For years, decentralized finance (DeFi) has promised borderless access to capital, yet its lending markets have remained largely walled off by steep collateral requirements. If you wanted a crypto loan, you typically had to lock up assets worth far more than you wished to borrow. This over-collateralization made sense for risk management, but it left out millions of users with limited crypto holdings and stifled the capital efficiency that DeFi was meant to unlock. Now, thanks to onchain risk scores, a new chapter is opening, one where under-collateralized crypto loans are not just possible but rapidly gaining traction.

Why Over-Collateralization Ruled DeFi Lending, Until Now

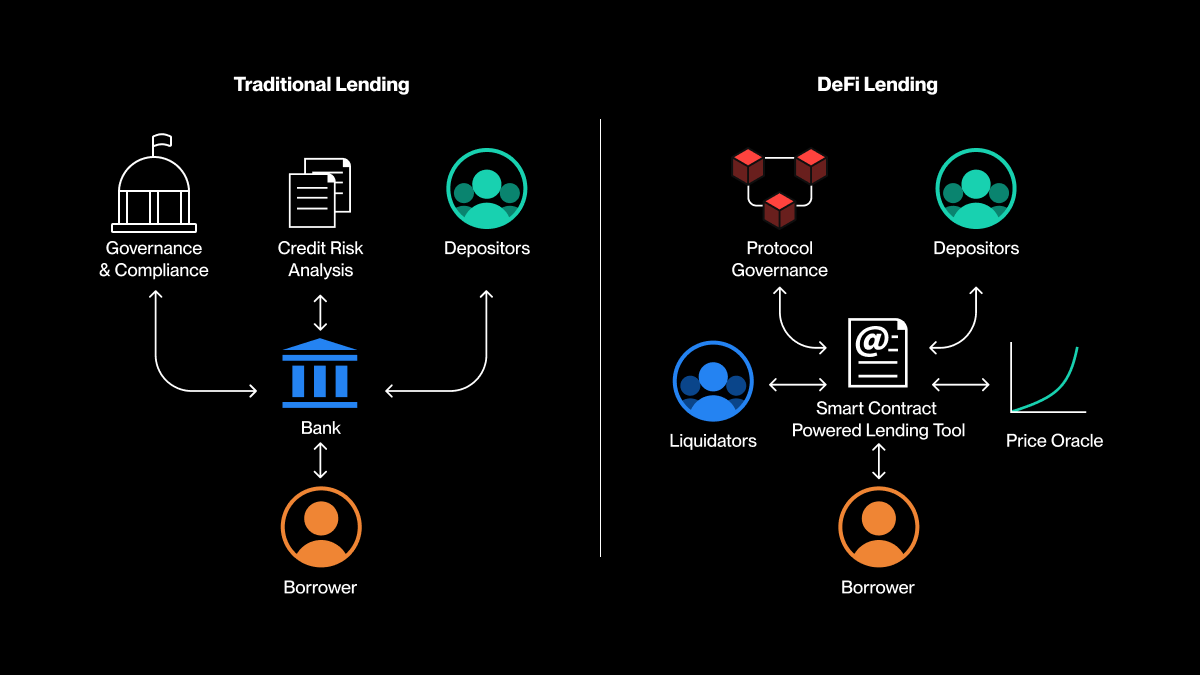

The earliest DeFi protocols like MakerDAO and Aave set a precedent: to borrow $1,000 in stablecoins, you’d need to post $1,500 (or more) in ETH or another asset. This approach shielded lenders from default risk, but it also meant DeFi liquidity pools were underutilized, and the sector struggled to compete with the capital efficiency of traditional finance. The absence of reliable credit assessment tools in a pseudonymous ecosystem made under-collateralized lending a non-starter. Without a way to gauge if a borrower would repay, protocols defaulted to the blunt instrument of over-collateralization.

But as DeFi matures, so does its data. Every transaction, loan repayment, and liquidation event is recorded onchain, creating a transparent financial footprint. Onchain risk scoring protocols now tap this data to assess creditworthiness, enabling a seismic shift toward under-collateralized crypto loans.

How Onchain Risk Scores Work: Turning Data Into Trust

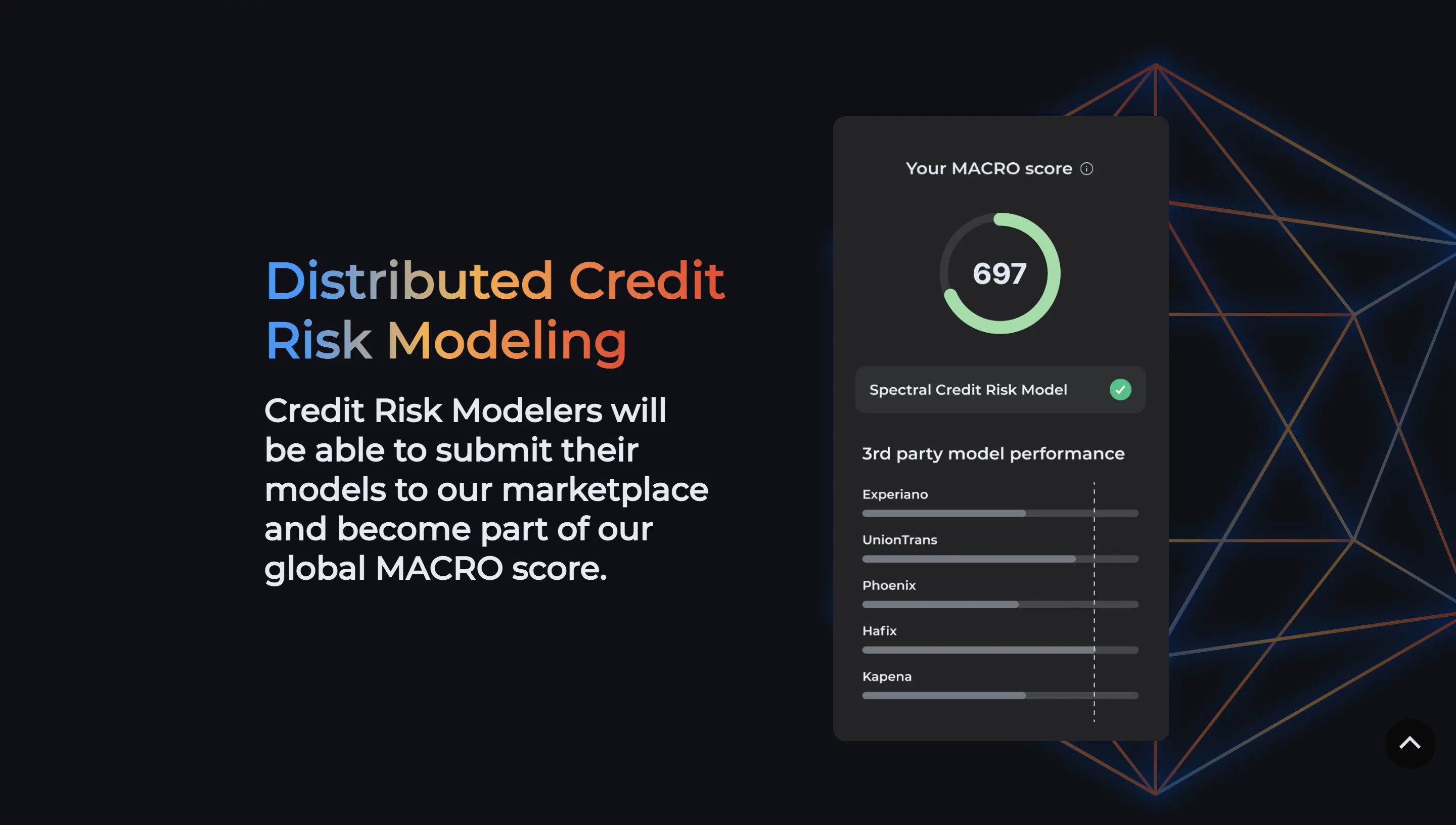

Onchain risk scores function much like traditional credit scores, but instead of relying on opaque credit bureaus and off-chain paperwork, they analyze a user’s blockchain activity. Protocols like RociFi, Spectral Finance, Credora, and others scan a wallet’s transaction history, borrowing patterns, liquidation records, and even cross-protocol interactions. The result is a dynamic risk profile that reflects real-time behavior, not just static snapshots.

For example, RociFi assigns borrowers to different collateral pools based on their risk score. Those with stellar onchain histories, demonstrating timely repayments and prudent risk management, can access loans with as little as 71% collateral. Others may face requirements up to 90%, but even this is a significant improvement over the 150% and ratios that once dominated DeFi. Spectral’s MACRO score, ranging from 300 to 850 much like FICO in traditional finance, gives lenders a nuanced tool for pricing risk and calibrating terms.

Decentralized Identity and the Rise of Reputation-Based Lending

The backbone of this revolution is decentralized identity (DID). By linking onchain activity with verifiable credentials, without sacrificing privacy, DID frameworks allow protocols to build persistent reputations for users. This means your DeFi behavior can follow you across platforms, enabling seamless borrowing experiences and fairer access to capital. The more you interact responsibly with lending protocols, the stronger your onchain reputation becomes.

Crucially, this isn’t just theory. Undercollateralized lending is already compounding as an asset class. According to recent research, protocols like Credora and Spectra are leveraging onchain credit scoring to power real-world lending opportunities. As the data available to lenders grows richer, borrowing rates and collateral requirements can be optimized for each user’s risk tolerance. This is moving DeFi closer to the sophistication of traditional credit markets, without the gatekeepers.

For a deeper dive into how these mechanisms work in practice, see our detailed analysis on enabling under-collateralized crypto lending with onchain risk scores.

As onchain risk scores gain traction, we’re witnessing a feedback loop of innovation. Each successful repayment, each responsible borrower, strengthens the case for under-collateralized lending and encourages more protocols to experiment with reputation-based risk models. The result is an expanding universe of lending products tailored to diverse risk appetites and user profiles. This shift is especially meaningful for users in emerging markets, who have historically been excluded from both traditional and DeFi credit due to lack of collateral or formal credit history.

Key Benefits of Onchain Credit Scoring in DeFi

-

Unlocks Under-Collateralized Lending: Onchain credit scores allow DeFi protocols to offer loans with significantly reduced collateral requirements, moving beyond the traditional over-collateralized model. This enables borrowers with strong onchain reputations to access capital more efficiently, as seen in platforms like RociFi and Spectral Finance.

-

Enhances Capital Efficiency: By reducing the need for excessive collateral, onchain risk scoring frees up liquidity for both lenders and borrowers. This shift increases the overall capital utilization rate in DeFi, making lending protocols more attractive and competitive compared to traditional finance.

-

Expands Financial Access and Inclusion: Onchain credit scoring democratizes lending by enabling users without large crypto holdings to obtain loans based on their transaction history and reputation. This broadens participation in DeFi, opening the door for a wider range of borrowers globally.

-

Improves Risk Assessment and Transparency: Protocols like Spectral Finance use transparent, data-driven models—such as the MACRO score—to evaluate borrower risk. This allows lenders to make informed decisions and tailor loan terms to individual risk profiles, fostering a more robust and transparent lending ecosystem.

-

Enables Dynamic Loan Terms: With granular onchain risk data, DeFi platforms can offer personalized interest rates, loan durations, and collateral requirements. Borrowers with higher credit scores can benefit from more favorable terms, while lenders can better manage risk and optimize returns.

-

Reduces Fraud and Default Rates: Comprehensive onchain analysis—factoring in liquidation history, protocol interactions, and wallet behavior—helps identify risky borrowers and potential fraud. This proactive risk management strengthens the overall health of DeFi lending markets.

Transparency is central to this new paradigm. Unlike legacy finance, where credit decisions are often shrouded in secrecy, onchain credit scoring is auditable by anyone. Lenders can independently verify a borrower’s onchain reputation, while borrowers can build portable credit profiles that unlock better terms over time. This transparency also helps protocols fine-tune their risk models, reducing systemic vulnerabilities like mass liquidations that have plagued DeFi in volatile markets.

Of course, challenges remain. The pseudonymous nature of crypto means that identity can still be fragmented across wallets, and data privacy must be balanced against the need for robust credit assessment. But the rapid evolution of decentralized identity solutions is closing this gap, allowing users to selectively share proof of reputation while keeping sensitive data private.

Protocols are also exploring hybrid approaches that combine onchain signals with offchain data, think KYC-light solutions or integrations with traditional credit bureaus, further enriching the credit landscape. As more capital flows into DeFi, onchain credit scoring could ultimately bring trillions of dollars in real-world value onto blockchain rails, fulfilling DeFi’s promise of borderless, inclusive finance.

What’s Next for Onchain Risk Scores and DeFi Credit?

The coming years will likely see a proliferation of specialized credit protocols: some catering to institutional liquidity providers with rigorous risk controls, others serving retail borrowers seeking flexible terms. Expect continued improvements in the granularity and predictive power of onchain risk scores as machine learning techniques are applied to ever-larger datasets. The rise of composable identity standards means your DeFi reputation could soon unlock not just loans but insurance, trading limits, and even real-world financial services.

For developers and protocol designers, integrating onchain credit scoring is fast becoming table stakes. Lenders who ignore these tools may find themselves outcompeted by platforms that can offer lower collateral ratios and better rates without compromising security.

For users, the message is clear: your onchain behavior matters more than ever. Building a positive repayment history and engaging transparently with lending protocols can open doors that were once closed by collateral requirements alone. It’s a new era where financial opportunity is tied not just to what you own but how you participate in the ecosystem.

If you’re ready to explore how under-collateralized crypto loans work in practice and how you can leverage your own onchain reputation for better borrowing terms, check out our guide on how onchain risk scores enable under-collateralized lending in DeFi. The future of decentralized credit is here, and it’s being written onchain.