Decentralized identity (DID) is rapidly transforming the DeFi lending landscape, pushing the boundaries of what’s possible with under-collateralized onchain credit. For years, the DeFi ecosystem has been dominated by over-collateralized loans, which require borrowers to lock up more value than they borrow. This model, while effective for protecting lenders, excludes a massive segment of potential users and stifles real-world adoption. Today, DID and onchain risk scores are rewriting these rules, making DeFi lending more accessible, dynamic, and competitive with traditional finance.

Why Decentralized Identity Matters in DeFi Lending

At its core, decentralized identity in DeFi enables users to establish verifiable, self-sovereign identities on the blockchain. Unlike traditional KYC processes that rely on centralized authorities, DID empowers individuals to control their own data and reputation. This shift is crucial for under-collateralized lending: lenders need to trust that borrowers are creditworthy, while borrowers require privacy and autonomy.

The evolution of DID is tightly linked to the rise of onchain risk scores. By aggregating a user’s transaction history, repayment behavior, and participation across DeFi protocols, these scores provide a transparent and tamper-resistant measure of creditworthiness. Projects like Spectral and Reputation DAO are pioneering this space, developing DID-powered credit systems that enable under-collateralized loans without sacrificing security or transparency (wada.org).

Breakthroughs Driving Under-Collateralized DeFi Credit

Key Innovations Powering Undercollateralized DeFi Lending

-

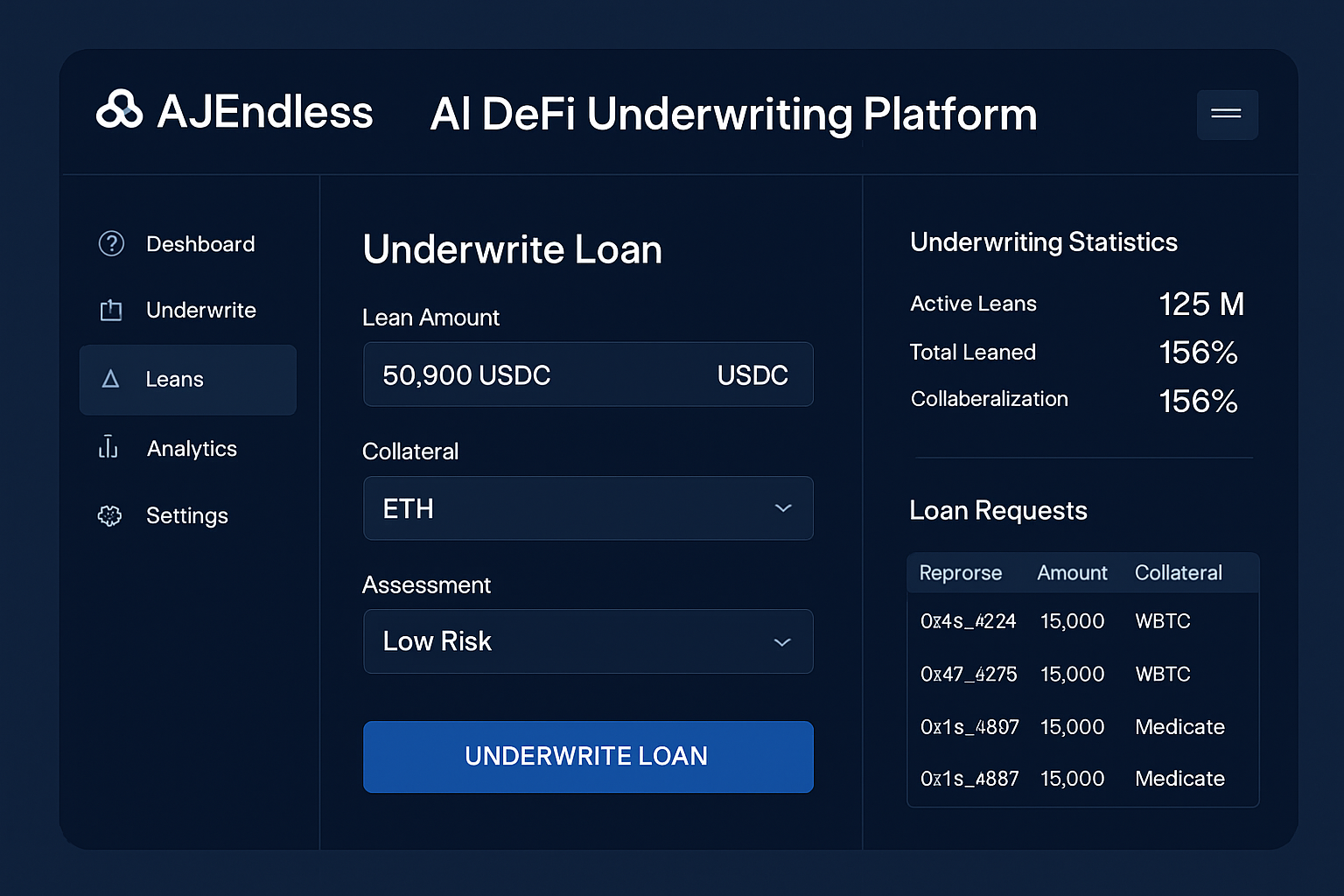

AI-Powered Underwriting by AJEndless AI: AJEndless AI leverages artificial intelligence to analyze on-chain data, such as transaction patterns and cash flows, enabling lenders to assess borrower creditworthiness and offer under-collateralized loans based on real financial behavior.

-

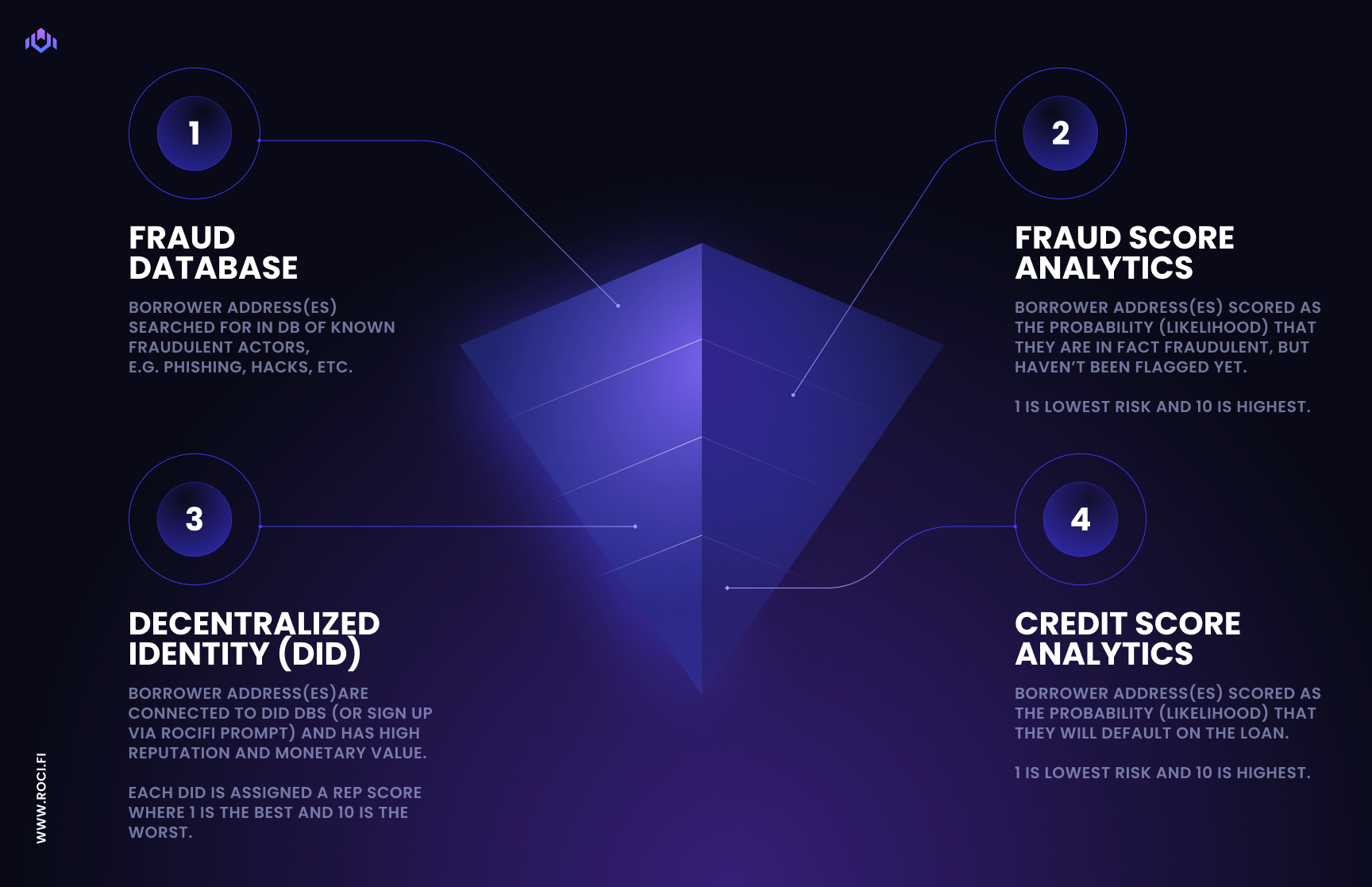

Non-Fungible Credit Scores (NFCS) by RociFi: RociFi introduces NFCS tokens, which serve as on-chain credit scores. These tokens allow users to prove ownership of address bundles and access under-collateralized loans using their DeFi transaction history and Web3 reputation.

-

Soulbound Tokens (SBTs) by MetisDAO: MetisDAO utilizes non-transferable Soulbound Tokens to represent users’ on-chain identity and reputation. These SBTs help lenders evaluate creditworthiness, making under-collateralized lending possible by leveraging users’ DeFi activity and reputation.

-

Decentralized Credit Scoring by Cred Protocol: Cred Protocol builds decentralized credit scores by quantifying on-chain lending risk. This innovation allows more users to access DeFi loans with less collateral by providing transparent, data-driven credit evaluations.

-

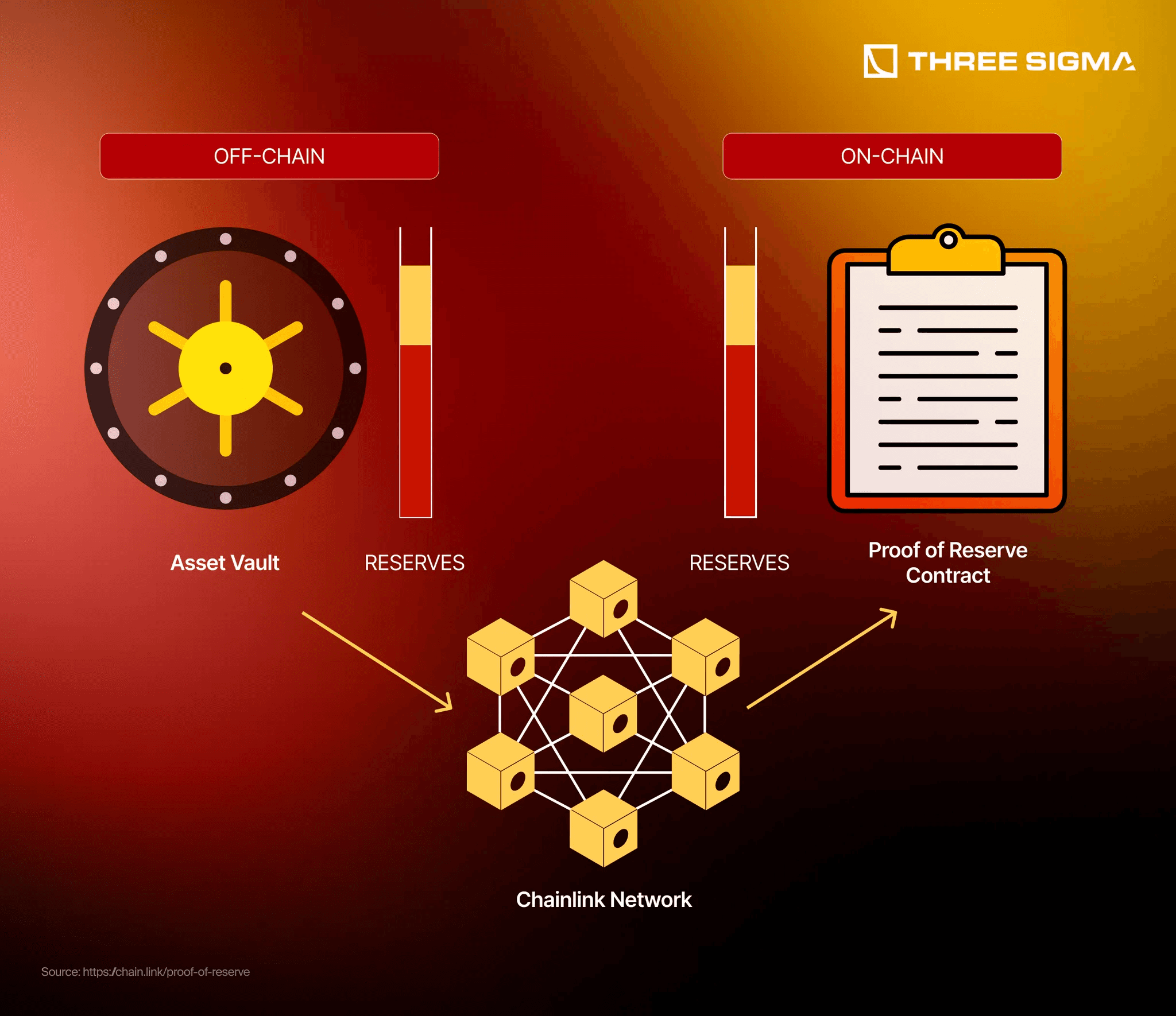

Privacy-Preserving Identity Verification by Teller & Chainlink: Teller, in collaboration with Chainlink, has developed a privacy-preserving oracle solution that enables under-collateralized crypto loans. This system assesses creditworthiness while maintaining user privacy, addressing a key barrier for broader DeFi adoption.

The past year has seen an explosion of innovation around DID for crypto loans. Here are several standout developments:

- AI-Powered Underwriting: Platforms like AJEndless AI analyze onchain data, transactional behaviors, wallet activity, and cash flows, to assess borrower reliability. This real-time analysis allows for nuanced risk modeling far beyond static collateral ratios.

- Non-Fungible Credit Scores (NFCS): RociFi’s NFCS tokens let users prove ownership over bundles of addresses, tying together their Web3 activity into a portable DeFi reputation. This unlocks access to credit for those with established onchain histories (bravenewcoin.com).

- Soulbound Tokens (SBTs): MetisDAO leverages non-transferable tokens as proof of identity and reputation. These SBTs serve as persistent credentials that can’t be sold or transferred, perfect for building trust in decentralized lending (cryptonitecapital.com).

- Decentralized Credit Scoring: Cred Protocol quantifies lending risk by building decentralized credit scores from onchain activity, making under-collateralized lending more viable (docs.credprotocol.com).

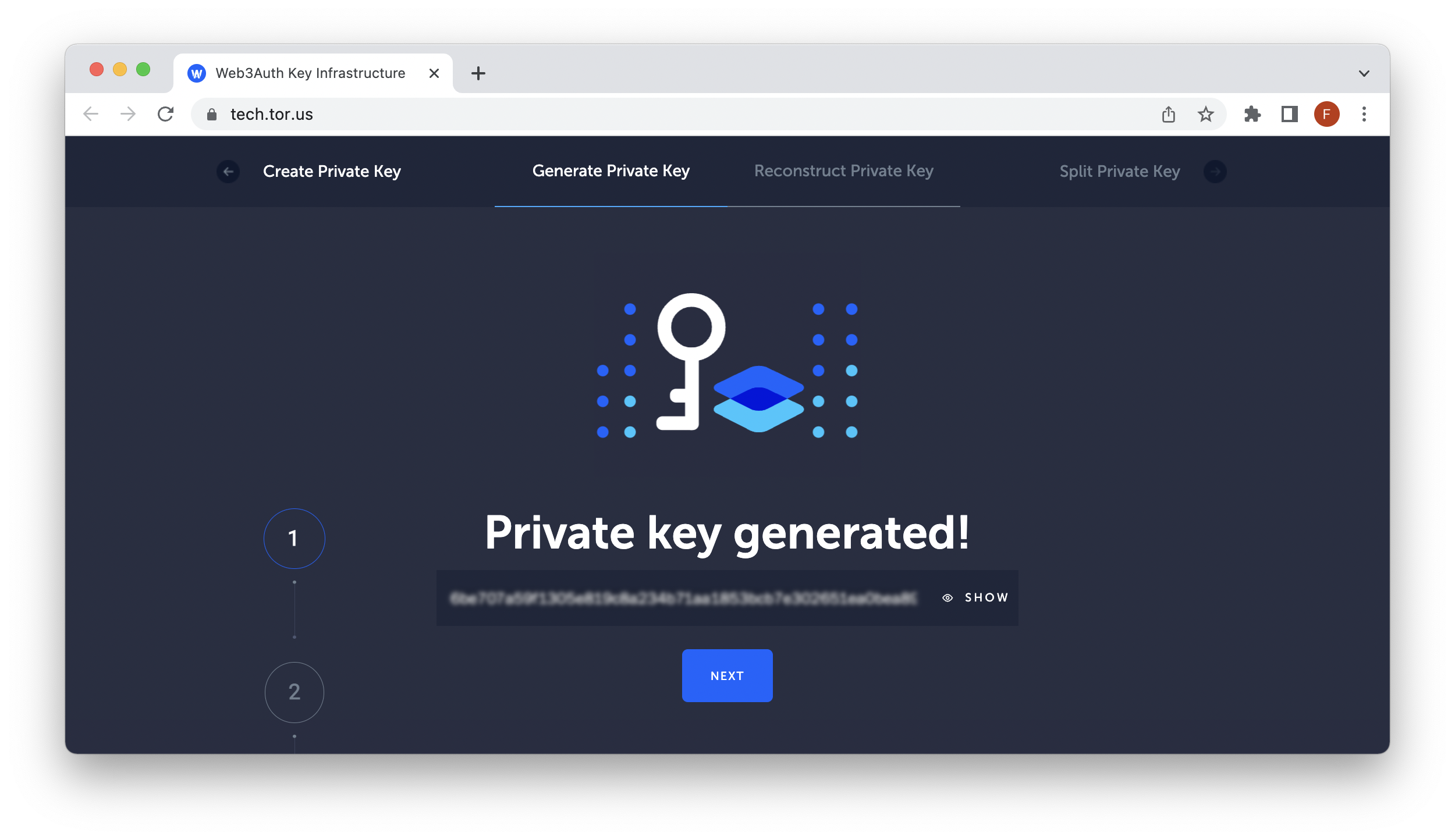

- Privacy-Preserving Identity Verification: Teller and Chainlink have demonstrated how privacy-preserving oracles can enable credit assessments without exposing sensitive user data (blog.teller.org).

DID: The Key to Unlocking Financial Access and Inclusion

The impact of self-sovereign identity in DeFi extends far beyond technical innovation. In regions where traditional banking infrastructure is weak or exclusionary, decentralized lending markets powered by DID offer a lifeline. By allowing users to build and port their Web3 credit scoring across platforms, DID lowers entry barriers for the underbanked and unbanked worldwide.

This new paradigm supports not just individual borrowers but also institutions seeking to deploy capital efficiently in global markets. As protocols move beyond static collateral requirements and towards dynamic risk assessment based on transparent onchain behavior, the entire notion of trust in finance is being reimagined.

Of course, with greater access comes a heightened need for robust risk management. Web3 credit scoring and portable DeFi reputations are only as valuable as the data and algorithms behind them. The best DID-powered protocols are transparent about their methodologies, open to community audit, and constantly evolving to address new vectors of risk. This transparency is not just a technical detail; it’s a foundational requirement for trust in a system where code replaces the banker’s handshake.

For lenders, these advances mean they can finally price risk more efficiently, targeting borrowers who demonstrate reliability on-chain rather than simply those with the deepest pockets. For borrowers, especially those previously locked out of both DeFi and traditional finance, DID-based systems offer a path to fairer credit and genuine financial mobility. This is where self-sovereign identity in DeFi becomes more than a buzzword, it’s a lever for systemic change.

What’s Next for DID and Under-Collateralized Lending?

As DID and onchain risk scores mature, expect to see even more granular, real-time credit models that blend off-chain data (like income or employment) with on-chain behavior. Privacy-preserving technologies, such as zero-knowledge proofs, will play a critical role in ensuring user data remains secure while still enabling accurate risk assessment. The endgame? A DeFi lending market that rivals, or even surpasses, the inclusivity and efficiency of traditional finance.

For developers and institutions, the challenge now is integration, how to weave DID frameworks and decentralized credit scoring into existing DeFi infrastructure without sacrificing user experience or security. Open standards, cross-protocol compatibility, and community-driven governance will be vital in scaling these solutions globally. The protocols that strike the right balance between privacy, transparency, and usability will set the standard for the next generation of DeFi lending.

Checklist: Building a DID-Powered DeFi Lending Strategy

In the coming years, the most successful DeFi ecosystems will be those that embrace DID for crypto loans and empower users with portable, provable reputations. Not only does this unlock new markets and drive adoption, but it also aligns with the core ethos of Web3: open access, user sovereignty, and trust through transparency. As under-collateralized lending becomes mainstream, expect DID and onchain risk scores to form the backbone of a more equitable and efficient financial future.