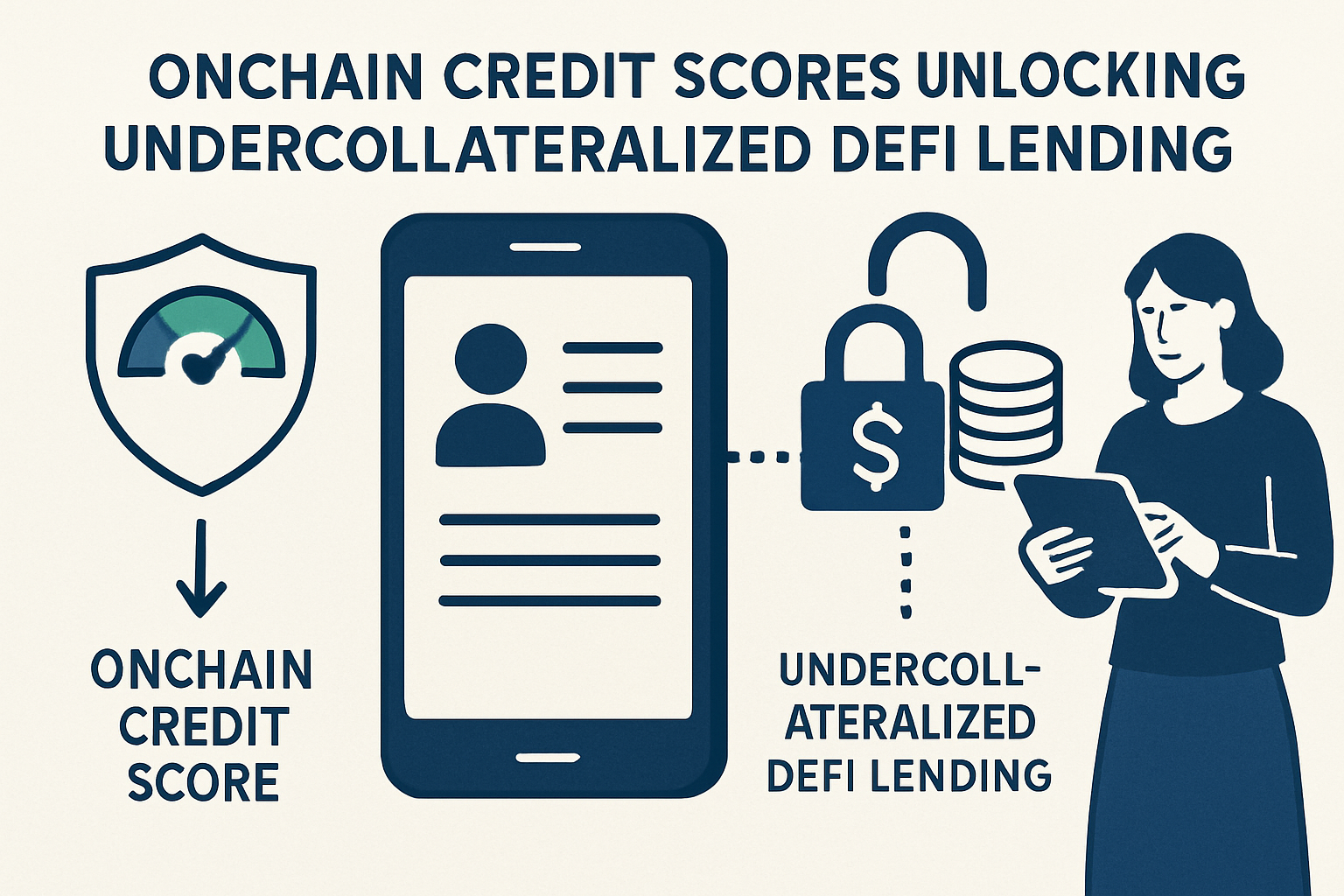

Picture this: you want to borrow stablecoins for a trading opportunity, but you don’t have a mountain of ETH or BTC to lock up as collateral. Traditionally, DeFi lending has been a game for the whales, where overcollateralization is the rule and capital efficiency takes a back seat. But that’s changing fast, and the catalyst is onchain credit scores.

Onchain credit scores are shaking up decentralized finance by making undercollateralized lending not just possible, but scalable. Instead of locking up more assets than you borrow, your borrowing power is determined by your on-chain reputation, think transparent transaction history, repayment behavior, and even your interactions with DeFi protocols.

Why Overcollateralization Holds DeFi Back

The current state of DeFi lending looks impressive on paper, billions in total value locked, but it’s also fundamentally inefficient. Most protocols require users to deposit $1.50 or more for every $1 they wish to borrow. This limits who can participate and ties up huge amounts of otherwise productive capital.

This model exists because smart contracts can’t chase down defaulters like banks do in TradFi. But what if we could quantify risk, just like traditional lenders do? Enter decentralized identity credit and onchain risk assessment tools.

How Onchain Credit Scores Actually Work

An onchain credit score is like a passport for your crypto reputation. Instead of relying on off-chain data or opaque algorithms, these scores are built from your wallet’s actual activity:

Key Factors Influencing Onchain Credit Scores in DeFi

-

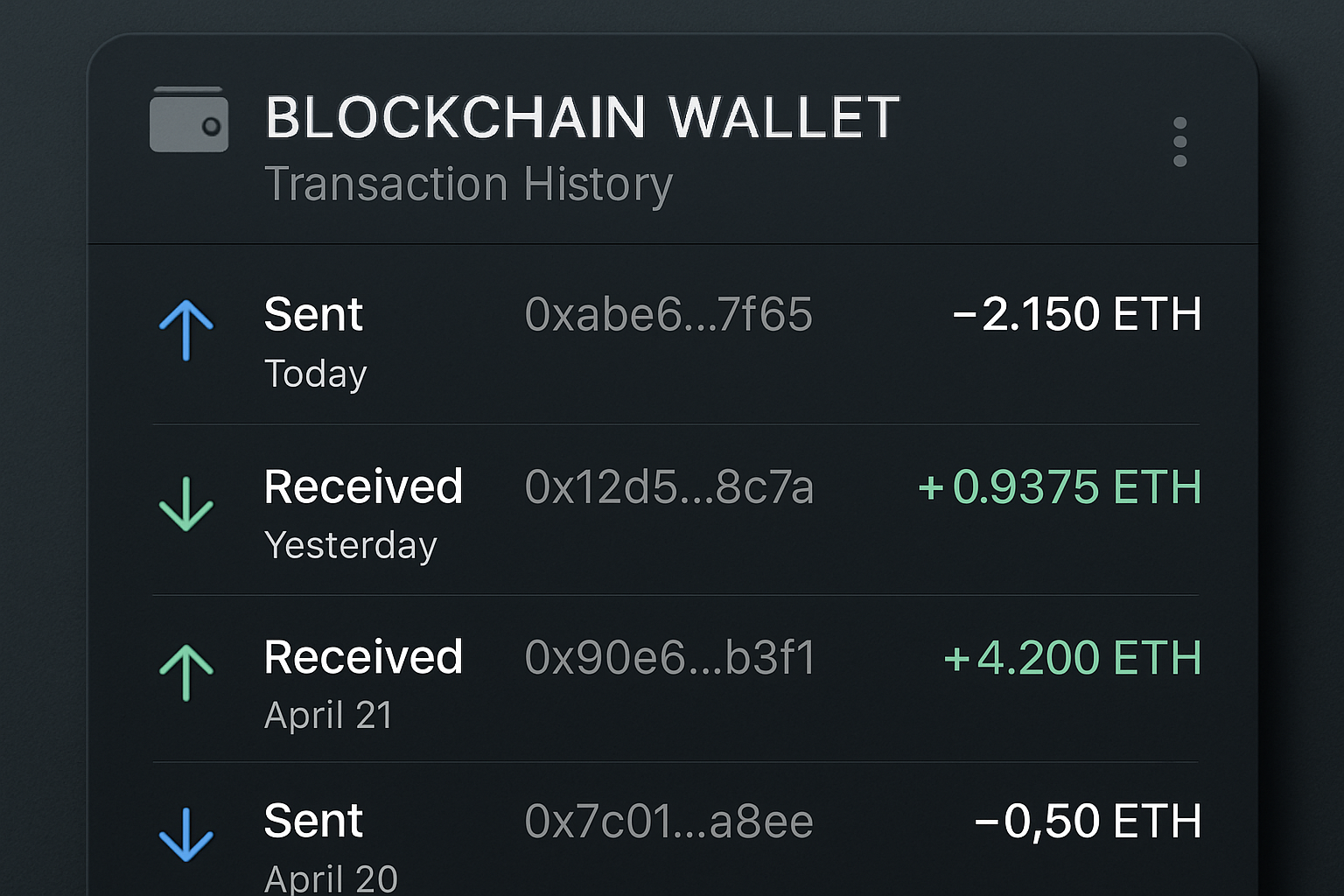

On-Chain Transaction History: A borrower’s history of wallet activity—such as the frequency, volume, and diversity of transactions—provides insight into their financial behavior and reliability within the DeFi ecosystem.

-

Repayment Behavior: Timely repayment of past DeFi loans and successful completion of borrowing cycles are crucial indicators of creditworthiness. Protocols like Credora and More Protocol factor this in to assess risk.

-

Interactions with DeFi Protocols: Engagement with platforms like Aave, Compound, and liquidity pools demonstrates experience and trustworthiness, which can positively impact credit scores.

-

Wallet Age and Activity Consistency: Older wallets with consistent activity are generally considered lower risk, as they indicate long-term participation and stability in the crypto ecosystem.

-

On-Chain Asset Holdings: The diversity and value of assets held in a wallet, including stablecoins and blue-chip tokens, help gauge a borrower’s financial health and ability to repay loans.

-

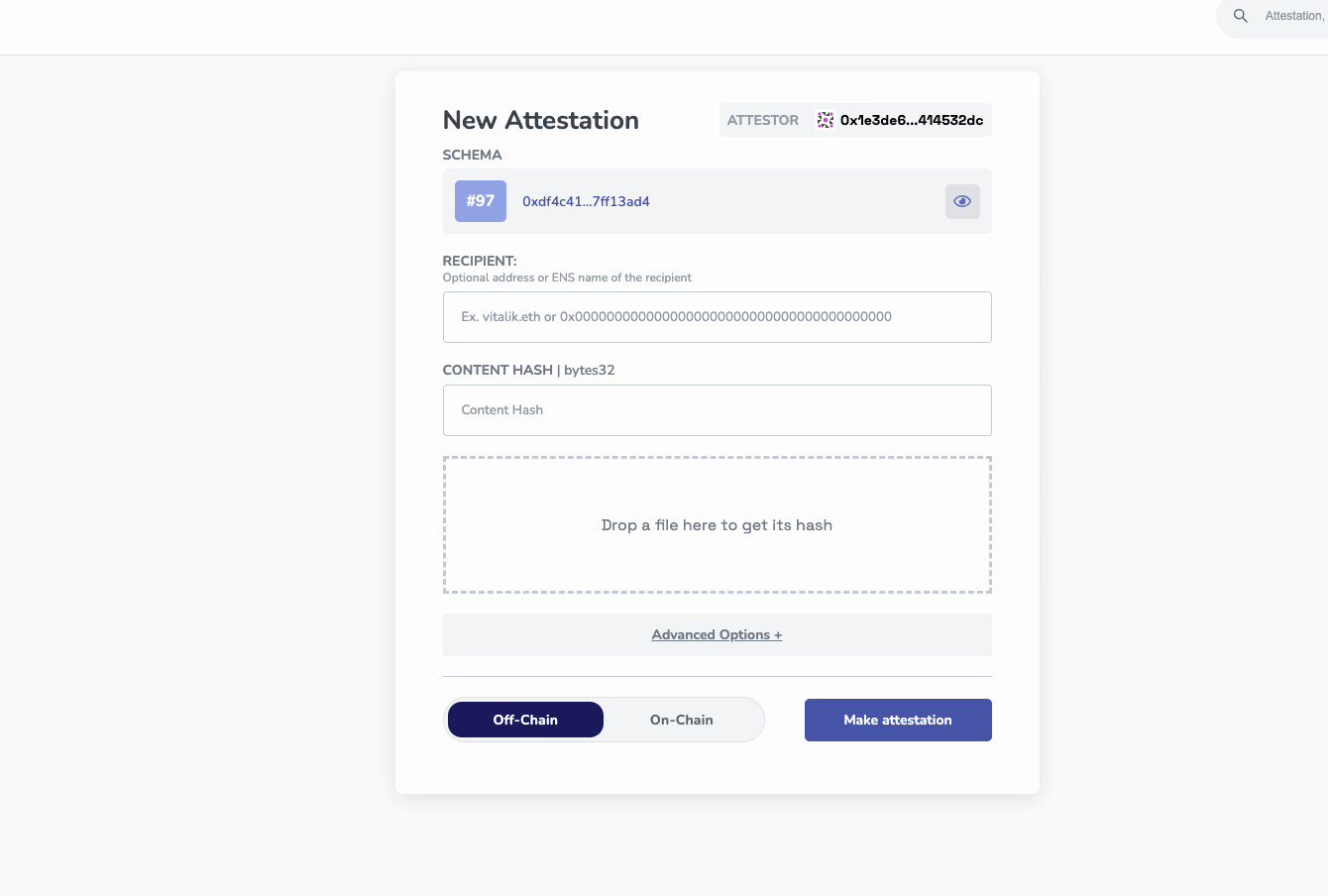

Use of On-Chain Identity and Attestations: Verified on-chain identities and attestations (such as those enabled by Ethereum Attestation Service) add credibility and allow protocols to link activity across multiple platforms securely.

-

Participation in Governance and Staking: Active involvement in protocol governance or staking activities signals commitment and alignment with DeFi communities, which some scoring models reward.

-

Integration of Off-Chain Data via Oracles: Solutions like Chainlink DECO enable secure verification of off-chain data (e.g., traditional credit scores or KYC), enriching on-chain credit assessments without compromising privacy.

This means if you’ve consistently paid back Aave loans on time or provided liquidity without rugging pools, your wallet builds trust, and that trust becomes leverage for future loans with less collateral required.

Pioneers Pushing Undercollateralized Lending Forward

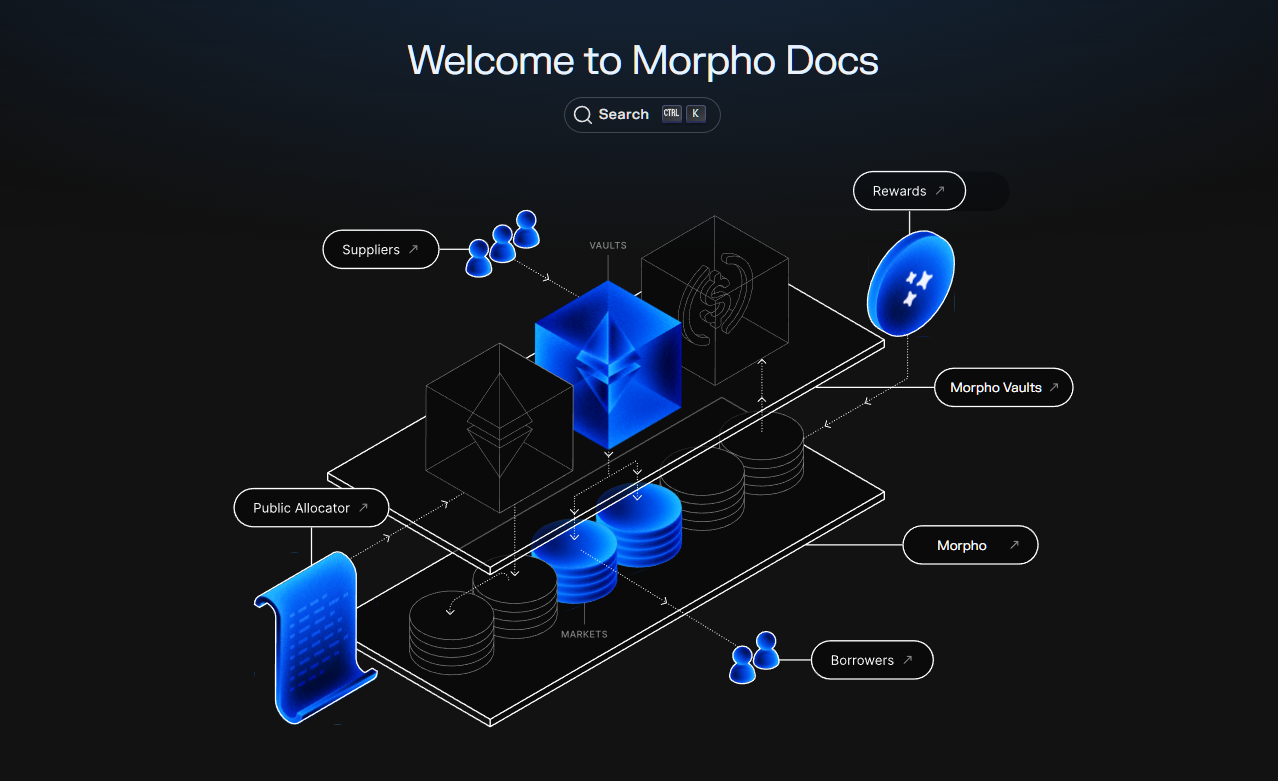

A wave of new projects is building the infrastructure for this next-gen lending market:

- Credora and amp; More Protocol: Let users borrow up to 200% of their collateral by integrating real-time onchain credit scoring.

- Teller and amp; Chainlink DECO: Use zero-knowledge proofs to verify off-chain data without sacrificing privacy, unlocking new types of risk assessment.

- Spectral Finance: Their MACRO score analyzes multi-protocol transaction data for a holistic view of wallet reputation.

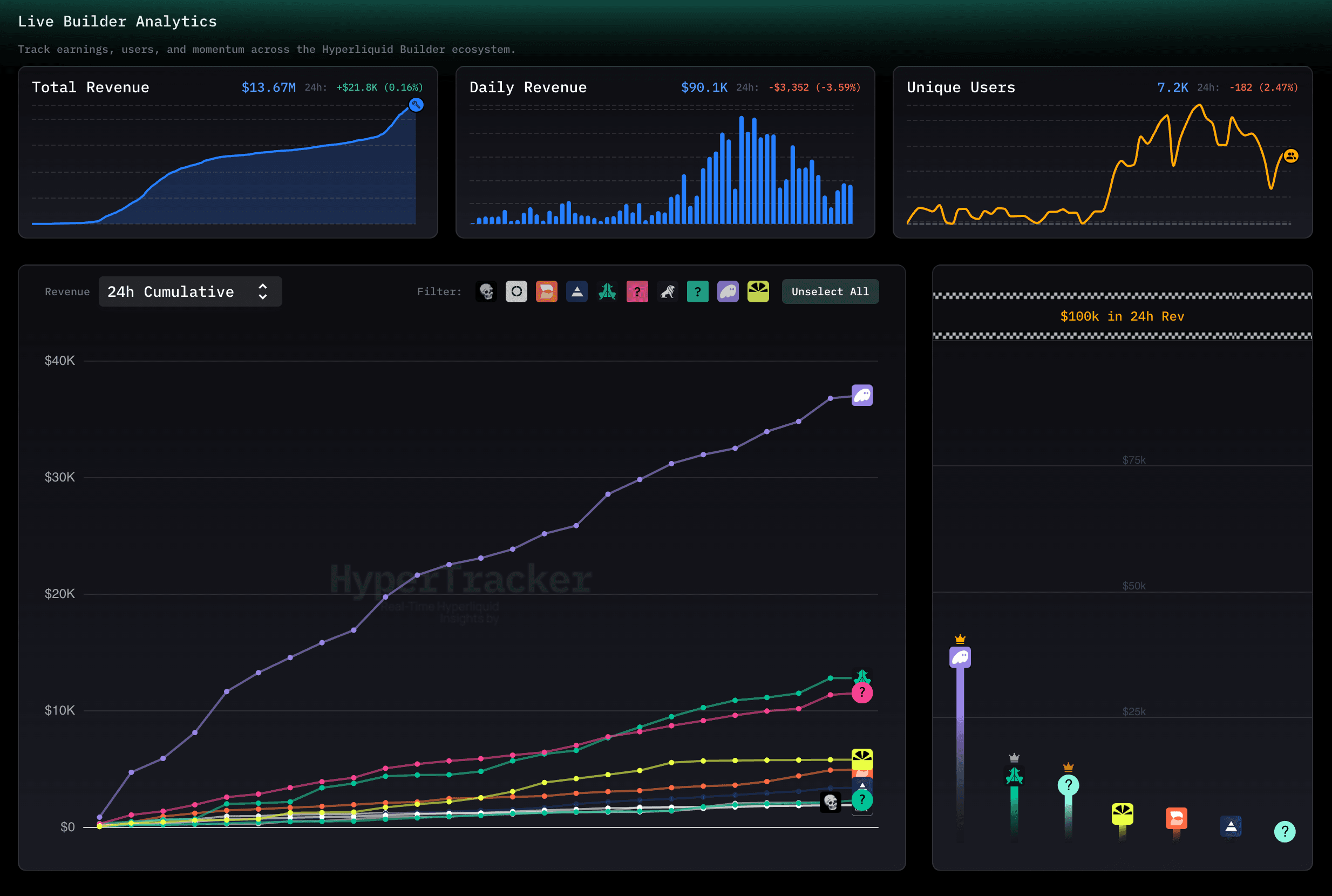

This isn’t pie-in-the-sky stuff, it’s already happening across Ethereum and Layer-1s like Flow Blockchain. The result? More people can access loans with less friction, while lenders get granular risk visibility before putting capital at stake.

The Benefits: Capital Efficiency Meets Financial Inclusion

The impact here goes beyond just making lending more efficient. By using transparent, verifiable metrics instead of arbitrary gatekeeping or massive collateral demands, undercollateralized DeFi lending powered by onchain risk scores opens doors for:

- Bigger borrowing power: Borrowers don’t have to lock up all their assets just to access liquidity.

- Broader participation: Users without deep pockets can build a crypto credit reputation over time, no TradFi history needed!

- Lender protection: Real-time risk assessment lets lenders price loans dynamically based on actual borrower behavior.

If you want to dive deeper into how these systems work behind the scenes (and see live examples), check out our full guide at cryptocreditscores.org.

But let’s get real: the road to mass adoption of undercollateralized DeFi lending isn’t all sunshine and rainbows. There are still crucial challenges to iron out, and the ecosystem is evolving at breakneck speed. Let’s break down what’s working, what still needs work, and where the next wave of innovation is heading.

What’s Holding Back Undercollateralized Lending?

For all their promise, onchain credit scores aren’t a silver bullet yet. The biggest hurdles? Data privacy, cross-protocol interoperability, and the ever-present risk of Sybil attacks (where users game the system with multiple wallets). Projects like Teller and Chainlink’s DECO are pioneering privacy-preserving proofs so your off-chain identity isn’t doxxed every time you apply for a loan. Meanwhile, attestation standards on Ethereum are making it easier for protocols to recognize reputation earned across different dApps.

Lenders are also learning fast that not all on-chain activity is created equal. Flash loan exploits or wash trading can inflate scores unless protocols carefully filter for genuine behavior. That’s why multi-factor models, combining repayment history, protocol diversity, and even social graph analysis, are emerging as best practice in DeFi risk assessment.

The Real-World Impact: More Than Just Numbers

Here’s where things get really exciting: undercollateralized lending with robust crypto credit reputation systems is already unlocking new use cases that go way beyond simple loans:

5 Groundbreaking DeFi Apps Powered by Onchain Credit Scores

-

Credora & More Protocol: By integrating onchain credit scores on the Flow Blockchain, Credora and More Protocol enable users to borrow up to 200% of their collateral on MORE Markets, unlocking undercollateralized loans for a wider range of DeFi participants.

-

Teller x Chainlink (DECO): Teller and Chainlink have developed a proof of concept for undercollateralized crypto loans using Chainlink’s DECO protocol, which verifies off-chain data with zero-knowledge proofs—bringing privacy and trust to onchain credit checks.

-

Spectral Finance: Spectral Finance pioneered the Multi-Asset Credit Risk Oracle (MACRO) score, an onchain credit scoring system that analyzes DeFi transaction data to assess borrower risk and enable undercollateralized lending.

-

Goldfinch: Goldfinch is a decentralized credit protocol that leverages onchain and off-chain data to issue undercollateralized loans, expanding DeFi lending to users and businesses without large crypto reserves.

-

TrueFi: TrueFi offers uncollateralized loans to vetted borrowers by analyzing onchain creditworthiness, helping institutions and individuals access capital efficiently while maintaining transparency and risk controls.

From microloans for emerging market entrepreneurs to dynamic credit lines for DAOs and NFT collectors, the possibilities are multiplying. As more users build up a verifiable onchain track record, financial inclusion becomes more than just a buzzword, it becomes reality.

What’s Next? The Roadmap for DeFi Credit Evolution

The next 12-24 months will be pivotal. Expect to see:

- Mainstream stablecoin lenders integrating risk-based pricing: Borrowers with higher scores pay less interest or post less collateral.

- Decentralized identity standards maturing: Wallet-linked DIDs (decentralized identifiers) will make it harder to fake reputations while keeping user data private.

- Lender protection products: Think insurance pools or automated liquidation backstops tailored specifically to undercollateralized markets.

This is no longer theoretical, protocols like Credora and Spectral Finance are proving that transparent risk scoring can power safer, more accessible lending at scale. And as institutional capital starts eyeing these markets (especially with stablecoins now ubiquitous), the potential inflow could be in the trillions according to industry leaders.

Ready to Build Your Onchain Reputation?

Your wallet isn’t just a key, it’s your passport to financial opportunity in Web3. Start building your score by interacting responsibly with lending platforms, repaying loans promptly, and diversifying your DeFi activity across trusted protocols. Want actionable tips? We’ve got you covered below!

The future of decentralized finance will be powered by trustless reputation, not arbitrary barriers or TradFi red tape. Whether you’re a borrower looking for leverage or a lender searching for yield without blind risk, embracing onchain credit scoring is your ticket into the next era of capital-efficient crypto lending.