privacy.

Arcx’s Sapphire v3 DeFi Passport uses an onchain scoring system to reward good actors with better loan terms and less collateral required. If you have a strong onchain reputation, you get more flexible access to credit. Simple as that.

Centrifuge bridges DeFi and traditional finance by tokenizing real-world assets and using elements of DID to assess borrower risk. This means businesses can unlock liquidity from assets like invoices, without needing to over-collateralize in crypto.

The New Pillars: Privacy, Security, and Interoperability

It’s not all smooth sailing yet. For DIDs to power the next wave of DeFi lending innovation, we need to solve some tough problems:

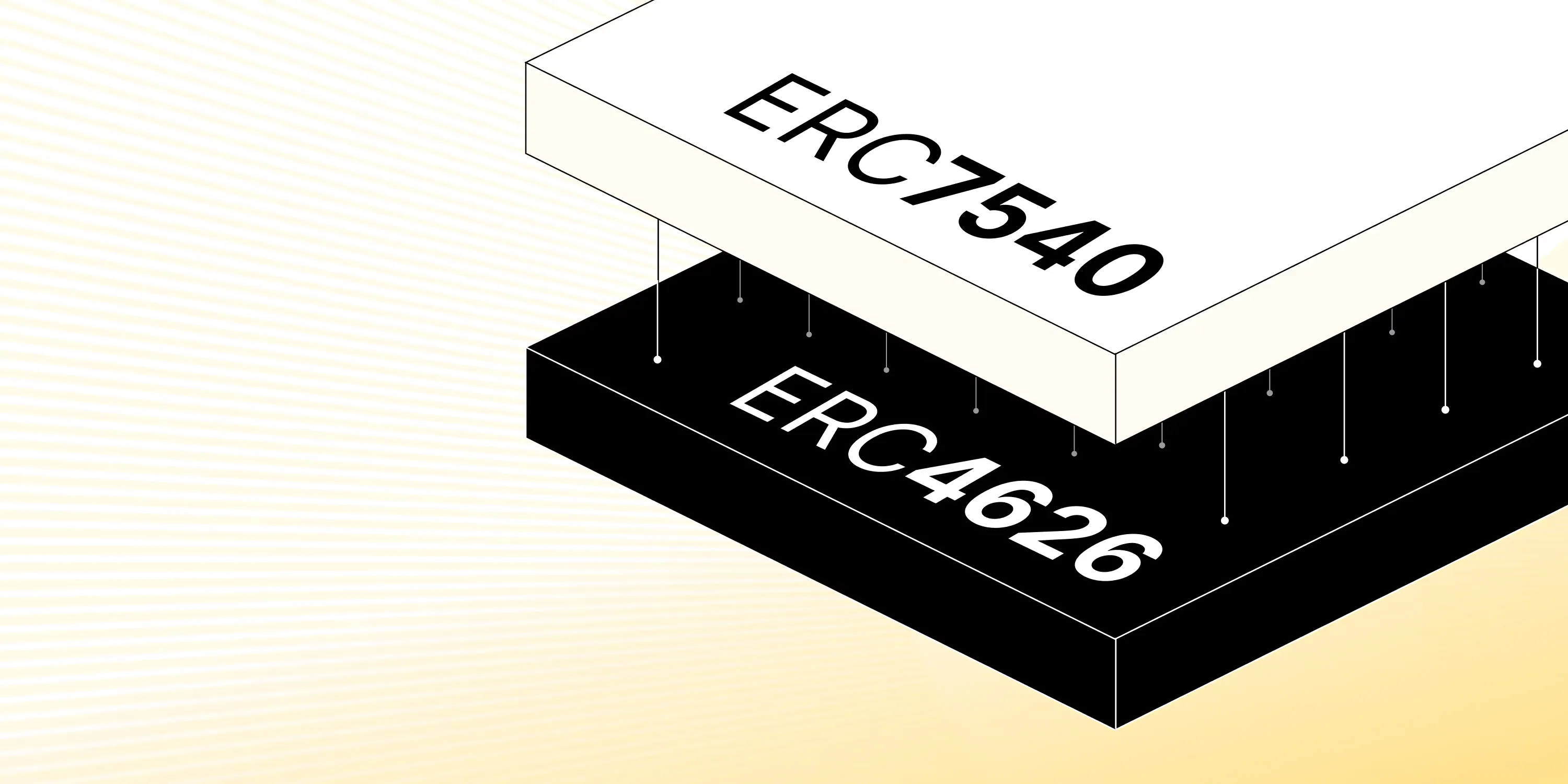

- Standardization: Without common DID frameworks, it’s tough for protocols to talk to each other.

- Privacy vs. Transparency: Balancing user privacy with the need for verifiable trust is tricky. Zero-knowledge proofs and privacy-preserving oracles like DECO are leading the charge here.

- Regulatory Compliance: As DeFi matures, ensuring DIDs meet KYC and AML standards will be key for institutional adoption. Read more about these challenges.

This is just the tip of the iceberg. The next section will dive deeper into how onchain risk scores and privacy-preserving credit assessment are driving this revolution – and what it means for your next DeFi loan.

Onchain Risk Scores: The Heart of Crypto Credit Scoring

Let’s talk nuts and bolts: onchain risk scores are quickly becoming the backbone of privacy-preserving credit assessment in DeFi. Instead of relying on a faceless credit bureau, you’re building your own reputation by interacting with smart contracts, repaying loans, and demonstrating responsible wallet activity. Protocols like Spectral and Reputation DAO are pushing this frontier, letting you prove your trustworthiness with a cryptographically secure record that’s portable across platforms.

Why does this matter? Because it unlocks a new kind of financial inclusion. If you’ve been locked out of TradFi due to lack of credit history or geography, your onchain activity can now speak for you. DeFi lenders can offer under-collateralized loans to users with strong onchain risk scores, reducing barriers and expanding access to capital. It’s a radical shift from gatekeeping to open opportunity.

How DID Changes the Game for Borrowers and Lenders

For borrowers, DID means you finally get credit for your positive behavior, literally. Your repayment history, wallet interactions, and even verified off-chain credentials become part of your crypto credit score. This isn’t just theoretical: platforms are already using these scores to offer lower collateral requirements and more favorable loan terms to trustworthy users.

Lenders benefit too. With richer data and better risk assessment tools, they can confidently extend credit with less collateral locked up, driving higher yields and a more dynamic lending market. The result? More liquidity flows through DeFi protocols, powering everything from small business loans to personal finance, all without sacrificing security or privacy.

What’s Next? Scaling Up DeFi Lending Innovation

The future of decentralized identity in DeFi is bright, but there’s work to do before under-collateralized lending is truly mainstream. Expect rapid progress as DID standards mature and more protocols adopt interoperable frameworks. Privacy tech like zero-knowledge proofs will keep evolving, allowing users to prove eligibility without giving up sensitive details.

Institutional players are watching closely too. As regulatory clarity emerges around KYC/AML compliance for DIDs, expect a new wave of capital and innovation pouring into the space. We’re already seeing experiments with tokenized real-world assets and hybrid on/off-chain credit scoring that blur the lines between traditional finance and crypto-native systems.

5 Ways DID-Powered Undercollateralized Lending Could Reshape Global Finance

-

1. Unlocking Credit for the Underbanked: DID-based lending platforms like Centrifuge and Teller Finance let borrowers prove identity and creditworthiness without traditional banks, opening up loans to millions globally who lack access to legacy financial systems.

-

2. Boosting Capital Efficiency in DeFi: By replacing over-collateralization with DID-powered credit assessments, protocols such as Arcx’s DeFi Passport allow users to borrow more with less locked capital—making DeFi lending more efficient and attractive for both retail and institutional users.

-

3. Enabling Privacy-Preserving Credit Checks: Solutions like Chainlink DECO allow borrowers to verify off-chain credentials (like bank balances) without exposing sensitive data, paving the way for secure, privacy-first undercollateralized loans on-chain.

-

4. Bridging Traditional and Decentralized Finance: DID integration lets DeFi protocols tokenize real-world assets and assess borrower risk more like traditional banks, helping platforms such as Centrifuge bring institutional-grade lending and real-world assets on-chain.

-

5. Fostering Global Trust Through Verifiable Reputation: With on-chain credit scores from systems like Spectral and Reputation DAO, borrowers can build portable, verifiable reputations—reducing fraud and enabling cross-border lending without intermediaries.

If you’re a builder or power user in DeFi, now’s the time to get familiar with decentralized identity tools and onchain risk scoring protocols. These are the rails that will power the next generation of permissionless finance, more accessible, more efficient, and far more inclusive than anything TradFi can offer.

Want to dig deeper? Check out how DECO enables private off-chain data verification or learn about real-world adoption challenges here. The revolution is happening, don’t get left behind.