For years, decentralized finance (DeFi) lending protocols have demanded that borrowers lock up more collateral than the value of their loan. This over-collateralization is a direct response to the pseudonymous nature of blockchain accounts: with no traditional credit history or off-chain identity, lenders have little recourse if a borrower defaults. Yet, this approach locks out millions who lack large crypto holdings and severely limits DeFi’s capital efficiency.

Now, onchain reputation scores are reshaping the landscape. By leveraging transparent blockchain activity and decentralized identity frameworks, these scores make it possible to assess borrower risk without requiring excessive collateral. The result? A new era of under-collateralized crypto loans that could unlock trillions in liquidity for global markets without sacrificing trust or transparency.

How Onchain Reputation Scores Work

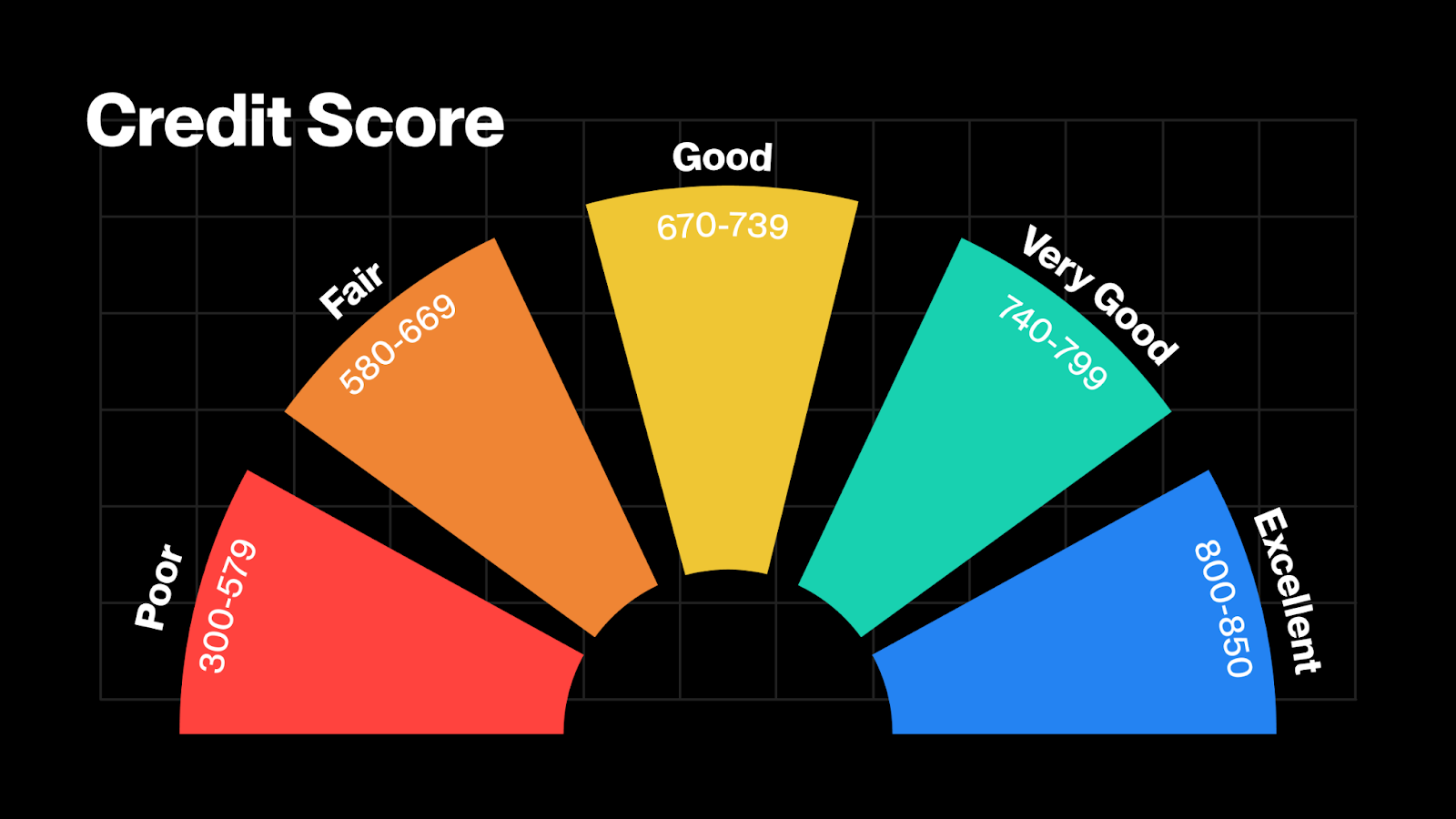

At their core, onchain reputation scores analyze a user’s historical behavior across the blockchain. This includes not only wallet-to-wallet transactions but also loan repayments, participation in DAOs, governance voting patterns, and interactions with various decentralized applications (DApps). By aggregating these data points into a comprehensive profile, protocols can evaluate creditworthiness far more dynamically than traditional models allow.

For example, if a user has consistently repaid DeFi loans on time and participated actively in governance decisions, their wallet reputation engine will reflect this reliability. Lenders can then offer under-collateralized crypto loans to such users with greater confidence, rewarding responsible behavior and broadening access to capital.

Key Innovations Powering Decentralized Credit Scoring

The rapid evolution of DeFi has given rise to several technical innovations designed specifically for under-collateralized lending:

Leading Protocols Using Onchain Reputation for Under-Collateralized Lending

-

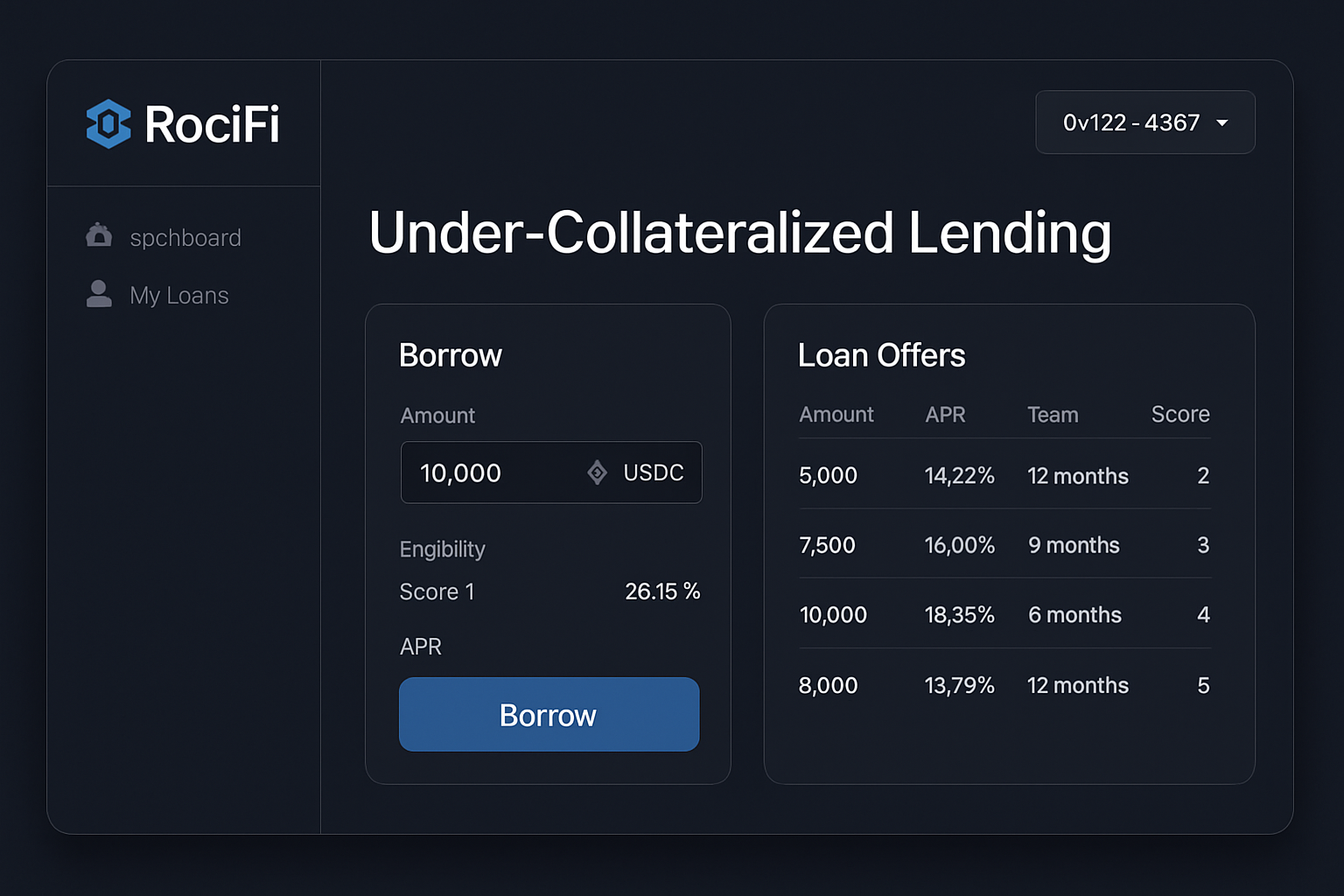

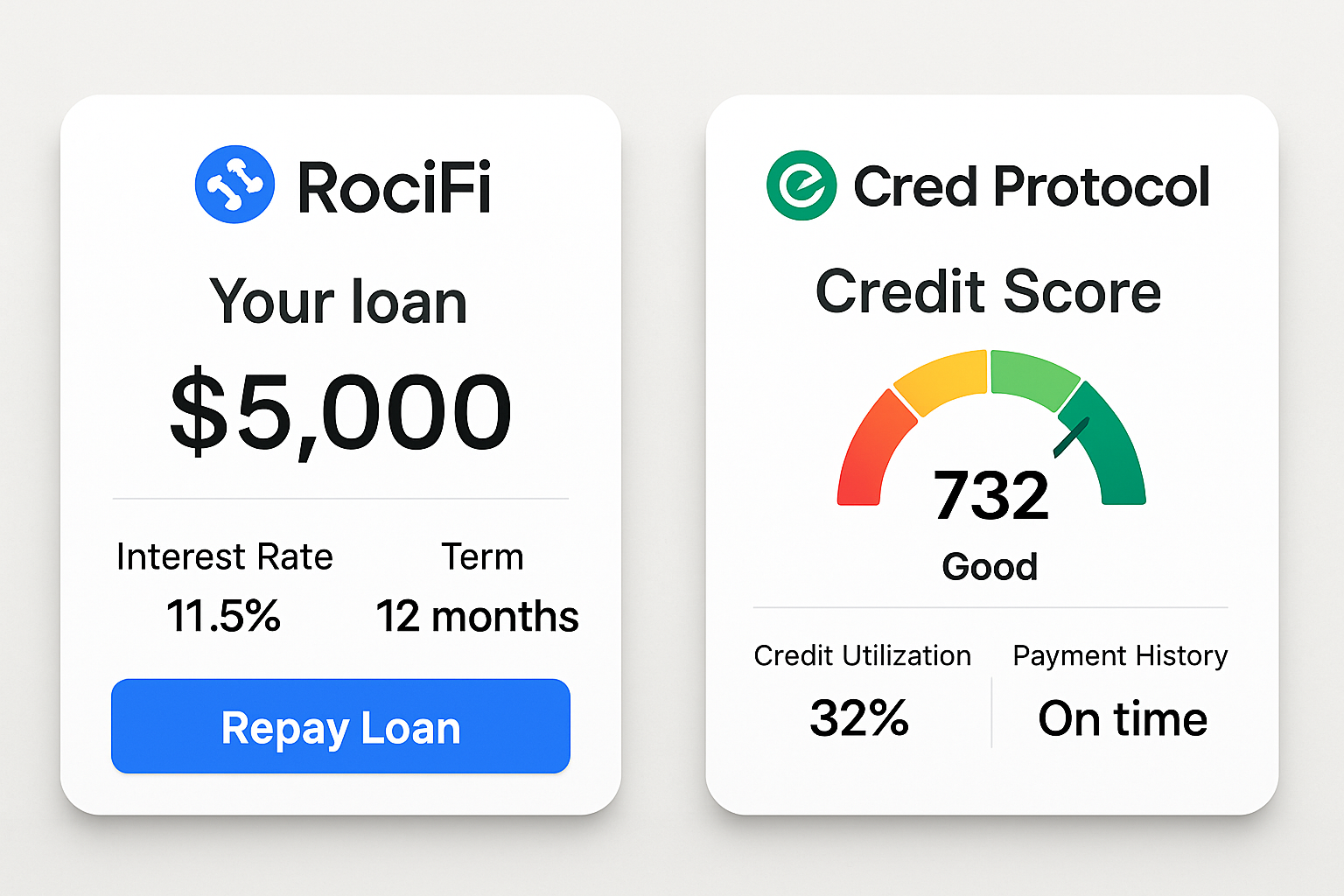

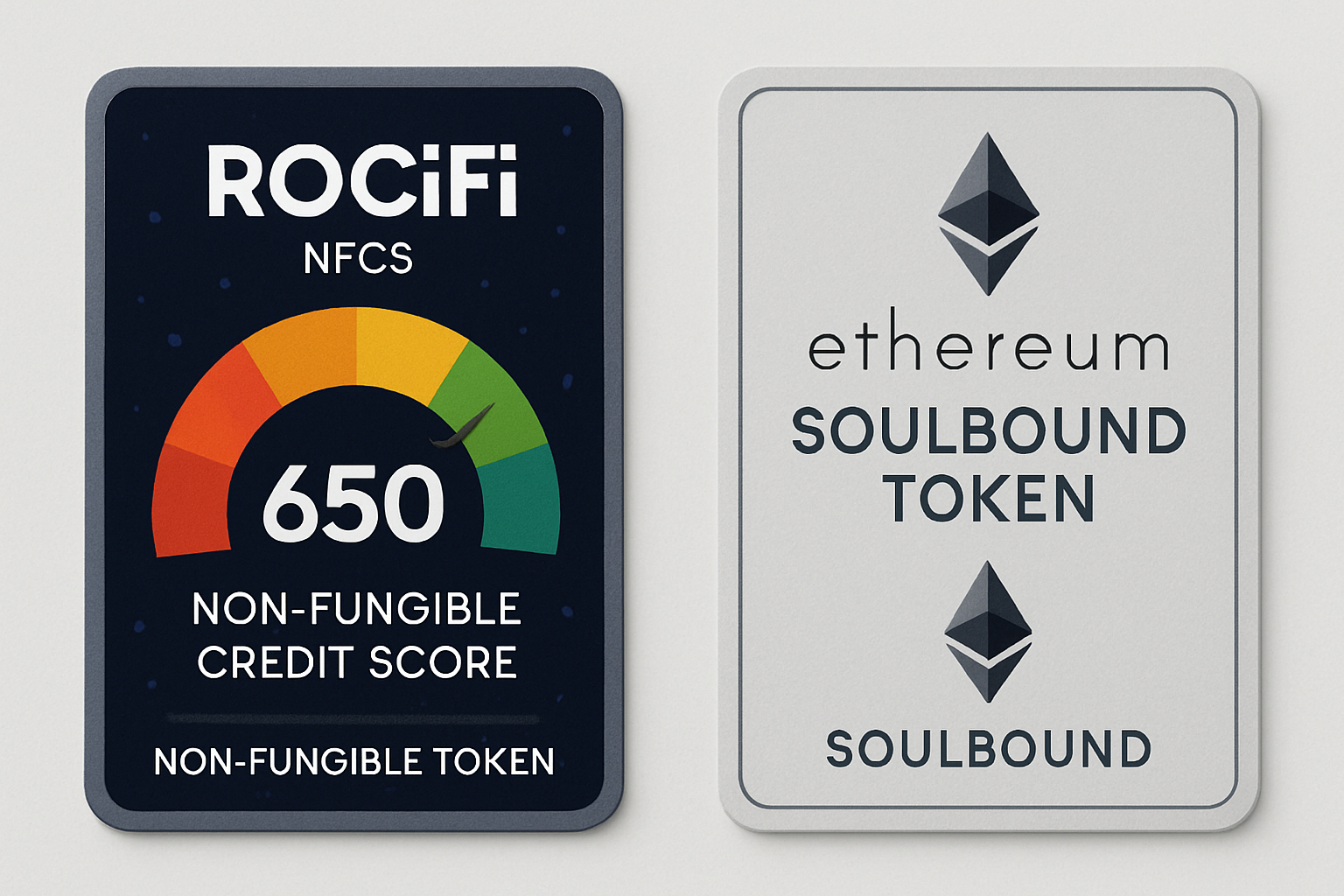

RociFi: RociFi leverages on-chain credit scores and issues Non-Fungible Credit Score (NFCS) tokens—non-transferable ERC-721 tokens that reflect a user’s creditworthiness based on wallet activity, enabling under-collateralized lending.

-

Cred Protocol: Cred Protocol provides decentralized credit scoring by analyzing users’ historical on-chain behavior, such as loan repayments and transaction patterns, to facilitate under-collateralized loans on DeFi platforms.

-

Goldfinch: Goldfinch is a leading DeFi lending protocol that enables under-collateralized loans by combining on-chain activity with off-chain borrower data, expanding access to crypto credit for real-world businesses.

-

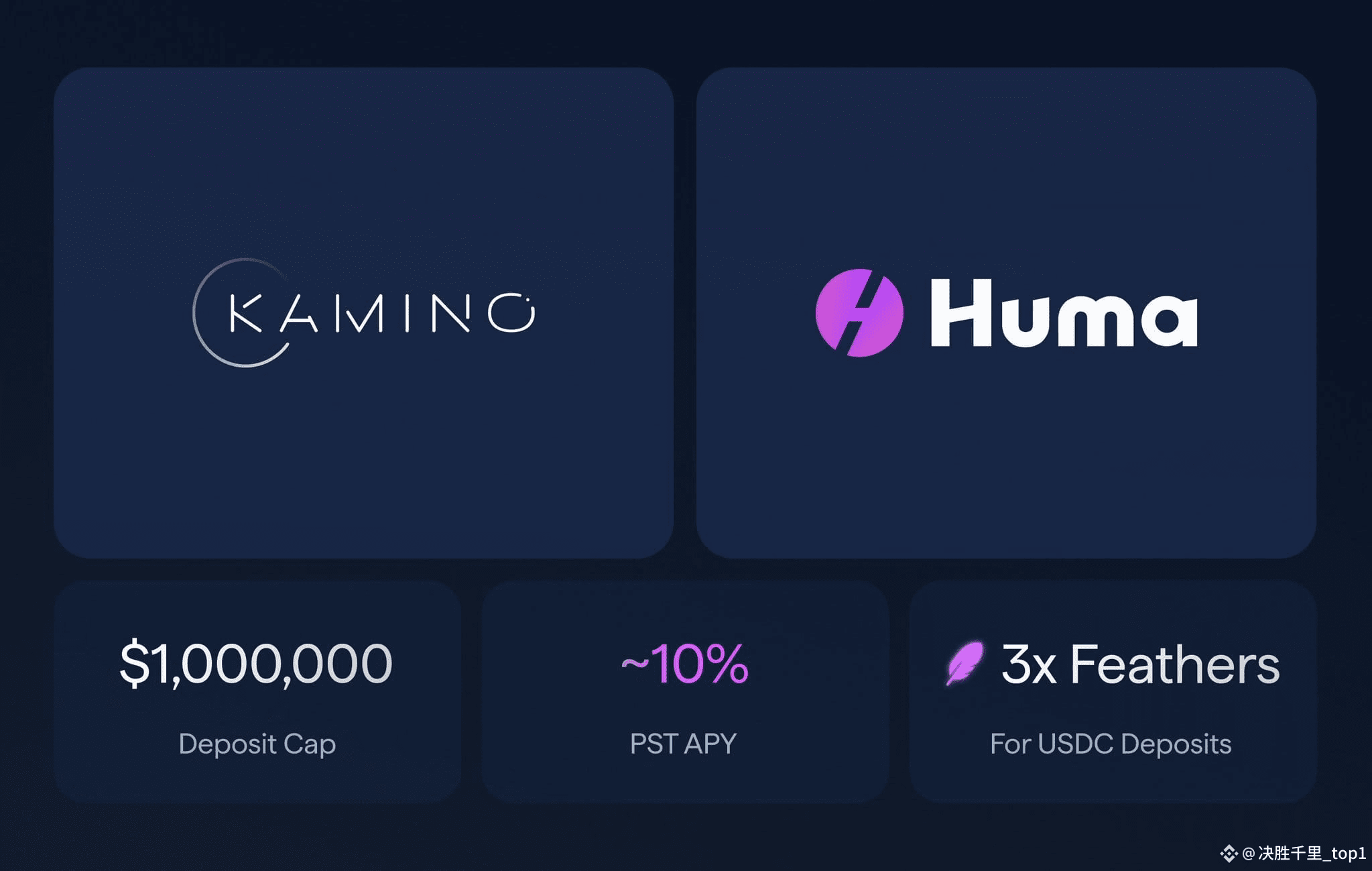

Huma Finance: Huma Finance utilizes on-chain reputation and decentralized identity (DID) systems to assess borrower risk, supporting under-collateralized lending for both individuals and enterprises.

-

TrueFi: TrueFi offers uncollateralized lending by evaluating borrowers’ on-chain and off-chain reputations, including historical repayment data and attestations, to make risk-managed lending decisions.

-

Creditcoin: Creditcoin connects borrowers and lenders across blockchains, recording credit history on-chain to build transparent, portable reputations that unlock under-collateralized loans.

Decentralized Identity (DID): Users can anchor their blockchain addresses to decentralized identities that incorporate social media profiles, DAO memberships, NFT ownerships, and more. This extra layer of verifiable data helps lenders distinguish between high- and low-risk borrowers based on both financial activity and broader digital footprint (source).

Soulbound Credit Tokens: Inspired by non-transferable gaming items, soulbound tokens (SBTs) are permanently tied to individual wallets. They can represent achievements such as successful loan repayments or attestations from reputable community members, creating an immutable record of trustworthiness within the DeFi ecosystem (source).

Non-Fungible Credit Scores (NFCS): Projects like RociFi issue non-transferable ERC-721 tokens that encode a user’s credit score based on onchain behavior. These tokens cannot be sold or transferred, ensuring that each score is unique to its owner and immune to market manipulation (source).

The Benefits: Efficiency Meets Inclusivity

The shift toward onchain reputation systems carries profound implications for DeFi risk assessment:

- Enhanced Capital Efficiency: Lower collateral requirements mean users can access funds without tying up large portions of their portfolio.

- Democratized Access: Borrowers previously excluded from DeFi due to asset limitations now have pathways to credit based purely on digital reputation.

- Transparent Risk Assessment: Every metric used in scoring is publicly auditable, fostering trust between counterparties while reducing room for manipulation or hidden biases.

Tackling Privacy and Standardization Challenges

Inevitably, linking personal identifiers or behavioral data to blockchain addresses raises privacy concerns. Zero-knowledge proofs are emerging as a solution, allowing users to verify aspects of their creditworthiness without exposing sensitive details (source). Meanwhile, the sector still faces hurdles around standardizing how wallet reputations are calculated across platforms, an essential step if under-collateralized lending is ever to scale globally.

Standardization is not just a technical challenge; it is also a matter of trust and interoperability. Without common frameworks for DeFi risk assessment, lenders may hesitate to extend credit across protocols, and borrowers might find their hard-earned reputation siloed to a single ecosystem. As industry consortia and open-source working groups coalesce around decentralized identity lending, we can expect more portable and composable crypto credit scoring models to emerge.

Real-World Impact: Scaling Up Under-Collateralized Crypto Loans

The practical impact of onchain reputation scores is already visible in the market. Early movers like RociFi, Huma Finance, and zScore are piloting systems where wallet reputation engines determine loan terms, sometimes offering unsecured loans to users with exceptional repayment histories. These innovations do more than unlock capital; they foster a culture of accountability unique to blockchain finance.

Imagine a future where your wallet’s soulbound credit tokens, accumulated through years of responsible DeFi participation, grant you instant access to liquidity pools at competitive rates. No paperwork, no intrusive background checks, just transparent metrics and programmable trust.

Yet, the journey is just beginning. Protocols must continue refining their risk models by incorporating new data points, such as DAO governance participation or even off-chain credentials via secure oracles. The integration of privacy-preserving technologies like zero-knowledge proofs will be crucial for protecting user autonomy while maintaining verifiable standards for lenders.

What’s Next: Building the Future of Decentralized Credit

The evolution of onchain reputation scores signals a paradigm shift not only for DeFi but for global finance at large. As these systems mature, we may see a convergence between traditional credit bureaus and decentralized wallet reputation engines, each learning from the other’s strengths in transparency, inclusivity, and risk management.

Top 5 Trends in Decentralized Identity Lending for 2025

-

Widespread Adoption of On-Chain Credit Scoring Protocols: Platforms like RociFi and Cred Protocol are leading the way in using on-chain data to generate verifiable credit scores, enabling under-collateralized lending and expanding DeFi access.

-

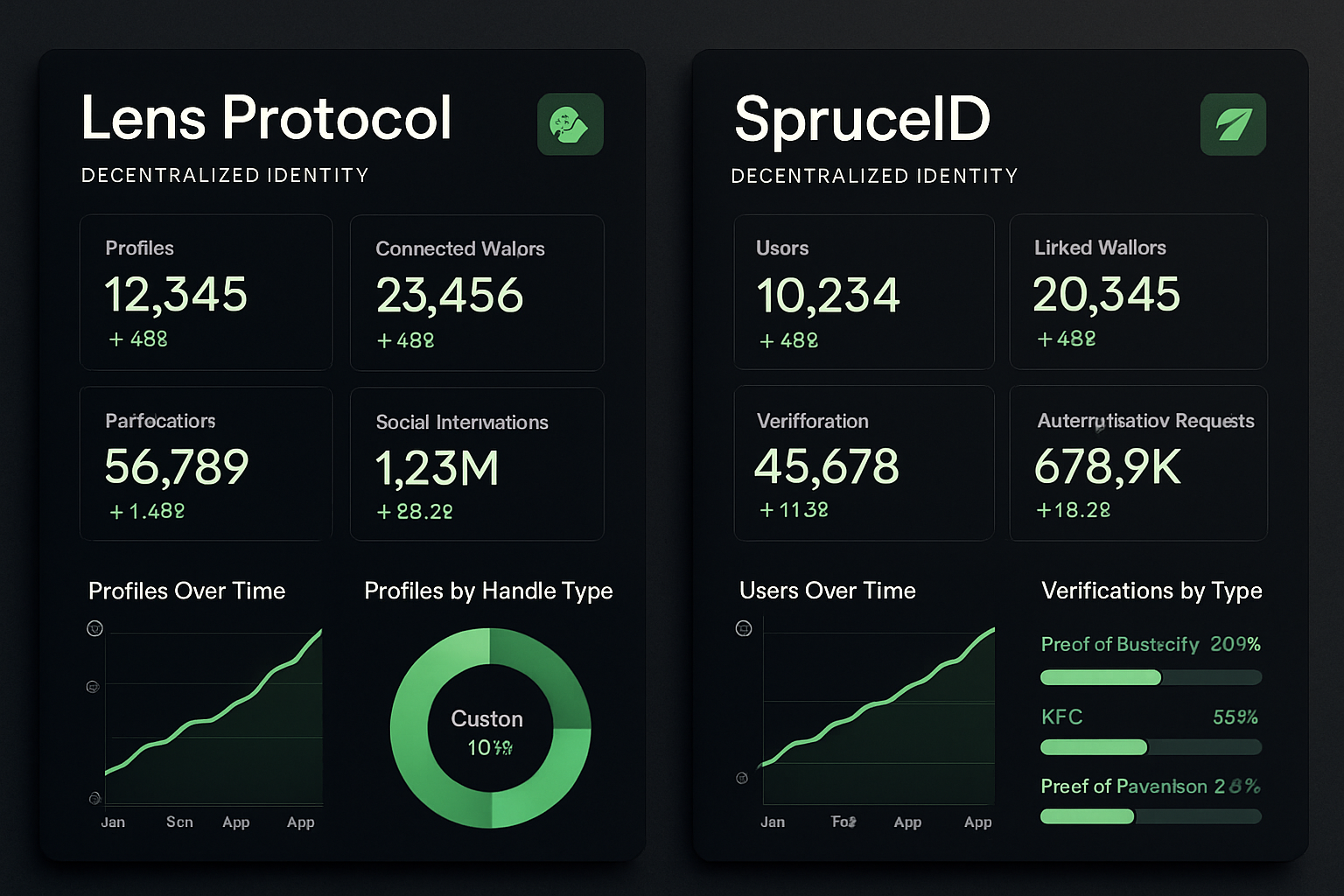

Integration of Decentralized Identity (DID) Solutions: Projects such as Lens Protocol and SpruceID are empowering users to link their blockchain addresses with rich, privacy-preserving identity profiles, making reputation portable and composable across platforms.

-

Emergence of Non-Fungible Credit Scores (NFCS) and Soulbound Tokens (SBTs): Innovations like RociFi’s NFCS and Ethereum Soulbound Tokens are providing non-transferable, on-chain representations of creditworthiness and reputation, which lenders can trust for risk assessment.

-

Privacy-Enhancing Technologies for Verifiable Credentials: Solutions such as Chainlink DECO are enabling zero-knowledge proofs and privacy-preserving attestations, allowing users to prove their creditworthiness without exposing sensitive data.

-

Standardization and Interoperability of Reputation Systems: Initiatives like W3C Decentralized Identifiers (DIDs) and Ethereum Attestation Service are working towards universal standards, making reputation scores and identity data usable across multiple DeFi platforms.

For developers and protocol architects, now is the time to experiment with new primitives, whether it’s soulbound credit tokens or advanced AI-driven risk analytics, to build fairer financial infrastructure. For users, cultivating an onchain reputation will become as important as managing one’s portfolio allocation.

Ultimately, under-collateralized crypto loans powered by robust onchain reputation systems promise not only greater capital efficiency but also a more open financial system, one where opportunity flows according to merit rather than privilege or legacy status.