Decentralized finance (DeFi) has upended traditional financial paradigms, but one persistent gap remains: true undercollateralized lending. Historically, DeFi lending platforms have required borrowers to lock up collateral exceeding their loan value. This model, while effective at minimizing default risk, limits capital efficiency and restricts access for users without substantial crypto holdings. The emergence of onchain credit scores is poised to change this landscape, introducing a new era where trust is built on transparent blockchain data rather than excessive collateralization.

Why Onchain Credit Scores Are the Missing Piece in DeFi Lending

The lack of reliable credit assessment tools has been a major obstacle for undercollateralized crypto loans. In the absence of conventional credit bureaus or centralized data sources, DeFi protocols historically could not gauge borrower risk without demanding high collateral. This overcollateralization stifles innovation and excludes vast segments of potential borrowers.

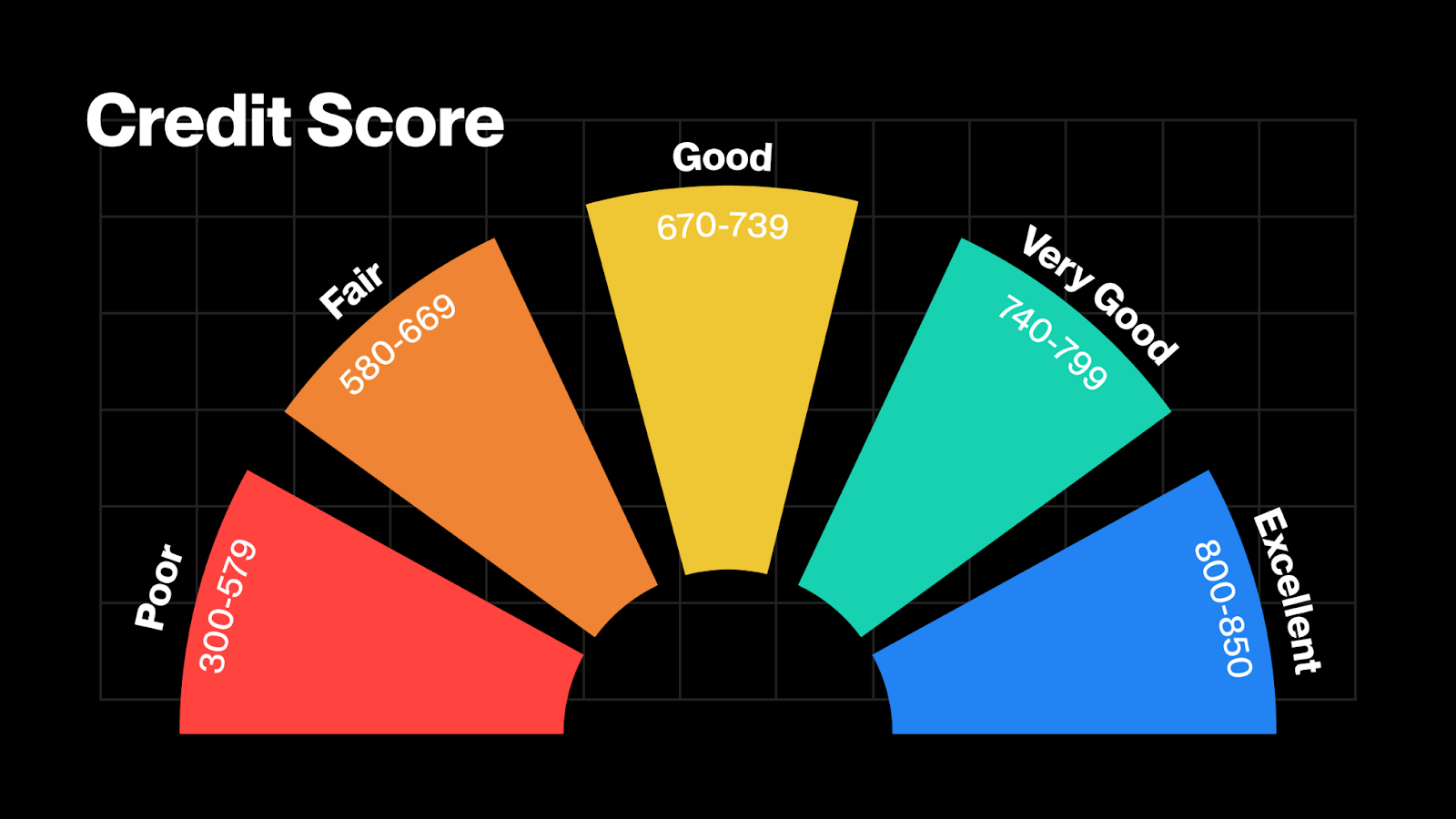

Onchain credit scores address this by leveraging a user’s verifiable blockchain activity, including transaction history, loan repayments, and protocol participation, to generate a dynamic risk profile. Unlike opaque traditional systems, this approach is fully transparent and resistant to manipulation. As noted by leading industry voices, the integration of onchain credit scoring is expected to unlock trillions of dollars in untapped capital for the DeFi ecosystem (source).

“Platforms like 3Jane, Providence, and Credora are pioneering methods to assess creditworthiness based on verifiable onchain behavior. ”: Visa. com

The Mechanics: How Onchain Credit Scores Enable Undercollateralized Crypto Loans

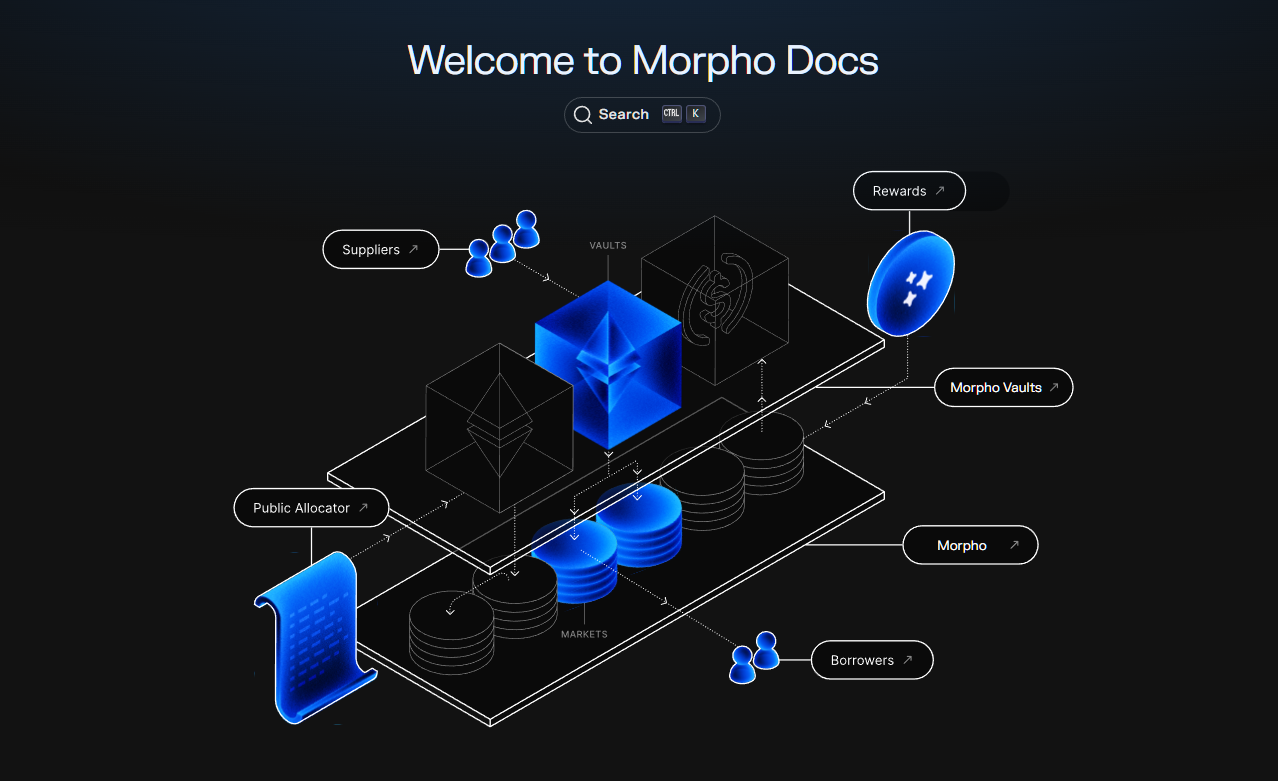

The core innovation lies in aggregating and analyzing onchain repayment history across multiple protocols. Platforms such as Goldfinch, Maple Finance, and TrueFi are already utilizing these scores to facilitate loans with significantly reduced collateral requirements. Here’s how it works:

Key Mechanisms Powering Onchain Credit Scoring in DeFi Lending

-

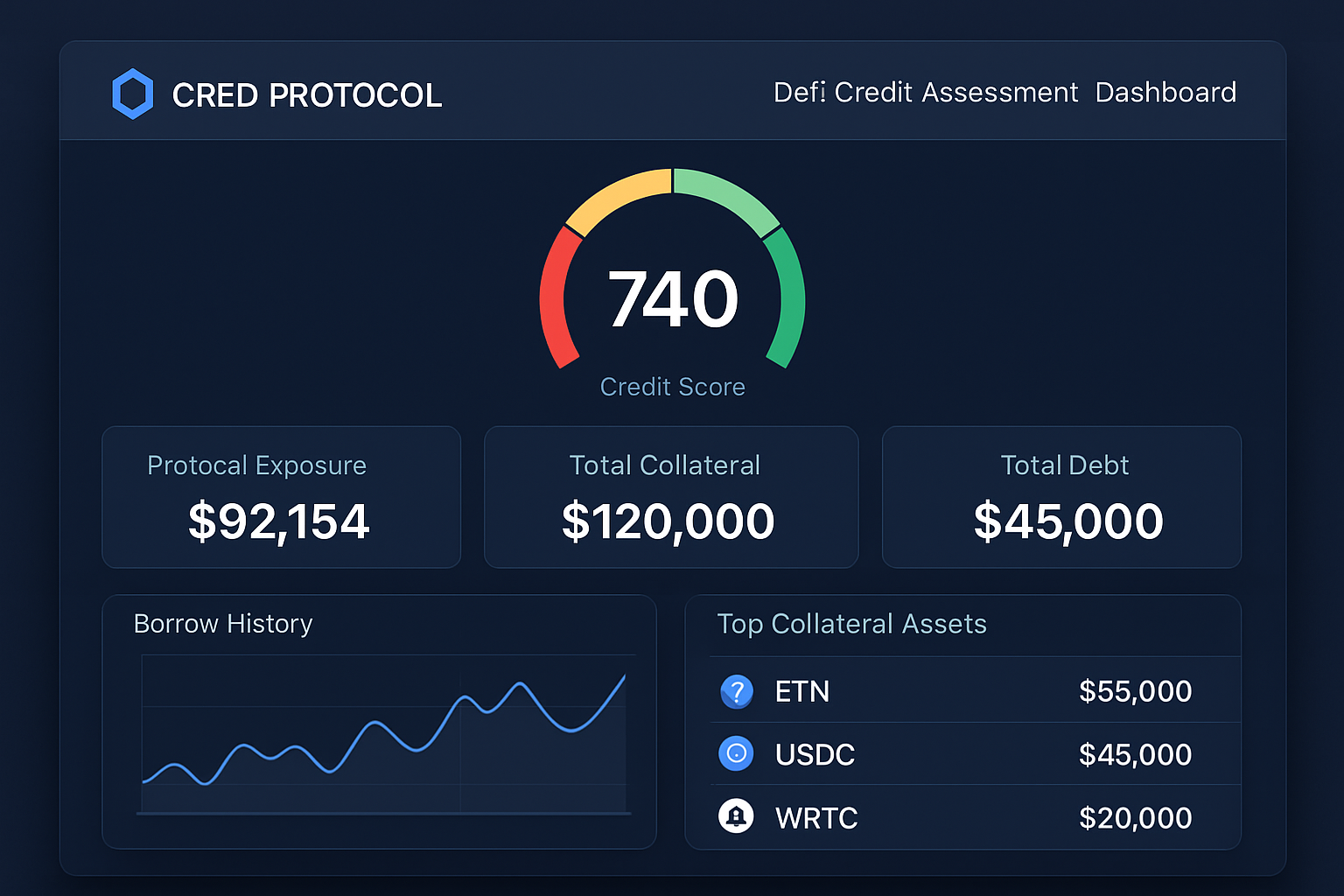

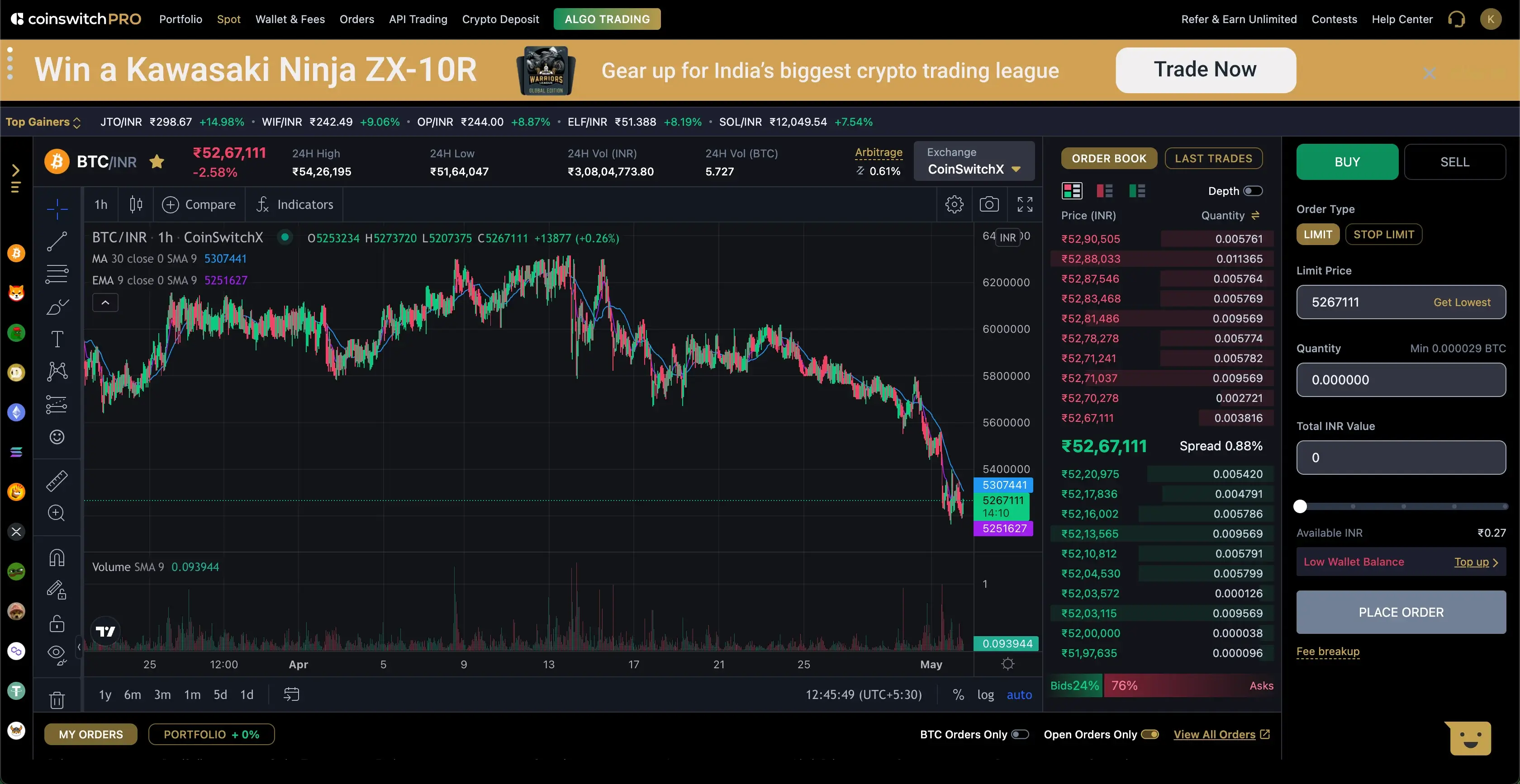

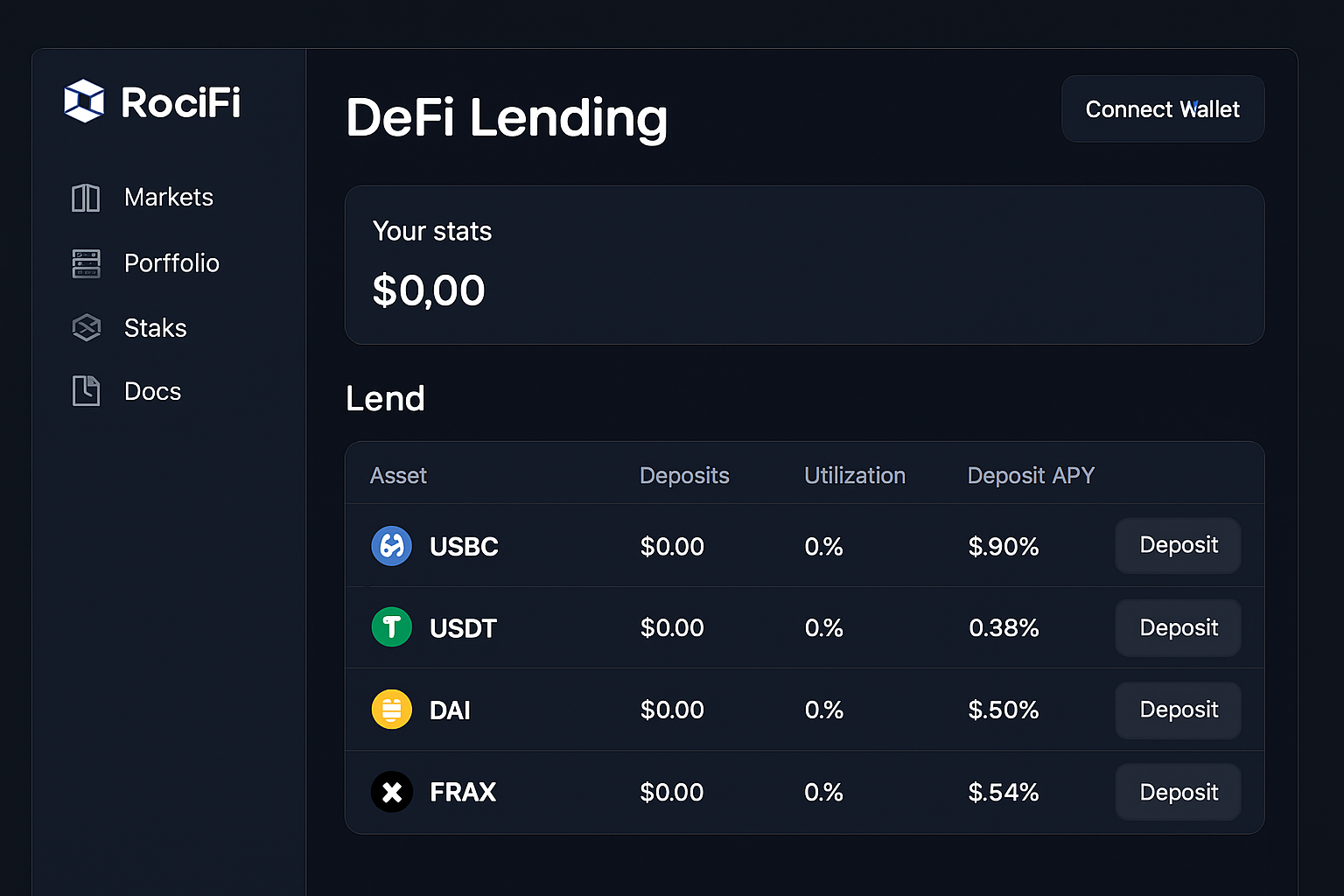

Decentralized Credit Assessment Protocols: Platforms like Cred Protocol, Credora, and RociFi analyze users’ on-chain transaction history, loan repayments, and DeFi activity to generate transparent credit scores, enabling lenders to assess risk without relying on traditional collateral.

-

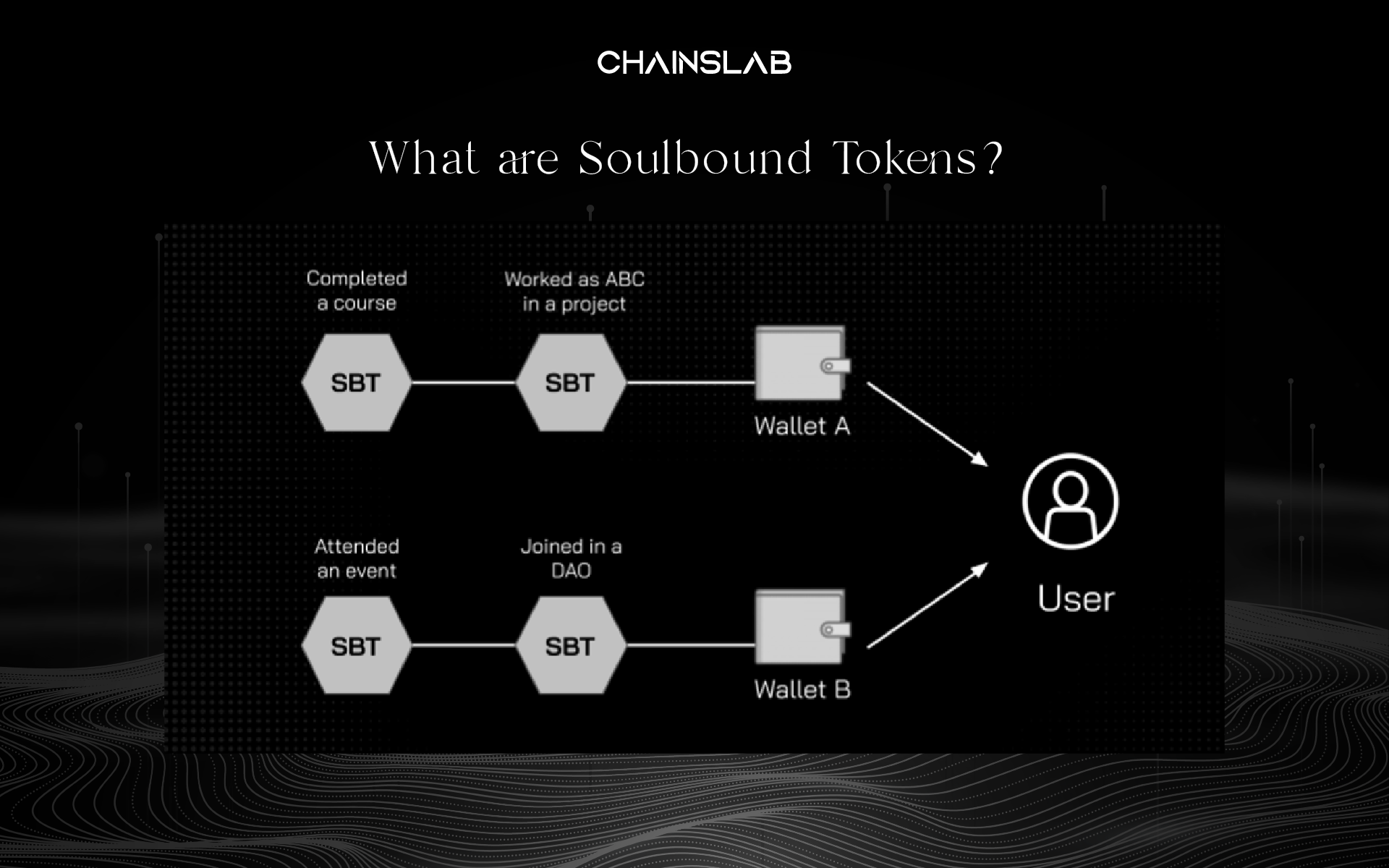

Reputation and Soulbound Tokens (SBTs): Some DeFi platforms utilize non-transferable tokens, such as Soulbound Tokens, to represent a user’s reputation or creditworthiness. These tokens are permanently linked to a specific blockchain address, providing an immutable record of trust and lending history.

-

Hybrid Models Integrating Off-Chain Data: Protocols like Providence and 3Jane combine on-chain behavior with off-chain credit data using privacy-preserving technologies such as Zero-Knowledge Proofs, allowing users to prove their creditworthiness without exposing sensitive personal information.

-

On-Chain Lending Platforms with Credit Scoring: Leading platforms including Goldfinch, Maple Finance, and TrueFi offer undercollateralized loans by leveraging on-chain credit scores and reputation systems to evaluate borrower risk.

-

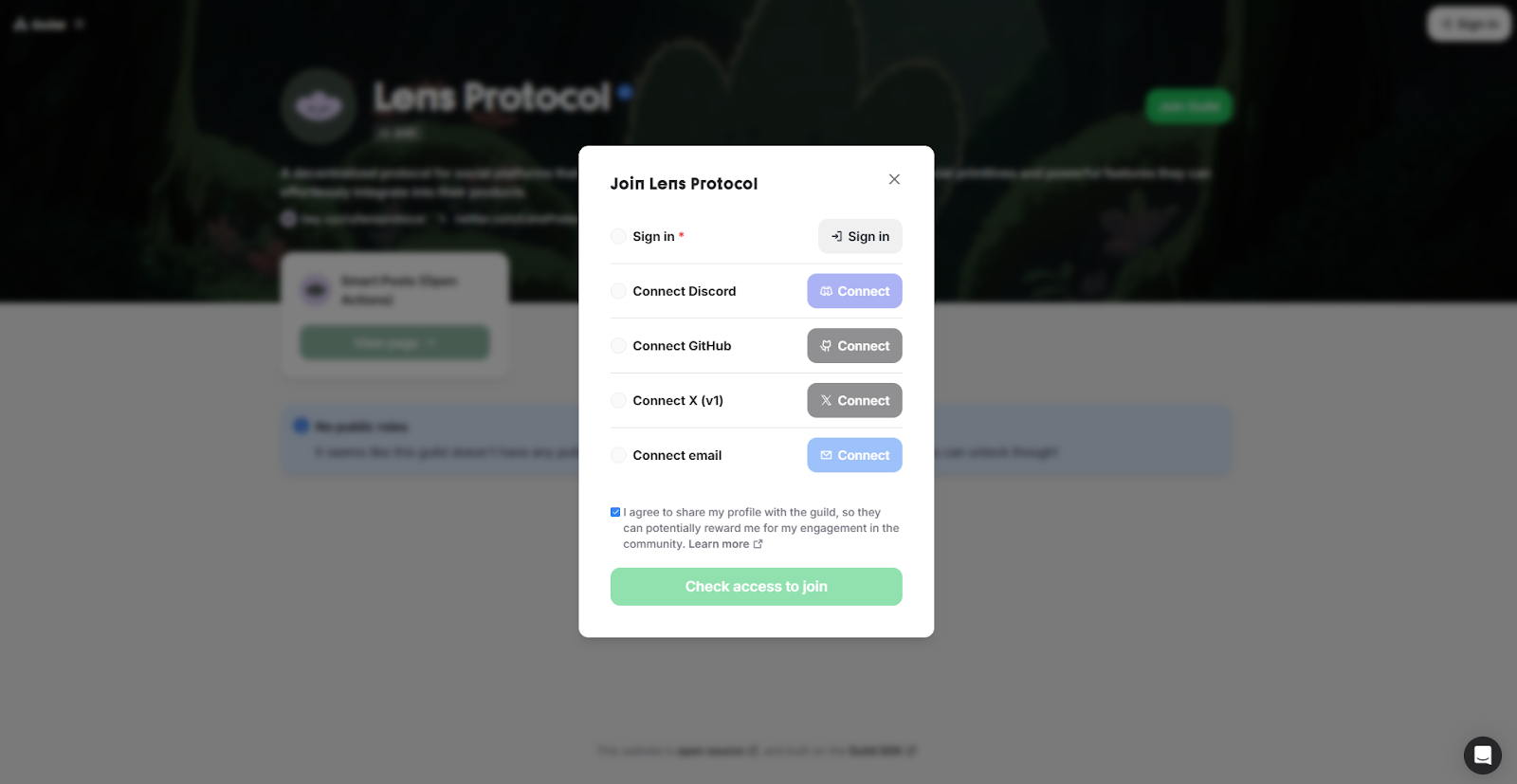

Decentralized Identity and Reputation Systems: Emerging solutions such as Lens Protocol and Gitcoin Passport enable users to build verifiable on-chain identities, linking their DeFi activity and reputation across platforms to support more accurate credit assessments.

By evaluating factors such as timely repayments, participation in governance votes, liquidity provision history, and even social staking or reputation tokens (like Soulbound Tokens), these systems provide lenders with granular insight into borrower reliability. This enables DeFi risk assessment that is both data-driven and privacy-preserving.

Practical Steps for Building Your Onchain Credit Profile

If you’re looking to access undercollateralized crypto loans or simply improve your standing within the evolving DeFi landscape, consider these actionable strategies:

- Engage Consistently: Regularly use reputable lending platforms with transparent repayment tracking.

- Repay Loans Promptly: Timely repayments are a critical factor in boosting your score.

- Diversify Protocol Interactions: Participation across multiple ecosystems can strengthen your reputation.

- Pursue Decentralized Identity (DID) Solutions: Linking your wallet with DID frameworks can further authenticate your activity without sacrificing privacy.

- Monitor Your Score: Utilize dashboards provided by emerging DeFi credit scoring platforms to track your progress.

This proactive approach not only increases your eligibility for undercollateralized loans but also contributes to broader financial inclusion within the decentralized economy. For an in-depth exploration of these mechanisms and their impact on capital efficiency in DeFi lending markets, see this detailed guide.

As the ecosystem matures, DeFi credit scoring platforms are evolving rapidly. Protocols now incorporate advanced analytics, machine learning, and cross-chain data aggregation to produce more nuanced risk assessments. This not only benefits borrowers seeking undercollateralized crypto loans but also empowers lenders with granular visibility into borrower reliability, reducing the probability of defaults and systemic shocks.

Emerging Trends: Beyond Basic Credit Scores

The next frontier for onchain credit scores lies in the integration of decentralized identity (DID) and privacy-preserving attestations. By combining DID frameworks with onchain repayment history, platforms can offer robust DeFi risk assessment without exposing sensitive personal data. Additionally, hybrid models are surfacing: these blend off-chain reputation signals with blockchain activity using zero-knowledge proofs, further expanding access to capital for users previously excluded from traditional finance.

Top DeFi Protocols Using Onchain Credit Scores

-

Goldfinch: A leading DeFi lending protocol pioneering under-collateralized crypto loans by leveraging onchain credit scores and off-chain data. Goldfinch enables borrowers to access capital with less collateral by assessing their blockchain reputation and repayment history.

-

Maple Finance: Maple offers institutional undercollateralized lending using onchain credit assessments. The platform evaluates borrower creditworthiness through blockchain activity and trusted delegate reviews, facilitating more efficient capital allocation.

-

TrueFi: TrueFi is a decentralized lending protocol that provides unsecured and undercollateralized loans based on onchain credit scoring and borrower transparency. Its system combines onchain analytics with community-driven risk assessment.

-

Credora: Credora specializes in real-time onchain credit analytics for DeFi and CeFi lenders. By analyzing borrowers’ onchain behavior and financial history, Credora enables undercollateralized lending with enhanced risk controls.

-

Spectra: Spectra (formerly Spectral Finance) introduces onchain credit scoring models that aggregate users’ blockchain activities into a single credit score, empowering lenders to offer undercollateralized loans with greater confidence.

-

RociFi: RociFi uses onchain reputation and credit scoring to facilitate undercollateralized lending. The protocol assigns credit scores based on wallet activity, repayment behavior, and risk metrics, allowing users to borrow with less collateral.

Institutional adoption is also accelerating. Entities like Maple Finance and Goldfinch have demonstrated that institutional-grade undercollateralized lending is possible when paired with transparent onchain risk metrics. As a result, liquidity providers are increasingly willing to allocate capital to these platforms, knowing that borrower risk is quantifiable and visible in real time.

What DeFi Users Need to Know Now

For users navigating this landscape, vigilance is key. Not all onchain credit scoring mechanisms are created equal; some protocols may lack rigorous risk controls or sufficient historical data. Before engaging:

- Review protocol documentation: Understand how scores are calculated and what protections exist for both borrowers and lenders.

- Check platform audits: Ensure smart contracts have undergone independent security reviews.

- Stay updated: Monitor new integrations between DID solutions and lending protocols as these can enhance your borrowing power while safeguarding privacy.

The market’s rapid evolution means opportunities, and risks, are dynamic. Staying informed will help you capitalize on the advantages of undercollateralized crypto loans while mitigating exposure to potential pitfalls.

Frequently Asked Questions About Onchain Credit Scoring

The rise of transparent, data-driven credit scoring in DeFi is not just a technical upgrade, it’s a foundational shift toward greater financial inclusivity. As more protocols adopt sophisticated risk assessment tools and decentralized identity frameworks, expect to see continued growth in both user participation and institutional capital flows.

If you’re ready to explore this transformative landscape further or want practical tips to maximize your eligibility for undercollateralized loans, visit our comprehensive resource at cryptocreditscores. org. The future of lending is open, transparent, and accessible, powered by your own onchain reputation.